ODSP Zero Down Car Loan Toronto: Your Secret Key 2026

Table of Contents

- Key Takeaways

- Unlocking Mobility: The Reality of Zero-Down Vehicle Financing for Recipients of Disability Support

- Pro Tip:

- The Shifting Landscape of Vehicle Financing: Your 'Secret Key' to 2026 and Beyond

- Deconstructing Lender Logic: Why Government Income Support is Different (But Not Disqualifying)

- Stability vs. Seizability: How to Highlight Your Income's Reliability

- Beyond the Benefit: The Holistic View Lenders Take on Your Application

- The Zero-Down Blueprint: Crafting an Irresistible Application

- Pro Tip:

- Essential Documentation: What You *Really* Need to Show

- Credit Score Mastery: Building Your Foundation for Zero-Down Approval

- Navigating the Lender Landscape: Who Offers Zero-Down Options for Disability Support Recipients?

- The Dealership Advantage: In-House Financing and Specialized Programs

- Beyond the Big Banks: Credit Unions and Specialized Finance Companies

- The True Cost of 'Zero Down': Unmasking Rates, Terms, and Hidden Fees

- Pro Tip:

- Example Scenarios: Zero Down vs. With Down Payment for ODSP Recipients (2026 Estimates)

- Vehicle Selection Strategy: Maximizing Your Loan's Potential and Affordability

- Post-Approval Empowerment: Managing Your Vehicle Loan Responsibly and Building Future Credit

- Pro Tip:

- Your Next Steps to Approval: A Strategic Action Plan

- Frequently Asked Questions About Zero-Down Vehicle Loans for Disability Support Recipients

Navigating the path to vehicle ownership can feel like an uphill battle, especially when you’re relying on disability support. In a bustling city like Toronto, where public transit, while extensive, doesn’t always meet every individual’s unique mobility needs, a personal vehicle can be a game-changer for independence, appointments, and overall quality of life. The good news? Securing a zero-down car loan as an ODSP recipient in 2026 is not just a pipe dream; it’s a tangible reality with the right strategy.

This comprehensive guide from SkipCarDealer.com is your secret key, unlocking the insights and actionable steps needed to drive away in your own vehicle without an upfront payment. We’ll demystify the process, tackle common misconceptions, and equip you with the knowledge to approach lenders with confidence, turning perceived challenges into strengths. Get ready to transform your mobility in Toronto and beyond.

Key Takeaways

- ODSP Income is Valid: Lenders increasingly recognize the stability of government disability benefits as a reliable income source for loan qualification.

- Credit is Crucial, but Not a Deal-Breaker: While a strong credit history helps, strategies like co-signers, secured cards, and demonstrating consistent bill payments can pave the way for approval, even with limited or challenged credit.

- Preparation is Power: Gathering all necessary financial documents and understanding your budget *before* applying significantly boosts your chances of securing a zero-down loan.

- Shop Smart, Not Just for the Car: Explore a range of lenders, from specialized finance companies to dealerships with in-house options, as their criteria for ODSP recipients can vary widely.

- Understand the “True Cost”: “Zero-down” doesn't mean “zero cost.” Focus on the total cost of the loan, including interest rates and terms, to ensure long-term affordability.

Unlocking Mobility: The Reality of Zero-Down Vehicle Financing for Recipients of Disability Support

For many ODSP recipients in Toronto, the idea of a “zero-down” vehicle loan seems too good to be true. It conjures images of complex financial hurdles and immediate rejection. However, the landscape of automotive financing has evolved significantly, making these options more accessible than ever before, especially as we move into 2026. A zero-down vehicle loan means you don't need to pay an upfront sum – often 10-20% of the vehicle's price – when you purchase the car. This eliminates a major barrier for individuals who may not have significant savings readily available.

What does this truly mean for someone on government income support? It means that the initial financial burden is removed, allowing you to allocate your funds to other essential living expenses or vehicle-related costs like insurance and registration. It's about empowering greater independence and access to opportunities, whether for medical appointments, community engagement, or simply enjoying the freedom of personal transportation that many Canadians take for granted.

