What If Your Car Loan *Was* Your Best Credit Card? (Post-Proposal Speed-Rebuild, Toronto)

Table of Contents

- Key Takeaways: Your Post-Proposal Power Play in Toronto

- The Phoenix from the Ashes: Why Your Car Loan is More Than Just Transportation Post-Consumer Proposal

- Untangling the Web: Decoding Your Credit Profile After a Consumer Proposal in Ontario

- The Strategic Edge: Why a Car Loan is Your Fastest Route to Credit Redemption in Toronto

- Navigating the Lender Labyrinth: Finding Your Approval Pathway in Ontario

- Traditional Banks (The Uphill Battle)

- Subprime Auto Lenders & Dealerships (Your Best Bet)

- Broker Networks

- What Lenders Are Looking For

- The Cost of Rebuilding: Unmasking Interest Rates, Fees, and the True Value of Your Loan

- Strategies to Mitigate High Costs:

- Your Strategic Roadmap: From Application to Accelerated Credit Growth in Greater Toronto

- Step 1: Budgeting for Success

- Step 2: Documentation is Key

- Step 3: Smart Car Selection

- Step 4: The Application Process

- Step 5: Payment Discipline is Paramount

- Step 6: Monitoring Your Progress

- Beyond the Loan: Supercharging Your Credit Rebuild with Complementary Strategies

- Secured Credit Cards

- Credit Builder Loans

- Utility & Bill Payments

- Responsible Financial Habits

- Driving Towards a Stronger Financial Future: Your Next Steps to Approval and Beyond

- FAQ: Your Most Pressing Questions Answered About Post-Proposal Car Loans

Key Takeaways: Your Post-Proposal Power Play in Toronto

- A car loan, when managed strategically, can be one of the most effective tools for credit rebuilding post-Consumer Proposal discharge in Ontario.

