Why 'Denied Everywhere' Is Our Favourite Challenge, Vancouver.

Table of Contents

- Why 'Denied Everywhere' Is Our Favourite Challenge, Vancouver.

- Welcome to the Challenge: Turning 'Denied Everywhere' into Your Next Car Key in Vancouver

- Key Takeaways

- Beyond the Score: Unpacking Why Vancouver Drivers Get 'Denied Everywhere'

- The Credit Report Confession: What Lenders Really See (and Fear)

- Life's Curveballs: Navigating Bankruptcy, Consumer Proposals, and New Beginnings

- The 'No Credit' Conundrum: New Immigrants and Students in Canada

- The Psychological Weight: Overcoming the Fear of 'No' and Reclaiming Your Confidence

- Vancouver's Lifelines: Where to Get a Car Loan After Being Denied Everywhere

- The Specialized Auto Finance Centre: Your First Stop in the Lower Mainland

- British Columbia's Credit Unions: A Community-Focused Alternative

- Online Loan Aggregators: Convenience with Caution

- The Power of Partnership: Co-Signers and Guarantors Explained

- Demystifying the Dollars: Realistic Rates, Terms, and the True Cost of a Challenged Credit Loan in British Columbia

- What to Expect: Realistic Interest Rates for Challenged Credit in Canada

- Beyond the Monthly Payment: Calculating Your Total Cost of Ownership

- Hidden Fees and Sneaky Charges: What to Scrutinize in Your Loan Agreement

- The Power of a Down Payment: How It Lowers Risk (and Your Payments)

- Structuring Your Loan for Success: Short Term vs. Long Term

- Your Application Arsenal: Building an Irresistible Case for Approval

- Essential Documents: The Paperwork That Paves Your Way

- Income Stability Over Size: Why Consistent Employment Matters Most

- Debt-to-Income Ratio: Understanding Your Capacity to Pay

- The Art of Explanation: Transparently Addressing Your Past Financial Challenges

- Choosing Your Ride Wisely: Vehicle Selection with Challenged Credit in British Columbia

- New vs. Used: The Strategic Choice for Credit Building

- Reliability Over Luxury: Focusing on Practical Vehicles for Your Commute in Vancouver

- Are Some Car Brands Easier to Finance? Understanding Lender Preferences

- The Golden Ticket: How Your Car Loan Rebuilds Your Financial Future in Canada

- Climbing the Credit Score Ladder: The Impact of On-Time Payments

- Graduating to Better Rates: Refinancing Opportunities Down the Road

- Beyond the Car: Opening Doors to Mortgages, Personal Loans, and Financial Freedom

- Navigating the Pitfalls: What to Avoid on Your Challenged Credit Journey

- 'Guaranteed Approval' Scams: If It Sounds Too Good to Be True...

- High-Pressure Sales Tactics: Recognizing and Resisting Them

- Ignoring the Fine Print: The Importance of Reading Your Contract Meticulously

- Borrowing More Than You Need: The Temptation of 'Extra Cash'

- Your Next Steps to Driving Away Confidently in Vancouver

- Crafting Your Personalized Action Plan

- Finding the Right Partner: What Questions to Ask Your Finance Specialist

- The First Test Drive: From Application to Keys in Hand

- Frequently Asked Questions (FAQ)

Why 'Denied Everywhere' Is Our Favourite Challenge, Vancouver.

Welcome to the Challenge: Turning 'Denied Everywhere' into Your Next Car Key in Vancouver

You’ve been there. The hopeful application, the nervous wait, and then the crushing blow: "Sorry, we can't approve you at this time." If you’re a resident of Vancouver or anywhere in beautiful British Columbia, and you've faced the frustrating rejection of a car loan – perhaps multiple times – you know that sinking feeling. The dream of navigating the scenic Sea-to-Sky Highway, commuting efficiently through the city, or simply having the freedom to explore our stunning province seems to vanish. It feels like you’re stuck in a loop, hearing "denied everywhere" no matter where you turn.

But what if we told you that "denied everywhere" isn't a dead end? What if, for us at SkipCarDealer.com, it’s actually our favourite challenge? We believe that everyone in Vancouver deserves reliable transportation, regardless of past financial hiccups. We see your situation not as an obstacle, but as an opportunity to apply our specialized expertise. This article is your comprehensive guide to understanding why you might have been denied, where to look for solutions right here in British Columbia, and how to confidently secure the car loan you need to get back on the road. Let’s turn that frustration into the exciting reality of holding your next car keys.