Many believe that lenders automatically disqualify applicants on ODSP. This is a misconception. While it presents a different income profile, lenders are increasingly recognizing the consistent, predictable nature of disability benefits. They understand that a reliable income, regardless of its source, is a foundation for repayment. The “unseen value” here is not just mobility, but the potential for improved quality of life and reduced stress that comes with reliable transportation.

Pro Tip:

Don't assume 'zero down' means 'no costs'. Understand the full financial picture including interest, fees, and potential insurance requirements before committing. A thorough budget analysis is your best friend.

The Shifting Landscape of Vehicle Financing: Your 'Secret Key' to 2026 and Beyond

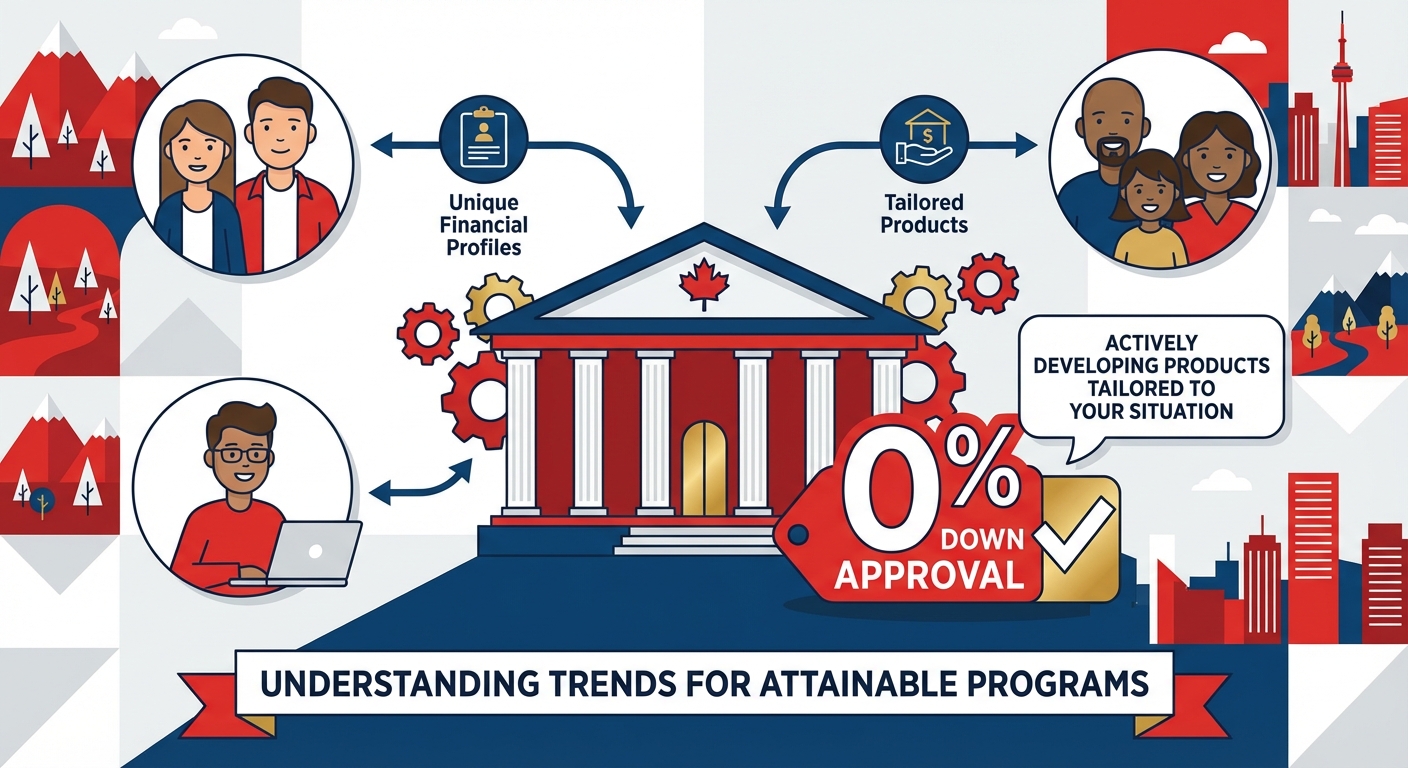

The automotive finance industry is in a constant state of flux, driven by technological advancements, economic shifts, and a growing understanding of diverse financial realities. For individuals relying on non-traditional income sources like ODSP, this evolution is particularly promising in 2026. Lenders are becoming more inclusive, moving beyond rigid, outdated models that primarily favoured traditional employment income.

The ‘secret key’ to navigating this evolving landscape lies in foresight, preparation, and leveraging emerging opportunities. Lenders are increasingly using sophisticated algorithms that can assess a broader range of financial indicators beyond just a credit score or employment history. They look at banking history, payment consistency for utilities, and the overall stability of income, whether it’s from employment or government benefits.

This shift means that your consistent ODSP payments, combined with a responsible financial history, can now be viewed as a strong asset. Specialized lenders and dealership finance departments are actively developing products tailored to these unique financial profiles. By understanding these trends, you can position yourself to take advantage of programs designed with your situation in mind, making zero-down approval more attainable than ever.

– A conceptual image representing financial freedom or a clear path forward, possibly with a subtle nod to future trends (e.g., modern vehicle on an open road, digital interface showing loan approval).

– A conceptual image representing financial freedom or a clear path forward, possibly with a subtle nod to future trends (e.g., modern vehicle on an open road, digital interface showing loan approval).

Deconstructing Lender Logic: Why Government Income Support is Different (But Not Disqualifying)

