How to Check Car Loan Legitimacy 2026: Canada Guide

Table of Contents

- How to Check Car Loan Legitimacy 2026: Canada Guide

- Key Takeaways

- The Illusion of a Good Deal: Why Car Loan Legitimacy Matters More Than Ever in 2026 Canada

- Beyond the Sticker Price: The True Financial & Emotional Cost of a Bad Loan

- The Evolving Landscape: Digital Scams, Sophisticated Traps, and the Urgency of Vigilance

- Decoding the Pillars of a Legitimate Car Loan Offer in Canada

- Transparency Defined: Rates, Fees, and the APR You Deserve to Understand

- The Paper Trail: What Every Legitimate Document Must Contain and Why

- Understanding Lender Identity: Who *Really* Holds Your Loan (and Why it Matters)

- Unmasking the Deceptive Tactics: Common Car Loan Scams in Canada

- The Yo-Yo and Spot Delivery Playbook: A Deep Dive into Post-Agreement Scams

- Phantom Charges and Hidden Fees: The Art of Padding the Bill

- Bait-and-Switch Interest Rates: The Changing Numbers Game

- Identity Theft & Phishing Scams: Beyond the Dealership Walls

- Unlicensed Brokers and Predatory Lenders: Spotting the Wolves in Sheep's Clothing

- Pro Tip: Document Everything – Your Paper Trail is Your Protection

- Your Pre-Approval Playbook: Safeguarding Your Finances Before You Shop

- Credit Score Mastery: Why it's Your First Line of Defense Against Bad Deals

- Budgeting for Reality: Knowing Your True Affordability Limit (Beyond the Monthly Payment)

- The Power of Independent Pre-Approval: Banks, Credit Unions, and Reputable Online Lenders

- Researching Lenders: Beyond the Dealership's Recommendation (Due Diligence for Your Dollar)

- The Contract Crucible: What to Scrutinize Before You Sign on the Dotted Line

- Line-by-Line Breakdown: Interest Rate, Term, Total Cost, and Every Fee

- Understanding the Fine Print: Early Payment Penalties, Insurance Add-ons, and Warranties

- The 'Cooling-Off' Period Myth vs. Reality in Canadian Car Purchases

- When to Walk Away: Non-Negotiables and Deal Breakers in a Loan Offer

- Navigating the Lender Landscape: Dealer Financing vs. Bank vs. Online Brokers

- Dealership Financing: Convenience vs. Potential Markups and Hidden Costs

- Traditional Banks & Credit Unions: Stability, Competitive Rates, and Trust

- Online Loan Brokers & Fintech: Speed, Variety, and the Need for Due Diligence

- Post-Signing Vigilance: Ensuring Your Loan Remains Legitimate

- Regular Statement Reviews: Catching Discrepancies Early

- Understanding Your Rights: What to Do if Terms Change Unexpectedly (After Signing)

- Refinancing Considerations: When and Why it Might Be an Option for a Better Deal

- Your Recourse & Protections: What to Do If You Suspect a Car Loan Scam in Canada

- Gathering Evidence: The Paper Trail is Your Weapon

- Who to Contact: Provincial Consumer Protection Agencies and Industry Regulators

- Legal Advice: When to Consult a Lawyer Specializing in Consumer Law

- Reporting Fraud: RCMP, Canadian Anti-Fraud Centre, and Local Police

- Your Next Steps to Approval: Driving Away with Confidence in 2026

- A Checklist for Legitimate Car Loan Success: Your Final Safeguards

- Empowering Your Car Buying Journey: Knowledge is Your Best Asset

- Frequently Asked Questions (FAQ) About Car Loan Legitimacy in Canada

How to Check Car Loan Legitimacy 2026: Canada Guide

Buying a car in 2026 is more than just picking a model and colour; it’s a significant financial commitment that demands vigilance, especially when it comes to securing a car loan. With the digital landscape constantly evolving and sophisticated scams on the rise, knowing how to check car loan offer legitimacy in Canada is paramount. This guide from SkipCarDealer.com equips you with the essential knowledge and practical steps to navigate the complex world of automotive financing, ensuring your investment is safe and sound.

Key Takeaways

- Verify Before You Trust: Always independently verify the lender's credentials and ensure they are licensed in your province.

- Pre-Approval is Power: Secure independent pre-approval from a bank or credit union before visiting a dealership to establish a benchmark and leverage.

