Uber Driver Car Loan: Your Phone *Is* Your Pay Stub.

Table of Contents

- Your Phone *Is* Your Pay Stub: Key Takeaways for Uber Driver Car Loans

- The Digital Footprint Advantage: How Your Gig Data Replaces the W-2

- Preparation is Power: The Non-Negotiables for Approval Odds

- Not All Lenders Are Equal: Finding Your Ally in the Auto Financing World

- Deconstructing the 'No Income Proof' Myth: What Lenders *Actually* Look For

- Beyond the W-2: The 'Uber Earnings Report' as Your New Resume

- Bank Statements: Your Financial Story Told in Transactions

- The Tax Man's Tale: Schedule C and Your Income Declaration

- Credit Score: The Unseen Co-Applicant for Every Car Loan

- The Lender Landscape: Who Will Give an Uber Driver a Car Loan?

- Traditional Banks & Credit Unions: The 'Old Guard' with New Rules

- Dealership Financing: Convenience vs. Cost for the Gig Worker

- Online Lenders & Fintech Platforms: The Digital Innovators

- The 'Buy Here, Pay Here' Option: A Last Resort Consideration

- Crafting Your Winning Application: Strategies for Uber Drivers

- The Power of the Down Payment: More Than Just a Good Idea

- Debt-to-Income Ratio: Your Invisible Financial Report Card

- The Co-Signer Advantage: When Two Incomes Are Better Than One

- What Car Should an Uber Driver Buy? Aligning Vehicle Choice with Loan Reality

- Beyond Approval: Understanding the True Cost of Your Uber Car Loan

- Interest Rates for Gig Workers: Why They Might Be Different

- Insurance Implications: Personal vs. Commercial Coverage for Ride-Share

- Maintenance, Depreciation, and Unexpected Costs: The Realities of Driving for Uber

- Your Next Steps to Approval: Navigating the Application Process

- The Document Checklist: What to Have Ready Before You Apply

- Pre-Approval Power: Why It's Your Best Friend

- What If You're Denied? Rejection Isn't the End of the Road

- Frequently Asked Questions About Car Loans for Uber Drivers

- Q: Can I get a car loan with bad credit if I drive for Uber?

- Q: How long do I need to be driving for Uber to qualify for a loan?

- Q: Do I need a business license to get an Uber car loan?

- Q: What's the best way to prove my Uber income?

- Q: Can I get a 0% APR car loan as an Uber driver?

- Q: Should I lease or buy a car for Uber driving?

- Q: Are there specific loan programs for gig workers or self-employed individuals?

Driving for Uber in Canada offers incredible flexibility and the freedom of being your own boss. But when it comes to securing a car loan, the traditional "pay stub" often feels like a relic from another era. How do you prove your income when your earnings fluctuate, your office is your car, and your boss is an algorithm? For years, self-employed individuals, especially gig workers, faced an uphill battle convincing lenders they were a good credit risk. The good news? The financial landscape is evolving, and your smartphone, the very device that powers your livelihood, is becoming your most powerful financial document.

At SkipCarDealer.com, we understand the unique challenges and opportunities faced by Canadian Uber drivers. We know that your dedication to the road deserves access to reliable transportation, and that means securing the right car loan. This comprehensive guide will demystify the process, showing you how your digital footprint can open doors to car financing, even when traditional income proof seems out of reach.

Your Phone *Is* Your Pay Stub: Key Takeaways for Uber Driver Car Loans

Navigating the world of car loans as an Uber driver can feel like a maze, but it doesn't have to be. Here's what you absolutely need to know right now to secure a car loan without traditional income proof:

- Digital is the New Traditional: Lenders are increasingly accepting your Uber app data, bank statements showing consistent deposits, and well-prepared tax returns as legitimate proof of income. Your digital records are your financial resume.

- Preparation is Paramount: This isn't a "no proof" loan; it's a "different proof" loan. Organize your digital earnings reports, understand your credit score, and have a clear picture of your financial health before you apply.

- Lender Specialization Matters: Not all lenders treat gig workers equally. Seek out financial institutions, online platforms, or dealerships that explicitly advertise self-employed or gig worker financing. They understand your unique situation better.