When an ODSP recipient applies for a car loan, lenders don't view their income as “lesser” but “different.” Their primary concern isn't the source of income itself, but its reliability and your ability to repay the loan. Unlike employment income, which can fluctuate due to layoffs, reduced hours, or job changes, ODSP payments are generally fixed and consistent, offering a predictable financial baseline. This predictability is a significant advantage that many applicants overlook.

Lenders also consider limitations on income garnishment for government benefits, which means their recourse in case of default is more limited. This doesn't mean they won't lend; it simply means they apply a different risk assessment model. Your strategy must be to proactively address these concerns by highlighting the stability of your income and demonstrating overall financial responsibility. By presenting a clear and organized application, you transform perceived risks into strengths, building trust and confidence with potential lenders.

Stability vs. Seizability: How to Highlight Your Income's Reliability

The consistent nature of disability benefits is a powerful asset. Unlike variable employment income – which can be subject to commissions, overtime, or unpredictable hours – ODSP provides a steady, predictable monthly sum. Lenders value this consistency because it directly correlates with your ability to make regular loan payments. This makes budgeting easier for both you and the lender assessing your risk.

To highlight this, ensure your bank statements clearly show regular, on-time deposits of your ODSP payments. This visual proof offers undeniable evidence of your income's reliability. Emphasize that these benefits are a guaranteed source of funds, less susceptible to economic downturns or employment market volatility. This stability can often outweigh some of the concerns lenders might have about income source or garnishment limitations, especially when coupled with other positive financial indicators.

Beyond the Benefit: The Holistic View Lenders Take on Your Application

While your ODSP income is foundational, lenders always take a holistic view of your financial health. They scrutinize several other critical factors to determine your creditworthiness and the likelihood of successful repayment. These include:

- Credit History: Your track record of borrowing and repaying debt. A history of timely payments on credit cards, utility bills, or previous loans is invaluable.

- Debt-to-Income Ratio (DTI): This measures how much of your monthly income goes towards debt payments. A lower DTI indicates more disposable income available for a new car loan. Lenders typically prefer a DTI below 40-45%.

- Payment History: Not just credit, but rent, utilities, and other recurring bills. Consistent, on-time payments demonstrate reliability.

