Mississauga: Your Essential Commute Is The Loan You Get.

Table of Contents

- Key Takeaways

- Navigating Essential Car Financing in Ontario Mid-Consumer Proposal

- The Daily Grind in Mississauga: When Your Commute Becomes a Non-Negotiable Necessity

- Mississauga's Reality: Public Transit Gaps and the Essential Worker

- Unpacking the 'Mid-Consumer Proposal' Conundrum: A Closer Look for Ontario Applicants

- Beyond 'Bad Credit': How a Consumer Proposal Differs from Bankruptcy in Ontario

- What Lenders See (and Fear): Mitigating Perceived Risk

- The Lender's Playbook: How Car Financing Works for Essential Workers in Ontario

- Not All Lenders Are Created Equal: Navigating Ontario's Financing Landscape

- The 'Risk Assessment' Matrix: Beyond Your Credit Score

- Crafting Your Irresistible Application: Strategies for Approval in Ontario

- The Power of Preparation: Documents You Must Have for Car Financing

- The Co-Signer Conundrum: When Does it Help (or Hinder) in Ontario?

- Down Payment Dynamics: Improving Your Odds and Terms in Ontario

- Beyond the Sticker Price: The True Cost of Your Essential Commute Car Loan in Ontario

- Interest Rates Explained: What to Expect Mid-Consumer Proposal in Ontario

- Hidden Fees and Charges: Unmasking the Total Cost of Car Financing

- Insurance Imperatives: The Significant Impact of Credit in Ontario Cities

- The Fuel Factor & Maintenance: Budgeting for the Real World in Mississauga

- Navigating the Ontario Car Market: Dealers, Vehicles, and Vetting for Your Essential Commute

- Specialized Dealers vs. Mainstream: Finding Your Best Bet in Ontario

- The Smart Car Choice: Reliability and Affordability for Your Essential Commute

- Due Diligence: Essential Checks Before Buying a Used Car in Ontario

- Your Loan, Your Future: Rebuilding Credit and Managing Your Financial Health in Ontario

- The Opportunity: A Car Loan as a Credit Rebuilding Tool in Ontario

- Payment Discipline: The Absolute Necessity for Financial Recovery

- Refinancing Roads: When and How to Explore Options Post-Proposal

- Your Next Steps to Approval: A Roadmap for Essential Workers in Ontario

- Recap: The Critical Elements for Success in Securing Your Essential Commute Loan

- Actionable Checklist: From Gathering Documents to Choosing the Right Vehicle

- Finding the Right Partner: How to Identify Reputable Lenders and Dealerships in Ontario

- Frequently Asked Questions About Car Financing Mid-Consumer Proposal in Ontario (FAQ)

Key Takeaways

- The 'Essential' Advantage: Highlighting your vehicle's necessity for work can significantly sway lenders, especially in areas like the Greater Toronto Area where public transit may not fully meet job demands.

- Mid-Proposal Nuances: A consumer proposal is distinct from bankruptcy. Lenders evaluate your adherence to the proposal and your overall financial stability.

- Lender Diversity: Specialized subprime lenders and dealerships in Ontario often have more flexible criteria than traditional banks for those in consumer proposals.

- Beyond the Interest Rate: Understand the total cost of ownership, including insurance (which can be higher in cities like Toronto or Ottawa), maintenance, and fuel.

- Documentation is King: A strong application package, including proof of essential work and a detailed budget, is crucial for approval.

- Credit Rebuilding Opportunity: A responsibly managed car loan can serve as a powerful tool to rebuild your credit score post-proposal.

Navigating Essential Car Financing in Ontario Mid-Consumer Proposal

In the sprawling landscape of Ontario, particularly in vibrant but traffic-laden cities like Mississauga, a reliable vehicle isn't a luxury – it's often the backbone of an essential work commute. Picture this: you're an essential worker, perhaps in healthcare, logistics, or manufacturing, with shifts that don't align with conventional public transit schedules, or your workplace is simply beyond the reach of a convenient bus route. For many navigating a consumer proposal, the crucial need for transportation collides directly with challenging financial realities. It's a common dilemma across communities from Hamilton to Kingston, and from Windsor to Oshawa, where daily life simply demands a set of wheels. This deep dive will explore how individuals mid-consumer proposal in Ontario can secure car financing for their essential work commute, transforming a potential roadblock into a strategic, empowering step towards regaining financial stability and maintaining vital employment.

