Vancouver Auto Loans: Where Your Bank Statements Are the Boss.

Table of Contents

- Key Takeaways

- 2. The Vancouver Reality: Why Bank Statements Become Your Financial Storyteller

- 2.1. Beyond the Pay Stub: Understanding Vancouver's Diverse Workforce

- 2.2.

- Pro Tip: Not all bank statements are created equal. Lenders prioritize clarity, consistency, and a full transaction history. Ensure your statements are well-organized and span at least 3-6 months. The clearer the picture you present, the more confident a lender will be in your ability to manage a new car payment.

- 3. Unpacking the 'Bank Statements Only' Myth: Who This Path Is Truly For

- 3.1. The Self-Employed Entrepreneur in British Columbia

- 3.2. Newcomers to Canada: Establishing Financial Footing in Vancouver

- 3.3. Rebuilding Your Financial Narrative: A Second Chance in the Lower Mainland

- 3.4. The Cash-Rich, Credit-Thin Individual: More Common Than You Think

- 4. The Art of the Statement: What Vancouver Lenders Really Scrutinize

- 4.1. Consistency is King: Demonstrating Stable Income Flow

- 4.2. Expense Management: What Your Outgoings Reveal

- Pro Tip: Lenders in Vancouver look for a healthy debt-to-income ratio, even without traditional credit scores. Your bank statements are their primary window into this. Aim for expenses not exceeding 30-40% of your verifiable income to demonstrate strong repayment capacity for a new auto loan.

- 4.3. The 'Red Flags' on Your Bank Statements

- 4.4. Required Documentation Beyond Just Statements

- 5. Navigating the Vancouver Lending Labyrinth: Dealerships vs. Direct Lenders

- 5.1. The Dealership Advantage in British Columbia

- Pro Tip: Some dealerships in Vancouver, and across the Lower Mainland, have dedicated finance managers experienced with bank statement-only applications. Seek out reviews or ask directly about their expertise in this area. Their experience can be invaluable in crafting a successful application.

- 5.2. Exploring Direct Lenders: Banks, Credit Unions, and Alternative Finance Companies

- 5.3. Comparing the Offerings: Interest Rates, Loan Terms, and Down Payments

- 6. Beyond the Numbers: Interest Rates, Terms, and the Hidden Costs of Non-Traditional Approval

- 6.1. The Reality of Interest Rates for Bank Statement Loans in Vancouver

- 6.2. Decoding Loan Terms: Shorter vs. Longer Periods

- 6.3. Unmasking Hidden Fees and Charges

- Pro Tip: Always ask for a full, itemized breakdown of all costs associated with the loan. Read the fine print thoroughly before signing anything in Vancouver or anywhere else in British Columbia. Don't be afraid to walk away if terms are unclear or unfavourable. Transparency from your lender is non-negotiable.

- 6.4. The Power of a Co-Signer (When Bank Statements Need a Boost)

- 7. Crafting Your Financial Narrative: Optimizing Your Bank Statements for Success

- 7.1. The Power of Preparation: Organizing Your Documents

- 7.2. Explaining Irregularities: Adding Context to Your Transactions

- 7.3. Building a Strong Financial Relationship in Vancouver

- 7.4.

- 8. Your Next Steps to Driving Away: Securing Your Vancouver Auto Loan

- 8.1. Researching Vancouver Lenders: Who Specializes in Your Situation?

- 8.2. Pre-Approval Power: Knowing Your Buying Capacity

- 8.3. The Car Selection Sweet Spot: Matching Vehicle to Approval

- 8.4. From Application to Keys: The Final Stages

- 9. Frequently Asked Questions (FAQ) about Bank Statement Auto Loans in Vancouver

Navigating the bustling streets of Vancouver, British Columbia, often requires a reliable set of wheels. But what if your financial journey doesn't fit the traditional mould of pay stubs and pristine credit scores? For many residents in this vibrant city, from the innovative freelancer in Gastown to the hard-working new immigrant in Surrey, the path to auto financing can seem complex. This is where your bank statements step up, transforming from mere transaction records into your most compelling financial narrative.