- Savings and Assets: While you're seeking a zero-down loan, having some savings or other assets (even modest ones) can demonstrate financial prudence and provide a buffer.

Each of these elements contributes to – or detracts from – your approval odds for a zero-down option. Understanding and proactively managing them is key. For more on navigating challenging credit situations, you might find our article on Bad Credit Car Loan: Consolidate Payday Debt Canada 2026 incredibly helpful.

The Zero-Down Blueprint: Crafting an Irresistible Application

Securing a zero-down car loan as an ODSP recipient in 2026 requires more than just meeting basic criteria; it demands a strategically prepared and presented application. Think of your application as your financial resume – it needs to be clear, comprehensive, and compelling. Proactive steps taken before you even speak to a lender can significantly improve your chances of approval and potentially secure better terms.

This blueprint focuses on organization, transparency, and highlighting your strengths. It's about demonstrating reliability and seriousness, which are qualities highly valued by lenders. Don't underestimate the power of a well-structured application; it speaks volumes about your ability to manage your finances responsibly.

Pro Tip:

Gather all necessary documentation *before* you start applying. A well-organized application demonstrates reliability and seriousness to lenders, streamlining the approval process and making a positive first impression.

Essential Documentation: What You *Really* Need to Show

Having your documents in order is paramount. Lenders need concrete proof of your financial situation. Here's a detailed checklist:

- Proof of ODSP Income:

- Recent ODSP statements (typically for the last 3-6 months).

- Annual statement from ODSP.

- Direct deposit confirmation.

- Bank Statements:

- Recent 3-6 months of bank statements from your primary chequing account.

- These reveal consistent ODSP deposits, spending habits, and proof of responsible money management (e.g., no excessive overdrafts).

- Identification:

- Valid Canadian Driver’s License (G, G2, or G1 in some cases – though G2 is generally preferred for car loans, and G1 will be very difficult for a zero-down loan).

- Secondary ID (e.g., passport, provincial ID card, utility bill with your address).

- Proof of Address:

- Recent utility bill (hydro, gas, internet) or a lease agreement.

- Other Financial Records:

- Any other loan statements (student loans, personal loans).

- Credit card statements.

- Proof of other assets (e.g., savings account balances, investments, if applicable).

Organize these documents neatly, perhaps in a binder or a digital folder, so you can present them efficiently. This shows diligence and makes the lender’s job easier, which can reflect positively on your application.

Credit Score Mastery: Building Your Foundation for Zero-Down Approval

Your credit score is a numerical representation of your creditworthiness. While a perfect score isn't required for a zero-down ODSP loan, actively understanding and working to improve it is a powerful strategy. Many ODSP recipients might have limited credit history or past challenges, but these are not insurmountable obstacles in 2026.

Strategies for building or improving your credit:

- Secured Credit Cards: These cards require a deposit, which becomes your credit limit. Using them responsibly (making small purchases and paying them off in full and on time) is an excellent way to build positive credit history.

- Small Personal Loans: A small loan from a credit union or even a “credit builder” loan can help establish a payment history. Make sure the payments are affordable within your ODSP budget.

- Authorized User: If a trusted family member with good credit adds you as an authorized user on their credit card, their positive history can sometimes reflect on your report.

- Ensure Bill Payments are Reported: Not all landlords or utility companies report to credit bureaus. Inquire if they do, or consider services that report rent payments to credit bureaus.

Consistent, on-time payments across all your financial obligations are the bedrock of a strong credit profile. Even small, positive actions can significantly strengthen your application for a zero-down vehicle loan. For those starting from scratch, our article Zero Credit? Perfect. Your Canadian Car Loan Starts Here offers more detailed guidance.

The Co-Signer Advantage: When and How to Leverage Support

For many ODSP recipients seeking a zero-down car loan, a co-signer can be a game-changer. A co-signer is someone with good credit who agrees to take on legal responsibility for the loan if you default. Their involvement significantly mitigates the lender's risk, often leading to:

- Higher Approval Odds: Lenders are more confident approving a loan when there's a second, financially strong party backing it.