Key Takeaways

- Your credit score isn't the only factor; income stability, down payment, and lender relationships are equally vital.

- Specialized finance centres and credit unions in British Columbia are often your best allies when traditional banks say no.

- Understanding realistic interest rates and the true cost of a loan is crucial to avoid future financial strain.

- A car loan, when managed responsibly, is a powerful tool for rebuilding and improving your credit score.

- Preparation is key: Having your financial story and documents ready significantly boosts your approval odds.

Beyond the Score: Unpacking Why Vancouver Drivers Get 'Denied Everywhere'

It’s easy to point a finger at "bad credit" as the sole culprit for loan rejections, but the reality for Vancouver drivers is far more nuanced. Lenders look at a mosaic of financial indicators, and understanding these can empower you to address the underlying issues effectively. Moving past the simplistic label allows us to explore the common financial situations in British Columbia that lead to a "denied everywhere" experience.

The Credit Report Confession: What Lenders Really See (and Fear)

Your credit report is a detailed financial autobiography, meticulously compiled by agencies like Equifax and TransUnion in Canada. When a lender in Vancouver pulls your report, they're looking for patterns and specific entries that signal risk. Late payments, especially those 30, 60, or 90+ days overdue, are red flags. Collections accounts, where a debt has been sold to a collection agency, indicate a serious breakdown in payment. Defaults on previous loans, repossessions, or charge-offs are even more severe. High credit utilization – using a large percentage of your available credit limits – also makes lenders nervous, suggesting you might be overextended. Each of these entries is weighted, and a cluster of them can quickly lead to a rejection, even if your current income seems strong.

Life's Curveballs: Navigating Bankruptcy, Consumer Proposals, and New Beginnings

Life in British Columbia, much like anywhere, can throw unexpected challenges. Job loss, illness, divorce, or business failure can lead to significant financial distress, sometimes resulting in bankruptcy or a consumer proposal. These major financial events, while offering a fresh start, leave a significant mark on your credit report for several years. Lenders often view them with caution, as they signify a past inability to meet financial obligations. However, it's crucial to understand that these are not permanent roadblocks. Many specialized lenders in Vancouver and across Canada are experienced in helping individuals rebuild after such events. They focus on your current financial stability and your commitment to a fresh start. For an in-depth look at this path, check out our guide on Post-Proposal Car Loan: Your Credit Score Just Got a Mulligan.

The 'No Credit' Conundrum: New Immigrants and Students in Canada

A surprising number of rejections in Vancouver aren't due to bad credit, but to no credit at all. This is a common challenge for new immigrants to Canada and students. You might have an excellent financial history in your home country, or a steady income as a student, but without a Canadian credit file, lenders have no way to assess your payment behaviour. This "thin file" makes you an unknown risk. While frustrating, there are strategies to overcome this, such as securing a co-signer, demonstrating consistent employment, or working with lenders who specialize in newcomer programs.

The Psychological Weight: Overcoming the Fear of 'No' and Reclaiming Your Confidence

Repeated rejections take an emotional toll. The fear of hearing "no" again can be paralyzing, leading some Vancouver residents to give up on their car search entirely. It's vital to address this psychological weight. Understand that a rejection isn't a personal judgment; it's a reflection of a lender's risk assessment based on specific criteria. Reclaiming your confidence means shifting your mindset from defeat to determination. Prepare yourself, understand the process, and approach your next application with the knowledge that solutions exist. Your past does not define your future, especially when it comes to securing a necessary car loan in British Columbia.

Vancouver's Lifelines: Where to Get a Car Loan After Being Denied Everywhere

When traditional banks shut their doors, it can feel like there's nowhere left to turn. But for Vancouver residents, a world of specialized financing options exists, designed specifically for those navigating challenging credit situations. These aren't just general national solutions; they're resources tailored to the unique financial landscape of British Columbia.

