Consumer Proposal Car Loan 2026: Get Approved in Toronto.

Table of Contents

- Key Takeaways: Your Roadmap to a Car Loan During a Consumer Proposal in 2026

- Beyond the 'No': Unpacking Your Car Loan Eligibility During a Consumer Proposal in Toronto

- The 'Why 2026?' Angle: Anticipating the Lending Landscape for CP Borrowers

- Understanding the R7 Reality: What Lenders See on Your Credit Report

- Navigating the Toronto Lending Labyrinth: Where to Find Car Loans During a CP

- Alternative & Subprime Lenders: Your Primary Gateway to Financing

- Dealership Financing vs. Direct Lenders: A Toronto Comparison

- Credit Unions: An Overlooked Option for Ontario Residents?

- The Art of the Application: Boosting Your Odds for Approval in Toronto

- Down Payments: Your Golden Ticket to Better Terms and Approval

- The Power of a Co-Signer: When it Helps, When it Hurts

- Income Stability & Debt-to-Income Ratio: What Lenders Really Look For

- Budgeting for Success: Beyond the Monthly Payment (Insurance, Maintenance, Fuel)

- Decoding the Fine Print: Rates, Terms, and Hidden Costs to Watch Out For

- Understanding APR vs. Interest Rate: The True Cost of Borrowing

- Balloon Payments, Early Repayment Penalties, and Other Surprises

- The True Cost of a High-Interest Loan: Long-Term Financial Impact

- Avoiding Predatory Practices: Protecting Yourself in the Toronto Market

- Life After the Proposal: Car Loan Opportunities and Rebuilding Your Credit Foundation

- The Credit Score Comeback: How Your Rating Improves Post-CP

- Accessing Mainstream Lenders: Banks, Credit Unions, and Lower Rates

- Strategic Car Choices: Leasing vs. Buying Post-CP for Optimal Credit Building

- Beyond the Loan: Practical Transportation Solutions for Toronto Residents

- Public Transit (TTC) & Ride-Sharing: Is a Car Always Necessary in the GTA?

- Considering More Affordable Used Car Options: The Smart Buy During a CP

- Your Next Steps to Approval: A Strategic Plan for Toronto Car Buyers

- Step-by-Step Guide: From Budgeting to Driving Off the Lot

- Resources for Support in the GTA: Credit Counsellors & Legal Aid

- Frequently Asked Questions (FAQ) about Car Loans & Consumer Proposals

Navigating financial waters during a consumer proposal can feel like steering through a dense fog, especially when a crucial need like a car arises. For many Toronto residents, a reliable vehicle isn't a luxury; it's a necessity for work, family, and daily life in a sprawling city. The good news? Securing a car loan, even with an active consumer proposal, is absolutely possible in 2026. It requires a strategic approach, a clear understanding of the lending landscape, and a commitment to demonstrating financial stability.

At SkipCarDealer.com, we understand the unique challenges and opportunities that arise when you're working to rebuild your financial foundation. This comprehensive guide will arm you with the knowledge and tactics to get approved for a car loan in Toronto while still in a consumer proposal, setting you on the road to financial recovery and reliable transportation.

Key Takeaways: Your Roadmap to a Car Loan During a Consumer Proposal in 2026

- Approval is Possible: Despite common misconceptions, you can secure a car loan in Toronto while in a consumer proposal, primarily through alternative and subprime lenders.

- Expect Higher Rates: Lenders view an R7 credit rating as higher risk, leading to significantly higher interest rates, often ranging from 15% to 29.99% APR in 2026.

- Down Payments are Key: A substantial down payment (10-20% or more) is your most powerful tool to reduce risk, improve terms, and increase approval chances.

- Financial Stability Matters: Lenders prioritize consistent income and a manageable debt-to-income ratio to ensure you can afford the new loan alongside your proposal payments.

- Shop Smart & Negotiate: Don't settle for the first offer. Compare terms, understand the true cost of borrowing, and be prepared to negotiate, even with subprime lenders.

- Long-Term Credit Building: A responsibly managed car loan during your proposal can be a powerful step in rebuilding your credit for future financial opportunities.