The Daily Grind in Mississauga: When Your Commute Becomes a Non-Negotiable Necessity

Mississauga's Reality: Public Transit Gaps and the Essential Worker

For residents of Mississauga, a city known for its vast suburban sprawl and industrial parks, and indeed much of Ontario outside of bustling downtown cores like Toronto, relying solely on public transit for an essential work commute can be a logistical nightmare. Imagine working a night shift at a hospital in Brampton, or needing to reach a manufacturing plant in Vaughan, or a distribution centre near Pearson International Airport – areas where public transit options become sparse or non-existent during off-peak hours. Shift work, specific industry locations (e.g., industrial parks, healthcare facilities that are often not centrally located), or simply the sheer distance often demand a personal vehicle. A car is not just convenience; it's a lifeline to employment, a tool that ensures you can reliably get to your job, support your family, and contribute to the local economy.

So, what truly defines an 'essential' commute in the eyes of a lender? It's more than just saying "I need a car for work." Lenders want to see concrete evidence. They are looking for scenarios where the absence of a personal vehicle would directly jeopardize your employment or significantly hinder your ability to earn an income. This could include:

- Irregular Hours: If your job requires early mornings, late nights, or weekend shifts when public transit is less frequent or unavailable.

- Remote Work Locations: Employment in industrial parks, rural areas, or specific facilities not well-served by bus routes or GO Transit.

- Tool or Equipment Transport: If your job necessitates transporting tools, equipment, or materials that cannot be carried on public transit.

- Caregiving Responsibilities: While not strictly a 'work' commute, if a vehicle is essential for transporting dependents to childcare or medical appointments that directly enable you to work, this can also be a persuasive factor.

Articulating your specific need clearly and providing supporting documentation is paramount. This isn't about making an emotional plea; it's about presenting a clear, logical, and documented case for why a vehicle is integral to your ongoing employment and financial recovery.

Pro Tip: Obtain a letter from your employer verifying your work hours, location, and the necessity of a personal vehicle for your role. This concrete evidence can significantly bolster your loan application, demonstrating to lenders that the car loan is a necessity, not a discretionary expense.

Unpacking the 'Mid-Consumer Proposal' Conundrum: A Closer Look for Ontario Applicants

Beyond 'Bad Credit': How a Consumer Proposal Differs from Bankruptcy in Ontario

When you're navigating a consumer proposal in Ontario, the phrase "bad credit" often gets thrown around, but it doesn't quite capture the full picture. While both a consumer proposal and bankruptcy significantly impact your credit rating, they are fundamentally different processes under Canada's Bankruptcy and Insolvency Act (BIA). A consumer proposal is a formal, legal agreement to repay a portion of your unsecured debts, typically over a period of up to five years. It's a structured, proactive path to financial recovery, demonstrating a commitment to repaying creditors rather than liquidating assets. For more insights on how consumer proposals can actually open doors, check out our guide on Consumer Proposal? Good. Your Car Loan Just Got Easier.

This distinction is vital for lenders. When you're mid-proposal, you are actively managing your debt, working with a Licensed Insolvency Trustee (LIT), and adhering to a payment plan. This signals a level of responsibility and commitment that can be viewed more favourably than a bankruptcy, which often implies a complete inability to repay. Lenders understand that individuals in consumer proposals are taking steps to get back on track financially, and a car loan for an essential commute can be seen as a necessary tool to facilitate that recovery.

What Lenders See (and Fear): Mitigating Perceived Risk

Despite the distinctions, lenders often perceive individuals in a consumer proposal as higher risk. This isn't personal; it's a cold calculation based on past financial difficulties and the ongoing debt repayment obligations. Their primary fears include:

- Default Risk: The concern that you might default on the car loan, adding another financial burden to an already delicate situation.

- Proposal Jeopardy: The worry that new debt could jeopardize your ability to make your consumer proposal payments, potentially leading to the failure of the proposal.

- Limited Recourse: In the event of default, the legal complexities of recovering funds from someone in a consumer proposal can be greater.

However, understanding these perceptions is the first step to building a compelling case. You can mitigate these concerns by demonstrating:

- Consistent Proposal Adherence: Proof that all your consumer proposal payments are up-to-date and have been made consistently. This is paramount.

- Stable Employment: A long, stable work history with a consistent income stream reassures lenders of your ability to make payments.

- Low Debt-to-Income Ratio (Post-Proposal): While you have proposal payments, showing that the *new* car loan payment will not overextend you financially is key.

- The 'Essential' Nature: As discussed, clearly articulating why this car is absolutely necessary for your work and, therefore, your financial rehabilitation.

- Down Payment: A down payment significantly reduces the lender's risk and shows your commitment.

By proactively addressing these points with robust documentation and clear communication, you transform from a perceived "high-risk" applicant into a "recovering individual making strategic financial choices."