The Specialized Auto Finance Centre: Your First Stop in the Lower Mainland

Dealerships with dedicated in-house finance specialists are often your strongest allies. Unlike a single bank, these centres, like SkipCarDealer.com, cultivate relationships with a vast network of lenders. This network includes not only major Canadian banks such as RBC, Scotiabank, and TD, but also a crucial array of specialized non-prime lenders who focus exclusively on higher-risk profiles. Their expertise lies in understanding your unique financial story and matching it with a lender most likely to approve you. They know how to present your application in the best possible light, highlighting your strengths (like stable income or a solid down payment) and explaining past challenges. They're adept at crafting custom loan packages that traditional institutions simply aren't equipped to offer. If you're receiving employment insurance in British Columbia, for example, a specialized finance centre can help you navigate getting approved. For more details, see our article: British Columbia EI? Your Car Loan Just Called 'Shotgun'.

British Columbia's Credit Unions: A Community-Focused Alternative

Credit unions, such as Vancity, Coast Capital Savings, or Prospera Credit Union, operate with a different philosophy than big banks. As member-owned financial cooperatives, they often prioritize community well-being and individual circumstances over rigid credit scores. For residents in Vancouver, Surrey, or Victoria, this can be a significant advantage. Credit unions may be more willing to look beyond a low credit score and consider your overall financial picture, your relationship with the credit union, and your commitment to the community. While they still require sound financial practices, their flexibility can make them a viable option when traditional lenders say no.

Online Loan Aggregators: Convenience with Caution

Online platforms that connect applicants with multiple lenders offer unparalleled convenience. You can submit one application and potentially receive offers from several lenders, saving you time and effort. However, this convenience comes with a caveat. It’s crucial to vet these services thoroughly to ensure legitimacy and protect your personal information. Look for aggregators with strong reputations, clear privacy policies, and secure websites. Be wary of any platform promising "guaranteed approval" without any credit check – these are often red flags. For residents in British Columbia, using reputable online services can be a quick way to explore various financing options from the comfort of your home, but diligence is key.

The Power of Partnership: Co-Signers and Guarantors Explained

If you have a trusted individual with good credit who is willing to support your application, a co-signer or guarantor can significantly boost your approval odds. A co-signer shares equal responsibility for the loan, meaning if you miss payments, they are legally obligated to cover them. A guarantor typically only becomes responsible if you default. This arrangement reduces the lender's risk, making them more comfortable extending credit. However, it's a serious commitment for both parties. Before involving another person, have crucial, transparent conversations about the responsibilities, potential impacts on their credit, and a clear plan for repayment. Understanding the legal implications in British Columbia is also vital to protect everyone involved.

Pro Tip: Prepare Your Financial Story, Not Just Your Numbers: Lenders are people too. While numbers on a credit report are important, being ready to explain any past financial difficulties and outline your current stability can make a huge difference. Transparency builds trust and allows a finance specialist to advocate for you more effectively. Don't just submit forms; tell your story.

Demystifying the Dollars: Realistic Rates, Terms, and the True Cost of a Challenged Credit Loan in British Columbia

One of the biggest anxieties surrounding challenged credit car loans in Vancouver is the fear of exorbitant costs. It's true that interest rates will be higher than for prime borrowers, but understanding the realities, avoiding hidden fees, and structuring your loan smartly can make it manageable and a powerful tool for financial recovery.

What to Expect: Realistic Interest Rates for Challenged Credit in Canada

When your credit is challenged, interest rates reflect the increased risk lenders are taking. While prime rates might be in the single digits, rates for challenged credit can range considerably. For minor credit hiccups or a relatively new credit history, you might see rates in the 8-15% range. For more severe situations, such as recent bankruptcy or multiple collections, rates could be 15-25% or even higher. It's crucial to understand that these are not meant to be predatory but reflect the statistical likelihood of default for certain credit profiles. The goal is to secure a loan, make consistent payments, and then aim to refinance for a better rate once your credit improves.

| Credit Situation | Typical Interest Rate Range (Canada) | Example Monthly Payment (for $20k over 5 years) |

|---|---|---|

| Excellent Credit (760+) | 4-7% | $377 - $396 |

| Good Credit (680-759) | 6-10% | $391 - $425 |

| Fair/Challenged Credit (580-679) | 8-15% | $418 - $476 |

| Poor/Rebuilding Credit (under 580, recent bankruptcy/proposal) | 15-29.9% | $476 - $696 |

*Note: These are illustrative ranges. Actual rates depend on individual circumstances, lender, and market conditions in British Columbia.