- Better Interest Rates: With reduced risk, lenders are typically willing to offer lower interest rates, saving you hundreds or thousands of dollars over the life of the loan.

A good co-signer is someone with a stable income, excellent credit history, and a low debt-to-income ratio. They should understand the full implications of co-signing, as it impacts their own credit and financial liability. If you have a trusted family member or friend willing to co-sign, it’s a powerful tool for unlocking zero-down options and securing more favourable terms.

Navigating the Lender Landscape: Who Offers Zero-Down Options for Disability Support Recipients?

The quest for a zero-down car loan when on ODSP requires a strategic approach to finding the right lender. Not all financial institutions are created equal, and their willingness to lend to individuals with non-traditional income sources varies. Understanding the landscape is crucial for targeting lenders most likely to say “yes.” From the established giants to the specialized niche players, each has a distinct approach to risk and eligibility.

Your goal is to identify institutions that are flexible, understanding of unique financial situations, and have a track record of approving loans for ODSP recipients. Don't limit your search to just one type of lender; cast a wide net to maximize your chances and compare offers.

The Dealership Advantage: In-House Financing and Specialized Programs

Dealerships, particularly larger ones or those specializing in used vehicles, often present a significant advantage for ODSP recipients seeking zero-down loans. Why?

- Multiple Lender Relationships: Dealerships work with a wide network of banks, credit unions, and specialized finance companies. This means they can “shop around” for you, finding a lender within their network that is more amenable to non-traditional income profiles.

- In-House Financing (Buy Here, Pay Here): Some dealerships offer their own financing, often referred to as “buy here, pay here” programs. These can be more flexible with credit and income requirements, as the dealership itself is the lender. While convenient and often a guaranteed approval route, be aware that interest rates can be higher.

- Specialized Programs: Many dealerships have dedicated finance managers who are experienced in securing loans for customers with unique financial circumstances, including those on ODSP. They understand the specific documentation and strategies required.

The convenience of getting financing directly at the dealership is a major plus, streamlining the car-buying process. However, always compare their offers – particularly interest rates – with other options to ensure you're getting the best possible deal. For insights into navigating various lender types, especially in challenging credit scenarios, our article Unmasking 'Bad Credit' Car Lenders: Red Flags You Miss, Quebec can offer valuable perspectives, even though its location focus is Quebec.

Beyond the Big Banks: Credit Unions and Specialized Finance Companies

While major banks can be quite conservative with zero-down loans for ODSP recipients, often preferring higher credit scores and traditional employment, other institutions offer promising alternatives:

- Credit Unions: These member-owned financial cooperatives often provide more personalized service and are more willing to consider individual circumstances. They may have specific programs for community members or those with non-traditional incomes, and their rates can sometimes be more competitive than other subprime lenders.

- Specialized Finance Companies: These companies specialize in lending to individuals with challenging credit, limited credit history, or non-traditional income sources. They are specifically structured to assess and mitigate the risks associated with these profiles. While their interest rates might be higher than prime rates, they are often the most accessible route for a zero-down loan for ODSP recipients. They understand the stability of government benefits and can tailor solutions.

Don't hesitate to explore these avenues. Their understanding of unique financial situations can lead to approval where traditional banks might hesitate.

The True Cost of 'Zero Down': Unmasking Rates, Terms, and Hidden Fees

The allure of “zero down” is undeniable, but it's crucial to understand that it doesn't mean “zero cost” in the long run. A zero-down loan simply defers the initial payment; it doesn't eliminate it from the overall financial equation. For ODSP recipients in 2026, understanding the full financial implications – especially interest rates, loan terms, and potential hidden fees – is paramount to making an informed decision and ensuring long-term affordability.

