Your Child Tax Benefit: The Unexpected Car Loan Key in Vancouver.

Table of Contents

- Key Takeaways

- The Unconventional Income: Why Your Child Tax Benefit Holds Power in British Columbia Car Financing

- Demystifying Lender Perceptions: CTB as Stable Income

- The British Columbia Imperative: Why a Car is More Than a Luxury for Families in Metro Vancouver

- Pro Tip: Consistency is Key

- Deconstructing Eligibility: Beyond the Basic Threshold for Vancouver Residents

- The 'Only CTB' Nuance: What if Your Benefit is Your Sole Income?

- The Silent Partner: Your Credit History in British Columbia

- Debt-to-Income (DTI) Ratio: The Unspoken Rule

- British Columbia Driver’s Licence and Residency: The Non-Negotiables

- Pro Tip: Pre-Qualify for Insurance

- Navigating the Vancouver & British Columbia Car Market with CTB: Specifics You Need to Know

- Local Market Realities: Affordability in Metro Vancouver

- Vehicle Choice Matters: New vs. Used, and Smart Budgeting

- Vehicle Type and Family Needs: Practical Considerations for British Columbia Life

- The Financial Deep Dive: Unpacking Interest Rates, Loan Terms, and Hidden Costs in British Columbia

- Demystifying Interest Rates: What to Expect and How to Improve Them

- Loan Terms: The Balance Between Monthly Payments and Total Cost

- Hidden Costs and Fees in British Columbia: What to Watch Out For

- Pro Tip: Demand a Full Breakdown

- Your Lender Landscape in British Columbia: Banks, Dealerships, and Specialty Finance Companies

- Traditional Banks (e.g., RBC, TD, BMO, Scotiabank, CIBC in British Columbia): Higher Hurdles, Potentially Lower Rates

- Dealership Finance Departments (e.g., OpenRoad Auto Group, AutoCanada dealerships across British Columbia): Your Best Bet for Flexibility

- Specialty Finance Companies: Tailored Solutions for Unique Situations

- Pro Tip: Shop Around Aggressively

- Crafting a Winning Application: Strategies for Maximizing Your Approval Odds in Vancouver

- Documentation is Your Foundation: What to Bring to Your British Columbia Lender

- Building a Strong Case: Demonstrating Financial Stability

- The Co-Signer Option: When it Helps and When to Be Cautious

- Pro Tip: Be Transparent and Honest

- Beyond the Loan: Insurance, Maintenance, and Building Your Credit Future in British Columbia

- Navigating Car Insurance in British Columbia with ICBC: Essential Knowledge

- The Overlooked Cost: Budgeting for Vehicle Maintenance and Repairs

- Leveraging Your Car Loan to Build a Stronger Credit Score

- Real-Life Scenarios: How CTB-Backed Car Loans Empower Families Across British Columbia

- The Surrey Single Parent: Connecting to Opportunity

- The Victoria Family: Navigating Health and Essentials

- The Burnaby Newcomer: Building Independence and Credit

- Your Roadmap to Driving Away: Final Steps and Long-Term Financial Health in Metro Vancouver

- Recap: The Power of Preparation and Persistence

- Beyond the Purchase: Sustaining Your Financial Well-being

- Empowerment on the Road Ahead

- Frequently Asked Questions (FAQ) About Child Tax Benefit Car Loans in British Columbia

For families across Metro Vancouver and throughout British Columbia, the idea of securing a car loan can often feel like an insurmountable challenge, especially when traditional employment income isn't the primary source of funds. Many believe that government benefits, while helpful for daily living, simply don't carry enough weight for a significant financial commitment like purchasing a vehicle. But what if we told you that your Canada Child Benefit (CTB) could be the unexpected key to unlocking vehicle ownership?