- Scrutinize Every Detail: Read the entire loan contract line-by-line, paying close attention to APR, total cost of credit, and any unexpected fees.

- Don't Be Pressured: A legitimate offer allows you time to review and won't involve high-pressure sales tactics or demands for immediate signatures.

- Document Everything: Keep meticulous records of all communications, advertisements, and signed documents for your protection.

The Illusion of a Good Deal: Why Car Loan Legitimacy Matters More Than Ever in 2026 Canada

In 2026, a legitimate car loan offer in Canada is one that is transparent, fully disclosed, and adheres to provincial and federal consumer protection laws, ensuring all terms, rates (especially the APR), and fees are clearly presented and agreed upon by both parties without deceptive practices or hidden clauses.

Beyond the Sticker Price: The True Financial & Emotional Cost of a Bad Loan

The allure of a shiny new vehicle can often overshadow the critical details of its financing. In Canada's current economic climate, with rising living costs and inflation, a bad car loan isn't just a minor inconvenience; it's a financial anchor that can drag you down for years. An illegitimate loan can hide exorbitant interest rates, undisclosed fees, or even put you at risk of identity theft. Imagine committing to a vehicle, only to find your monthly payments are hundreds of dollars higher than expected due to hidden charges, or discovering your personal information has been compromised. The stress, anxiety, and long-term financial burden can be immense, impacting your credit score, future borrowing capacity, and overall peace of mind. For many Canadians, a car is an essential tool for work and daily life, making a secure and legitimate financing deal non-negotiable.

The Evolving Landscape: Digital Scams, Sophisticated Traps, and the Urgency of Vigilance

The methods used by scammers are becoming increasingly sophisticated. Gone are the days when you only had to worry about shady practices at a physical dealership. In 2026, the digital realm is a new frontier for car loan fraud. Online platforms, social media, and phishing emails are now common battlegrounds where fraudsters impersonate legitimate lenders, offering seemingly irresistible deals that are too good to be true. These digital traps can be incredibly convincing, using professional-looking websites and persuasive language to trick unsuspecting buyers into divulging sensitive personal and financial information. The urgency of vigilance has never been higher, requiring an updated understanding of both traditional and modern deceptive tactics to safeguard your investment.

Decoding the Pillars of a Legitimate Car Loan Offer in Canada

Transparency Defined: Rates, Fees, and the APR You Deserve to Understand

The foundation of any legitimate car loan offer is absolute transparency. This means every single cost associated with your loan must be clearly itemized and explained. Don't just look at the advertised interest rate; focus on the Annual Percentage Rate (APR). The interest rate is simply the cost of borrowing the principal amount. The APR, however, includes the interest rate PLUS any additional fees charged by the lender, spread over the life of the loan. This gives you the true, total cost of borrowing. For example, a loan might advertise a 7.99% interest rate, but with administrative fees, documentation fees, and a loan origination fee, the actual APR could jump to 9.5% or even higher. Always ask for a breakdown of all fees. Legitimate lenders will provide this upfront, without hesitation.

Here's a comparison of how fees impact the true cost of a $30,000 car loan over 60 months:

| Scenario | Interest Rate | Fees | APR | Estimated Monthly Payment | Total Cost of Loan |

|---|---|---|---|---|---|

| Transparent Offer | 7.99% | $0 | 7.99% | $608.00 | $36,480 |

| Offer with Hidden Fees | 7.99% | $1,500 (Admin, Doc, Origination) | ~9.65% | $638.00 | $38,280 |

As you can see, an extra $1,500 in fees can significantly increase your monthly payment and the total amount you pay over the loan term.

The Paper Trail: What Every Legitimate Document Must Contain and Why

A legitimate car loan contract in Canada is a legal document that must adhere to strict provincial and federal regulations. It should be comprehensive, clearly written, and devoid of ambiguous language or blank spaces. Essential components include:

- Lender's Identity: Full legal name and contact information of the lending institution.

- Borrower's Details: Your full legal name, address, and contact information.

- Vehicle Identification Number (VIN): The unique identifier for the vehicle you are financing.

- Exact Loan Amount (Principal): The total amount of money you are borrowing.

- Interest Rate and APR: Both the nominal interest rate and the total Annual Percentage Rate must be clearly stated.