Pro Tip: Ensure all your consumer proposal payments are up-to-date and have a clear record of these payments. This demonstrates reliability and commitment to your financial recovery, which lenders value highly when assessing your application.

To illustrate the difference from a lender's perspective, consider this:

| Factor | Consumer Proposal | Bankruptcy |

|---|---|---|

| Nature of Action | Offer to repay debts (partial) | Liquidation of assets to clear debts |

| Credit Impact | R-7 rating, stays on report for 3 years post-completion | R-9 rating, stays on report for 6-7 years post-discharge |

| Lender Perception | Demonstrates commitment to repayment, proactive recovery | Implies inability to repay, more severe credit event |

| New Credit Access | More feasible, especially for essential needs like car loans | More challenging, often requires longer waiting periods |

| Trustee Involvement | Oversees payments, generally no approval needed for new loans | Manages assets, more direct oversight during process |

The Lender's Playbook: How Car Financing Works for Essential Workers in Ontario

Not All Lenders Are Created Equal: Navigating Ontario's Financing Landscape

When you're seeking car financing mid-consumer proposal in Ontario, it's crucial to understand that not all lenders operate on the same playing field. Your traditional major banks (like RBC, TD, BMO, CIBC, Scotiabank) and credit unions typically have stringent lending criteria, often prioritizing applicants with excellent credit scores. They are generally less willing to take on the perceived risk associated with individuals in a consumer proposal, especially for what they might consider a "discretionary" purchase.

However, the financing landscape in Ontario is diverse. Your best avenues for approval will likely be:

- Specialized Subprime Lenders: These are finance companies that specifically cater to individuals with challenging credit histories, including those in consumer proposals, post-bankruptcy, or with low credit scores. They have different risk assessment models and are more accustomed to working with these unique financial situations. They might be independent finance companies or be affiliated with larger automotive groups.

- Dealerships with Dedicated Finance Departments: Many dealerships across Ontario, from the bustling automotive rows in Toronto and Mississauga to local dealers in smaller cities like Sudbury, Thunder Bay, or Sault Ste. Marie, have finance managers who specialize in securing loans for all credit types. They often have established relationships with a network of subprime lenders and can act as an intermediary, matching you with a lender willing to approve your application.

- Online Car Loan Brokers: Services like SkipCarDealer.com connect applicants with a wide network of lenders, including those specializing in non-prime financing. They streamline the application process and can often secure pre-approvals quickly.

These specialized providers understand the nuances of a consumer proposal and view it as a path to recovery, not a permanent scarlet letter. They are more focused on your current ability to pay, the stability of your employment, and the essential nature of the vehicle.

The 'Risk Assessment' Matrix: Beyond Your Credit Score

While your credit score is undoubtedly a factor, for specialized lenders, it's just one piece of a much larger puzzle. They employ a comprehensive 'risk assessment' matrix that looks at several critical elements:

- Income Stability: Do you have a steady job? How long have you been employed? Lenders prefer applicants with a long history at the same employer, or at least consistent employment in the same industry. They want to see verifiable income, whether through pay stubs, employment letters, or T4s.

- Length of Employment: A longer tenure at your current job signals reliability and reduces perceived risk. If you've recently changed jobs, ensure you can explain the career progression or reason for the change positively.

- Debt-to-Income Ratio: This ratio compares your total monthly debt payments (including your consumer proposal payments and the proposed car loan payment) to your gross monthly income. Lenders want to see that you have enough disposable income to comfortably afford the new car payment without straining your finances.

- Down Payment: As mentioned, a down payment directly reduces the loan amount and the lender's risk. It also shows your commitment and ability to save.

- The Purpose of the Loan: This is where your 'essential work commute' narrative becomes incredibly powerful. For a specialized lender, a car loan that enables you to maintain employment and generate income is viewed more favourably than a loan for a luxury item. It demonstrates that the loan directly supports your financial recovery.

- Residency Stability: How long have you lived at your current address? Stability in residence is often seen as an indicator of overall stability.

By understanding these factors, you can prepare your application to highlight your strengths and mitigate perceived weaknesses. It’s about presenting a holistic picture of your financial responsibility and your clear path forward.

Pro Tip: Prepare a detailed personal budget that clearly shows how the new car loan payment will fit into your existing financial obligations without jeopardizing your consumer proposal payments. This demonstrates financial responsibility and foresight to lenders.