Life in British Columbia, particularly in the sprawling communities of the Lower Mainland, often necessitates personal transportation. Public transit, while robust in central Vancouver, can be less convenient or non-existent in areas like Surrey, Langley, Coquitlam, or the Fraser Valley, making school drop-offs, grocery runs, medical appointments, and access to job opportunities incredibly challenging without a car. This article from SkipCarDealer.com is here to debunk myths and illuminate a clear path for British Columbia families to leverage their Child Tax Benefit for a car loan, transforming a perceived obstacle into a tangible solution for financial independence on wheels.

Key Takeaways

- Yes, securing a car loan with primarily or solely Child Tax Benefit income is genuinely possible in British Columbia.

- Success hinges on understanding specific lender criteria, managing expectations regarding interest rates, and choosing the right vehicle.

- The Vancouver market presents unique challenges and opportunities that require a tailored approach.

- This article will equip you with the knowledge to navigate the process, from application to driving away, and beyond.

The Unconventional Income: Why Your Child Tax Benefit Holds Power in British Columbia Car Financing

You might be wondering, "Why would a lender consider my Child Tax Benefit as income for a car loan?" The answer lies in how financial institutions assess stability and predictability. Unlike variable income streams, the Canada Child Benefit is a federally administered program, offering consistent, non-taxable monthly payments to eligible families. This inherent reliability is precisely what makes it a legitimate and increasingly accepted basis for loan approval, especially when partnered with the right lending specialists.

Demystifying Lender Perceptions: CTB as Stable Income

Financial institutions, when evaluating loan applications, are primarily concerned with your ability to consistently make payments. Traditional employment income, with its pay stubs and T4s, is the most common proof. However, government benefits like the CTB are viewed differently but equally favourably by many lenders. They are not subject to the whims of employment changes, economic downturns affecting specific industries, or self-employment fluctuations. The federal government's commitment to these programs means a dependable income stream for recipients, which translates into lower risk for lenders. This stability allows them to categorize it as a reliable, predictable source of funds, making it a viable foundation for a vehicle loan.

The British Columbia Imperative: Why a Car is More Than a Luxury for Families in Metro Vancouver

For many families in British Columbia, particularly those residing outside the immediate downtown core of Vancouver, a car is not merely a convenience; it's a necessity. Consider the daily grind for a family living in Surrey, Langley, or even parts of Burnaby or Coquitlam. Public transit, while extensive, often involves multiple transfers, long commute times, and can be impractical for managing school runs, childcare drop-offs, or carrying groceries for a family. Access to essential services, medical appointments in specialized clinics, or even better-paying job opportunities often requires the flexibility and reach that only a personal vehicle can provide. From weekend trips to the North Shore mountains to visiting family in the Fraser Valley, a car unlocks a level of independence and opportunity that significantly enhances family life in our geographically diverse province.

Pro Tip: Consistency is Key

Lenders value a consistent payment history of your CTB. Ensure your bank statements clearly show these regular deposits. Having a few months of statements that consistently display your CTB arriving on time demonstrates to lenders that this income is reliable and you manage it effectively. Avoid frequent overdrafts or erratic banking habits, as these can signal instability.

Deconstructing Eligibility: Beyond the Basic Threshold for Vancouver Residents

While the Child Tax Benefit is a powerful asset, securing a car loan isn't just about having an income source. It involves a holistic assessment of your financial profile. You might have heard about a general monthly income threshold, perhaps around $1,750, that some lenders mention. It's important to understand that while this figure can be a common benchmark, it's not universal, and options exist for those receiving less, especially when other factors are favourable. Let's dive deeper into the specific criteria that truly make a CTB-only applicant eligible in British Columbia.

The 'Only CTB' Nuance: What if Your Benefit is Your Sole Income?

For applicants whose Child Tax Benefit is their sole reported income, lenders will apply a more rigorous risk assessment. Without other income streams, your CTB must demonstrate sufficient capacity to cover both your existing living expenses and the new car loan payment. Strategies to strengthen your application in this scenario include having a strong credit history (even if it's limited), demonstrating low existing debt, and ideally, offering a down payment, however small. Lenders will closely scrutinize your bank statements to ensure your CTB income is consistently received and that you manage your finances responsibly, avoiding frequent overdrafts or a history of missed payments on other bills.