- Loan Term: The duration of the loan in months (e.g., 60 months, 72 months).

- Payment Schedule: Clear details of your monthly or bi-weekly payment amount and due dates.

- Total Cost of Credit: The sum of all interest and fees you will pay over the life of the loan.

- Collateral Details: Confirmation that the vehicle is the collateral for the loan.

- Prepayment Terms: Information on any penalties or benefits for paying off the loan early.

This detailed paper trail is your legal protection. Any missing information or vague wording is a significant red flag.

Understanding Lender Identity: Who *Really* Holds Your Loan (and Why it Matters)

When you secure a car loan, it's crucial to know who the actual lender is. There are generally two types: direct lenders and indirect lenders. Direct lenders are financial institutions like banks (e.g., TD, RBC, Scotiabank) and credit unions (e.g., Vancity in Vancouver, Desjardins in Montreal) that lend money directly to you. Indirect lenders, like dealerships or brokers, act as intermediaries, arranging financing through their network of banks or other financial institutions. While dealership financing can be convenient, it's important to understand that the dealership often marks up the interest rate provided by the actual lender, earning a commission. Verifying the actual lender's credentials ensures you're dealing with a reputable entity. Provincial regulations, such as Ontario's Motor Vehicle Dealers Act (MVDA) or British Columbia's Business Practices and Consumer Protection Act (BPCPA), mandate disclosure of the lender's identity to protect consumers. Always confirm the ultimate lender's name and do your own research on them.

Never feel pressured to make an immediate decision or sign anything you haven't fully understood. A legitimate offer will allow you time to review the contract, ask questions, and even take it home to consult with a trusted advisor. If you feel rushed, pressured, or uncomfortable, simply say "no" and walk away. Your financial well-being is more important than any "limited-time offer."

Unmasking the Deceptive Tactics: Common Car Loan Scams in Canada

The Yo-Yo and Spot Delivery Playbook: A Deep Dive into Post-Agreement Scams

These are particularly insidious scams that often occur after you've already driven off the lot.

Yo-Yo Financing: Also known as "financing fell through," this scam involves a dealership letting you take possession of a car before the financing is truly finalized. Days or even weeks later, they'll call you back, claiming the original financing fell through and demanding you sign a new contract with a significantly higher interest rate or different terms. They might threaten to report the car as stolen if you don't comply. This tactic preys on your emotional attachment to the new vehicle.

Spot Delivery: Similar to Yo-Yo, but often involves a conditional sales contract where the dealer has the right to repossess the vehicle if they can't find financing on the original terms. While legal in some forms, it can be abused. In provinces like Quebec, with its robust consumer protection laws under the Consumer Protection Act, consumers generally have stronger recourse against such tactics, often allowing cancellation if financing terms change. However, in provinces like Alberta, the onus is more on the consumer to understand the conditional nature of the sale. Always ensure your financing is 100% approved and non-conditional before driving off.

Phantom Charges and Hidden Fees: The Art of Padding the Bill

This is where dealers inflate the price of the car by adding charges for unnecessary or non-existent services. Common phantom charges include:

- Unnecessary Extended Warranties: Often marked up significantly or for services you don't need.

- Rustproofing/Undercoating: For modern vehicles, this is often redundant and overpriced.

- Credit Insurance: Can be useful but is often bundled without clear explanation, adding to your loan.

- VIN Etching: A security feature, but often charged at an inflated rate when it could be cheaper or free elsewhere.

- 'Dealer Prep' or 'PDI' (Pre-Delivery Inspection) Fees: While PDI is legitimate, watch for excessive amounts or additional "dealer prep" fees that duplicate existing charges.

- Inflated Administrative Costs: Legitimate administrative fees exist (typically $300-$700 in Canada), but anything significantly higher warrants scrutiny.

These charges, while seemingly small individually, can add thousands to your total loan amount, increasing your monthly payments without providing real value.

Bait-and-Switch Interest Rates: The Changing Numbers Game

This tactic starts with an attractive, low interest rate advertised or quoted verbally to draw you in. Once you've spent hours at the dealership, test-driven the car, and emotionally committed, the numbers suddenly change. The finance manager might claim your credit score wasn't as good as initially thought, or that the advertised rate was for a different model or specific conditions you don't meet. The new rate is significantly higher, but by this point, you're exhausted and invested, making it harder to walk away.