Crafting Your Irresistible Application: Strategies for Approval in Ontario

The Power of Preparation: Documents You Must Have for Car Financing

The saying "failing to prepare is preparing to fail" holds especially true when applying for car financing mid-consumer proposal. A complete, organized application package not only speeds up the approval process but also demonstrates your seriousness and reliability to the lender. Here's a comprehensive checklist of essential documents you must have ready:

- Proof of Income: Recent pay stubs (typically 2-3 months), T4 slips from the previous year, and a letter of employment verifying your position, start date, and annual salary. If self-employed, bring your Notice of Assessment and bank statements. For more on navigating loans as a gig worker, see our article on Banks Need Pay Stubs. We Need Your Drive. Gig Worker Car Loans.

- Employer Verification Letter: As previously recommended, a letter from your employer outlining your work hours, location, and explicitly stating the necessity of a personal vehicle for your role.

- Consumer Proposal Documentation: Your consumer proposal agreement, proof of your Licensed Insolvency Trustee (LIT), and a clear record of all payments made to date, showing that you are in good standing with your proposal.

- Bank Statements: Recent bank statements (typically 3-6 months) to show consistent income deposits, responsible spending habits, and the ability to manage your existing finances.

- Proof of Residence: Utility bills (hydro, gas, internet), a lease agreement, or mortgage statements with your current address. Lenders want to see stable residency.

- Valid Ontario Driver's License: Essential for any vehicle purchase and insurance.

- Proof of Identity: Another piece of government-issued ID (e.g., passport, SIN card, health card, though often not accepted as primary ID due to privacy concerns).

The more organized and complete your application, the better your chances of a smooth and swift approval process, whether you're in Ottawa, London, or any other city in Ontario.

The Co-Signer Conundrum: When Does it Help (or Hinder) in Ontario?

Exploring the role of a co-signer is a common consideration for individuals with challenged credit. A co-signer is someone with good credit who agrees to be equally responsible for the loan if you default. For applicants in a consumer proposal, a co-signer can significantly improve approval odds and potentially secure more favourable interest rates. They effectively reduce the lender's risk by providing an additional layer of security.

However, it's crucial to understand the responsibilities involved for the co-signer. Their credit will be impacted by the loan, and they will be legally obligated to make payments if you are unable to. This is a significant commitment and should only be undertaken with someone you trust implicitly and who fully understands the implications. While a co-signer can be a powerful tool, it's not always necessary, especially if you have stable income and a strong case for an essential commute. In some cases, if the co-signer's financial situation is also complex, it could even hinder the application.

| Co-Signer Benefit | Co-Signer Risk |

|---|---|

| Increased Approval Odds | Legal Obligation for Debt |

| Potentially Lower Interest Rates | Credit Score Impacted |

| Access to Better Loan Terms | Strained Relationships if Default Occurs |

| Demonstrates Shared Responsibility | Potential for Collection Efforts |

Down Payment Dynamics: Improving Your Odds and Terms in Ontario

A substantial down payment is one of the most effective strategies to improve your car loan approval odds and secure better terms, even when you're mid-consumer proposal. It acts as a powerful signal of commitment and significantly reduces the lender's risk. Here's why:

- Reduced Loan Amount: A larger down payment means you borrow less money, making the loan inherently less risky for the lender.

- Lower Monthly Payments: A smaller principal balance translates to lower monthly payments, improving your debt-to-income ratio and making the loan more affordable.

- Reduced Interest Paid: You'll pay interest on a smaller amount, saving you money over the life of the loan.

- Increased Equity: You start with more equity in the vehicle, protecting you from being "underwater" (owing more than the car is worth) early in the loan term.

- Demonstrates Financial Responsibility: Saving for a down payment shows lenders that you are capable of budgeting and managing your money effectively, even while in a consumer proposal.

Even a modest down payment can make a significant difference. If you can only afford 5-10%, it's still better than nothing. Aim for 10-20% if possible. This isn't just about getting approved; it's about setting yourself up for financial success with more manageable payments and reduced overall costs.