Beyond the 'No': Unpacking Your Car Loan Eligibility During a Consumer Proposal in Toronto

Can I get a car loan while still in a consumer proposal? Yes, absolutely. While it presents more hurdles than traditional financing, obtaining a car loan during an active consumer proposal in Toronto is a realistic goal. Lenders, particularly those specializing in non-prime financing, understand that life continues during a proposal, and reliable transportation is often essential for job security and adhering to your payment plan. The key lies in understanding how your financial situation is perceived and how to best present yourself as a viable borrower.

The 'Why 2026?' Angle: Anticipating the Lending Landscape for CP Borrowers

As we look towards 2026, the lending landscape for individuals in consumer proposals continues to evolve. Economic factors such as interest rate fluctuations by the Bank of Canada, inflation, and employment rates directly influence lender appetite for risk. In 2026, we anticipate a continued emphasis on stable income and lower debt-to-income ratios from lenders. Technology also plays a growing role, with advanced algorithms helping subprime lenders better assess risk beyond just a credit score, potentially offering more nuanced approval decisions for Toronto residents.

Furthermore, increased awareness and competition among alternative lenders mean more options might be available, but consumer protection agencies are also keeping a closer eye on lending practices, aiming to curb predatory rates. This means while more doors might open, diligence in understanding terms remains paramount.

Understanding the R7 Reality: What Lenders See on Your Credit Report

When you file a consumer proposal in Canada, your credit report receives a significant update. For the duration of your proposal and typically for three years after it's completed, you'll carry an R7 credit rating. This rating signals to lenders that you are making regular payments under a debt management agreement. It's a clear indicator of past financial difficulty and, from a traditional lender's perspective, represents a higher risk.

Lenders evaluate an R7 rating as a sign that you've had to restructure your debts. While it's a negative mark, it's generally viewed more favourably than a bankruptcy (which results in an R9 rating). They'll want to see that you are consistently making your proposal payments, that your income is stable, and that you haven't taken on excessive new debt since filing. Your R7 rating means you'll likely be directed towards subprime lenders who specialize in working with higher-risk profiles, as traditional banks in Toronto typically shy away from R7 applicants.

For more detailed information on credit scores and their impact, you might find our guide The Truth About the Minimum Credit Score for Ontario Car Loans helpful.

Pro Tip: The Myth of Automatic Disqualification – Why Persistence Pays Off

Many individuals mistakenly believe an active consumer proposal means an automatic "no" for any new credit, including car loans. This is simply not true. While mainstream banks may decline you, a robust ecosystem of alternative and subprime lenders in Toronto and across Canada specifically caters to this market. Don't let initial rejections deter you. Persistence, coupled with a well-prepared application and a clear understanding of your financial standing, significantly increases your chances of approval. Think of it as finding the right niche lender, not convincing a reluctant one.

Navigating the Toronto Lending Labyrinth: Where to Find Car Loans During a CP

Finding a car loan during a consumer proposal isn't about knocking on every bank door. It's about knowing which doors are open to you. In Toronto and the broader Ontario region, several types of lenders specialize in assisting individuals with challenging credit histories.

Alternative & Subprime Lenders: Your Primary Gateway to Financing

These lenders are your most probable source of financing. Unlike traditional banks that adhere to strict credit scoring models, alternative and subprime lenders specialize in assessing risk differently. They understand that credit scores don't always tell the whole story. They're more interested in your current ability to repay the loan, which includes:

- Stable Income: Proof of consistent employment and sufficient income to cover both your consumer proposal payments and the new car loan.

- Down Payment: A willingness to make a significant down payment drastically reduces their risk.

- Debt-to-Income Ratio: A manageable ratio demonstrating you're not over-extended.

- CP Payment History: Evidence of on-time and consistent payments on your consumer proposal.

These lenders often operate through specialized dealerships or direct online platforms. While their interest rates will be higher than prime rates (typically 15% to 29.99% APR in 2026 for subprime loans), they offer the crucial bridge to getting you approved. They are more flexible and often have programs tailored for R7 clients.

Dealership Financing vs. Direct Lenders: A Toronto Comparison

When seeking a car loan in the Greater Toronto Area (GTA) with a consumer proposal, you'll generally encounter two main avenues:

- Dealership Financing: Many dealerships, especially larger ones or those specializing in "bad credit car loans," have relationships with multiple subprime lenders. They act as intermediaries, submitting your application to various financing partners to find an approval.