Identity Theft & Phishing Scams: Beyond the Dealership Walls

The digital age has opened new avenues for fraud. Scammers create fake websites or send phishing emails that mimic legitimate lenders or dealerships. Their goal is to trick you into providing sensitive personal information like your Social Insurance Number (SIN), banking details, or driver's license number. This information is then used for identity theft, not for processing a legitimate car loan. Always verify the URL of any website you visit, look for "https://" in the address bar, and be suspicious of unsolicited emails or texts asking for personal details. Legitimate lenders will not ask for your SIN via unsecure email.

Unlicensed Brokers and Predatory Lenders: Spotting the Wolves in Sheep's Clothing

Dealing with unlicensed individuals or companies for a car loan is a major risk. These entities operate outside regulatory oversight, meaning you have little to no consumer protection if something goes wrong. Characteristics of predatory lending include:

- Exorbitant Rates: Interest rates far exceeding market averages, sometimes reaching 30-60% or more.

- Vague or Unclear Terms: Contracts with confusing language, missing details, or terms that are difficult to understand.

- Aggressive Tactics: High-pressure sales, demanding immediate decisions, or threatening consequences if you don't sign.

- Targeting Vulnerable Individuals: Often preying on those with poor credit, low income, or limited financial literacy.

Before engaging with any broker or lender, especially online, verify their licensing. In provinces like Ontario, motor vehicle dealers and salespersons must be registered with OMVIC (Ontario Motor Vehicle Industry Council). In Alberta, it's AMVIC (Alberta Motor Vehicle Industry Council). A quick online search on the provincial regulator's website can confirm if they are legitimate and licensed.

Pro Tip: Document Everything – Your Paper Trail is Your Protection

Maintain a comprehensive record of every interaction and document related to your car purchase and loan. This includes initial advertisements, emails, text messages, loan applications, verbal quotes (note down names and dates), and all signed contracts. If a dispute arises, this documentation becomes your most powerful weapon to prove deceptive practices or breaches of contract. Keep both digital and physical copies in an organized manner.

Your Pre-Approval Playbook: Safeguarding Your Finances Before You Shop

Credit Score Mastery: Why it's Your First Line of Defense Against Bad Deals

Your credit score is a three-digit number that tells lenders how risky you are as a borrower. A strong credit score (typically 680+) grants you access to the most competitive interest rates. Before you even set foot in a dealership, obtain your credit report from Equifax and TransUnion, Canada's two major credit bureaus. Review it for accuracy; errors can negatively impact your score. Understanding your score empowers you to gauge what a legitimate interest rate should look like for you. If you have a strong score, a dealer offering you 15% interest is clearly trying to take advantage. For more insights on improving your credit, especially after financial challenges, check out our guide on Your 'Impossible' Car Loan Just Got Approved. Self-Employed, Poor Credit..

Budgeting for Reality: Knowing Your True Affordability Limit (Beyond the Monthly Payment)

Many consumers make the mistake of only budgeting for the monthly loan payment. A legitimate financial plan considers the total cost of car ownership. Create a comprehensive budget that includes:

- Monthly Loan Payment: The principal and interest.

- Insurance: Often a significant expense, especially for newer cars or younger drivers.

- Fuel Costs: Factor in your daily commute and weekend trips.

- Maintenance & Repairs: Oil changes, tire rotations, unexpected repairs.

- Registration & Licensing: Annual fees.

- Depreciation: The car's loss of value over time.

- Parking Fees: If applicable in urban centres like Toronto or Vancouver.

Understanding your true affordability limit prevents you from being "payment poor" and ensures you can comfortably manage all associated costs.

The Power of Independent Pre-Approval: Banks, Credit Unions, and Reputable Online Lenders

The single most effective strategy to protect yourself is to secure independent pre-approval from your own bank or credit union *before* you start shopping. This means you approach a financial institution like Scotiabank, CIBC, or a local credit union (e.g., Vancity in Vancouver, Desjardins in Montreal) and get approved for a specific loan amount at a confirmed interest rate. This pre-approval gives you immense leverage at the dealership. You walk in as a cash buyer, knowing exactly how much you can spend and what rate you qualify for. It sets a benchmark; if the dealership offers you a higher rate, you know they're marking it up. Major banks often offer competitive rates, while local credit unions might provide more personalized service and sometimes greater flexibility for members. This strategy ensures you're negotiating from a position of strength, not desperation.