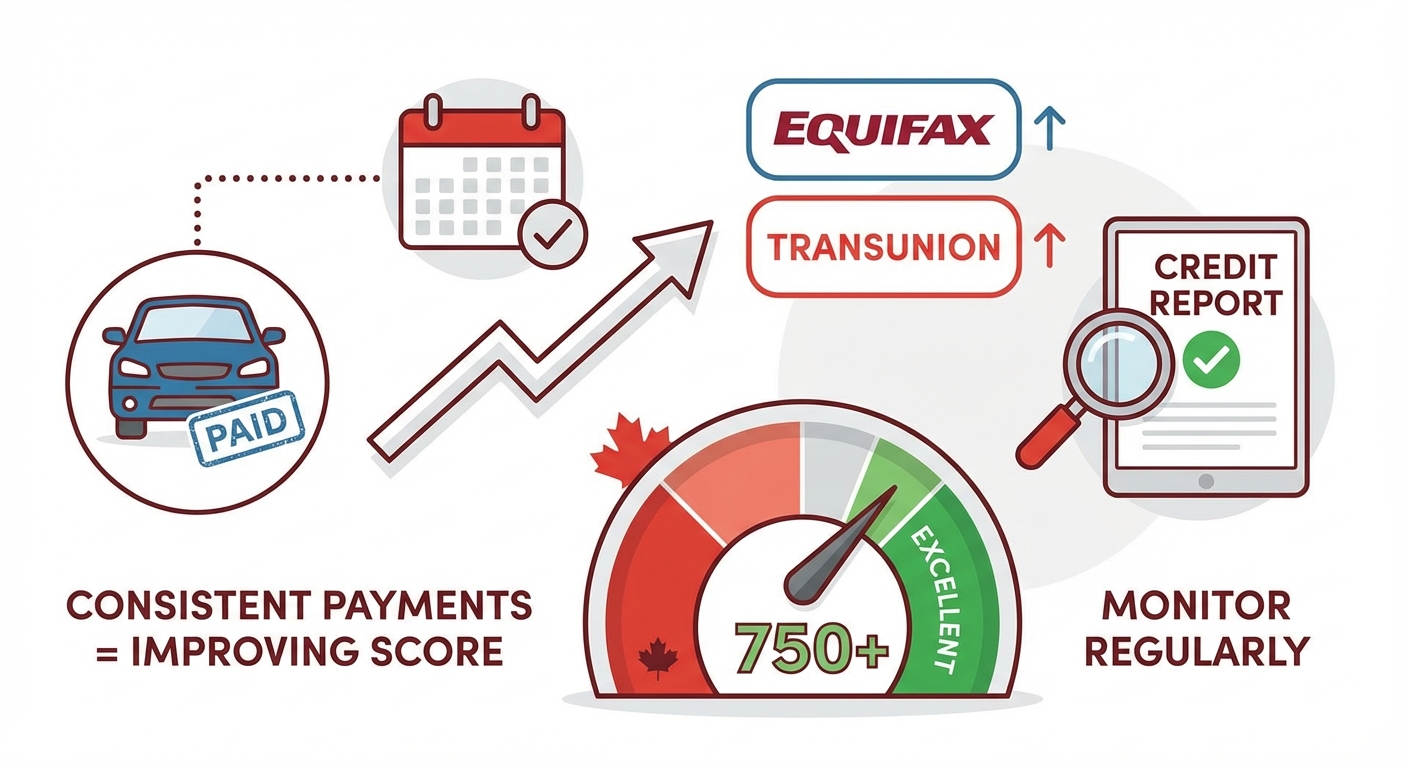

- Expect higher initial interest rates, but your unwavering focus must be on consistent, on-time payments as this directly impacts your credit score.

- Dealerships specializing in subprime financing, particularly those prevalent in the Greater Toronto Area and other major Ontario cities, often offer more accessible approval options compared to traditional banks.

- Choosing the right vehicle and loan term is paramount, ensuring both affordability within your post-proposal budget and maximum positive impact on your credit profile.

- Beyond the car loan, proactive credit monitoring and the judicious use of additional secured credit products will significantly accelerate your credit rebuilding journey.

The Phoenix from the Ashes: Why Your Car Loan is More Than Just Transportation Post-Consumer Proposal

Emerging from a Consumer Proposal in Ontario can feel like a fresh start, a monumental relief. Yet, for many Canadians in cities like Toronto, Mississauga, and Ottawa, the immediate aftermath also brings a stark reality check: your credit score has taken a significant hit. This isn't a judgment; it's simply the mechanics of the credit reporting system. Traditional lenders, like major banks, often view a recently discharged Consumer Proposal with caution, making it challenging to secure new credit, whether it's a credit card or a line of credit. But what if there was a powerful, often overlooked, tool that could not only get you reliable transportation but also act as your primary engine for credit recovery?

Enter the car loan. For individuals navigating the credit landscape post-Consumer Proposal, a car loan isn't merely a means to get from point A to point B. It's a strategic financial instrument, a deliberate power play designed to rapidly rebuild your credit profile. Think of it not just as a purchase, but as a super-charged credit card for your credit score, reporting substantial, consistent positive activity to the major credit bureaus every single month.

The stigma of 'bad credit' needs to be reframed as a 'credit rebuilding opportunity.' This shift in perception is crucial. While unsecured credit products like credit cards might be elusive or come with very low limits and high fees, a secured auto loan offers a unique entry point. Why? Because the loan is backed by collateral – the vehicle itself. This reduces the risk for lenders, making them more willing to approve applicants who might otherwise be declined.