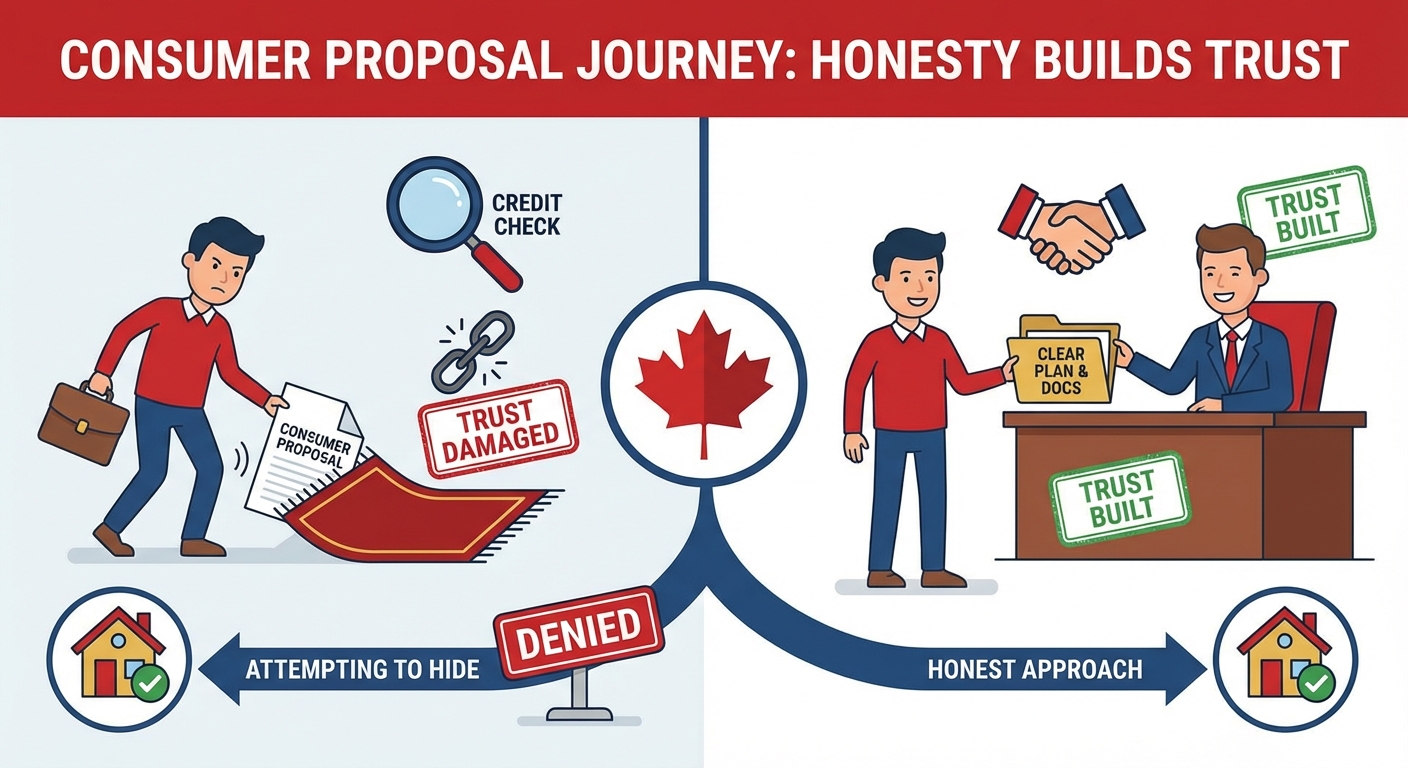

Pro Tip: Be transparent about your consumer proposal status from the outset. Attempting to hide it will only damage trust once the lender discovers it during their credit check. Approach lenders with honesty, a clear plan for managing your finances, and all necessary documentation.

Beyond the Sticker Price: The True Cost of Your Essential Commute Car Loan in Ontario

Interest Rates Explained: What to Expect Mid-Consumer Proposal in Ontario

Let's be upfront: if you're seeking car financing mid-consumer proposal in Ontario, you should expect higher interest rates than someone with pristine credit. This is a direct reflection of the perceived higher risk lenders take on. While someone with excellent credit might secure rates as low as 3-7%, individuals in a consumer proposal could face rates ranging from 10% to 30% or even higher, depending on their specific circumstances, the lender, and the vehicle. It's a reality driven by risk assessment.

Understanding the Annual Percentage Rate (APR) is critical. The APR includes not just the interest rate but also any other fees charged by the lender, giving you a more accurate picture of the total annual cost of borrowing. When comparing offers, always look at the APR, not just the advertised interest rate. While higher rates can be daunting, remember that this loan is a tool for rebuilding your credit. As your financial situation improves and your consumer proposal concludes, there may be opportunities to refinance at a lower rate in the future. For more on this, check out our guide on Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit.

Hidden Fees and Charges: Unmasking the Total Cost of Car Financing

The sticker price and interest rate are just part of the equation. Many car loans come with additional fees and charges that can significantly inflate your total cost. It's vital to be vigilant and ask for a comprehensive breakdown of all expenses before signing any agreement. Common fees to watch out for in Ontario include:

- Administration Fees: Dealerships or lenders may charge these for processing your loan application and paperwork. They can range from a few hundred dollars to over a thousand.