- Direct Lenders: These are independent financial institutions or online platforms that offer loans directly to consumers. You apply with them, and if approved, they provide the funds for you to purchase a vehicle from any dealership.

Let's compare the pros and cons in a Toronto context:

| Feature | Dealership Financing (Toronto) | Direct Lenders (Toronto/Online) |

|---|---|---|

| Convenience | One-stop shop; they handle applications to multiple lenders. | Requires more legwork to compare lenders yourself. |

| Speed | Often faster, can drive away same day if approved. | Approval process might take longer, funds may not be immediate. |

| Rate Negotiation | May have less transparency; focus often on monthly payment. Dealerships get a commission. | Often more transparent rates; can compare offers before approaching a dealer. |

| Vehicle Choice | Limited to the dealership's inventory. | Freedom to choose any vehicle from any seller (dealership or private). |

| Flexibility | Less flexible on loan terms as they work with specific partners. | Potentially more flexible, as you choose the loan first, then the car. |

| Typical APR (2026) | 18% - 29.99% (depends on lender partnerships) | 15% - 28% (can sometimes be slightly lower due to fewer intermediaries) |

In Toronto, many specialized dealerships are adept at securing financing for CP clients. They can be a good starting point, but it's always wise to compare their offers with what a direct lender might provide.

Credit Unions: An Overlooked Option for Ontario Residents?

Credit unions like Meridian, DUCA, or Alterna Savings often pride themselves on a more community-focused and personalized approach to lending. While they are still financial institutions and will be cautious with an R7 rating, they might be more willing to consider your individual circumstances, especially if you have an existing relationship with them. If you've been a member in good standing for years, demonstrating responsible financial behaviour even prior to your proposal, they might offer slightly better rates or more flexible terms than a pure subprime lender. It's always worth exploring this option if you have an established history with a local credit union in Toronto or elsewhere in Ontario.

Pro Tip: Don't Just Accept the First Offer – Negotiation is Key

Even when dealing with subprime lenders, there's often room for negotiation. Don't feel pressured to accept the very first interest rate or term presented. Be prepared to walk away if the terms are not manageable. Leverage any down payment you have, or a potential co-signer, to push for better rates. Ask about any fees included in the APR and if they can be reduced. Remember, your goal is not just approval, but approval on terms you can genuinely afford without jeopardizing your consumer proposal.

The Art of the Application: Boosting Your Odds for Approval in Toronto

Your application is your opportunity to present yourself as a reliable borrower, even with a consumer proposal. By strategically highlighting your strengths and addressing potential weaknesses, you can significantly improve your chances of approval in Toronto.

Down Payments: Your Golden Ticket to Better Terms and Approval

A substantial down payment is, without a doubt, your most powerful asset when seeking a car loan during a consumer proposal. Why? It directly reduces the lender's risk. If you default, they recover more of their money from the sale of the repossessed vehicle. For you, a larger down payment can translate into:

- Higher Approval Chances: Lenders are more likely to approve you.

- Lower Interest Rates: Less risk for the lender often means they're willing to offer a slightly better rate.

- Smaller Monthly Payments: A reduced loan principal means lower payments, easing your budget.

- Less Overall Interest Paid: Over the life of the loan, you'll save a significant amount.

Aim for at least 10-20% of the vehicle's purchase price, if possible. For a $20,000 car, that's $2,000 to $4,000. Strategies for saving for a down payment include setting aside tax refunds, side hustle income, or even selling unneeded assets. For more creative ways to manage your funds, consider reading Your Cash Stays Put. Assets Just Bought Your Car, No Down Payment, Toronto.

| Scenario | Loan Amount | Interest Rate (Estimated CP Rate) | Loan Term | Estimated Monthly Payment (Principal & Interest) | Total Interest Paid |

|---|---|---|---|---|---|

| No Down Payment | $20,000 | 22% APR | 60 months | ~$550 | ~$13,000 |

| 10% Down Payment ($2,000) | $18,000 | 20% APR | 60 months | ~$475 | ~$10,500 |

| 20% Down Payment ($4,000) | $16,000 | 18% APR | 60 months | ~$405 | ~$8,300 |

(Note: These are illustrative figures for 2026 and actual rates may vary based on individual circumstances and market conditions.)