Let's dive deeper into this analogy: How does a car loan function like a powerful, long-term credit card? Just as consistent, on-time payments on a credit card gradually improve your score, so too do the regular, scheduled payments on an auto loan. However, the impact of a car loan is often magnified. You're typically dealing with a larger principal amount and a longer repayment term (e.g., 48-72 months). Each payment demonstrates sustained financial responsibility, contributes to principal reduction, and, crucially, is reported to both Equifax and TransUnion, the primary credit bureaus in Canada. This creates a robust, positive payment history, which is one of the most significant factors in determining your credit score. This isn't just about getting a car; it's about strategically leveraging a necessity into a credit-building powerhouse. For more insights on how these loans are approved, check out our guide on Post-Proposal Car Loan: Your Credit Score Just Got a Mulligan.

Untangling the Web: Decoding Your Credit Profile After a Consumer Proposal in Ontario

Understanding the impact of a Consumer Proposal (CP) on your credit report is the first step toward effective rebuilding. In Ontario, as in the rest of Canada, a Consumer Proposal typically remains on your credit report for a period of three years after you have successfully completed and been discharged from it. This means that even after you've made your final payment and received your certificate of full performance, the "scar" remains visible to lenders for a while longer. During this time, your credit score will likely be significantly lower than before the proposal, often in the 'poor' or 'fair' range (e.g., below 600).

When you're rebuilding from scratch, it's important to identify the specific credit factors that are most damaged. The payment history, which accounts for approximately 35% of your credit score, takes the biggest hit. The CP itself indicates a history of missed or late payments on previous debts. Your credit mix also suffers; often, a CP involves consolidating or eliminating various types of credit (revolving, installment), leaving your profile unbalanced. Furthermore, the length of your credit history might appear shorter or less stable, as older, positive accounts may have been closed or included in the proposal.

But lenders, especially those specializing in subprime financing in regions like Barrie or Oshawa, look beyond just the numerical score. They want to see stability and a clear plan moving forward. They assess factors such as your current income stability, your employment history, your debt-to-income ratio (post-proposal), and your ability to make a down payment. They understand that a Consumer Proposal is a specific legal process designed to help individuals get back on their feet, not a permanent mark of irresponsibility. What they need to see is evidence that you've learned from past challenges and are now capable of managing new credit responsibly.

Pro Tip: Your Credit Report is Your Blueprint

After your Consumer Proposal discharge, immediately obtain and meticulously review your credit report from both Equifax and TransUnion. These reports are your blueprint for credit rebuilding. Check for accuracy: ensure your CP is marked as 'discharged' and that no old debts are incorrectly showing as active or delinquent. Identify any lingering errors and dispute them promptly. Understanding exactly what needs fixing empowers you to target your rebuilding efforts effectively.

This comprehensive view helps them make an informed decision, differentiating between someone who has simply defaulted and someone who has completed a structured financial recovery. Your willingness to engage in this process signals a commitment to financial health.

The Strategic Edge: Why a Car Loan is Your Fastest Route to Credit Redemption in Toronto

When it comes to credit rebuilding after a Consumer Proposal, not all forms of credit are created equal. While secured credit cards are excellent for demonstrating responsible revolving credit use, a car loan offers a unique and powerful advantage that can significantly accelerate your journey towards a stronger credit score. This acceleration stems from several key mechanisms inherent to secured installment loans.

First, consider the impact of Consistent Reporting, Big Impact. A car loan typically involves substantial monthly payments over an extended period. Each of these payments, made on time, creates a robust and consistent positive payment history that is reported to the credit bureaus. Compared to the smaller, often less frequent payments on a secured credit card, these larger, regular contributions have a more significant and visible impact on your credit report. They demonstrate a sustained ability to manage a substantial financial commitment, which weighs heavily in credit scoring models.

Next is Credit Mix Mastery. Credit scoring models favour individuals with a healthy mix of different credit types. After a Consumer Proposal, your credit profile often lacks diversity, primarily consisting of closed accounts or perhaps a single secured credit card. Adding a secured installment loan, like a car loan, diversifies your credit mix. This blend of revolving credit (like credit cards) and installment credit (like auto loans) signals to lenders that you can responsibly manage various types of debt, a factor highly valued by credit bureaus.