Beyond the Monthly Payment: Calculating Your Total Cost of Ownership

Focusing solely on the monthly payment can be a trap. A lower monthly payment often means a longer loan term, which translates to paying significantly more interest over the life of the loan. For Vancouver residents, it’s essential to look at the total cost of ownership. This includes the vehicle's purchase price, all interest accrued, any fees, insurance costs, fuel, and maintenance. A thorough understanding allows you to make a financially sound decision rather than just finding the cheapest monthly option.

Hidden Fees and Sneaky Charges: What to Scrutinize in Your Loan Agreement

Before signing any contract in British Columbia, scrutinize every line item. Be aware of common fees such as administration fees, documentation fees, lien registration fees, and extended warranty upsells. While some fees are legitimate and standard, others can be negotiable or even questionable. Ask for a full breakdown of all costs. Never hesitate to ask for clarification on anything you don't understand. A reputable finance specialist will be transparent and happy to answer all your questions.

The Power of a Down Payment: How It Lowers Risk (and Your Payments)

Even a small down payment can make a significant difference. It reduces the amount you need to borrow, which directly lowers your monthly payments and the total interest paid. More importantly, a down payment signals commitment and reduces the lender's risk, often making them more willing to approve your loan or offer slightly better terms. For residents in Vancouver, even a few hundred dollars saved can go a long way. For more insights on this, you might find our article on No Down Payment? Your Gig Just Bought a Hybrid. Seriously. helpful.

Structuring Your Loan for Success: Short Term vs. Long Term

The loan term directly impacts your monthly payments and total interest paid. A shorter term (e.g., 3-4 years) means higher monthly payments but significantly less interest paid overall, allowing you to build equity faster. A longer term (e.g., 6-7 years) offers lower monthly payments, making the loan more affordable in the short term, but you'll pay more in interest over time and potentially face negative equity for longer. For those rebuilding credit, balancing affordability with total cost is key. Often, a slightly longer term to keep payments manageable is a good starting point, with the goal of refinancing to a shorter term once your credit improves.

Your Application Arsenal: Building an Irresistible Case for Approval

When you have challenged credit, simply filling out a form isn't enough. You need to present a compelling financial narrative that goes beyond your credit score. For Vancouver residents, proactive preparation is the secret weapon that can turn a "denied everywhere" into an "approved here."

Essential Documents: The Paperwork That Paves Your Way

Having all your necessary documents prepared in advance streamlines the application process and shows lenders you are organized and serious. A comprehensive checklist should include:

- Proof of Income: Recent pay stubs (2-3), employment letter, Canada Revenue Agency (CRA) Notice of Assessment for self-employed individuals, bank statements showing consistent deposits, or proof of government benefits.

- Proof of Residency: Utility bills (hydro, internet, gas) or a lease agreement with your current Vancouver address.

- Identification: Valid Canadian driver's license or other government-issued photo ID.

- Banking Statements: Recent bank statements (3-6 months) to demonstrate financial stability and responsible money management.

- Trade-in Documents (if applicable): Vehicle registration, ownership, and current loan statements.

This organized approach signals reliability to any lender in British Columbia.

Income Stability Over Size: Why Consistent Employment Matters Most

For challenged credit loans, lenders often prioritize stability over the sheer size of your income. A steady job history, even if the income is modest, demonstrates reliability and a consistent ability to make payments. Lenders want to see that your income is verifiable and likely to continue. If you've recently changed jobs, be prepared to explain the circumstances. If you're self-employed, proving consistent income can be trickier but not impossible; this is where your CRA Notice of Assessment and thorough bank statements become critical.

Debt-to-Income Ratio: Understanding Your Capacity to Pay

Your Debt-to-Income (DTI) ratio is a critical metric for lenders. It's the percentage of your gross monthly income that goes towards debt payments. To calculate it, sum up all your monthly debt payments (rent/mortgage, credit cards, existing loans, etc.) and divide that by your gross monthly income. Lenders generally prefer a DTI below 40-45%. A high DTI suggests you might be overextended, making it difficult to take on new debt. Strategies to improve it before applying include paying down credit card balances or consolidating existing debts. Understanding your DTI helps you set realistic expectations for your loan amount.