- Credit Score Still Reigns: Even with non-traditional income, your credit score remains a critical factor in approval and interest rates. Work to improve it.

- Down Payment Power: A significant down payment can dramatically improve your approval odds and secure better terms, signaling reduced risk to lenders.

The Digital Footprint Advantage: How Your Gig Data Replaces the W-2

The days of needing a physical W-2 or a stack of pay stubs to prove your income are fading, especially for the dynamic world of gig economy workers. Lenders are adapting, recognizing that an Uber driver's income, while non-traditional, can be stable and substantial. Your Uber app logs every trip, every fare, every bonus – creating a rich, verifiable data trail. This digital footprint, combined with your banking history and tax filings, paints a comprehensive picture of your earning potential. It's a shift from static documents to dynamic, real-time financial evidence, putting the power of proof directly in your hands (and on your phone).

Preparation is Power: The Non-Negotiables for Approval Odds

Securing a car loan as an Uber driver isn't about finding a shortcut; it's about smart preparation. Lenders still need confidence in your ability to repay the loan. This means presenting a clear, consistent, and positive financial story. What are the non-negotiables? Firstly, impeccable digital records of your Uber earnings. Secondly, a thorough understanding of your credit health – what's on your report, and how can you improve it? Thirdly, a clear overall financial picture, including your expenses and savings. This isn't a 'no proof' loan; it's a 'different proof' loan, and your diligence in preparation will be your greatest asset.

Not All Lenders Are Equal: Finding Your Ally in the Auto Financing World

The auto financing world is diverse, and not every lender is equipped or willing to work with gig economy income. Traditional banks might stick to rigid, outdated criteria, while credit unions often offer more flexibility due to their community-focused approach. Then there are specialized online lenders and certain dealerships that have embraced the gig economy, developing algorithms and processes specifically designed to assess non-traditional income. Knowing where to look can save you time, frustration, and potentially secure you a much better deal. Your goal is to find an ally who understands your unique earning model.

Deconstructing the 'No Income Proof' Myth: What Lenders *Actually* Look For

When you hear "car loan for Uber driver no income proof," it can be misleading. It doesn't mean you don't need to prove your income at all. It means you don't need the *traditional* W-2 or employer-issued pay stub. Lenders still need to verify your income and assess your ability to make payments. For Uber drivers, this verification comes through a combination of digital records that collectively tell your financial story. Let's break down what those critical pieces of evidence are.

Beyond the W-2: The 'Uber Earnings Report' as Your New Resume

Your Uber earnings reports are gold. These weekly or monthly summaries, readily available through your Uber driver app or online portal, detail your gross earnings, net pay after Uber's commission, tips, bonuses, and even mileage. Lenders scrutinize these reports for consistency and trends. They want to see a reliable pattern of income over several months, ideally 6-12 months, or even longer (12-24 months is often preferred). A steady income shows stability, while an upward trend demonstrates growth and strong potential. High gross earnings are positive, but lenders will also look at your net income to understand your actual take-home pay.

Bank Statements: Your Financial Story Told in Transactions

Your bank statements provide a real-world validation of your Uber earnings reports. Lenders will look for regular, consistent deposits from Uber (or similar ride-share platforms) into your account. These deposits corroborate the figures on your earnings reports and demonstrate that the money is indeed flowing into your hands. Beyond just deposits, bank statements offer a broader view of your financial habits – how you manage your money, your spending patterns, and whether you maintain a healthy balance. For more on how your banking activity can serve as income proof, check out our guide: Self-Employed? Your Bank Account *Is* Your Proof. Get Approved.

The Tax Man's Tale: Schedule C and Your Income Declaration

In Canada, if you're self-employed, your income and expenses are typically reported on a T2125 Statement of Business or Professional Activities, which is part of your T1 Income Tax and Benefit Return. This document is a critical piece of evidence for lenders. It formally declares your self-employment income, expenses, and ultimately, your net profit. Lenders will review your T2125 to understand your declared income over the past one or two tax years. They'll assess how your stated income aligns with your Uber earnings reports and bank statements, looking for consistency and accuracy. While deductions are great for tax purposes, lenders will focus on your net taxable income as a realistic indicator of your repayable capacity.