The Long-Term Commitment, Long-Term Gains aspect is also crucial. Car loans often have terms ranging from 48 to 72 months, or even longer. This extended period provides a sustained track record of positive reporting. Every month you make a payment, you're reinforcing your commitment to financial responsibility. This long-term positive data builds a foundation of trust that shorter-term credit products simply can't replicate, proving your ability to manage debt over an extended horizon, which is a powerful indicator for future lenders. This consistent positive history is invaluable, especially in competitive markets like Brampton or Sudbury.

Finally, the distinction between Secured vs. Unsecured credit cannot be overstated. After a Consumer Proposal, traditional banks are often hesitant to offer unsecured loans or credit cards because there's no collateral backing the debt. A car loan, however, is a secured loan, meaning the vehicle itself acts as collateral. This significantly reduces the risk for lenders, making them far more willing to approve post-proposal applicants. This security allows them to extend credit when others won't, providing you with that crucial entry point back into the credit system.

Pro Tip: The Power of Payment History

Remember, payment history accounts for approximately 35% of your credit score – it's the single most influential factor. A car loan, with its large, consistent monthly payments over several years, offers an unparalleled opportunity to build a solid, positive payment history. Making every payment on time is not just about keeping your car; it's about actively constructing the foundation of your improved credit score.

Leveraging a car loan strategically isn't just about needing a vehicle; it's about understanding how it functions as a powerful tool for credit redemption, offering advantages that other credit products simply can't match. For those in Toronto seeking immediate transportation solutions post-CP, our guide on Toronto: Your Post-CP, No-Down Work Car. (Yes, *Today*.) offers further insights.

Navigating the Lender Labyrinth: Finding Your Approval Pathway in Ontario

One of the most pressing questions for anyone discharged from a Consumer Proposal is, "Where can I actually get approved for a car loan?" The lending landscape after a Consumer Proposal can be complex, but understanding the different types of lenders is key to finding your approval pathway in Ontario.

Traditional Banks (The Uphill Battle)

For most individuals immediately after a Consumer Proposal discharge, securing a car loan from a major Canadian bank (such as RBC, TD, BMO, Scotiabank, CIBC, or National Bank) will be an uphill battle. Traditional banks typically have very strict lending criteria and are often risk-averse. They prefer applicants with long, unblemished credit histories and high credit scores. While it's not entirely impossible to get approved by a traditional bank years after discharge and with a significantly rebuilt credit profile, it's highly unlikely immediately post-proposal. Their automated systems often flag a Consumer Proposal as high-risk, leading to swift rejections.

Subprime Auto Lenders & Dealerships (Your Best Bet)

This is where your best opportunities lie. Dealerships, particularly those in bustling urban centres like Toronto, Mississauga, and across Ontario, often have dedicated 'special finance' departments. These departments work with a network of subprime auto lenders who specialize in financing individuals with challenging credit histories, including those who have recently completed a Consumer Proposal. These lenders understand the nuances of a CP – they recognize that it signifies a structured resolution of past debt, not a perpetual inability to manage finances. They are more focused on your current ability to pay, your income stability, and your commitment to rebuilding credit.

These dealerships and lenders are equipped to assess your unique situation, looking beyond just your credit score. They're more concerned with factors like your current employment, consistent income, and your overall financial stability post-proposal. They see the potential for a long-term, responsible customer rather than just a past credit event.

Broker Networks

Another excellent option is to work with an auto loan broker. Brokers act as intermediaries, connecting applicants with a wider range of lenders, including those specialized subprime financiers, who might be a good fit for their unique credit situation. A reputable broker understands the specific criteria of different lenders and can help package your application in the most favourable light. They save you time and the potential damage to your credit score from multiple 'hard' inquiries by traditional banks that are unlikely to approve you anyway.