At SkipCarDealer.com, we understand that life in British Columbia is dynamic, and so are your financial circumstances. This comprehensive guide dives deep into how your bank statements can become your most powerful tool for securing an auto loan in Vancouver, revealing the true story of your financial health and stability, even when traditional credit reports tell a different, or incomplete, tale.

Key Takeaways

- Direct answers to 'Can I get an auto loan with bank statements only in Vancouver?' Yes, absolutely. While less conventional, it's a viable pathway for many, especially with the right approach and lender.

- Who this financing option primarily serves in British Columbia (e.g., self-employed, new immigrants, credit rebuilding). This method is a lifeline for entrepreneurs, gig workers, newcomers establishing Canadian credit, and individuals actively working to improve their financial standing after past challenges.

- The critical role of financial consistency and cash flow analysis over traditional credit scores. Lenders using bank statements prioritize a clear, consistent history of income and responsible spending, looking for your ability to manage finances and make regular payments. Your cash flow is the main event.

- Anticipated interest rates, typical loan terms, and approval timelines for this specific niche. Expect rates to be potentially higher and terms perhaps shorter than traditional loans due to the perceived risk. Approval timelines can vary but a well-prepared application can speed up the process considerably.

2. The Vancouver Reality: Why Bank Statements Become Your Financial Storyteller

Vancouver is a city of innovation, diverse cultures, and evolving work models. The traditional nine-to-five job with a bi-weekly pay stub is no longer the sole economic engine. This shift has created a need for flexible financing solutions, and astute lenders have adapted, looking beyond conventional metrics to understand a borrower's true financial capacity.

2.1. Beyond the Pay Stub: Understanding Vancouver's Diverse Workforce

The rise of the gig economy, self-employment, and contract work has profoundly reshaped the employment landscape across British Columbia, particularly in urban centres like Vancouver. Think of the booming tech sector, the vibrant arts and culture scene, or the myriad of small businesses flourishing in neighbourhoods from Kitsilano to Commercial Drive. Many talented individuals contribute significantly to the economy but don't receive a standard T4 slip or employment letter that traditional lenders typically demand.

For these dynamic Vancouverites, traditional income verification (think T4s, employment letters, or even CRA Notices of Assessment for the most recent year) often falls short. It simply doesn't capture the real-time, consistent income flow of a freelance graphic designer, a ride-share driver, or a consultant juggling multiple contracts. Lenders who still rely solely on these outdated methods risk alienating a significant portion of the productive workforce.