Credit Score: The Unseen Co-Applicant for Every Car Loan

Even without traditional pay stubs, your credit score remains paramount. It's a numerical representation of your financial reliability and your history of managing debt. A strong credit score signals to lenders that you are a responsible borrower, making you a lower risk. This translates directly into better interest rates and a higher likelihood of approval. Conversely, a low credit score can lead to higher interest rates, stricter terms, or even denial. Factors influencing your score include payment history, amounts owed, length of credit history, new credit, and credit mix. If you've recently been through a consumer proposal or bankruptcy, don't despair; it's still possible to get approved. For more on rebuilding your credit after such events, read our guide: Post-Proposal Car Loan: Your Credit Score Just Got a Mulligan.

The Lender Landscape: Who Will Give an Uber Driver a Car Loan?

The search for a car loan as an Uber driver can lead you down several paths. Understanding the different types of lenders and their typical approaches to self-employed individuals is key to finding the best fit for your situation. Each has its own set of advantages and disadvantages.

Traditional Banks & Credit Unions: The 'Old Guard' with New Rules

Major banks and credit unions are often the first stop for car loans due to their competitive rates. However, they can be more conservative and might require more extensive documentation, often preferring a longer history of self-employment (e.g., two years of tax returns). Credit unions, being member-owned, sometimes offer more flexibility and a willingness to look beyond rigid criteria, especially if you have an existing relationship with them. They may be more open to considering alternative income verification methods for long-standing members.

Dealership Financing: Convenience vs. Cost for the Gig Worker

Most dealerships work with a network of lenders, including those who specialize in various credit tiers and income types. This can be convenient, offering a one-stop shop for both your vehicle and your financing. Some dealership finance managers are adept at finding solutions for gig workers, understanding the nuances of their income. However, the convenience can sometimes come at a cost, as rates might be higher than what you could secure through direct lenders. It's crucial to be prepared and understand your options before stepping onto the lot.

Online Lenders & Fintech Platforms: The Digital Innovators

The rise of online lenders and FinTech platforms has been a game-changer for gig workers. These companies often leverage advanced algorithms and AI to assess risk, moving beyond traditional credit scores and W-2s. They can analyze your bank data, Uber earnings reports, and other digital footprints in real-time, often providing quick pre-approvals. Many specialize in non-traditional income financing, making them an excellent option for Uber drivers. They are designed for speed and efficiency, often requiring fewer physical documents.

The 'Buy Here, Pay Here' Option: A Last Resort Consideration

'Buy Here, Pay Here' (BHPH) dealerships offer in-house financing, meaning they are both the seller and the lender. They are known for their easy approval processes, often catering to individuals with very poor credit or those who have been denied elsewhere. While this might seem appealing for an Uber driver struggling to get approved, the downside is usually extremely high interest rates, restrictive terms, and often a limited selection of older, less reliable vehicles. For an Uber driver whose livelihood depends on their vehicle, this option should generally be considered a last resort.

Crafting Your Winning Application: Strategies for Uber Drivers

Getting approved for a car loan as an Uber driver isn't just about proving income; it's about presenting yourself as a low-risk, reliable borrower. By strategically enhancing your application, you can significantly increase your chances of approval and secure more favourable terms.

The Power of the Down Payment: More Than Just a Good Idea

A significant down payment is one of the most effective ways to strengthen your loan application, especially when you have non-traditional income. It immediately reduces the amount you need to borrow, which in turn lowers the lender's risk. A larger down payment also typically results in lower monthly payments, making the loan more affordable and sustainable for your fluctuating Uber income. Furthermore, it can help you secure a better interest rate, saving you thousands over the life of the loan. It demonstrates your commitment and financial stability.

Debt-to-Income Ratio: Your Invisible Financial Report Card

Your Debt-to-Income (DTI) ratio is a critical metric lenders use to assess your ability to manage monthly payments. It's calculated by dividing your total monthly debt payments by your gross monthly income. For Uber drivers, accurately calculating your gross income can be tricky, but using your average gross earnings from Uber reports is a good starting point. Lenders generally prefer a DTI of 36% or lower. A high DTI indicates you might be overextended, making you a higher risk. To improve it, focus on increasing your income (more Uber hours!) or, more practically, reducing your existing monthly debt obligations.