What Lenders Are Looking For

Regardless of the lender type, certain factors will always be paramount:

- Income Stability: Lenders need to see a consistent, verifiable source of income that can comfortably cover your car payments and other living expenses.

- Down Payment Potential: Even a small down payment signals commitment and reduces the lender's risk.

- Clear Budget Post-Proposal: Demonstrating that you have a handle on your finances and a realistic budget for a car loan is crucial.

- Documentation: Be prepared with proof of income (pay stubs, employment letters), proof of residence, your Consumer Proposal discharge papers, and banking information.

Pro Tip: Leverage Your Down Payment

Even a modest down payment can significantly improve your approval odds and potentially lead to a lower interest rate. For lenders in smaller communities like Orillia, Peterborough, or Windsor, a down payment demonstrates your commitment to the loan and your ability to manage your finances. It reduces the amount you need to borrow and, consequently, the lender's risk, making your application much more attractive.

Choosing the right lender pathway is critical. By focusing on specialized subprime lenders and dealerships or utilizing a broker, you dramatically increase your chances of approval, setting the stage for your credit rebuilding success. For those who might feel their situation is "impossible," it's worth exploring how The Consumer Proposal Car Loan You Were Told Was Impossible can become a reality.

The Cost of Rebuilding: Unmasking Interest Rates, Fees, and the True Value of Your Loan

One of the realities of securing a car loan after a Consumer Proposal is that you will likely face higher interest rates initially. It's crucial to have Realistic Interest Rate Expectations. For post-proposal applicants in Ontario, interest rates can range significantly, often starting from 9-12% and potentially going much higher, depending on the severity of your credit challenges, the loan term, the vehicle chosen, and the lender. While these rates might seem daunting compared to prime rates, it's essential to view them as the 'cost of rebuilding' – a temporary investment in restoring your financial standing.

This higher rate is what lenders refer to as a 'Risk Premium'. Lenders charge more for perceived higher risk. A Consumer Proposal indicates a past inability to meet financial obligations, which translates to a higher risk profile in their eyes. However, the good news is that this risk premium decreases over time with a consistent history of on-time payments. As your credit score improves, you become a less risky borrower, opening the door to refinancing opportunities at lower rates down the line.

Beyond interest rates, be vigilant about Hidden Fees & Add-ons. Dealerships often present various add-ons that can inflate the total cost of your loan. These can include:

- Extended Warranties: While some can offer peace of mind, ensure they provide genuine value and aren't excessively priced.

- Rust Proofing/Paint Protection: Often overpriced and sometimes unnecessary, especially for newer vehicles.

- Credit Insurance (Life, Disability, Critical Illness): This covers your payments if you're unable to work, but it's often optional and can be expensive. Always compare with external insurance providers.

- Documentation Fees: Standard, but ensure they are reasonable and disclosed upfront.

Strategies for negotiation are key here. Don't be afraid to decline add-ons you don't need or to negotiate their price. Ask for a breakdown of all costs and understand what each item entails.

Understanding the Calculating Your True Cost of Borrowing is paramount. It's easy to get fixated solely on the monthly payment. However, a lower monthly payment often means a longer loan term and, consequently, paying significantly more interest over the life of the loan. Always ask for the total amount you will pay back (principal + interest + fees) and the Annual Percentage Rate (APR), which includes fees, to get a clear picture of the true cost of borrowing.

Strategies to Mitigate High Costs:

- Shorter Loan Terms: If your budget allows, opt for the shortest loan term possible. While monthly payments will be higher, you'll pay significantly less interest overall.

- Larger Down Payments: As discussed, a larger down payment reduces the principal amount borrowed, lowering both your monthly payments and the total interest paid.

- The Power of Refinancing Later: This is a critical strategy. After 12-18 months of impeccable payments on your initial loan, your credit score will have likely improved. At this point, you can explore refinancing your car loan with a traditional bank or a prime lender for a much lower interest rate, saving you thousands of dollars over the remaining term.

