If you are currently navigating a consumer proposal, you have likely heard the whispers: "You can't get credit for seven years," or "No dealership will touch you until you have your discharge papers." It is a common misconception that enters the mind of almost every Canadian going through the insolvency process. You might feel like you are stuck in a financial penalty box, forced to rely on unreliable public transit or an aging vehicle that costs more in repairs than it is worth.

The reality of the Canadian lending landscape is far more nuanced. While a consumer proposal (CP) is a significant mark on your credit report, it is not a total blockade to vehicle ownership. In fact, for many, obtaining a car loan during an active proposal is one of the most strategic moves they can make to accelerate their financial recovery. This guide serves as your comprehensive roadmap, stripping away the myths and providing the hard facts about how auto financing works when you are in the middle of a debt settlement process.

Key Takeaways

- Legally Possible: There is no law in Canada preventing you from obtaining a car loan while in a consumer proposal.

- Trustee Involvement: You generally require a "Letter of Consent" from your Licensed Insolvency Trustee (LIT) for new credit exceeding $1,000.

- Subprime Reality: Expect interest rates in the 18% to 29% range, as you will be working with specialized non-prime lenders.

- Credit Rebuilding: An auto loan is a "secured" tradeline that can significantly boost your credit score faster than waiting for the proposal to end.

- Income is King: Lenders care more about your current stability and "ability to pay" than your past credit mistakes.

Understanding the Consumer Proposal and Your Credit

To navigate the path forward, you first need to understand where you are standing. A consumer proposal is a legal process governed by the Bankruptcy and Insolvency Act. It allows you to pay back a portion of what you owe to your creditors over a maximum of five years. Once the creditors and the court approve it, you are legally protected from collections and wage garnishments.

However, your credit report tells a specific story during this time. When you enter a CP, your credit accounts are assigned an R7 rating. On a scale of 1 to 9, where R1 is "pays on time" and R9 is "permanent write-off or bankruptcy," an R7 indicates that you are making payments under a debt management arrangement.

The "7-Year Rule" is often misunderstood. In Canada, a consumer proposal remains on your Equifax or TransUnion report for either three years after you make your final payment or six to seven years after you initially filed-whichever comes first. This means if you take the full five years to pay off your proposal, the mark stays for a total of eight years from the start. This long-term impact is exactly why waiting until the end to rebuild your credit is often a mistake.

The Legal Requirement: Trustee Permission

One of the most critical hurdles is the legal requirement regarding new debt. Under the Bankruptcy and Insolvency Act, if you are in an active proposal and wish to obtain credit over $1,000, you are technically required to disclose that you are in a proposal. More importantly, most lenders who specialize in CP loans will demand a "Letter of Consent" from your Licensed Insolvency Trustee (LIT).

Why would a Trustee say yes to you taking on more debt? Trustees are humans who understand that in Canada, a car is often a necessity, not a luxury. If you need a vehicle to get to work, transport your children, or maintain your daily life, the Trustee sees the car loan as a tool for stability. As long as the monthly payment does not jeopardize your ability to make your proposal payments, most Trustees are happy to provide the necessary documentation.

The process usually involves submitting a budget to your Trustee showing that you can afford the new payment. Once they review your income and expenses, they issue a formal letter stating they have no objection to the purchase. This letter is the "golden ticket" that specialized lenders need to finalize your file.

The Lending Landscape: Who Will Finance You?

If you walk into a major bank like TD, RBC, or Scotiabank while in an active consumer proposal, you will likely be met with a polite but firm "no." These institutions use automated underwriting systems that automatically decline any applicant with an active insolvency. They are "prime" lenders who only deal with "A-paper" clients.

To get approved, you must look toward the subprime or "non-prime" lending market. In Canada, this space is occupied by specialized companies like Avante, Rifco, iA Auto Finance, and Eden Park. These lenders do not use a "one-size-fits-all" computer algorithm. Instead, they use "manual underwriting," where a human being looks at your employment history, your income, and the reason for your proposal.