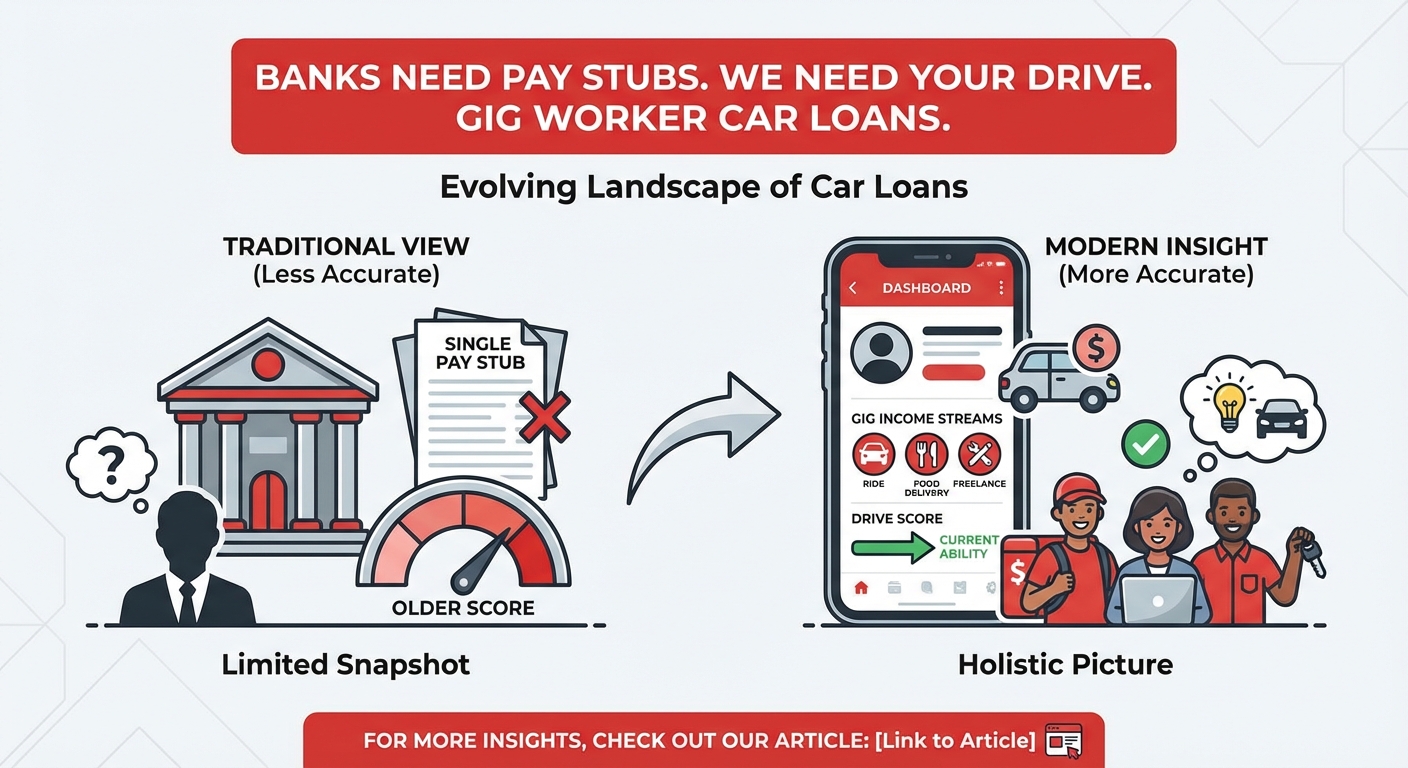

This is where the shift in lending philosophy becomes crucial. Forward-thinking lenders and finance professionals are moving away from an exclusive reliance on credit scores to a deep dive into cash flow and banking habits. They understand that a consistent pattern of deposits and responsible expense management in your bank account paints a far more accurate picture of your ability to service a car loan than a single pay stub or an older credit score. For more insights on this evolving landscape, check out our article: Banks Need Pay Stubs. We Need Your Drive. Gig Worker Car Loans.

2.2.

(Context: A diverse group of Vancouver residents – perhaps a freelancer, a small business owner, and a new immigrant – thoughtfully reviewing their bank statements or a car advertisement, symbolizing the non-traditional path to auto financing.)

Your bank statements essentially tell your financial story, month by month. They show your income, your spending habits, and your overall financial stability. For lenders, this granular data is invaluable. It helps them assess risk, understand your repayment capacity, and ultimately make an informed decision on your auto loan application.

Pro Tip: Not all bank statements are created equal. Lenders prioritize clarity, consistency, and a full transaction history. Ensure your statements are well-organized and span at least 3-6 months. The clearer the picture you present, the more confident a lender will be in your ability to manage a new car payment.

3. Unpacking the 'Bank Statements Only' Myth: Who This Path Is Truly For

The idea of securing an auto loan with just bank statements might sound like a last resort, but for many in British Columbia, it's a primary and perfectly valid financing strategy. This approach caters to specific demographics whose financial realities aren't easily captured by conventional credit scoring models.

3.1. The Self-Employed Entrepreneur in British Columbia

Vancouver is a hub for entrepreneurs. From the tech startups in Yaletown to the independent boutiques in Gastown, self-employment is a driving force. However, navigating fluctuating income with traditional loan applications can be a headache. This is where detailed bank statements become your strongest advocate. They allow you to demonstrate business viability and consistent revenue through a clear transaction history, even if your income isn't fixed or comes from multiple sources.

Lenders will look for regular deposits from clients, sales, or contract payments. They want to see a pattern that indicates a sustainable income stream, even if the exact amount varies from month to month. Your bank statements provide the necessary evidence to show that you're not just earning, but consistently earning enough to manage a car loan payment. For more insights specifically tailored to self-employed individuals, you might find our article Self-Employed? Your Bank Doesn't Need a Resume. particularly helpful.