The Co-Signer Advantage: When Two Incomes Are Better Than One

If you're struggling to secure a loan on your own, or if you want to get a better interest rate, a co-signer can be a game-changer. A co-signer, typically a family member or close friend, agrees to be equally responsible for the loan if you default. Their stable income and strong credit history can significantly bolster your application, reducing the perceived risk for the lender. This can lead to approval where you might have been denied, or to a much more favourable interest rate. However, it's a serious commitment for both parties, and clear communication about repayment responsibilities is essential.

What Car Should an Uber Driver Buy? Aligning Vehicle Choice with Loan Reality

The type of car you choose for Uber driving isn't just about personal preference; it directly impacts your loan approval and long-term profitability. Lenders are more comfortable financing reliable, fuel-efficient vehicles because they represent a lower risk of default (due to lower running costs) and retain their value better. Furthermore, your vehicle must meet Uber's specific requirements in your city (age, model, passenger capacity). Prioritize cars known for durability, low maintenance costs, and excellent fuel economy. New cars offer warranties, but used cars can be a more budget-friendly option, especially for high-mileage driving. For insights into financing used cars as a self-employed individual, consider reading: Approval Secrets: Navigating the Best Used Car Finance Options for Ontario’s Self-Employed.

Context: An infographic comparing popular fuel-efficient cars suitable for ride-sharing (e.g., Toyota Prius, Honda Civic, Hyundai Elantra) with their estimated running costs/MPG.

Context: An infographic comparing popular fuel-efficient cars suitable for ride-sharing (e.g., Toyota Prius, Honda Civic, Hyundai Elantra) with their estimated running costs/MPG.Beyond Approval: Understanding the True Cost of Your Uber Car Loan

Getting approved is just the first step. For an Uber driver, understanding the full financial implications of a car loan goes far beyond the monthly payment. Your vehicle is your business tool, and its true cost includes several factors that can significantly impact your profitability.

Interest Rates for Gig Workers: Why They Might Be Different

Self-employed individuals, particularly those in the gig economy, might face slightly higher interest rates than traditionally employed borrowers. This isn't a judgment on your work ethic but rather a reflection of perceived risk due to income variability. Lenders may see self-employment as less stable than a salaried position, even if your Uber earnings are consistent. To mitigate this, a strong credit score, a substantial down payment, and a well-documented history of consistent earnings become even more crucial. Shopping around and getting pre-approved by multiple lenders can also help you find the most competitive rates available for your unique situation.