The Power of a Co-Signer: When it Helps, When it Hurts

A co-signer with excellent credit can significantly boost your approval chances and potentially secure a lower interest rate. Their creditworthiness essentially "backs" your loan, reducing the lender's risk. However, it's a serious commitment:

- Benefits: Higher approval odds, potentially lower APR, and a chance to rebuild your own credit with timely payments.

- Responsibilities: The co-signer is equally responsible for the loan. If you miss payments, their credit score will be negatively impacted, and they will be legally obligated to make the payments.

- Potential Pitfalls: It can strain relationships if you struggle to make payments. Ensure both parties fully understand the commitment.

Finding a suitable co-signer in Toronto means finding someone with a strong credit history, stable income, and a willingness to take on this responsibility. It should ideally be a close family member or trusted friend who fully understands the implications.

Income Stability & Debt-to-Income Ratio: What Lenders Really Look For

Lenders want assurance that you can consistently afford your car loan payments alongside your consumer proposal payments and other living expenses. They'll scrutinize your income stability and your debt-to-income (DTI) ratio.

- Income Stability: Consistent employment with a steady income source is crucial. Lenders prefer to see at least 6-12 months of stable employment. If you're self-employed, prepare detailed income records.

- Debt-to-Income Ratio: This ratio compares your total monthly debt payments (including your CP, existing debts, and the proposed car loan) to your gross monthly income. Lenders typically prefer a DTI below 40-45%. A high DTI suggests you might be over-leveraged and at higher risk of default.

To showcase financial stability, gather recent pay stubs, bank statements, and proof of your consumer proposal payments. Highlight any additional stable income sources, such as government benefits (if applicable and consistent), or side income. Demonstrating a well-managed budget will speak volumes.