3.2. Newcomers to Canada: Establishing Financial Footing in Vancouver

Canada welcomes thousands of new immigrants every year, many of whom choose to settle in culturally diverse cities like Vancouver, Surrey, and Richmond. While these newcomers often arrive with strong financial backgrounds and professional experience from their home countries, they typically lack an established Canadian credit history. This "credit-thin" status can be a significant barrier when applying for traditional loans.

Local bank statements, however, can be a powerful tool. They allow new residents to build a case for financial responsibility by showcasing consistent deposits from employment, transfers from overseas accounts, or even responsible spending habits within Canada, all without a long Canadian credit file. Lenders can see how you manage your money day-to-day, providing tangible evidence of your financial stability and commitment to managing your funds responsibly.

3.3. Rebuilding Your Financial Narrative: A Second Chance in the Lower Mainland

Life happens, and sometimes financial challenges, such as past credit issues or even bankruptcy, can leave a mark on your credit report. For individuals in the Lower Mainland working diligently to rebuild their financial narrative, bank statements offer a crucial second chance. While your credit score might reflect past difficulties, your recent banking activity can tell a story of recovery and renewed responsibility.

Lenders will focus on current, positive banking behaviour. Are you avoiding overdrafts? Are you making regular deposits and managing your expenses prudently? Diligent savings and a clear absence of recent financial distress can significantly outweigh historical issues. This approach allows lenders to assess your current capacity and commitment to financial stability, rather than dwelling solely on your past. For those navigating the post-proposal phase, our article Post-Proposal Car Loan: Your Credit Score Just Got a Mulligan. offers further guidance.

3.4. The Cash-Rich, Credit-Thin Individual: More Common Than You Think

Not everyone relies on credit cards or traditional loans. Many Canadians, by choice, prefer debit and cash transactions, meticulously saving rather than borrowing. While this is a financially sound habit, it can paradoxically leave them "credit-thin" – meaning they have little to no credit history for lenders to evaluate. This situation is more common than you might assume, especially among younger generations or those who simply prefer to avoid debt.

For these individuals, their bank statements become their credit report. They showcase strong savings, consistent income, and responsible spending habits, acting as undeniable proof of financial health. Lenders can clearly see a pattern of living within one's means and accumulating savings, which is a strong indicator of reliability, even without a lengthy credit file.

4. The Art of the Statement: What Vancouver Lenders Really Scrutinize

When you present your bank statements for an auto loan in Vancouver, you're not just handing over a document; you're offering a detailed look into your financial life. Lenders aren't just glancing at a total; they're meticulously analyzing patterns, habits, and critical indicators of your financial health. Understanding what they're looking for can significantly improve your application's success.

4.1. Consistency is King: Demonstrating Stable Income Flow

The primary goal of a lender analyzing your bank statements is to verify your income and assess its stability. They want to see regular deposits, whether they're from employment, clients, government benefits, or other verifiable sources. Large, unexplained gaps in deposits or erratic income patterns can raise red flags, making it harder for lenders to predict your ability to make consistent loan payments.

For those with variable income, such as freelancers or commission-based workers, lenders will calculate an 'average' income over the provided period (typically 3 to 6 months). They'll look at the lowest income months as well as the highest, aiming to determine a realistic, conservative figure for your monthly disposable income. The more consistent your income, even if it varies slightly, the better your chances.

4.2. Expense Management: What Your Outgoings Reveal

Beyond income, your bank statements reveal your spending habits – and these are just as crucial. Lenders will pinpoint recurring bills such as rent or mortgage payments, utilities, insurance premiums, and any existing loan payments (student loans, personal loans, etc.). They're looking for responsible spending habits versus excessive discretionary spending that could jeopardize your ability to afford a car payment.

They’re also calculating your debt-to-income ratio, even without traditional credit scores. This ratio is a key indicator of your financial burden relative to your income. A high ratio suggests that a significant portion of your income is already committed to existing debts and expenses, leaving little room for a new car loan.

Pro Tip: Lenders in Vancouver look for a healthy debt-to-income ratio, even without traditional credit scores. Your bank statements are their primary window into this. Aim for expenses not exceeding 30-40% of your verifiable income to demonstrate strong repayment capacity for a new auto loan.