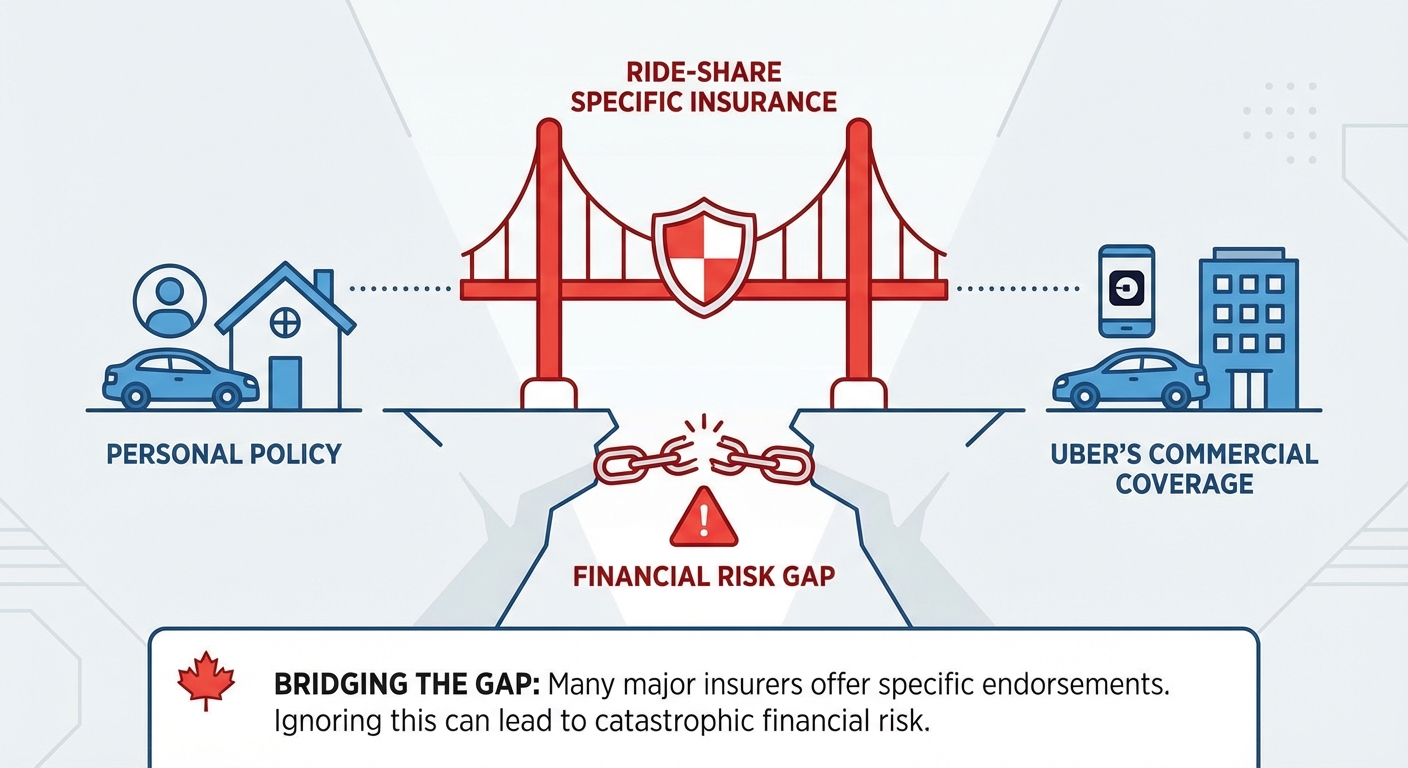

Insurance Implications: Personal vs. Commercial Coverage for Ride-Share

This is a critical, often overlooked, aspect for Uber drivers. Your personal auto insurance policy typically does NOT cover you when you're driving for a ride-sharing service. This means if you get into an accident while logged into the Uber app, your personal policy could deny your claim, leaving you with massive out-of-pocket expenses and a damaged (or totalled) vehicle. Lenders require full coverage insurance on a financed vehicle, and it's imperative that you have ride-share specific insurance that bridges the gap between your personal policy and Uber's commercial coverage. Many major insurers now offer specific ride-share endorsements or policies. Ignoring this can lead to catastrophic financial risk.

Context: A visual diagram illustrating the 'phases' of ride-share insurance coverage (app off, app on/waiting, passenger in car) and how personal vs. ride-share policies apply.

Context: A visual diagram illustrating the 'phases' of ride-share insurance coverage (app off, app on/waiting, passenger in car) and how personal vs. ride-share policies apply.Maintenance, Depreciation, and Unexpected Costs: The Realities of Driving for Uber

Driving for Uber puts significant wear and tear on your vehicle. You'll accumulate kilometres much faster than the average driver, leading to more frequent maintenance (oil changes, tire rotations, brake pads) and accelerated depreciation. Depreciation, the loss of a car's value over time, will be more pronounced for an Uber vehicle. You must budget for these realities. Beyond routine maintenance, unexpected repairs can crop up. A flat tire, a check engine light, or a minor fender bender can sideline your income and add unforeseen expenses. Factor these costs into your overall financial plan, treating your car as the essential business asset it is.

Your Next Steps to Approval: Navigating the Application Process

Armed with knowledge and a clear understanding of what lenders seek, you're ready to tackle the application process. This final section provides a practical roadmap to help you navigate it smoothly and effectively.

The Document Checklist: What to Have Ready Before You Apply

Preparation is key. Having all your documents organized and ready will streamline the application process and demonstrate your reliability to lenders. Here’s a comprehensive checklist:

- Uber Earnings Reports: At least 6-12 months, ideally 24 months, of detailed earnings summaries from the Uber driver app.