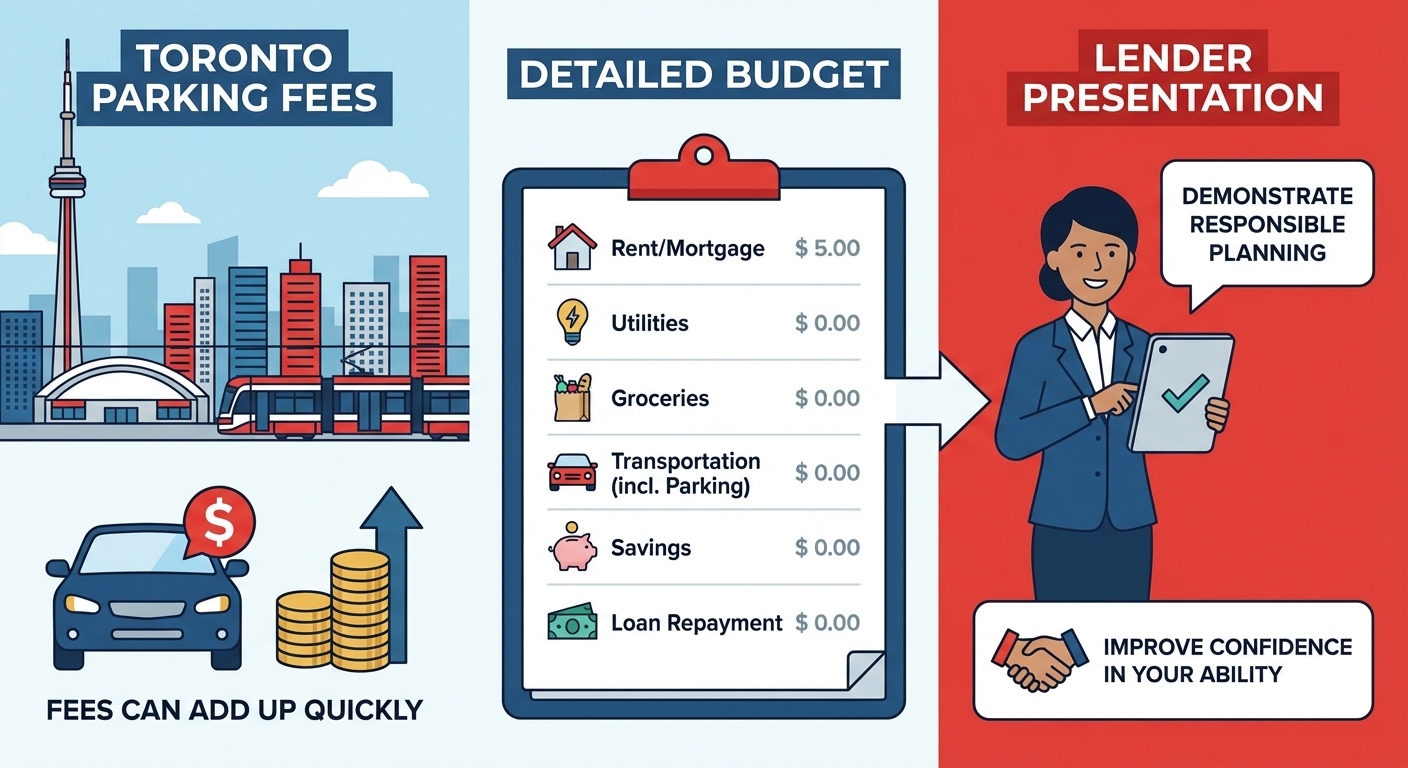

Budgeting for Success: Beyond the Monthly Payment (Insurance, Maintenance, Fuel)

Getting approved is one thing; affording the car long-term is another. Lenders appreciate applicants who have considered all aspects of car ownership. In a city like Toronto, these costs can be substantial:

- Insurance: Toronto has some of the highest car insurance rates in Canada. Get quotes *before* you buy. A new driver or someone with a less-than-perfect record (which can be the case post-CP) will face even higher premiums.

- Fuel: Gas prices fluctuate but are a constant expense. Consider your commute and vehicle fuel efficiency.

- Maintenance & Repairs: Budget for oil changes, tire rotations, and unexpected repairs. Older, cheaper cars might save on initial cost but incur higher maintenance.

- Parking: If you live or work in downtown Toronto, parking fees can add up quickly.

Create a detailed budget that includes all these costs. Presenting this to a lender can demonstrate your responsible financial planning and improve their confidence in your ability to manage the loan.

Context: A visual infographic or checklist depicting 'Car Loan Application Readiness' – showcasing key documents (pay stubs, bank statements, CP documents) and financial metrics (credit score, DTI).

Decoding the Fine Print: Rates, Terms, and Hidden Costs to Watch Out For

Securing a car loan during a consumer proposal means you'll likely face higher interest rates. This makes understanding the fine print even more critical. You need to know the true cost of borrowing to make an informed decision and avoid future financial strain.

Understanding APR vs. Interest Rate: The True Cost of Borrowing

This is a fundamental distinction that every borrower, especially those with challenging credit, must understand. The interest rate is simply the cost of borrowing the principal amount. However, the Annual Percentage Rate (APR) is the true, total cost of the loan over a year, expressed as a percentage. The APR includes:

- The nominal interest rate.

- Any mandatory fees (e.g., loan origination fees, administration fees, PPSA registration fees in Ontario).

- Sometimes, even certain insurance products rolled into the loan.

Always compare offers based on their APR, not just the stated interest rate. A loan with a slightly lower interest rate but high fees could end up being more expensive than one with a slightly higher interest rate but no additional fees. In 2026, be vigilant about what's included in the APR quoted by Toronto lenders.

For a deeper dive into how your credit score impacts your borrowing costs, check out Your Credit Score is NOT Your Rate. Get a Fair Loan, Toronto.

Balloon Payments, Early Repayment Penalties, and Other Surprises

Some loan agreements, particularly in the subprime market, can contain clauses that lead to unexpected costs. Scrutinize these carefully:

- Balloon Payments: A large, lump-sum payment due at the end of the loan term. While making monthly payments seem lower, this can be a significant financial shock if not planned for.

- Early Repayment Penalties: Some lenders charge a fee if you pay off your loan ahead of schedule. This is less common with Canadian car loans but important to confirm.

- Mandatory Add-ons: Be wary of lenders or dealerships that insist on adding expensive warranty packages, rust proofing, or credit insurance to your loan. These significantly increase the total cost and are often optional.

- Variable Interest Rates: Most car loans are fixed-rate, but always confirm. A variable rate could see your payments increase if market interest rates rise.

Always ask for clarification on any term you don't understand before signing. A reputable lender will be transparent about all aspects of the loan.