Researching Lenders: Beyond the Dealership's Recommendation (Due Diligence for Your Dollar)

Don't blindly accept the dealership's financing partners. Take the time to research potential lenders yourself. Check reviews on independent platforms, consult consumer protection agencies in your province, and look up their rating with the Better Business Bureau (BBB). A reputable lender will have a transparent online presence and positive customer feedback. This due diligence extends to online loan platforms as well; ensure they are well-established, have clear terms of service, and are registered to operate in Canada.

Your Social Insurance Number (SIN) is highly sensitive personal information. While it's required for a final credit application, it is NOT necessary for initial quotes, browsing, or general discussions about financing options. Be wary of any salesperson or online form that asks for your SIN too early in the process. Providing it prematurely can expose you to identity theft risks.

The Contract Crucible: What to Scrutinize Before You Sign on the Dotted Line

Line-by-Line Breakdown: Interest Rate, Term, Total Cost, and Every Fee

This is the moment of truth. Before you put pen to paper, meticulously review every single line of the loan contract. Do not skim. Use a checklist to ensure:

- Exact Interest Rate & APR: Does it match what was verbally agreed upon and your pre-approval?

- Loan Term: Is the number of months correct? (e.g., 60 months, 72 months).

- Total Principal: The exact amount borrowed.

- Total Interest Paid: The sum of all interest over the loan's life.

- Total Cost of the Loan: Principal + Total Interest + All Fees. This is the ultimate number.

- Itemized Fees: Are all fees clearly listed and do they match what you expected? Are there any new, unexplained additions?

- Payment Schedule: Dates and amounts of each payment.

- Vehicle VIN: Does it match the car you are buying?

Any discrepancy, no matter how small, warrants clarification. Do not proceed until you are 100% satisfied.

Understanding the Fine Print: Early Payment Penalties, Insurance Add-ons, and Warranties

Beyond the main numbers, the fine print holds crucial details. While less common in Canada than in the US, some loans might have prepayment penalties if you pay off your loan early. Understand if this applies to your contract. Carefully examine any insurance add-ons (e.g., life, disability, critical illness insurance) or extended warranties bundled into the loan. While some can be beneficial, they often significantly increase your total loan amount and are frequently optional. Ensure you understand what you're buying, whether it's truly necessary, and if it's priced fairly. Often, these can be purchased separately and more affordably.

The 'Cooling-Off' Period Myth vs. Reality in Canadian Car Purchases

A common misconception is that consumers have a universal "cooling-off" period to cancel a car purchase after signing, similar to some other consumer goods. In Canada, this is generally a myth for car purchases once the contract is signed and the vehicle is delivered. The contract is legally binding. While some provinces might offer limited rescission rights in very specific circumstances (e.g., for direct sales contracts signed away from a business's premises, or if a dealer fails to disclose material facts), these are exceptions, not the rule. For example, in Ontario, there is no automatic cooling-off period for vehicle purchases. Once you sign, you're committed. This is why pre-contract vigilance is so crucial.

When to Walk Away: Non-Negotiables and Deal Breakers in a Loan Offer

Empower yourself to identify the red flags that should prompt you to walk away:

- Unexplained Fees: Any charge that can't be clearly justified.

- Mismatched Terms: If the interest rate, term, or loan amount in the contract differs from what was agreed upon.

- Pressure Tactics: Being rushed, told "this offer is only good right now," or threatened with losing the car.

- Vague Language: Ambiguous clauses, blank spaces, or terms you don't understand.

- "Spot Delivery" Concerns: If the contract implies the financing isn't truly finalized.

- Lack of Documentation: If the dealer refuses to provide copies of documents.

Walking away is always an option, and a legitimate dealer will respect that decision.

The car buying process can be long and tiring, but fatigue is an enemy of good decision-making. Insist on taking your time to review the contract thoroughly. Don't hesitate to ask for a copy to take home or to have a trusted friend, family member, or financial advisor look it over. A legitimate deal will withstand this scrutiny.