The Silent Partner: Your Credit History in British Columbia

Your credit history plays a monumental role in your approval odds and the interest rate you'll be offered. A good credit score (typically 650+) indicates a reliable borrower and can lead to more favourable terms. However, if you have bad credit, no credit history, a past bankruptcy, or are currently in a consumer proposal, don't despair. Many specialized lenders in British Columbia understand these situations and are willing to work with you. The key is transparency and understanding that your options might involve higher interest rates initially. A car loan, if managed responsibly, can be a fantastic tool for rebuilding or establishing your credit. If you're navigating the complexities of post-proposal financing, you might find our article, 'Post-Proposal Car Loan: Your Credit Score Just Got a Mulligan,' particularly insightful. Even with low credit, a car loan is within reach in British Columbia, as we explore in 'That '69 Charger & Your Low Credit? We See a Future, British Columbia.'

Debt-to-Income (DTI) Ratio: The Unspoken Rule

Your Debt-to-Income (DTI) ratio is a critical metric for lenders. It compares your total monthly debt payments (credit cards, student loans, personal loans, rent/mortgage) to your gross monthly income (in this case, your CTB). Lenders typically prefer a DTI ratio below 40-45%. Even with stable CTB income, a high DTI can signal that you're stretched too thin, making it harder to secure approval. Prioritizing the reduction of existing high-interest debt before applying for a car loan can significantly improve your DTI and, consequently, your chances of approval.

British Columbia Driver’s Licence and Residency: The Non-Negotiables

To secure a car loan and legally drive in British Columbia, you must possess a valid BC driver's licence. This means having at least a Class 7 (Novice, or 'N' stage) for most new drivers, though a full Class 5 licence is generally preferred. While a Class 7 learner's permit (G1 equivalent) might qualify you for a loan with some lenders, insurance costs will be significantly higher, and options more limited. You also need to prove stable residency in British Columbia. This typically involves providing utility bills, rental agreements, or other official documents showing your current address in the province.

Pro Tip: Pre-Qualify for Insurance

Before applying for a loan, get an estimated insurance quote from ICBC. As British Columbia's public auto insurer, ICBC rates can vary significantly based on your driving history, location (e.g., Vancouver vs. Victoria), and the vehicle you choose. Knowing your approximate insurance cost demonstrates to lenders that you've considered all aspects of vehicle ownership and can realistically afford the total monthly expense, not just the loan payment.

Navigating the Vancouver & British Columbia Car Market with CTB: Specifics You Need to Know

The British Columbia car market, particularly in Metro Vancouver, comes with its own set of unique challenges and opportunities. High housing costs and a generally elevated cost of living mean that budgeting for a vehicle requires careful consideration. For those relying on Child Tax Benefit, making smart choices about the vehicle itself is paramount. It’s about finding reliable, affordable transportation that aligns with your financial reality, rather than chasing luxury.

Local Market Realities: Affordability in Metro Vancouver

Let's be frank: car ownership in Metro Vancouver can be expensive. Average used car prices are often higher here than in other parts of Canada due to demand and supply dynamics. Add to that the unique insurance landscape of ICBC, where rates can fluctuate significantly based on where you live (e.g., Vancouver, Richmond, Burnaby, vs. Kelowna or Prince George), your driving history, and the type of vehicle. Parking in high-density areas is another cost often overlooked, as is the general maintenance that comes with any vehicle. Understanding these local realities is the first step in setting a realistic budget for your car. For instance, a basic annual insurance premium for a driver in Vancouver might be hundreds of dollars more than for a similar driver in Nanaimo.