The True Cost of a High-Interest Loan: Long-Term Financial Impact

It's easy to focus solely on the monthly payment, but with high-interest loans (e.g., 20-29% APR), the total amount you pay over the loan term can be staggering. This is particularly true for used cars, which depreciate quickly.

| Loan Amount | Interest Rate (APR) | Loan Term | Monthly Payment (Approx.) | Total Paid Over Term | Total Interest Paid |

|---|---|---|---|---|---|

| $15,000 | 10% | 60 months | $318 | $19,080 | $4,080 |

| $15,000 | 20% | 60 months | $396 | $23,760 | $8,760 |

| $15,000 | 28% | 60 months | $463 | $27,780 | $12,780 |

As you can see, a higher interest rate dramatically increases the total cost, almost doubling the interest paid in the 28% APR example compared to the 10% APR. This impact means you're paying significantly more for the same car, which can prolong your financial recovery. Therefore, securing the lowest possible rate, even in the subprime market, is crucial.

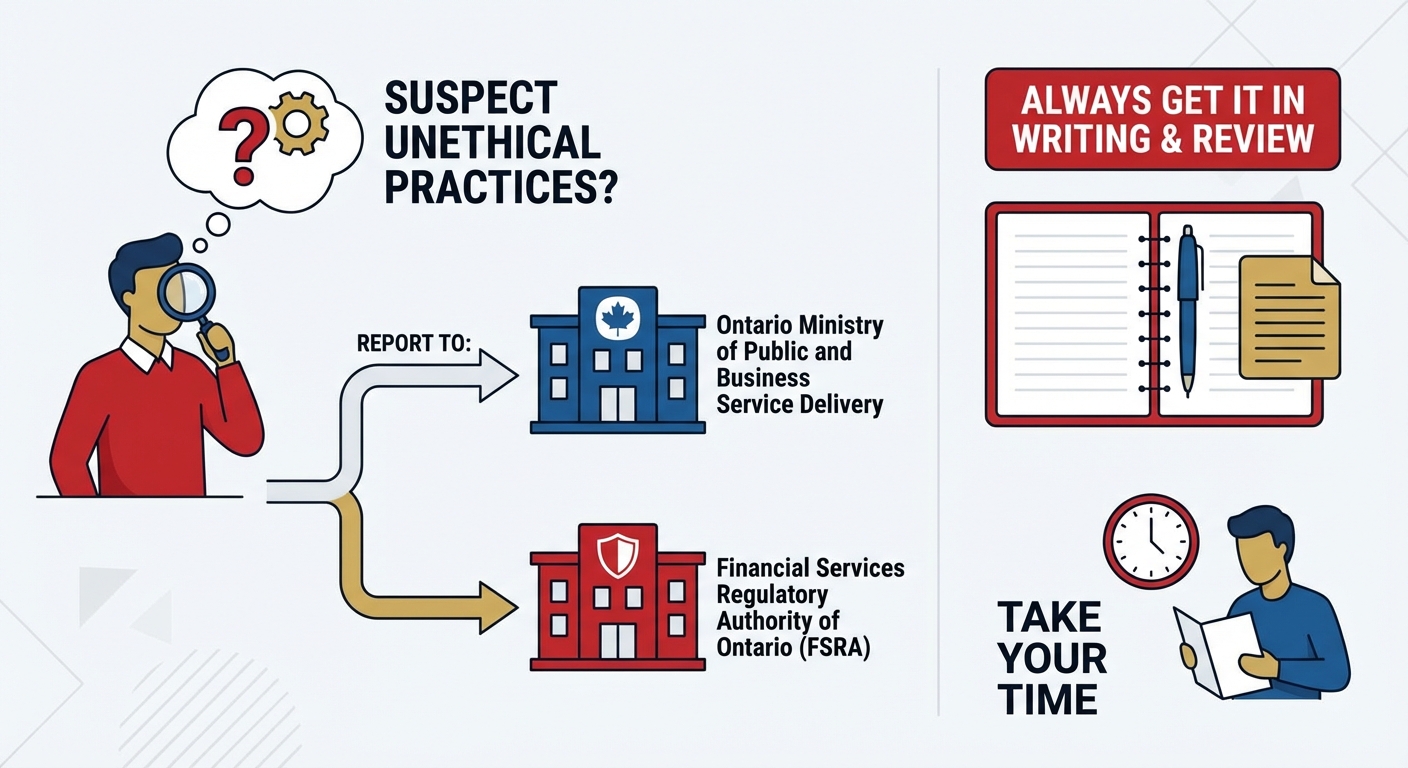

Avoiding Predatory Practices: Protecting Yourself in the Toronto Market

Unfortunately, where there's demand for high-risk lending, there can be predatory practices. In Toronto and Ontario, be aware of:

- Pressure Tactics: High-pressure sales to sign immediately without reading the contract.