Interest rates are heavily influenced by your credit score, the perceived risk of your financial profile (including income source), and prevailing market conditions. For ODSP recipients, especially those with limited or challenged credit, interest rates will likely be higher than those offered to prime borrowers. This is the lender's way of mitigating their increased risk. Loan terms (the length of time you have to repay the loan) also play a critical role; longer terms mean lower monthly payments but significantly higher total interest paid over time.

Pro Tip:

Always read the fine print of any loan agreement. A 'zero down' offer might come with higher interest rates or longer terms than a loan requiring an upfront payment, significantly impacting the total cost over time. Ask about all fees, including administrative, loan origination, or documentation fees.

Example Scenarios: Zero Down vs. With Down Payment for ODSP Recipients (2026 Estimates)

Let's illustrate with some realistic scenarios for a used car valued at $18,000, considering typical rates for ODSP recipients in 2026:

| Loan Feature | Scenario A: Zero Down (Subprime Credit) | Scenario B: Zero Down (Improved Credit/Co-signer) | Scenario C: With $1,800 Down (Subprime Credit) |

|---|---|---|---|

| Vehicle Price | $18,000 | $18,000 | $18,000 |

| Down Payment | $0 | $0 | $1,800 (10%) |

| Amount Financed | $18,000 | $18,000 | $16,200 |

| Estimated Interest Rate (Annual) | 14.99% - 19.99% | 8.99% - 12.99% | 12.99% - 17.99% |

| Loan Term | 72 months (6 years) | 60 months (5 years) | 72 months (6 years) |

| Estimated Monthly Payment (Avg. Rate) | $375 - $420 | $370 - $405 | $320 - $360 |

| Total Interest Paid (Avg. Rate) | $9,000 - $12,240 | $4,200 - $6,300 | $6,800 - $9,500 |

| Total Cost of Vehicle (Incl. Interest) | $27,000 - $30,240 | $22,200 - $24,300 | $24,800 - $27,500 |

As you can see, while Scenario A offers the immediate benefit of no upfront cash, it comes with a significantly higher total cost due to higher interest rates and a longer term. Scenario B demonstrates how a stronger credit profile or a co-signer can dramatically reduce interest and total cost, even with zero down. Scenario C shows the benefit of even a small down payment, reducing the amount financed and thus the total interest. Beyond interest, be vigilant for “hidden” fees:

- Loan Origination Fees: A fee charged by the lender for processing the loan.

- Documentation Fees: Dealerships often charge for paperwork.

- Mandatory Add-ons: Some lenders/dealerships might push for extended warranties, credit life insurance, or specific vehicle protection plans. While some can be beneficial, ensure they are optional and truly necessary for your situation.

Always ask for a full breakdown of all costs before signing. Your primary goal is not just approval, but securing an affordable loan that fits comfortably within your ODSP budget for the entire term.