It is also vital to distinguish between specialized dealerships and "Buy Here Pay Here" (BHPH) lots. A specialized non-prime dealership works with the lenders mentioned above. They help you get a loan that is reported to the credit bureaus. A BHPH lot, on the other hand, acts as the bank themselves. Many of these lots do not report to Equifax or TransUnion, meaning you could pay 30% interest for three years and your credit score won't move a single point.

The Cost of Financing: What to Expect

Transparency is key when discussing the costs. You are considered a "high-risk" borrower because you have already legally negotiated a break on your previous debts. Lenders compensate for this risk by charging higher interest rates.

| Feature | Prime Loan (Good Credit) | Consumer Proposal Loan |

|---|---|---|

| Interest Rate (APR) | 5% - 9% | 18.9% - 29.9% |

| Down Payment | Optional ($0 down common) | Highly Recommended ($500 - $2,000) |

| Loan Term | Up to 84-96 months | 36 - 60 months (usually) |

| Vehicle Age Limits | New or up to 10 years old | Usually 7 years or newer |

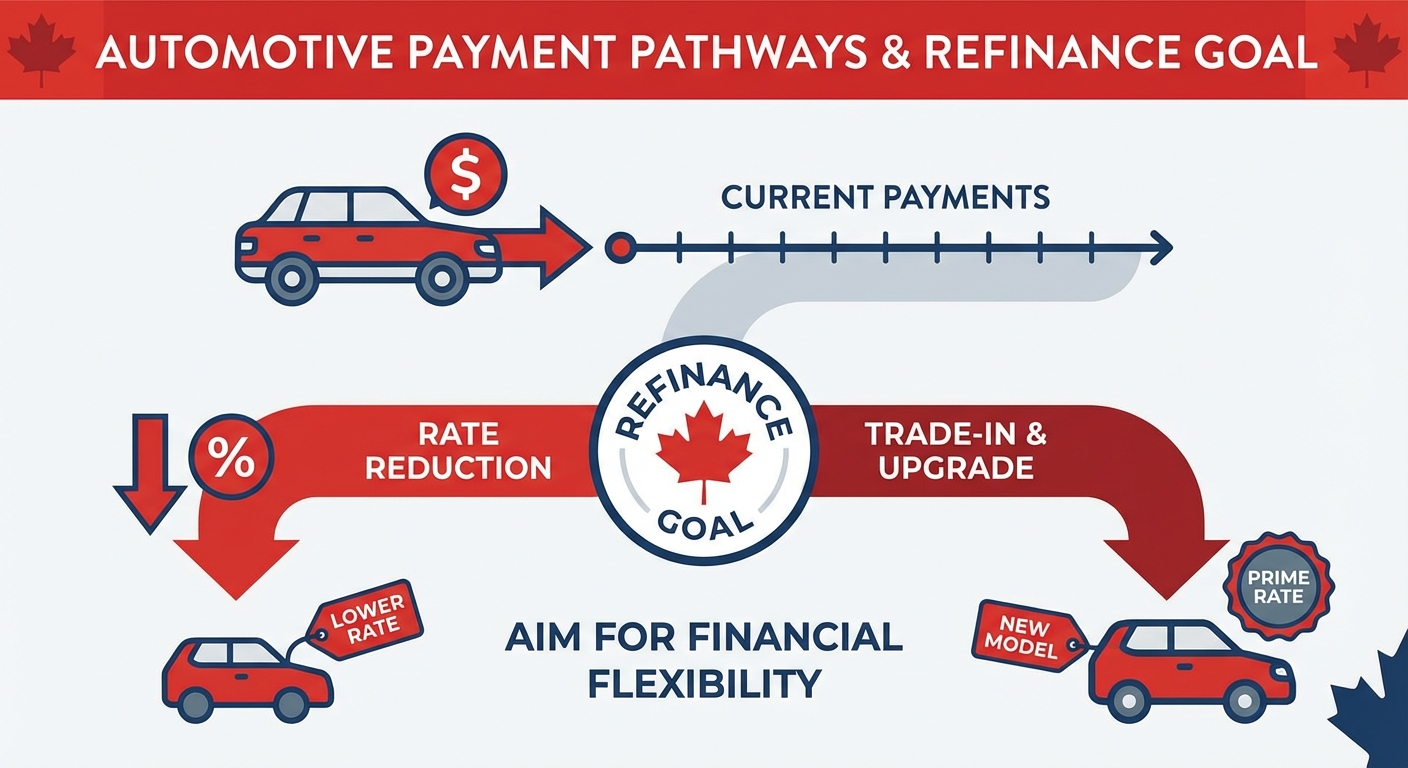

While the interest rates seem staggering, remember that this is a temporary bridge. The goal is not to carry a 25% interest rate for six years. The goal is to take a 3-year loan, pay it perfectly for 12 to 18 months, and then refinance at a much lower rate once your credit score has recovered.

Furthermore, you must account for "Total Cost of Ownership." Insurance companies also view those in consumer proposals as higher risks. You might find your monthly premiums are slightly higher, and you will likely be required to carry "Full Coverage" (Collision and Comprehensive) as a condition of the loan. This is to protect the lender's asset while you are paying it off.

Step-by-Step Guide to Getting Approved

Success in getting a car loan during a CP is all about preparation. Lenders in this category are looking for stability. They want to see that while your past was rocky, your present is rock solid.

Step 1: Prove Your Income

In the subprime world, your pay stub is more important than your credit score. Lenders generally want to see a minimum gross monthly income of $2,000 to $2,500. They prefer "garnishable" income-meaning you are a T4 employee. If you are self-employed, you will need to provide at least two years of Notices of Assessment (NOAs) from the CRA and several months of bank statements to prove consistent cash flow.

Step 2: Stabilize Your Residency

Lenders hate "skips"-people who move frequently and are hard to track down. If you have lived in the same apartment or house for more than two years, your approval odds increase dramatically. If you have recently moved, be prepared to explain why and provide a history of your previous addresses.