Pro Tip: Don't Just Look at the Monthly Payment

While an affordable monthly payment is important for your budget, it shouldn't be your sole focus. Always ask for the total cost of the loan and the Annual Percentage Rate (APR). A seemingly low monthly payment over an extended term can hide a much higher total cost due to accumulated interest. Comparing APRs across different offers will give you the most accurate comparison of borrowing costs.

By being informed and strategic, you can navigate the costs of a post-proposal car loan effectively, ensuring that while you pay a premium for rebuilding, you're doing so in the most financially intelligent way possible.

Your Strategic Roadmap: From Application to Accelerated Credit Growth in Greater Toronto

Securing a car loan after a Consumer Proposal is a strategic decision that requires careful planning and execution. This roadmap outlines the steps to not only get approved but also to maximize the credit rebuilding potential of your new loan, particularly in dynamic regions like Greater Toronto.

Step 1: Budgeting for Success

Before you even start looking at cars, create a realistic and comprehensive budget. A car isn't just a monthly payment; it involves insurance (which can be significantly higher post-proposal), fuel, maintenance, and potential parking costs, especially in dense urban centres like Toronto or Ottawa. Ensure your budget can comfortably accommodate all these expenses without strain. Overstretching your finances for a vehicle is counterproductive to credit rebuilding.

Step 2: Documentation is Key

Be prepared. Gathering all necessary paperwork in advance will streamline the application process and demonstrate your readiness to lenders. This typically includes:

- Proof of income (recent pay stubs, employment letter, T4s, or tax assessments for self-employed individuals).

- Proof of residence (utility bills, lease agreement).

- Your Consumer Proposal discharge papers.

- Government-issued ID.

- Banking information (void cheque or direct deposit form).

Having these documents ready shows you're serious and organized.

Step 3: Smart Car Selection

Choose an affordable, reliable vehicle that fits your budget and minimizes financial strain. While a brand-new luxury car might be tempting, a reliable used car is often the smarter choice for credit rebuilding.

| Factor | New Car for Credit Rebuilding | Used Car for Credit Rebuilding |

|---|---|---|

| Initial Cost | Higher purchase price | Lower purchase price |

| Depreciation | Faster depreciation, especially in the first few years | Slower depreciation, more stable value |

| Interest Impact | Higher loan amount means more interest paid over time | Lower loan amount, less total interest paid |

| Maintenance/Reliability | Often comes with manufacturer warranty, lower immediate maintenance costs | Potential for higher maintenance costs, but can be mitigated by choosing certified pre-owned or reliable brands |

| Credit Impact | A larger loan, if managed well, can show greater responsibility | Still provides strong credit-building potential with smaller commitment |

Focus on value and practicality. A car that causes financial stress through high payments or unexpected repairs will hinder your credit journey.

Step 4: The Application Process

When you apply at a dealership or through a broker, they will typically conduct a credit inquiry. Be aware of the difference between a 'soft' inquiry (which doesn't affect your score and is often used for pre-approvals) and a 'hard' inquiry (which occurs when you formally apply for credit and can temporarily dip your score by a few points). Try to limit hard inquiries by applying with lenders or brokers who can find multiple options with a single inquiry. Your broker or dealership should explain this process clearly.

Step 5: Payment Discipline is Paramount

This is the most critical step for credit rebuilding. Your car loan is a tool, and its effectiveness depends entirely on your usage. Set up automatic payments to ensure you never miss a due date. If possible, consider making bi-weekly payments, which can help you pay down the principal faster and reduce overall interest. Avoid missed payments at all costs; even one late payment can significantly damage the positive progress you've made.

Step 6: Monitoring Your Progress

Regularly check your credit score and report (from Equifax and TransUnion) every few months. You should start to see the positive impact of your consistent car loan payments reflected in an improving score and a healthier credit report. This monitoring also allows you to catch any inaccuracies early.