4.3. The 'Red Flags' on Your Bank Statements

Just as there are positive indicators, certain transactions can signal caution to lenders. Frequent overdrafts or Non-Sufficient Funds (NSF) fees are major red flags, indicating poor financial management or a lack of sufficient funds. Similarly, numerous gambling transactions, excessive payday loan repayments, or high-interest cash advances suggest financial distress and a reliance on costly short-term solutions, which lenders will view negatively.

Unexplained large withdrawals or transfers that appear inconsistent with your regular spending patterns could also indicate financial instability or a lack of transparency. The goal is to present a clear, stable, and responsible financial picture.

4.4. Required Documentation Beyond Just Statements

While bank statements are central to this financing approach, they are rarely the *only* document required. You'll still need to provide standard identification and residency proofs:

- Proof of residency in Vancouver or British Columbia: This could include recent utility bills (hydro, internet), a lease agreement, or property tax statements.

- Valid Canadian driver's license: Or an equivalent provincial identification if you're not the primary driver but are financing the vehicle.

- Vehicle details: If you've already chosen a specific car, having its make, model, year, and VIN (Vehicle Identification Number) ready will streamline the process.

5. Navigating the Vancouver Lending Labyrinth: Dealerships vs. Direct Lenders

When seeking an auto loan in Vancouver using your bank statements, knowing where to turn is half the battle. The lending landscape offers several avenues, each with its own advantages and considerations. Understanding these options will help you choose the best fit for your unique financial situation.

5.1. The Dealership Advantage in British Columbia

For many Vancouver residents, starting their auto loan journey at a dealership makes the most sense. Modern dealerships, especially larger ones or those specializing in varied credit situations, often have robust in-house financing departments. These departments are particularly adept at handling non-traditional approvals, frequently operating with more flexible criteria than conventional banks.

A key advantage is their access to a wide network of third-party lenders. This means your application isn't just reviewed by one institution; it can be submitted to multiple lenders, including those who are less reliant on traditional credit scores and more open to evaluating bank statements. This significantly increases your chances of approval. SkipCarDealer.com works with many such lenders across British Columbia to maximize your opportunities.

Pro Tip: Some dealerships in Vancouver, and across the Lower Mainland, have dedicated finance managers experienced with bank statement-only applications. Seek out reviews or ask directly about their expertise in this area. Their experience can be invaluable in crafting a successful application.

5.2. Exploring Direct Lenders: Banks, Credit Unions, and Alternative Finance Companies

While dealerships offer convenience, direct lenders are another option, each with distinct characteristics:

5.2.1. Traditional Banks (e.g., RBC, TD, BMO in Vancouver):

These institutions are generally more stringent in their lending criteria. While it's possible to secure a loan with them using bank statements, it usually requires a long-standing, excellent relationship with the bank, substantial savings, or other collateral. They may also require more than just statements, such as a co-signer with strong credit or a significant down payment, to offset the perceived risk of a non-traditional application.

5.2.2. Local Credit Unions (e.g., Vancity, Coast Capital Savings):

Credit unions, by their very nature, are community-focused and often more flexible and understanding of individual circumstances in British Columbia. If you're an existing member with a good banking history, they might be more willing to consider your bank statements as primary income verification. Building a strong personal relationship with a local credit union can significantly improve your chances, as they often take a more holistic view of your financial health.

5.2.3. Independent Finance Companies:

These specialized lenders cater specifically to higher-risk or non-traditional applicants. They are often the go-to for bank statement-only loans because their business model is built around assessing risk differently. While they offer greater accessibility, it's important to note that they may come with higher interest rates to offset the increased perceived risk compared to traditional loans.

5.3. Comparing the Offerings: Interest Rates, Loan Terms, and Down Payments

When relying on bank statements for an auto loan in Vancouver, it's crucial to set realistic expectations regarding the loan terms. Here's a general comparison:

| Feature | Traditional Auto Loan (Good Credit) | Bank Statement Auto Loan (Non-Traditional) |

|---|---|---|

| Interest Rates | Typically 0% - 7% (Prime Rates) | Often 8% - 29.9% (Higher due to perceived risk) |

| Loan Terms | Usually 60-84 months (sometimes longer) | Often 36-72 months (can be shorter to reduce risk) |

| Down Payment | Often optional, or small (5-10%) | Highly recommended, often 10-20% or more (significantly improves approval odds and rates) |

| Approval Speed | Very fast, often same day | Can take longer due to manual review, but still possible within 24-48 hours with prepared documents |

The undeniable impact of a larger down payment cannot be overstated. By putting more money down upfront, you reduce the total amount financed, which lowers the lender's risk and can significantly improve your approval odds, and often, secure more favourable interest rates and terms. It demonstrates your commitment and reduces the loan-to-value ratio, making the deal more attractive to lenders.