- Vague Terms: Lack of clarity on interest rates, fees, or total cost.

- "Guaranteed Approval" Without Checks: While approval is possible, legitimate lenders still perform due diligence. Be wary of anyone promising a loan without reviewing your finances.

- Excessive Fees: Unjustified administration fees or charges that seem disproportionate to the loan amount.

In Ontario, consumers are protected by various laws, including the Consumer Protection Act. If you suspect unethical practices, you can report them to the Ontario Ministry of Public and Business Service Delivery or the Financial Services Regulatory Authority of Ontario (FSRA). Always get everything in writing and take your time to review it.

Context: A visual of a magnifying glass over a complex loan agreement, highlighting terms like 'APR', 'Fees', 'Penalties', to symbolize careful review.

Life After the Proposal: Car Loan Opportunities and Rebuilding Your Credit Foundation

While this article focuses on getting a car loan during a consumer proposal, it's essential to understand that your financial prospects significantly improve once your proposal is completed. This provides a clear path to better lending opportunities and a stronger credit foundation.

The Credit Score Comeback: How Your Rating Improves Post-CP

Once your consumer proposal is completed (all payments made and conditions met), the R7 rating will eventually be removed from your credit report. Typically, the proposal will remain on your credit file for three years after it's been paid in full, or six years from the date of filing, whichever comes first. During this period, your credit score will gradually start to recover. By making all your proposal payments on time and managing any new credit responsibly (like your car loan!), you demonstrate a commitment to financial stability. This consistent positive behaviour will slowly but surely improve your credit score, moving you away from the R7 category.

Accessing Mainstream Lenders: Banks, Credit Unions, and Lower Rates

With a completed consumer proposal off your credit report and a history of responsible payments (especially a car loan taken during the proposal), you'll gain access to a much wider range of lending options. Traditional banks like RBC, TD, Scotiabank, and local credit unions in Toronto will view you as a much lower risk. This means:

- Significantly Lower Interest Rates: You could qualify for prime rates, potentially in the single digits, saving you thousands of dollars over the life of a loan.

- More Favourable Terms: Flexible payment schedules, longer loan terms (if desired), and fewer restrictions.

- Wider Vehicle Selection: Less pressure to choose a car based solely on what a subprime lender will finance.

A car loan successfully managed during your proposal can act as a bridge, proving your creditworthiness to mainstream lenders once the proposal is resolved. It's a strategic move for credit rebuilding. Consider how a car loan can be a powerful tool for rebuilding credit, as discussed in What If Your Car Loan *Was* Your Best Credit Card? (Post-Proposal Speed-Rebuild, Toronto).

Pro Tip: Monitor Your Credit Report Religiously for Accuracy and Improvement

Regularly obtain your credit reports from Equifax and TransUnion. This is crucial during and after your consumer proposal. Check for accuracy – ensure your CP is correctly reported and that no old debts are lingering incorrectly. Monitoring your report allows you to track your credit score's improvement, identify any errors, and confirm when the proposal information is removed, signaling your readiness for prime lending.

Strategic Car Choices: Leasing vs. Buying Post-CP for Optimal Credit Building

Once your consumer proposal is complete and your credit is on the mend, you'll have more options for car acquisition. Both leasing and buying have different implications for your finances and credit building:

- Buying: Builds equity in an asset. A car loan, repaid consistently, will continue to build your payment history and improve your credit score. You own the car outright once paid off.

- Leasing: Offers lower monthly payments and allows you to drive a newer vehicle more often. However, you don't build equity, and at the end of the lease, you'll either need to return the car or buy it out. Leasing can still contribute to your credit history with on-time payments.