The Art of Explanation: Transparently Addressing Your Past Financial Challenges

Don't shy away from your financial past. Instead, embrace transparency. Be ready to honestly and concisely explain any past difficulties, focusing on the lessons learned and the steps you've taken to stabilize your financial situation. For example, if you experienced a job loss, explain how you've since secured stable employment. If a medical emergency led to missed payments, describe your current health and financial recovery. Avoid making excuses; instead, focus on your current stability and your commitment to responsible financial management moving forward. This proactive approach builds trust with your finance specialist in Vancouver.

Pro Tip: Always Get Pre-Approved Before You Shop: A pre-approval gives you a clear budget, strengthens your negotiating position, and saves you time and potential disappointment at the dealership. It demonstrates that a lender is willing to work with you and allows you to focus on finding the right vehicle within your approved parameters. It’s a smart move for any car buyer in Vancouver, especially those with challenged credit.

Choosing Your Ride Wisely: Vehicle Selection with Challenged Credit in British Columbia

Once you're on the path to approval, the excitement of choosing a car can be overwhelming. However, for those with challenged credit, making smart vehicle choices that align with your financial situation and loan approval odds is paramount. Focus on reliability, long-term value, and affordability.

New vs. Used: The Strategic Choice for Credit Building

While the allure of a new car is strong, a reliable pre-owned vehicle is almost always the smartest choice when rebuilding credit. New cars depreciate rapidly the moment they leave the lot, meaning you could owe more than the car is worth for a significant portion of your loan term (negative equity). Used cars, on the other hand, offer better value, have already absorbed the steepest depreciation, and often come with lower insurance costs. A well-maintained used vehicle allows you to secure a manageable loan, make consistent payments, and effectively build your credit without overextending yourself financially.

Reliability Over Luxury: Focusing on Practical Vehicles for Your Commute in Vancouver

When your credit is challenged, practicality should be your guiding principle. Focus on vehicles known for their reliability, fuel efficiency, and lower maintenance costs. Think brands like Honda, Toyota, Hyundai, Mazda, or certain Ford and Chevrolet models. These vehicles are readily available in the Canadian used car market, easier to insure, and will serve your needs for commuting around Vancouver or exploring British Columbia without unexpected, budget-busting repairs. Prioritize getting a vehicle that reliably gets you from A to B, rather than one with all the bells and whistles.