Vehicle Choice Matters: New vs. Used, and Smart Budgeting

For CTB-only applicants, a reliable used car is almost always the most sensible starting point. New vehicles depreciate rapidly, carry higher price tags, and often come with more stringent loan requirements. Focus on well-maintained, fuel-efficient used models known for their longevity and lower maintenance costs. Think Honda Civic, Toyota Corolla, Hyundai Elantra, or similar compact sedans or small SUVs like a Honda CR-V or Toyota RAV4. These vehicles offer excellent value, are generally affordable to insure, and have readily available parts. Setting realistic expectations means prioritizing functionality and reliability over bells and whistles, avoiding the common pitfall of overspending on a vehicle that will strain your budget.

Vehicle Type and Family Needs: Practical Considerations for British Columbia Life

When selecting a vehicle, think about your family's specific needs. How many children do you have? Do you need ample cargo space for groceries, strollers, or sports equipment? Fuel efficiency is critical for commutes across the Fraser Valley or frequent trips, especially with fluctuating gas prices. Safety features, such as airbags, anti-lock brakes, and electronic stability control, are non-negotiable for protecting your loved ones. Consider a vehicle with a good safety rating and a proven track record for reliability. These practical considerations will guide you to a choice that serves your family well without breaking the bank.

The Financial Deep Dive: Unpacking Interest Rates, Loan Terms, and Hidden Costs in British Columbia

Understanding the financial architecture of your car loan is paramount to making an informed decision. For those financing with Child Tax Benefit, managing expectations around interest rates and meticulously scrutinizing all costs will protect you from unwelcome surprises and ensure the loan is truly manageable.

Demystifying Interest Rates: What to Expect and How to Improve Them

It's important to have realistic expectations regarding interest rates. For non-traditional income loans, especially if your credit history is limited or challenged, interest rates might be higher than those advertised for prime borrowers. This is because lenders perceive a slightly elevated risk. Factors influencing your rate include your credit score, the loan term, and the age and value of the vehicle. A newer, lower-kilometre vehicle typically qualifies for a better rate than an older one. However, don't view a higher initial rate as a permanent fixture. Consistently making on-time payments can significantly improve your credit score over time, opening the door for refinancing your loan later at a lower rate, potentially saving you thousands of dollars over the life of the loan.

Loan Terms: The Balance Between Monthly Payments and Total Cost

The loan term refers to the length of time you have to repay the loan. Shorter terms (e.g., 36-48 months) mean higher monthly payments but less interest paid over the life of the loan. Longer terms (e.g., 60-84 months) result in lower monthly payments, making them more budget-friendly in the short term, but you'll pay more in total interest. For CTB recipients, finding the 'sweet spot' is crucial. You need a monthly payment that comfortably fits your budget without extending the loan so long that the total cost becomes prohibitive. A common strategy is to opt for a slightly longer term to keep payments low, with the intention of paying extra whenever possible or refinancing when your credit improves.

Hidden Costs and Fees in British Columbia: What to Watch Out For

Beyond the vehicle's price and interest, several other costs and fees are common in British Columbia when purchasing a car. Being aware of these can prevent surprises:

| Cost/Fee Category | Description & British Columbia Specifics | Tips for CTB Applicants |

|---|---|---|

| Provincial Sales Tax (PST) & GST | PST (7%) applies to used vehicles sold by GST registrants (dealerships). GST (5%) applies to the sale of new vehicles and used vehicles sold by a GST registrant. Private sales only incur PST. These are calculated on the purchase price. | Factor 12% (PST+GST) into your budget for new or dealership used cars. Only PST for private sales. |

| Documentation (Doc) Fees | Dealerships charge these for processing paperwork, registering the vehicle, etc. These can range from $299 to $699+ in British Columbia. | These are typically non-negotiable but ask for a breakdown. Ensure they are reasonable. |

| PPSA Registration | Personal Property Security Act registration. This registers the lender's security interest in the vehicle in British Columbia. (~$10-20) | A standard, small, unavoidable fee. |

| Dealer Administration Fees | Separate from doc fees, sometimes charged for general overhead. Often bundled, ensure transparency. | Question any vague "admin" fees. Demand clarity on what they cover. |

| Tire Levy | A small provincial levy on new tires, often passed on to the buyer. ($5-7 per tire) | Usually a minor cost, but be aware it exists. |

| Optional Add-ons | Extended warranties, rustproofing, paint protection, fabric protection, anti-theft devices. | Carefully consider if these are truly necessary for a used car on a tight budget. They significantly increase your total loan amount and interest. Often best to decline. |

Pro Tip: Demand a Full Breakdown

Always insist on a transparent, itemized breakdown of all costs before signing any agreement. This includes the vehicle price, taxes, all fees, and the total interest over the loan term. Do not be rushed or pressured into signing anything you don't fully understand. A reputable dealership will be happy to provide this clarity.