For optimal credit building post-CP, a car loan where you own the asset often provides a clearer path to demonstrating long-term financial responsibility and building equity, which can be beneficial for future financial goals.

Beyond the Loan: Practical Transportation Solutions for Toronto Residents

While getting a car loan during a consumer proposal is achievable, it's also important to consider if a car is the immediate or sole solution for your transportation needs, especially in a city like Toronto.

Public Transit (TTC) & Ride-Sharing: Is a Car Always Necessary in the GTA?

Toronto boasts an extensive public transit system (TTC), including subways, streetcars, and buses, that covers much of the GTA. For many residents, especially those living and working in urban cores, relying on public transit can be a cost-effective and stress-free alternative to car ownership. Monthly passes are significantly cheaper than car payments, insurance, fuel, and parking combined.

Ride-sharing services like Uber and Lyft also offer on-demand transportation. While not economical for daily commutes, they can be a viable option for occasional trips, late-night travel, or when public transit isn't convenient. Before committing to a high-interest car loan, do a detailed cost-benefit analysis of these alternatives versus the total cost of car ownership in Toronto.

Considering More Affordable Used Car Options: The Smart Buy During a CP

If car ownership is essential, consider opting for a reliable, more affordable used vehicle. A lower purchase price means a smaller loan amount, which can translate to:

- Easier Approval: Lenders are more comfortable financing smaller amounts.

- Lower Monthly Payments: Eases the strain on your budget alongside your CP payments.

- Less Interest Paid: Even with a high interest rate, the overall interest will be less on a smaller principal.

Look for dealerships in the Toronto area that specialize in quality used cars and have experience with subprime financing. Focus on vehicles known for reliability and lower maintenance costs. A $10,000 car with a 25% APR is financially much more manageable than a $30,000 car with the same rate. This strategic choice allows you to meet your transportation needs while minimizing financial burden during your consumer proposal.

Your Next Steps to Approval: A Strategic Plan for Toronto Car Buyers

Taking action requires a clear, structured approach. Here's a step-by-step guide to move from understanding to successfully driving off the lot in Toronto while managing your consumer proposal.

Step-by-Step Guide: From Budgeting to Driving Off the Lot

- Assess Your Needs & Budget:

- Determine if a car is truly essential.

- Create a comprehensive budget, accounting for loan payments, insurance (get quotes!), fuel, maintenance, and parking. Know your absolute maximum affordable monthly payment.

- Calculate how much you can realistically put down as a down payment.

- Gather Your Documents:

- Proof of income (pay stubs, employment letter, bank statements).

- Proof of residence (utility bills, lease agreement).

- Driver's licence.

- Details of your consumer proposal, including current payment status.

- List of existing debts and monthly payments.

- Research Lenders:

- Start with online subprime lenders and specialized dealerships in the GTA.

- If applicable, inquire with your local credit union where you have an existing relationship.

- Compare potential interest rates and terms (APR is key!).

- Pre-Approval (If Possible):

- Some direct lenders offer pre-approval, which gives you an idea of what you qualify for before you start shopping for a car.

- Shop for a Vehicle:

- Focus on reliable, affordable used cars that fit your budget and loan approval.

- Consider models with lower insurance costs.

- Apply for the Loan:

- Be honest and transparent about your consumer proposal.

- Submit all required documentation promptly.

- Review Offers & Negotiate:

- Carefully read the loan agreement, focusing on APR, total cost, and any hidden fees.

- Don't hesitate to negotiate for better terms or to walk away if an offer isn't right.

- Finalize & Drive Away:

- Once satisfied, sign the paperwork.

- Ensure you have insurance in place before leaving the lot.

Resources for Support in the GTA: Credit Counsellors & Legal Aid

If you feel overwhelmed or need further guidance, several resources in the GTA can help:

- Non-Profit Credit Counsellors: Agencies like Credit Canada Debt Solutions or Consolidated Credit offer free or low-cost advice on budgeting, debt management, and understanding your credit.

- Licensed Insolvency Trustees (LITs): The professionals who administer consumer proposals can provide clarification on your proposal's impact on new credit.

- Community Legal Clinics: For questions about consumer protection laws or unfair lending practices in Ontario, local legal aid clinics can offer assistance.

Don't hesitate to seek professional help to ensure you're making the best financial decisions for your situation.