Vehicle Selection Strategy: Maximizing Your Loan's Potential and Affordability

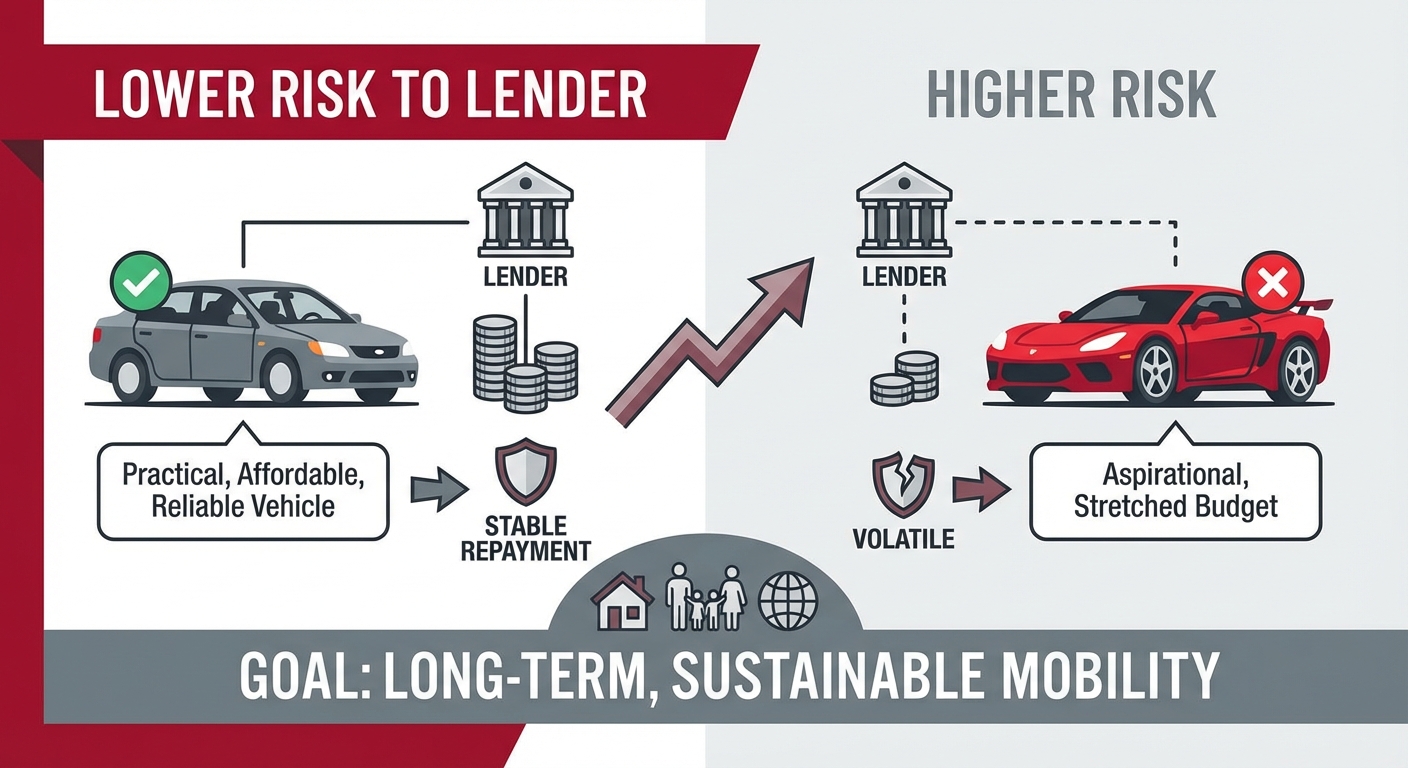

Choosing the right vehicle is a critical step, especially when you’re relying on a zero-down ODSP car loan in Toronto. Your choice directly impacts not only your monthly payments but also your long-term financial stability. It’s about making a smart, practical decision that aligns with your budget and approval limits, rather than being swayed by wants over needs.

Lenders also consider the vehicle itself when approving loans. They prefer vehicles that hold their value well and are easily resold, as this reduces their risk in case of default. Focusing on reliability and affordability will not only make your application more appealing but also ensure your new mode of transportation doesn't become a financial burden.

- New vs. Used: For ODSP recipients, a reliable used vehicle is almost always the more sensible choice for a zero-down loan. New cars depreciate rapidly the moment they leave the lot, and their higher price tags mean larger loan amounts, higher interest accrual, and steeper monthly payments. A well-maintained used car – typically 3-5 years old – offers excellent value, has already absorbed the steepest depreciation, and often comes with a lower insurance premium.

- Reliable Models: Research vehicles known for their dependability and low maintenance costs. Brands like Honda, Toyota, Mazda, and certain models from Hyundai or Kia often top reliability charts. Avoid vehicles known for frequent, expensive repairs, as these can quickly derail your budget.

- Budget Alignment: Stick strictly to what you can afford. Consider not just the monthly loan payment, but also insurance, fuel, maintenance, and potential parking costs in Toronto. A general rule is that your total vehicle-related expenses (loan, insurance, gas, maintenance) shouldn't exceed 10-15% of your monthly income.