Step 3: The 15% Budgeting Rule

Before applying, do the math. A responsible lender will not allow your car payment to exceed 15% of your gross monthly income. For example, if you earn $4,000 a month, your maximum car payment should be $600. If you try to buy a luxury SUV with a $900 monthly payment, you will be declined regardless of your income, as it represents a "payment-to-income" (PTI) risk.

Step 4: Request the Trustee Letter

Once you have a rough idea of the vehicle price and payment, contact your Trustee. Tell them: "I am looking to finance a reliable vehicle for approximately $15,000 with a payment of $450/month. This will allow me to continue working and won't affect my proposal payments." Most Trustees have a template ready for this exact scenario.

Step 5: Choose the Right Vehicle

This is not the time for a BMW or a high-end truck. Lenders are more likely to approve "sensible" vehicles with high resale value and proven reliability, such as a Toyota Corolla, Honda Civic, or Hyundai Elantra. They look for vehicles with lower kilometres (usually under 120,000 km) to ensure the car lasts longer than the loan term.

Rebuilding Your Credit Score While Paying the Loan

The most powerful aspect of a car loan during a consumer proposal is the "Double-Whammy" effect on your credit recovery. While the consumer proposal is slowly working to settle your old debts, the car loan is actively building a new, positive history.

Think of your credit score as a bucket. The consumer proposal put a large hole in the bottom of that bucket. Every on-time car payment is like a cup of water poured into the bucket. If you just pay the proposal, you are barely dripping water in. If you add a car loan (and perhaps a secured credit card), you are filling the bucket much faster than it can leak.

| Scenario | Credit Score at Discharge | Time to Prime Rates |

|---|---|---|

| Proposal Only (No new credit) | 500 - 540 | 24 - 36 Months Post-Discharge |

| Proposal + Car Loan (Perfect History) | 620 - 680 | 0 - 6 Months Post-Discharge |

By the time you receive your Certificate of Full Performance (the document that ends your proposal), you could already have a two-year history of perfect automotive payments. At that point, you can often go back to the lender and ask for a rate reduction, or trade the vehicle in for a newer model at a "prime" interest rate. This is the "Refinance Goal" that every borrower in a CP should aim for.

Potential Pitfalls and Red Flags to Avoid

While the path to a car loan is open, it is also lined with predatory actors who want to take advantage of your situation. You must be vigilant.