Your Lender Landscape in British Columbia: Banks, Dealerships, and Specialty Finance Companies

Understanding where to apply for a car loan is just as important as understanding the terms. For CTB recipients in British Columbia, the landscape of lenders offers various avenues, each with its own set of criteria, advantages, and disadvantages. Knowing your options empowers you to choose the path most likely to lead to approval.

Traditional Banks (e.g., RBC, TD, BMO, Scotiabank, CIBC in British Columbia): Higher Hurdles, Potentially Lower Rates

Major Canadian banks often represent the "prime" lending market. They typically have the strictest income and credit requirements. While they offer the most competitive interest rates, securing a car loan with primarily or solely CTB income from a traditional bank can be challenging. They prefer applicants with strong credit scores, substantial down payments, and verifiable traditional employment income. If your CTB is supplemented by significant other income and you have an excellent credit history, it's worth exploring, but for most CTB-only applicants, these institutions might be a difficult first stop.

Dealership Finance Departments (e.g., OpenRoad Auto Group, AutoCanada dealerships across British Columbia): Your Best Bet for Flexibility

Dealership finance departments are often the most flexible and effective option for applicants with non-traditional income sources like CTB. Why? Because they don't lend their own money; they act as intermediaries, working with a network of various lenders – including major banks, credit unions, and subprime finance companies. This allows them to "shop around" on your behalf, finding a lender willing to approve your loan based on your specific financial situation. They are adept at navigating complex applications and can structure deals that might not be possible directly through a bank. While this convenience might sometimes come with slightly higher interest rates or aggressive upselling of add-ons, the approval odds are significantly better. Be wary of "Buy Here, Pay Here" models if you have other options, as these often come with very high interest rates and fewer consumer protections.

Specialty Finance Companies: Tailored Solutions for Unique Situations

Beyond traditional banks and dealership networks, a growing number of specialty finance companies in British Columbia are specifically designed to serve individuals with unique financial situations, including those relying on government benefits or facing credit challenges. These lenders specialize in assessing non-traditional income sources and are more willing to take on higher-risk applicants. The trade-off, however, is typically higher interest rates compared to prime loans. Nevertheless, they offer high approval odds and can be a crucial stepping stone for individuals looking to get a vehicle and simultaneously build their credit history. Reputable examples operate throughout British Columbia and are often accessible through dealership finance departments. For those facing significant credit hurdles, like a consumer proposal, understanding these specialized options is crucial. You can learn more about navigating these challenges in our article 'Think Your Consumer Proposal Trapped Your Car Payments? Think Again, British Columbia.'

Pro Tip: Shop Around Aggressively

Don't settle for the first offer you receive. Apply to a few different lenders or through a reputable dealership that works with multiple finance partners within a short timeframe (e.g., 14-30 days). This period is often treated as a single inquiry on your credit report, minimizing the impact on your score. Comparing offers rigorously will ensure you secure the best possible terms and interest rate for your situation. Remember, every percentage point matters over the life of a loan.

Crafting a Winning Application: Strategies for Maximizing Your Approval Odds in Vancouver

Applying for a car loan when your primary income is the Child Tax Benefit requires a strategic approach. It's about presenting your financial situation in the strongest possible light, providing clear documentation, and understanding what extra steps can boost your application. These strategies are particularly effective in the competitive Vancouver lending market.