Beyond the Loan: Supercharging Your Credit Rebuild with Complementary Strategies

While your car loan will be a cornerstone of your credit rebuilding journey post-Consumer Proposal, it's not the only tool in your arsenal. By combining your auto loan with other smart financial strategies, you can accelerate your credit growth even further, creating a truly robust financial foundation.

Secured Credit Cards

A secured credit card is an excellent complement to your car loan. With a secured card, you provide a cash deposit that becomes your credit limit. This deposit secures the card, making it accessible even with a low credit score. Use it responsibly: make small purchases you can immediately pay off, and always pay your balance in full and on time. This adds another positive tradeline to your credit report, demonstrating your ability to manage revolving credit, a different type of credit than your installment car loan. This diversification further strengthens your credit mix.

Credit Builder Loans

Some financial institutions offer specialized "credit builder loans." With this type of loan, the money you borrow is held in a savings account or GIC until you've paid off the loan. Once paid in full, you receive the funds. These are designed purely for credit building, reporting your consistent payments to the bureaus without requiring you to manage a large sum of money upfront. They are smaller than car loans but offer another layer of positive payment history.

Utility & Bill Payments

While not all utility or phone companies report to credit bureaus, an increasing number do, or at least they report *negative* information (missed payments). Ensure all your household bills – rent, utilities (hydro, gas), internet, and phone – are paid on time, every time. A clean record on these accounts, even if not always reported positively, prevents further damage to your credit profile. Some services, like rent reporting platforms, can even help get your on-time rent payments reported to credit bureaus, adding another positive tradeline.

Responsible Financial Habits

Beyond specific credit products, cultivating sound financial habits is fundamental. This includes:

- Maintaining a Stable Income: Your ability to make payments is directly tied to your income.

- Avoiding New Unnecessary Debt: Resist the urge to take on new loans or credit cards before your credit is fully restored.

- Building an Emergency Fund: Having a buffer of savings (e.g., 3-6 months of living expenses) prevents you from relying on credit in unforeseen circumstances, which can derail your rebuilding efforts.

Pro Tip: The Refinancing Opportunity

Once your credit score begins to improve, typically after 12-18 months of perfect, on-time payments on your car loan, explore the opportunity to refinance. Refinancing your car loan for a lower interest rate can save you significant money over the remaining term. It's a win-win: you continue to build credit with a positive tradeline, but now at a much more favourable cost. This is a crucial step in translating your credit rebuilding efforts into tangible financial savings.

By implementing these complementary strategies alongside your car loan, you're not just rebuilding credit; you're constructing a solid financial future, piece by piece.

Driving Towards a Stronger Financial Future: Your Next Steps to Approval and Beyond

Navigating the aftermath of a Consumer Proposal can feel like an uphill climb, but as we've explored, a strategically managed car loan can transform that climb into a steady, powerful ascent. It's more than just a vehicle; it's a meticulously chosen instrument designed to reconstruct your financial standing, offering a consistent, significant boost to your credit report where it matters most.

We've delved into why traditional credit avenues are often closed off post-proposal, and how specialized subprime lenders and dealerships in vibrant Canadian cities like Toronto, Mississauga, and across Ontario offer a vital lifeline. You now understand the critical role of consistent, on-time payments, the value of a balanced credit mix, and the significant impact a secured installment loan can have on your credit score over the long term. You're also equipped to navigate the realities of interest rates, identify hidden fees, and leverage strategies like down payments and future refinancing to your advantage.

The journey to a strong financial future requires patience, discipline, and consistent effort. Your car loan, managed wisely, will serve as a testament to your renewed financial responsibility, opening doors to better borrowing opportunities, lower interest rates, and greater financial freedom down the road. Don't let past financial challenges define your future. Instead, empower yourself with knowledge and take decisive action.

It's time to take control. Start the process today with informed decisions, and drive confidently towards the financial future you deserve.