One major red flag is the "Documentation Fee" or "Admin Fee" that exceeds $500. Some unscrupulous dealers try to tack on thousands of dollars in hidden fees because they know you feel "lucky" just to get an approval. Always review the "Bill of Sale" line-by-line. If there are charges for "Credit Protection" or "Etching" that you didn't ask for, demand they be removed.

Another danger is Negative Equity. If you are trading in an old car that you still owe money on, that debt gets "rolled into" the new loan. In a consumer proposal, you are already financially stretched. Adding $5,000 of old debt to a new 25% interest loan is a recipe for disaster. It is almost always better to sell your old car privately or include the shortfall in your proposal before you go shopping for a new one.

Finally, remember that your car loan and your consumer proposal are linked by your budget. If you miss a proposal payment, your Trustee could annul the proposal, bringing all your old debts back to life instantly. If that happens, you will almost certainly fail to make your car payments, leading to a repossession. You must maintain both perfectly.

Alternatives to a New Car Loan

If the interest rates or the monthly payments feel too high, you do have other options.

- Keeping Your Current Vehicle: In most Canadian provinces, there is a "property exemption" for vehicles. If your car is worth less than a certain amount (e.g., $7,000 in Ontario), you can keep it through the proposal. If it is reliable, keeping it and putting the "car payment" into a savings account is the cheapest way to survive the proposal.

- Co-signers: If you have a family member with good credit who is willing to co-sign, you may be able to bypass the subprime lenders entirely. A co-signer with an R1 credit rating can often help you get a loan at 8% or 10% instead of 25%. However, they must understand that they are 100% liable for the debt if you miss a payment.

- The "Cash Car" Route: If you can save up $3,000 to $5,000, you can buy a "beater" car for cash. This avoids interest entirely. The downside is that you aren't rebuilding your credit, and you risk high repair bills.

Frequently Asked Questions (FAQ)

Can I get a car loan if I just started my Consumer Proposal?

Yes. Many lenders will consider your application as soon as the "45-day window" has passed (the time creditors have to vote on your proposal). Once the proposal is legally binding, you are eligible to apply, provided you have a stable income.

Will my interest rate go down after my proposal is discharged?

Not automatically. Your interest rate is fixed for the term of the loan. However, once you are discharged and your credit score has improved, you can apply to "refinance" the loan or trade the car in for a new one with a much lower interest rate.

Do I need a down payment for a consumer proposal car loan?

While some lenders offer $0 down options, having "skin in the game" (usually $500 to $1,000) significantly increases your chances of approval and can sometimes help lower the interest rate by a few percentage points.

What happens if I miss a car payment while in a proposal?

Missing a payment on a secured car loan is dangerous. Subprime lenders are much quicker to repossess vehicles than traditional banks. One or two missed payments could result in the car being towed, which would also further damage your already fragile credit score.

Can I lease a car during a consumer proposal?

Leasing is significantly harder than financing during a CP. Most leasing companies (like Honda Financial or Ford Credit) have very strict credit requirements. Financing a used vehicle through a subprime lender is the much more common and successful path.

How does a student loan impact my ability to get a car loan in a CP?

If your student loan was included in your proposal (meaning it was more than 7 years old), it is treated like any other debt. If it was not included and you are still making payments, the lender will include that payment in your "Debt-to-Income" ratio, which might slightly lower the amount you can borrow for a car.

A Path Forward

Navigating the world of auto finance while in a consumer proposal requires a shift in perspective. It is easy to view the high interest rates and the need for Trustee permission as barriers. Instead, try to view them as the price of admission for a second chance.

A consumer proposal is not a dead end; it is a financial reset button. By securing a car loan that you can afford, and by making every single payment on time, you are doing more than just buying a way to get to work. You are proving to the Canadian financial system that you are a responsible borrower. You are overriding the "R7" on your report with a series of "R1" checkmarks.

The path to recovery is paved with consistent, small wins. If you have a stable job and a letter from your Trustee, the door to vehicle ownership is open. Take the time to budget correctly, choose a reliable vehicle, and use this loan as the foundation for your new financial life.