Documentation is Your Foundation: What to Bring to Your British Columbia Lender

Preparation is key. Walking into a dealership or lender with all your necessary documents ready demonstrates responsibility and streamlines the approval process. Here’s a checklist of what you should typically bring:

- Government-Issued ID: Valid driver's licence (Class 7N or Class 5) and potentially a second piece of ID.

- Proof of Residency: Recent utility bills (electricity, gas, internet), a current rental agreement, or mortgage statement showing your British Columbia address.

- Bank Statements: At least three to six months of bank statements clearly showing consistent, regular deposits of your Canada Child Benefit. This is crucial verification of your income.

- Other Income Verification (if applicable): If you receive any other benefits (e.g., GST/HST credit, provincial benefits) or have any part-time, casual, or gig income, bring documentation for these too. Even small, consistent amounts can strengthen your application.

- Reference Information: Names and phone numbers of a few personal references (not family members typically) who can verify your identity and residency.

Building a Strong Case: Demonstrating Financial Stability

Beyond the raw numbers, lenders are looking for signs of financial stability. A stable banking history, meaning few or no overdrafts, and a consistent record of paying other bills on time (even if it's just your phone or internet bill) can speak volumes. Even a small down payment, say 5-10% of the vehicle's price, can significantly improve your approval odds and potentially lower your interest rate. It shows the lender you have "skin in the game" and are serious about your commitment. While a down payment isn't always mandatory, it's a powerful tool to strengthen your application, especially for those with unique income situations. For further insights on navigating car purchases without an upfront payment, consider reading 'No Down Payment? Your Gig Just Bought a Hybrid. Seriously.'

The Co-Signer Option: When it Helps and When to Be Cautious

If you're finding it difficult to get approved on your own, or the interest rates offered are too high, a co-signer can be a game-changer. A co-signer, typically a family member or close friend with a good credit score and stable income, agrees to be equally responsible for the loan. Their financial strength can significantly boost your application, making approval more likely and potentially securing you a much lower interest rate. However, both parties must understand the risks: if you miss payments, it negatively impacts both your credit scores, and the co-signer is legally obligated to cover the debt. It's a serious commitment that should only be undertaken with complete trust and a clear understanding of the responsibilities involved.

Pro Tip: Be Transparent and Honest

Provide accurate information on your application. Lying or withholding information, even if it seems minor, can lead to your application being denied outright or even legal repercussions. Lenders appreciate honesty and a clear, realistic picture of your financial situation, even if it's not perfect. Being upfront allows them to find the best possible solution for you.

Beyond the Loan: Insurance, Maintenance, and Building Your Credit Future in British Columbia

Securing a car loan with your Child Tax Benefit is a significant achievement, but it's just the beginning of your journey into vehicle ownership. To truly embrace the financial independence a car provides, you need to understand the ongoing responsibilities, especially within British Columbia's unique landscape, and how this new loan can pave the way for a stronger financial future.

Navigating Car Insurance in British Columbia with ICBC: Essential Knowledge

In British Columbia, car insurance is primarily provided by the provincial Crown corporation, ICBC (Insurance Corporation of British Columbia). It's mandatory to have basic auto insurance, which covers third-party liability and accident benefits. Beyond this, you'll need to consider optional extended coverage like collision (for damage to your own vehicle in an at-fault accident) and comprehensive (for theft, vandalism, fire, and other non-collision damage). Premiums vary significantly based on your driving history, the type of vehicle, and your geographical location. For example, drivers in high-density areas like Vancouver or Richmond often pay more than those in Victoria or Kelowna due to higher accident rates and theft risks. Understanding these factors and getting a detailed quote is a vital step before finalizing your car purchase.

The Overlooked Cost: Budgeting for Vehicle Maintenance and Repairs

A common pitfall for new car owners is underestimating the cost of maintenance and unexpected repairs. Regular maintenance – oil changes, tire rotations, brake inspections – is crucial, especially for a used car, to ensure its reliability and longevity. Ignoring maintenance can lead to more expensive repairs down the road. It's highly advisable to set aside a small amount each month into a dedicated 'car fund.' Even $50-$100 can build up quickly to cover routine servicing or act as a buffer for unexpected issues like a flat tire or a dead battery. This proactive budgeting approach ensures your vehicle remains a dependable asset rather than a source of financial stress.