6. Beyond the Numbers: Interest Rates, Terms, and the Hidden Costs of Non-Traditional Approval

Securing an auto loan with bank statements in Vancouver is a fantastic opportunity for many, but it's essential to understand the full financial picture. This includes recognizing that non-traditional financing often comes with different parameters than what someone with a pristine credit history might receive. Transparency is key to making an informed decision.

6.1. The Reality of Interest Rates for Bank Statement Loans in Vancouver

Why are interest rates often higher for non-traditional financing? It boils down to risk assessment. When a lender relies primarily on bank statements, they are taking on a higher perceived risk compared to a borrower with a long, impeccable credit history. Traditional credit scores are a standardized, easily verifiable measure of a borrower's past payment behaviour. Without this, lenders must conduct a more manual, nuanced assessment of your financial habits, which inherently carries a higher degree of uncertainty. This increased risk is typically offset by a higher interest rate.

Therefore, while a prime borrower in a city like Ottawa or Calgary might qualify for rates as low as 0-5%, someone in Vancouver relying on bank statements might see rates in the range of 8% to 29.9%. It's a trade-off: greater accessibility to financing in exchange for a higher cost of borrowing. This is not to discourage you, but rather to ensure you enter the process with realistic expectations.

6.2. Decoding Loan Terms: Shorter vs. Longer Periods

Loan terms, or the duration over which you repay the loan, also play a significant role. For bank statement loans, lenders might prefer slightly shorter terms (e.g., 36-72 months instead of 84+ months) to reduce their exposure to risk over a longer period. This means higher monthly payments but a lower total interest paid over the life of the loan.

Conversely, a longer term can lead to lower monthly payments, making the loan more affordable on a day-to-day basis, but you'll pay more in total interest over time. Finding a payment plan that genuinely fits your bank statement-revealed income and budget is paramount. It's a delicate balance between monthly affordability and the overall cost of the loan.

6.3. Unmasking Hidden Fees and Charges

Beyond the interest rate, it's crucial to be aware of potential additional fees that can add to the total cost of your loan. These might include:

- Origination fees: A fee charged for processing a new loan application.

- Administrative costs: Fees for handling paperwork and setting up the loan.

- Processing fees: Similar to administrative fees, covering the costs of getting the loan ready.

- Early repayment penalties: Some lenders charge a fee if you pay off your loan ahead of schedule.

Pro Tip: Always ask for a full, itemized breakdown of all costs associated with the loan. Read the fine print thoroughly before signing anything in Vancouver or anywhere else in British Columbia. Don't be afraid to walk away if terms are unclear or unfavourable. Transparency from your lender is non-negotiable.

6.4. The Power of a Co-Signer (When Bank Statements Need a Boost)

If your bank statements, while positive, don't quite meet the lender's threshold for a standalone approval, a co-signer can be a game-changer. A co-signer is someone with a strong credit history and stable income who agrees to be equally responsible for the loan if you default. This significantly reduces the lender's risk, as they have a secondary party to pursue for payment.

Having a financially strong co-signer can dramatically improve your approval odds and potentially secure better terms, including lower interest rates. However, it's vital that both parties understand the responsibilities and risks involved. The co-signer's credit will be affected by the loan, and they will be legally obligated to make payments if you cannot. This decision should only be made with full transparency and trust between both individuals.

7. Crafting Your Financial Narrative: Optimizing Your Bank Statements for Success

Your bank statements are more than just a collection of numbers; they are a narrative of your financial behaviour. To maximize your chances of auto loan approval in Vancouver, it's not enough to simply hand over the documents. You need to present them in a way that clearly and confidently tells your positive financial story.