- PPSA Registration Fees (Personal Property Security Act): This is a provincial fee to register the loan against the vehicle, giving the lender security interest. It's a legitimate, but often overlooked, cost.

- Lien Registration Fees: Similar to PPSA, this ensures the lender has a legal claim to the vehicle until the loan is paid off.

- Documentation Fees: For preparing sales and loan documents.

- Extended Warranty/Insurance Products: While sometimes beneficial, these are often high-margin add-ons that can significantly increase your loan amount. Carefully consider if they are necessary for your budget.

- Negative Equity Rollover: If you're trading in a vehicle that you owe more on than it's worth, the "negative equity" might be rolled into your new loan, increasing your principal.

Always ask for a detailed invoice that itemizes every single charge. Don't be afraid to negotiate or question fees you don't understand or believe are excessive.

Insurance Imperatives: The Significant Impact of Credit in Ontario Cities

In Ontario, your credit history can heavily influence your auto insurance premiums, making it a critical budgeting consideration, especially in high-premium areas. Cities like Toronto, Brampton, Vaughan, Mississauga, and London often see some of the highest auto insurance rates in the country. If you have a challenged credit history, insurers may perceive you as a higher risk, potentially leading to significantly steeper premiums.

Here’s how to budget for and potentially mitigate these costs:

- Get Quotes Early: Before finalizing a car purchase, get multiple insurance quotes. This will give you a realistic idea of your monthly or annual premiums.

- Shop Around: Don't settle for the first quote. Different insurers have different underwriting models; what's high with one might be more reasonable with another.

- Consider Vehicle Type: Insurers factor in the make, model, age, and safety features of the car. A reliable, older, less powerful vehicle with good safety ratings will generally be cheaper to insure than a new, high-performance car.

- Increase Deductibles: A higher deductible (the amount you pay out-of-pocket before insurance kicks in) can lower your premium, but ensure you can afford the deductible if you need to make a claim.

- Bundle Policies: If you have home or tenant insurance, inquire about bundling discounts.

- Install Telematics: Some insurers offer discounts for installing a device that monitors your driving habits (e.g., speed, braking).

The Fuel Factor & Maintenance: Budgeting for the Real World in Mississauga

Beyond the loan payment and insurance, the ongoing costs of car ownership are substantial and must be factored into your budget. For your essential Mississauga commute, fuel costs can add up quickly, especially with fluctuating gas prices in Ontario. Consider the fuel efficiency of the vehicle you choose. A smaller, more economical car will be much cheaper to run than an SUV or truck.

Maintenance is another unavoidable expense. Even reliable used cars will require routine oil changes, tire rotations, brake service, and occasional repairs. Set aside a monthly amount specifically for maintenance and unexpected repairs. A general rule of thumb is to budget at least $50-$100 per month, increasing for older vehicles. Skipping maintenance to save money in the short term often leads to more expensive repairs down the road.

By meticulously accounting for all these costs – loan payment, interest, fees, insurance, fuel, and maintenance – you create a robust, realistic budget that prevents financial surprises and supports your overall recovery plan.

Pro Tip: Always request a comprehensive breakdown of all costs associated with the loan, including the total amount repayable over the entire loan term, before signing any agreement. This ensures full transparency and prevents unexpected financial burdens.

Navigating the Ontario Car Market: Dealers, Vehicles, and Vetting for Your Essential Commute

Specialized Dealers vs. Mainstream: Finding Your Best Bet in Ontario

When you're looking for car financing with a consumer proposal, understanding where to shop is as important as what to buy. You'll encounter two main types of dealerships in Ontario:

- Mainstream Dealerships (New and Used): These dealerships, often associated with major brands (Ford, Honda, Toyota, etc.), primarily cater to customers with good to excellent credit. While they may have a finance department that works with some subprime lenders, their primary focus is on prime customers. You might find fewer options or less understanding of your specific financial situation here.

- Specialized Subprime/Bad Credit Dealerships: These dealerships, common in metropolitan areas like Toronto, Hamilton, London, Kitchener, Sudbury, and Windsor, specifically target buyers with challenging credit histories. Their business model is built around helping individuals in consumer proposals, post-bankruptcy, or with low credit scores secure financing. They often have in-house finance teams or strong partnerships with multiple subprime lenders, increasing your chances of approval. They understand the nuances of non-prime lending and can guide you through the process more effectively.

For someone mid-consumer proposal, your best bet is often to start with specialized dealerships or online platforms like SkipCarDealer.com that connect you with lenders equipped to handle these unique financial circumstances. They are more likely to approve your loan and offer a selection of vehicles suitable for your budget and needs.