- Vehicle Value and Depreciation: Lenders are more comfortable financing vehicles with strong resale value. This protects their asset. Choosing a car that holds its value better can sometimes even lead to slightly better loan terms because it represents lower risk to the lender.

Remember, the goal is long-term, sustainable mobility. A practical, affordable, and reliable vehicle will serve you better than an aspirational one that stretches your budget to its breaking point.

– An image showcasing a diverse range of reliable, affordable used cars, emphasizing accessibility, practicality, and smart budgeting (e.g., a family looking at cars at a dealership).

– An image showcasing a diverse range of reliable, affordable used cars, emphasizing accessibility, practicality, and smart budgeting (e.g., a family looking at cars at a dealership).

Post-Approval Empowerment: Managing Your Vehicle Loan Responsibly and Building Future Credit

Congratulations, you've secured your zero-down ODSP car loan in Toronto for 2026! This is a significant achievement and a testament to your preparation and persistence. However, the journey doesn't end here. The period post-approval is equally critical for ensuring long-term financial success, maintaining your mobility, and leveraging this loan to build a stronger credit future. Responsible loan management is your key to unlocking further financial opportunities.

Making timely payments is the single most important action you can take. Every on-time payment is reported to credit bureaus, systematically building your credit score. This positive credit history will open doors to better rates on future loans, credit cards, and even rental opportunities. Treat your car loan as an opportunity to prove your financial reliability.

- Set Up Automatic Payments: Remove the risk of missing a payment by linking your bank account directly to the lender for automatic withdrawals. This ensures consistency and protects your credit score.

- Understand Your Loan Agreement: Keep a copy of your loan agreement and understand all its terms – your interest rate, payment due dates, any penalties for late payments, and early repayment options.

- Budget for Maintenance: Even reliable vehicles need regular maintenance (oil changes, tire rotations). Factor these into your monthly budget to avoid unexpected costs that could jeopardize your loan payments. A “maintenance fund” can be a lifesaver.

- Keep Insurance Current: Auto insurance is mandatory in Ontario and a requirement for your loan. Ensure your policy is always active and meets the lender's requirements.

By diligently managing your vehicle loan, you're not just paying for a car; you're investing in your financial future and building a foundation for greater economic independence. This positive track record will be invaluable.

Pro Tip:

Set up automatic payments from your disability support deposit to avoid missing deadlines. This is a foolproof way to protect your credit score and maintain a good standing with your lender.

Your Next Steps to Approval: A Strategic Action Plan

You now possess the “secret key” to navigating the zero-down car loan landscape as an ODSP recipient in Toronto for 2026. This isn't just information; it's a strategic action plan designed to empower you. The journey to securing your vehicle is within reach, and with each informed step, you build confidence and increase your chances of success.

Here's your consolidated roadmap:

- Assess Your Financial Standing: Review your ODSP income, create a realistic budget, and understand your current credit score. Identify areas for improvement.

- Gather Your Documents: Proactively collect all necessary identification, proof of income, and bank statements. Organize them meticulously.

- Strategize Your Credit: If your credit needs boosting, consider secured credit cards or a co-signer. Every positive step helps.

- Research Lenders: Look beyond traditional banks. Explore specialized finance companies, credit unions, and dealerships with flexible programs that understand non-traditional income.

- Compare Offers: Don't jump at the first “yes.” Carefully compare interest rates, loan terms, and all associated fees across different lenders. Focus on the total cost of the loan, not just the monthly payment.

- Choose Wisely: Select a reliable, affordable vehicle that truly fits your budget and lifestyle, ensuring long-term practicality.

- Commit to Responsible Management: Once approved, set up automatic payments and budget for all vehicle-related expenses to build excellent credit for the future.

Your independence and mobility are valuable. Take the first step with confidence. At SkipCarDealer.com, we are committed to helping Canadians from all walks of life find reliable transportation. We understand the nuances of financing for ODSP recipients and are here to guide you through the process.