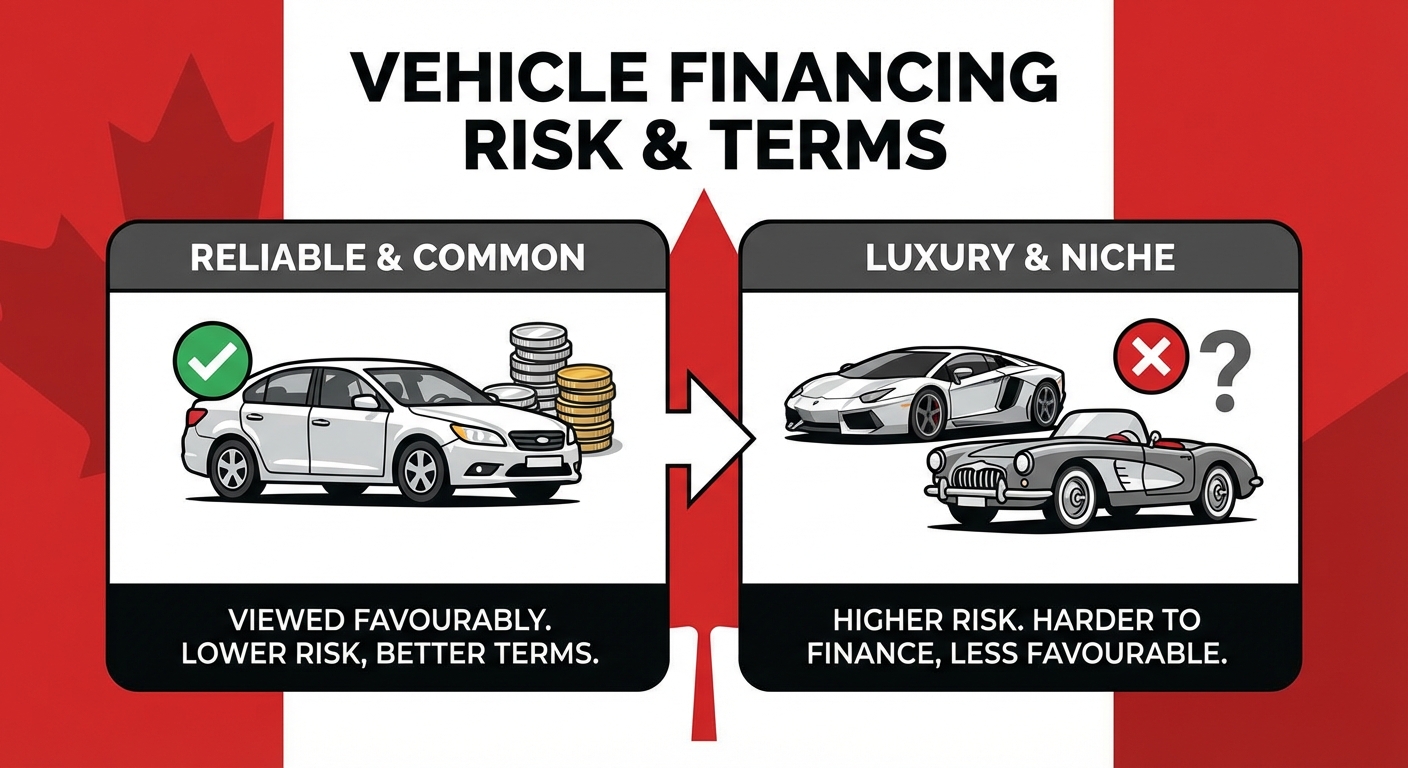

Are Some Car Brands Easier to Finance? Understanding Lender Preferences

Yes, to some extent. Lenders, especially those dealing with challenged credit, often prefer financing vehicles that retain their value well and have a strong resale market. This reduces their risk in case of a default. Brands known for reliability and strong resale value (like the Japanese manufacturers mentioned above) tend to be viewed more favourably. Conversely, luxury or niche brands, or vehicles with a history of high maintenance costs, might be harder to finance or come with less favourable terms, as they pose a higher risk to the lender.

The Golden Ticket: How Your Car Loan Rebuilds Your Financial Future in Canada

Securing a car loan when you have challenged credit is more than just getting a set of keys; it's a strategic move towards rebuilding your entire financial future. When managed responsibly, this loan becomes a powerful tool that can open doors to better financial products across Canada.

Climbing the Credit Score Ladder: The Impact of On-Time Payments

This is the core benefit. Every single on-time payment you make on your car loan is reported to Canada's major credit bureaus, Equifax and TransUnion. These consistent, positive entries directly contribute to improving your credit score. As your score climbs, you move into a lower-risk category for lenders. This isn't a quick fix, but a steady climb. Over time, a history of responsible auto loan payments demonstrates your ability to manage debt, which is precisely what future lenders want to see. This improved credit score is your golden ticket to better financial opportunities.

Graduating to Better Rates: Refinancing Opportunities Down the Road

Once you've made 12-18 months of consistent, on-time payments, and your credit score has shown significant improvement, you may become eligible to refinance your car loan. Refinancing means taking out a new loan, typically with a lower interest rate, to pay off your existing one. This can save you hundreds, or even thousands, of dollars in interest over the remaining term of your loan. It’s a tangible reward for your responsible financial behaviour and a smart strategy to further reduce your total cost of ownership in British Columbia.

Beyond the Car: Opening Doors to Mortgages, Personal Loans, and Financial Freedom

The positive impact of a responsibly managed auto loan extends far beyond just your vehicle. A strong payment history on an auto loan demonstrates to banks and other financial institutions that you are a reliable borrower. This can significantly improve your eligibility for other major financial products, such as mortgages for a home in Vancouver, personal loans for education or home improvements, and even better rates on credit cards. Your car loan becomes a stepping stone, laying the foundation for broader financial freedom and unlocking opportunities you might have thought were out of reach in British Columbia and beyond.

Pro Tip: Set Up Automatic Payments for Peace of Mind: Eliminate the risk of missing a payment – and damaging your rebuilding credit – by setting up automatic withdrawals from your bank account. This ensures consistency, protects your credit score, and frees up your mental energy from remembering due dates. It's a simple yet incredibly effective strategy for financial success.