The Smart Car Choice: Reliability and Affordability for Your Essential Commute

For those mid-consumer proposal, focusing on reliable, fuel-efficient, and affordable used vehicles is a strategic move. This isn't the time for luxury or high-performance cars. Lenders also prefer financing vehicles that hold their value reasonably well and are less likely to incur significant unexpected repair costs, which could jeopardize your ability to make payments.

Here are types of cars that often offer good value and lower running costs, making approval more likely:

- Compact Sedans: Honda Civic, Toyota Corolla, Hyundai Elantra, Mazda3. These are renowned for their reliability, fuel efficiency, and widespread availability of parts and service across Canada.

- Subcompact Cars: Toyota Yaris, Honda Fit, Kia Rio. Even more fuel-efficient and often lower purchase price.

- Mid-size Sedans: Honda Accord, Toyota Camry (slightly older models). Offer more space but still maintain good reliability.

- Small SUVs/Crossovers: Honda CR-V, Toyota RAV4, Hyundai Kona (older models). If you genuinely need more space or all-wheel drive for Ontario winters, these can be good options, but be mindful of slightly higher fuel consumption and purchase prices.

Prioritize vehicles that are 3-7 years old, have reasonable mileage (under 150,000 kilometres), and a strong service history. These models typically offer a good balance of depreciation, reliability, and affordability.

Due Diligence: Essential Checks Before Buying a Used Car in Ontario

Financial urgency should never compromise your vehicle choice. Buying a reliable used car requires careful due diligence. This will protect your investment and ensure your essential commute remains uninterrupted:

- Obtain a CarFax Report (or equivalent): This report provides a vehicle's history, including accident records, service history, odometer readings, previous registrations, and any liens on the vehicle. This is non-negotiable for any used car purchase in Ontario.

- Independent Mechanic's Inspection: Before finalizing any purchase, have a trusted, independent mechanic inspect the vehicle. They can identify potential issues that aren't obvious to the untrained eye, saving you from costly repairs down the road.

- Thorough Test Drive: Drive the car for at least 20-30 minutes on various road types (city, highway, bumps). Listen for unusual noises, check all controls (lights, wipers, AC, radio), and ensure it handles smoothly.

- Check for Recalls: Verify if there are any outstanding safety recalls for the specific make and model.

- Seller's Disclosure: In Ontario, registered dealers must provide a Used Vehicle Information Package (UVIP) for private sales, which contains important information about the vehicle. Ensure you receive and review this.

Pro Tip: Prioritize the total cost of ownership (purchase price + interest + insurance + fuel + maintenance) over just the appealing monthly payment. A cheaper car with high maintenance or insurance costs can quickly become a financial burden, jeopardizing your financial recovery.

Your Loan, Your Future: Rebuilding Credit and Managing Your Financial Health in Ontario

The Opportunity: A Car Loan as a Credit Rebuilding Tool in Ontario

This is where the strategic brilliance of securing an essential car loan mid-consumer proposal truly shines. A responsibly managed car loan, even one acquired during a challenging financial period, can be a powerful instrument for credit rebuilding. How does it work? Every consistent, on-time payment you make on your car loan is reported to Canada's major credit bureaus (Equifax and TransUnion). These positive payment entries demonstrate to future lenders that you are capable of managing debt, even after past difficulties. Over time, these consistent positive entries will gradually contribute to improving your credit score, laying a solid foundation for your financial future. This is a critical step towards moving past the consumer proposal and opening doors to more favourable lending terms down the road.

Payment Discipline: The Absolute Necessity for Financial Recovery

The importance of never missing a payment on your car loan or your consumer proposal cannot be overstated. This is the bedrock of your financial recovery. Missing a payment not only incurs late fees and potentially damages your credit score further but could also lead to repossession of your vehicle, undoing all your hard work. Furthermore, failing to meet your consumer proposal obligations could lead to its annulment, returning you to your original debt situation. This is why meticulous payment discipline is absolutely necessary.

Strategies for ensuring you never miss a due date:

- Set Up Automatic Payments: This is the most reliable method. Arrange for your car loan and consumer proposal payments to be automatically deducted from your bank account on or shortly after your payday.

- Calendar Reminders: Set multiple reminders (digital and physical) a few days before each payment is due.

- Budget Buffer: Always ensure you have a small buffer in your bank account to cover unexpected expenses or slight variations in payment timing.

- Communicate Early: If you foresee a legitimate difficulty in making a payment, contact your lender and your Licensed Insolvency Trustee *immediately*. They may be able to offer solutions or temporary arrangements, but only if you communicate proactively.