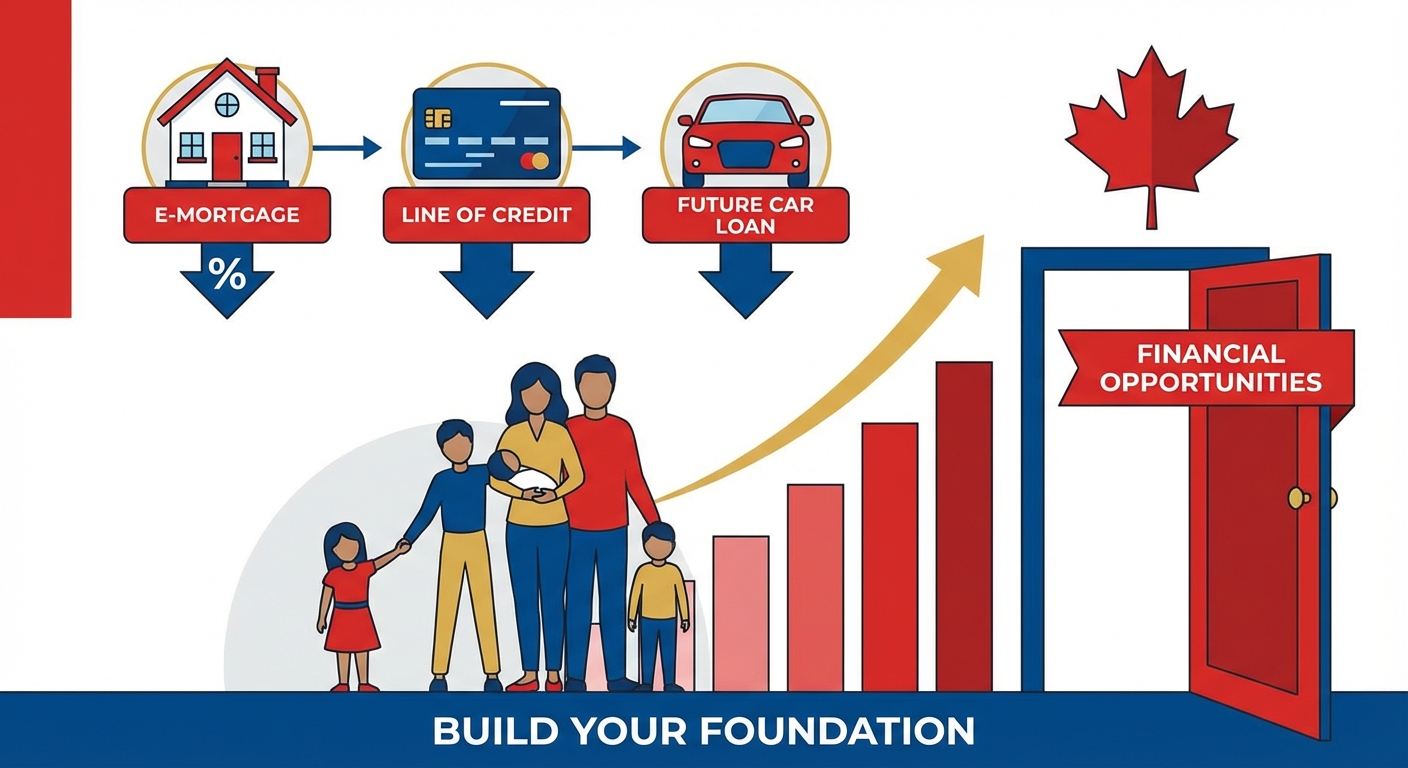

Leveraging Your Car Loan to Build a Stronger Credit Score

One of the most powerful long-term benefits of a car loan, especially when approved with non-traditional income, is its potential to significantly improve your credit score. Every on-time payment you make is reported to credit bureaus, demonstrating your reliability as a borrower. Over time, this consistent positive payment history will build a stronger credit profile, making it easier to qualify for other financial products like mortgages, lines of credit, or future car loans at much better interest rates. Treat your car loan as an opportunity to establish a solid financial foundation, opening doors to greater financial opportunities for your family in the years to come.