Navigating the Pitfalls: What to Avoid on Your Challenged Credit Journey

While there are many legitimate solutions for challenged credit car loans in Vancouver, the landscape also contains pitfalls. Being informed about common scams and predatory practices is crucial to protect yourself and ensure your journey to a new car is a positive one.

'Guaranteed Approval' Scams: If It Sounds Too Good to Be True...

Be extremely wary of any lender or dealership that promises "guaranteed approval" regardless of your credit history, especially if they claim no credit check is required. Legitimate lenders always perform a credit check to assess risk. These "guaranteed approval" offers often hide exploitative terms, exorbitant interest rates, hidden fees, or require you to purchase a vehicle far beyond its market value. If it sounds too good to be true, it almost certainly is. Protect yourself by sticking with reputable finance centres and lenders in British Columbia.

High-Pressure Sales Tactics: Recognizing and Resisting Them

Some dealerships might employ high-pressure sales tactics to rush you into a decision. This could include pushing you towards a car you don't want, adding unnecessary extras, or pressuring you to sign without fully understanding the terms. Recognize these tactics: "This deal is only good today," "Someone else is interested in this car," or "You won't get approved anywhere else." Empower yourself by taking your time, asking questions, and never feeling coerced. A reputable finance specialist will prioritize your understanding and comfort throughout the process in Vancouver.

Ignoring the Fine Print: The Importance of Reading Your Contract Meticulously

This cannot be stressed enough: Read every single word of your loan agreement before you sign. Understand the interest rate, the total loan amount, the term, all fees, late payment penalties, and any other clauses. If you don't understand something, ask for clarification. Do not be afraid to ask for a copy to review overnight if you feel rushed. Signing a contract in British Columbia without full comprehension can lead to unexpected financial burdens down the road. Due diligence here is your best defence.

Borrowing More Than You Need: The Temptation of 'Extra Cash'

Sometimes, lenders might offer to approve you for a loan amount slightly higher than the car's value, suggesting it as "extra cash" for emergencies or other needs. While this might seem appealing, it's a dangerous trap. Borrowing more than the vehicle is worth immediately puts you into negative equity, meaning you owe more than the car is worth. This makes it harder to sell or trade in the car later, and you'll be paying interest on money you don't actually need for the vehicle itself. Stick to borrowing only what's necessary for the car's purchase price and associated legitimate fees.

Your Next Steps to Driving Away Confidently in Vancouver

You’ve navigated the complexities of challenged credit and armed yourself with knowledge. Now, it's time to translate that understanding into action. For Vancouver residents, the path to securing a car loan and driving away confidently is clearer than ever.

Crafting Your Personalized Action Plan

Start by creating a step-by-step plan tailored to your unique financial situation:

- Assess Your Credit: Obtain your free credit report from Equifax and TransUnion. Understand what lenders see.

- Gather Documents: Compile all essential paperwork (income proof, ID, residency, bank statements) as detailed earlier.

- Determine Your Budget: Realistically calculate what monthly payment you can comfortably afford, considering your DTI and other expenses.

- Research Vehicles: Identify reliable, affordable used cars that fit your needs and budget.

- Find a Partner: Research reputable specialized auto finance centres in the Lower Mainland.

This organized approach minimizes stress and maximizes your chances of success.

Finding the Right Partner: What Questions to Ask Your Finance Specialist

When you connect with a finance specialist, treat it as an interview. You’re looking for a transparent, knowledgeable, and empathetic partner. Here are essential questions to ask:

- "What interest rates can I realistically expect with my credit situation?"

- "Are there any hidden fees not included in the advertised price or monthly payment?"

- "What are my options for loan terms, and how do they impact the total cost?"

- "How will this loan help me rebuild my credit score?"

- "What documents do you need from me to get the best possible approval?"

- "Can you explain all aspects of the contract before I sign?"

A good specialist will answer openly and ensure you feel completely comfortable.

The First Test Drive: From Application to Keys in Hand

The final step is to take the leap. With your plan in hand, your documents ready, and a clear understanding of the process, submit your application. Trust the expertise of your finance specialist to guide you through the approval. Then, enjoy that empowering moment: the first test drive of your new-to-you vehicle, knowing you've overcome the challenge of "denied everywhere." You'll be driving away confidently, not just with a car, but with a renewed sense of financial control and the freedom to explore the beautiful landscapes of British Columbia.