Refinancing Roads: When and How to Explore Options Post-Proposal

As your credit improves and, critically, once your consumer proposal is successfully completed and discharged, refinancing your car loan might become a viable and attractive option. Refinancing means taking out a new loan to pay off your existing car loan, ideally at a lower interest rate or with more favourable terms. This can significantly reduce your monthly payments and the total amount of interest you pay over the loan's lifetime.

Here’s when and how to explore refinancing in Ontario:

- Post-Proposal Completion: Wait until your consumer proposal is fully completed and discharged. This will have a positive impact on your credit score, making you a more attractive borrower.

- Improved Credit Score: Actively monitor your credit score. As it improves with consistent payments on your car loan and other debts, your eligibility for better rates will increase.

- Shop Around: Just like your initial loan, compare offers from various lenders. Don't assume your current lender will offer the best refinancing rate.

- Consider Loan Term: While a longer loan term can lower monthly payments, it might increase the total interest paid. Balance affordability with the overall cost.

Refinancing is a reward for your diligent financial management and can be a powerful final step in optimizing your car loan and further strengthening your financial health. For those in Toronto, specifically looking for post-CP options, our guide Toronto: Your Post-CP, No-Down Work Car. (Yes, *Today*.) offers additional localized advice.

Pro Tip: Set up automatic payments for your car loan and your consumer proposal to ensure you never miss a due date. This consistency is paramount for credit rebuilding and will significantly improve your financial standing.

Your Next Steps to Approval: A Roadmap for Essential Workers in Ontario

Recap: The Critical Elements for Success in Securing Your Essential Commute Loan

Securing a car loan mid-consumer proposal for an essential work commute in Ontario is entirely achievable, but it requires strategy, meticulous preparation, and transparency. Remember, the key is to present yourself as a responsible individual actively working towards financial recovery, for whom a vehicle is an absolute necessity, not a luxury. By highlighting your stable employment, proving your commitment to your consumer proposal, and demonstrating careful budgeting, you build a compelling case for lenders. This journey is not just about getting a car; it's about empowerment, maintaining your livelihood, and taking a tangible step towards a stronger financial future.

Actionable Checklist: From Gathering Documents to Choosing the Right Vehicle

To help you navigate this process, here's an actionable checklist to guide your journey to approval:

- Verify your essential commute need with detailed employer documentation.

- Gather all financial documents, including recent pay stubs, T4s, and full consumer proposal details with payment history.

- Create a detailed, realistic personal budget that clearly incorporates the new car loan payment.

- Consider your down payment options. Even a small down payment can make a difference.

- Research reliable, fuel-efficient, and affordable used vehicles (e.g., Honda Civic, Toyota Corolla).

- Identify specialized lenders or dealerships in your Ontario region (e.g., Kingston, Burlington, Oshawa, Barrie) that cater to challenging credit situations.

- Understand all loan terms, interest rates, and total costs (including fees and insurance) before committing to any agreement.

- Prepare questions for lenders and be ready to negotiate.

Finding the Right Partner: How to Identify Reputable Lenders and Dealerships in Ontario

Choosing the right financial partner is crucial, especially when you're in a vulnerable financial position. Here are tips for researching and selecting trustworthy lenders and dealerships who understand the nuances of financing mid-consumer proposal in Ontario, ensuring a fair and transparent process:

- Look for Specialization: Seek out dealerships or finance companies that explicitly advertise their expertise in bad credit or subprime financing. They are more likely to have the systems and lender relationships to help you.

- Check Online Reviews: Consult Google reviews, Better Business Bureau ratings, and other online testimonials. Look for patterns of positive experiences, especially regarding transparency, customer service, and fairness.

- Ask Detailed Questions: A reputable lender or dealership will be happy to answer all your questions about interest rates, fees, loan terms, and the application process. Be wary of those who are vague or rush you.

- Transparency is Key: Ensure they provide a clear, itemized breakdown of all costs associated with the loan and the vehicle. Avoid any dealer who pressures you into signing without fully understanding the terms.

- Don't Feel Pressured: A good partner will give you time to review documents and make an informed decision. High-pressure sales tactics are a red flag.

- Consult Your Trustee (Informally): While not required to approve, your Licensed Insolvency Trustee can sometimes offer general advice or point you towards reputable resources.

By taking these deliberate steps, you not only increase your chances of securing the essential car loan you need but also protect yourself from predatory practices, ensuring your path to financial recovery is as smooth as possible.

Pro Tip: Don't rush into the first offer. Take your time to compare at least 2-3 loan offers from different lenders or dealerships to ensure you're getting the best possible terms for your situation. This due diligence can save you thousands of dollars over the loan term.