7.1. The Power of Preparation: Organizing Your Documents

The first step to a successful application is meticulous organization. Lenders typically request the most recent 3 to 6 months of bank statements, though for highly variable income, they might ask for up to 12 months to get a broader picture. Ensure these statements are clear, legible, and complete.

Go through your statements and, if possible, highlight regular income deposits. Show consistent patterns of responsible spending, demonstrating that you manage your money effectively. Many online banking platforms allow you to export statements as PDFs, which are usually well-organized and easy to read. Avoid submitting blurry photos or incomplete screenshots, as this can create doubt and delay the process.

7.2. Explaining Irregularities: Adding Context to Your Transactions

No one's financial life is perfectly linear. There might be a month with a larger-than-usual expense, a period of slightly lower income, or an unusual deposit. Don't let these irregularities become stumbling blocks. Instead, prepare concise, clear explanations for any transactions that might raise questions.

For example, if you had a large withdrawal, explain it was for a family emergency or a significant, one-time purchase. If a month showed lower income, explain it was due to a seasonal slowdown or a brief transition between contracts. A well-articulated cover letter accompanying your statements, or a direct, honest conversation with the lender, can be highly beneficial. Transparency builds trust and helps the lender understand the full context of your financial situation.

7.3. Building a Strong Financial Relationship in Vancouver

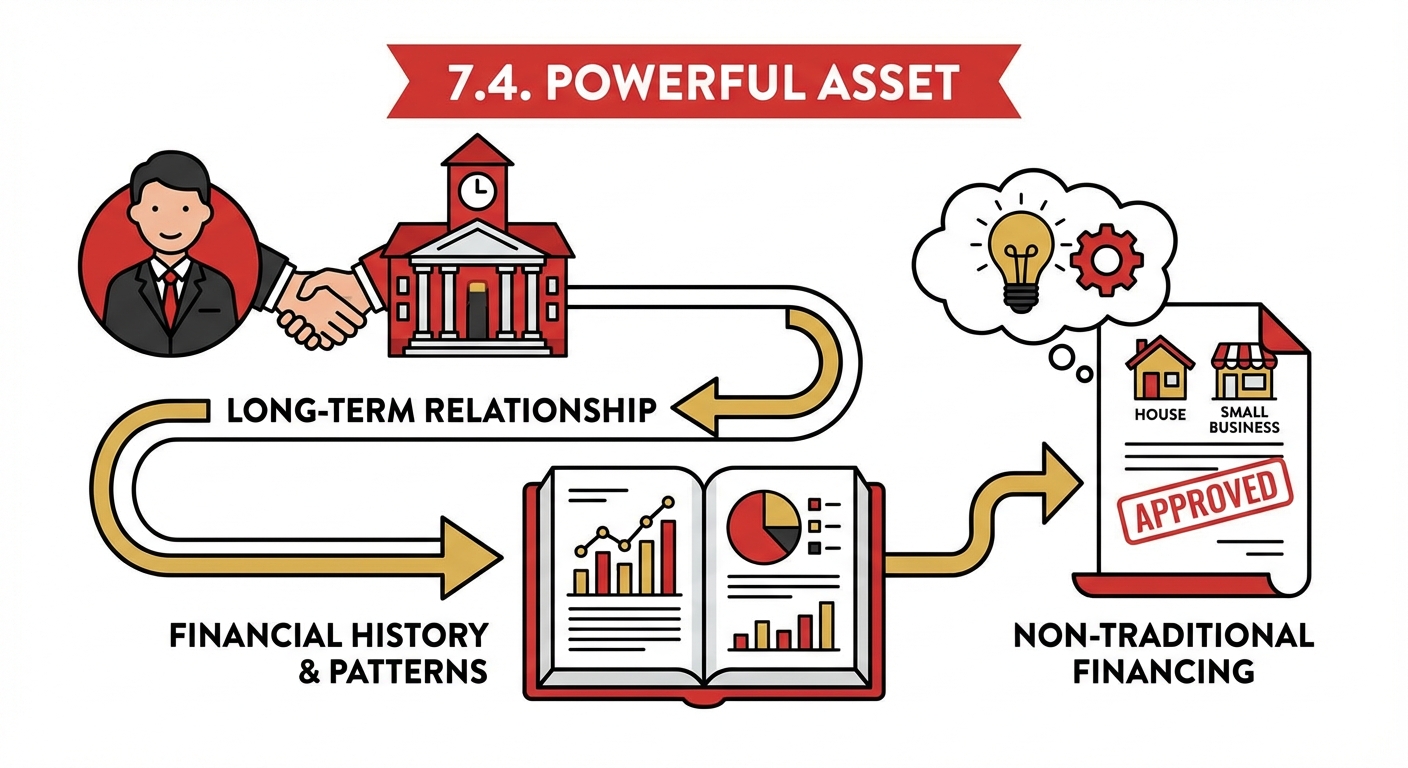

Lenders, especially local credit unions, value consistency and loyalty. Maintaining a consistent bank account with a local financial institution for an extended period demonstrates stability. Avoiding frequent account changes or opening too many new accounts simultaneously can signal instability or an attempt to obscure financial activity, which is a red flag for lenders.

Demonstrating loyalty and a consistent banking history with a single institution can sometimes work in your favour, as they will have a deeper understanding of your financial patterns and a historical record of your financial behaviour. This long-term relationship can be a powerful asset when seeking non-traditional financing.

7.4.

(Context: A person confidently handing over a neatly organized stack of bank statements and supporting documents to a friendly, professional loan officer or car salesperson in a modern office or dealership setting, symbolizing preparedness and transparency.)

8. Your Next Steps to Driving Away: Securing Your Vancouver Auto Loan

With your bank statements primed and your understanding of the process deepened, you're well-equipped to take the final steps towards securing your auto loan and driving away in a new-to-you vehicle in Vancouver. This stage involves strategic research, preparation, and confident negotiation.

8.1. Researching Vancouver Lenders: Who Specializes in Your Situation?