Real-Life Scenarios: How CTB-Backed Car Loans Empower Families Across British Columbia

It's one thing to talk about the possibilities, and another to see them in action. Let's look at how a car loan secured with Child Tax Benefit can genuinely transform daily life for families in various British Columbia communities.

The Surrey Single Parent: Connecting to Opportunity

Meet Sarah, a single parent in Surrey with two young children. Her CTB is her primary income, supplemented by a part-time job that's difficult to get to via public transit. She relies on friends and costly ride-shares for school pickups, doctor appointments, and grocery runs. Securing a reliable used sedan with a CTB-backed car loan changes everything. She can now easily manage school runs, explore better-paying job opportunities further afield, and take her children to extracurricular activities. The car not only provides essential transportation but also opens up a world of economic and social opportunities, reducing stress and enhancing her family's quality of life.

The Victoria Family: Navigating Health and Essentials

The Chen family lives in Victoria, and while their CTB helps, they've struggled with transportation. Their youngest child has regular specialist appointments across town, and public transit routes are indirect and time-consuming. With a family-friendly used SUV financed through their CTB, Mr. and Mrs. Chen can now comfortably and efficiently get their child to appointments. They can also do larger grocery hauls, enjoy spontaneous family outings to regional parks, and more easily visit relatives in nearby communities, giving them a newfound sense of freedom and control over their family's health and daily essentials.

The Burnaby Newcomer: Building Independence and Credit

Maria and her family recently immigrated to Burnaby. While they receive CTB, they have no established credit history in Canada, making traditional loans challenging. Through a specialty lender working with a dealership, they secure a loan for a compact car using their CTB. This car is vital for Maria to get to her English classes and part-time work, and for her husband to commute to his new job. Critically, making consistent, on-time payments on this car loan is their first step in building a strong Canadian credit history, which will be instrumental for future financial goals, such as securing a mortgage or other credit, solidifying their independence in their new country.

Your Roadmap to Driving Away: Final Steps and Long-Term Financial Health in Metro Vancouver

The journey from contemplating a car loan to driving away with the keys can seem long, especially when navigating it with non-traditional income. But with the right knowledge and a strategic approach, it's an entirely achievable goal for families across Metro Vancouver and British Columbia. SkipCarDealer.com is here to be your partner every step of the way.

Recap: The Power of Preparation and Persistence

Remember the critical steps: understand that your Canada Child Benefit is a legitimate and stable income source for lenders. Be meticulous in preparing your documentation, especially bank statements clearly showing consistent CTB deposits. Be realistic about your budget, focusing on reliable used vehicles. Arm yourself with knowledge about interest rates, loan terms, and potential fees in British Columbia. Most importantly, don't be discouraged by initial hurdles; persistence and working with the right specialized lenders or dealership finance departments will lead to success.

Beyond the Purchase: Sustaining Your Financial Well-being

Securing the loan is a major milestone, but sustained financial health requires ongoing commitment. Continue budgeting diligently for all car-related expenses, including insurance, fuel, and a dedicated maintenance fund. Regularly monitor your credit score and strive to make all loan payments on time. This proactive approach will not only keep your vehicle running smoothly but also continue to build a robust financial foundation for your family's future.

Empowerment on the Road Ahead

A vehicle represents more than just transportation; it's a tool for empowerment. It offers freedom, expands opportunities for employment and education, and provides invaluable flexibility for families in British Columbia. By leveraging your Child Tax Benefit, you're not just buying a car; you're investing in your family's mobility, convenience, and long-term financial growth. Take the first step today towards securing that independence on the road ahead.