- Bank Statements: 6-12 months of bank statements showing consistent deposits from Uber and overall financial management.

- Tax Returns: Your T1 Income Tax and Benefit Returns for the past 1-2 years, including your T2125 Statement of Business or Professional Activities.

- Driver's License: Valid Canadian driver's license.

- Proof of Residency: Utility bills, lease agreement, or other documents confirming your address.

- Proof of Insurance: Quotes or existing policy details for ride-share coverage.

- Personal References: Some lenders might ask for references.

- Down Payment Funds: Proof of funds for your down payment (bank statement).

- List of Debts/Assets: A clear picture of your current financial obligations and assets.

Pre-Approval Power: Why It's Your Best Friend

Getting pre-approved for a car loan before you even step foot on a dealership lot is perhaps the most powerful strategy for any car buyer, especially an Uber driver. Pre-approval gives you a clear understanding of how much you can borrow, at what interest rate, and under what terms. This transforms you into a cash buyer at the dealership, giving you immense negotiating power on the vehicle's price. You're no longer negotiating financing; you're just buying the car. It sets realistic expectations and prevents you from being upsold on financing you can't afford or don't need.

What If You're Denied? Rejection Isn't the End of the Road

Being denied a car loan can be disheartening, but it's not the end of your journey. The first step is to understand *why* you were denied. Lenders are legally required to provide you with a reason. It could be your credit score, insufficient income verification, a high debt-to-income ratio, or even a lack of consistent self-employment history. Once you know the reason, you can strategize. Explore alternatives: a smaller loan, a less expensive car, finding a co-signer, or focusing on improving your credit score and financial documentation before reapplying. Every denial is a learning opportunity to strengthen your next application.

Frequently Asked Questions About Car Loans for Uber Drivers

Q: Can I get a car loan with bad credit if I drive for Uber?

A: Yes, it's possible to get a car loan with bad credit as an Uber driver, but it will likely come with higher interest rates. Lenders who specialize in subprime loans or those familiar with gig economy workers may be more willing to approve you. A strong down payment, a reliable co-signer, and a clear history of consistent Uber earnings can significantly improve your chances.

Q: How long do I need to be driving for Uber to qualify for a loan?

A: Most lenders prefer to see at least 6-12 months of consistent Uber income to establish a reliable earning pattern. Some more flexible or specialized lenders might consider applications with less history if other aspects of your financial profile (like a strong credit score or large down payment) are exceptionally good.

Q: Do I need a business license to get an Uber car loan?

A: While a formal business license isn't always a mandatory requirement for the car loan itself, having one can strengthen your application by formalizing your self-employment status. It demonstrates to lenders that you treat your Uber driving as a legitimate business. Additionally, local regulations in your Canadian city may require a business license to operate as a ride-share driver.

Q: What's the best way to prove my Uber income?

A: The most effective way to prove your Uber income is a combination of official Uber earnings reports (weekly/monthly summaries), bank statements showing consistent direct deposits from Uber, and your filed T1 Income Tax and Benefit Returns, specifically the T2125 Statement of Business or Professional Activities from the past 1-2 years.

Q: Can I get a 0% APR car loan as an Uber driver?

A: 0% APR car loan offers are typically very rare and usually reserved for buyers with excellent credit scores (often 750+) and a long history of stable, traditional employment. While not impossible, it's highly unlikely for most gig workers due to the perceived income variability, even with strong earnings. Focus on securing the lowest sustainable interest rate rather than a 0% offer.

Q: Should I lease or buy a car for Uber driving?

A: For most Uber drivers, buying is generally a more favourable option than leasing. Leases come with strict mileage limits, and exceeding these can result in hefty penalties – a common occurrence for high-mileage Uber drivers. When you buy, you own the asset, build equity, and have no mileage restrictions, though you'll still need to account for accelerated wear and tear and depreciation.

Q: Are there specific loan programs for gig workers or self-employed individuals?

A: Yes, the financial industry is increasingly recognizing the gig economy. Many online lenders and some specialized financial institutions are developing specific loan programs tailored for self-employed individuals and gig workers. These programs often use alternative data points and assessment models to evaluate income and risk, making them more accessible than traditional bank loans. Actively search for lenders who advertise these specialized options.