Not all lenders are created equal, especially when it comes to non-traditional financing. Your first step should be to identify dealerships and independent finance companies in the Lower Mainland known for bank statement approvals. Look for lenders who actively advertise 'no credit check' or 'bad credit loans,' as these are often equipped with the flexible financing options and experienced staff necessary to evaluate applications based on bank statements.

Check online reviews and testimonials. What are other customers saying about their experience with transparency, customer service, and approval processes? A lender with a reputation for helping individuals with unique financial situations is likely to be a better fit than a strictly traditional bank.

8.2. Pre-Approval Power: Knowing Your Buying Capacity

Even with non-traditional financing, seeking pre-approval is a crucial step. Pre-approval gives you a realistic understanding of how much you can borrow, based on an initial assessment of your bank statements and other provided information. This sets realistic expectations for your vehicle search, preventing you from falling in love with a car that's outside your approved budget.

Furthermore, a pre-approval strengthens your negotiation position at any dealership in British Columbia. You walk in as a serious buyer with financing already in place, giving you leverage and potentially leading to better deals on the vehicle itself. It streamlines the buying process and reduces stress.

8.3. The Car Selection Sweet Spot: Matching Vehicle to Approval

With your pre-approval in hand, it's time for realistic expectations regarding vehicle selection. Based on the analysis of your bank statements and the potential loan amount, you'll need to consider what type of vehicle and price range is appropriate. While it's possible to finance a new car with bank statements, slightly used vehicles are often easier to approve due to lower loan amounts. This reduces the overall risk for the lender and can improve your approval odds significantly.

Focus on a vehicle that meets your needs without overextending your budget. Remember, the goal is to secure reliable transportation that you can comfortably afford, not necessarily the most luxurious option. This responsible approach will also demonstrate financial prudence to your lender.

8.4. From Application to Keys: The Final Stages

Once you've found the right vehicle and your loan is approved, the final stage involves understanding the closing process. This includes reviewing and signing all contracts, understanding the terms and conditions, and facilitating the title transfer. Take your time to read every document carefully.

Ensure that all paperwork aligns exactly with the agreed-upon terms, interest rates, and fees. If anything differs from what was discussed or pre-approved, do not hesitate to ask for clarification. Transparency and thoroughness at this stage will protect you from any surprises down the road. Once all documents are signed and verified, you'll be handed the keys to your new vehicle, ready to explore all that Vancouver and British Columbia have to offer.