Navigating the Lender Landscape: Dealer Financing vs. Bank vs. Online Brokers

Dealership Financing: Convenience vs. Potential Markups and Hidden Costs

Dealership financing offers unparalleled convenience. You can select your vehicle and arrange financing all in one location, often driving away the same day. Dealers work with various lenders and can sometimes offer promotional rates from manufacturers. However, this convenience can come with drawbacks. Dealerships act as intermediaries, and they can mark up the interest rate they receive from their lending partners, earning a commission. This means you might pay a higher rate than if you went directly to a bank. Transparency can also be an issue, with less scrupulous dealers burying fees or pushing unnecessary add-ons. Always compare their offer to an independent pre-approval.

Traditional Banks & Credit Unions: Stability, Competitive Rates, and Trust

Securing a loan directly from a traditional bank (e.g., Scotiabank, CIBC, BMO) or a credit union is often the most reliable route. These institutions generally offer:

- Lower, More Competitive Rates: Especially for borrowers with good credit.

- Clear and Transparent Terms: Fewer hidden fees and straightforward contracts.

- Strong Consumer Protection: They are heavily regulated, offering a higher degree of security.

- Direct Relationship: You deal directly with your lender, making communication clearer.

For example, in 2026, a prime borrower (credit score 720+) might expect rates from major Canadian banks to be in the 6.99% to 8.99% range, while a subprime borrower (credit score 580-640) could see rates from 14.99% to 24.99%. Credit unions like Vancity in BC or Desjardins in Quebec often pride themselves on community focus and may offer flexible terms or slightly better rates to members, sometimes even for those with less-than-perfect credit. For those looking to refinance, especially after life changes, our article Refinance Car Loan After Parental Leave Ontario 2026 provides tailored advice.

Online Loan Brokers & Fintech: Speed, Variety, and the Need for Due Diligence

The rise of online loan brokers and FinTech companies has brought speed and convenience to car financing. They can quickly connect you with multiple lenders, potentially offering a wider range of options, especially for those with unique financial situations. However, this sector requires careful due diligence. While many online platforms are legitimate and reputable, others may be less transparent or even predatory. Always verify the platform's reputation, read reviews, and ensure they are properly licensed. Look for clear disclosure of rates, fees, and privacy policies. Never provide sensitive information to an unverified online entity.

Never settle for the first loan offer you receive. Make it a practice to compare at least three different offers: one from your personal bank or credit union, one from the dealership, and potentially one from a reputable online broker. This comparison allows you to identify the best legitimate deal, ensuring you're getting competitive rates and terms, and avoiding potential markups.

Post-Signing Vigilance: Ensuring Your Loan Remains Legitimate

Regular Statement Reviews: Catching Discrepancies Early

Your responsibility doesn't end once you've signed the contract and driven off. Meticulously review every monthly loan statement you receive. Check for:

- Correct Payment Amount: Does it match your contract?

- Accurate Interest Calculations: Is the interest being applied correctly?

- Principal Reduction: Is your principal balance decreasing as expected?

- Unexpected Charges: Are there any fees or charges that you don't recognize or didn't agree to?

Catching discrepancies early can prevent bigger problems down the line. If something looks off, contact your lender immediately.

Understanding Your Rights: What to Do if Terms Change Unexpectedly (After Signing)

Once a car loan contract is signed and finalized, the terms are legally binding for both you and the lender. It is generally illegal for a lender to unilaterally change the agreed-upon interest rate or other core terms after the contract has been executed. If a lender attempts to do this, especially after you've taken possession of the vehicle (a common 'Yo-Yo' scam tactic), you have strong consumer rights. Immediately document the attempted change, refer to your signed contract, and contact provincial consumer protection agencies. For complex situations, legal advice may be necessary. Our article What If Your Consumer Proposal *Unlocks* Your Car Loan, Ontario? offers insights into protecting your rights in challenging financial scenarios.

Refinancing Considerations: When and Why it Might Be an Option for a Better Deal

Refinancing your car loan means taking out a new loan to pay off your existing one, typically to secure a lower interest rate, reduce monthly payments, or change the loan term. It can be a legitimate option if:

- Interest Rates Have Dropped: Market rates are lower than when you first borrowed.

- Your Credit Score Has Improved: A better score qualifies you for better rates.

- You Want Different Terms: A longer term to lower payments, or a shorter term to pay it off faster.

- You Have a Predatory Loan: Escaping a high-interest, illegitimate loan.

Always ensure any refinancing offer is as legitimate and transparent as your initial loan, with a clear breakdown of all costs and benefits. Refinancing should genuinely save you money over the long term, not just shift costs around.

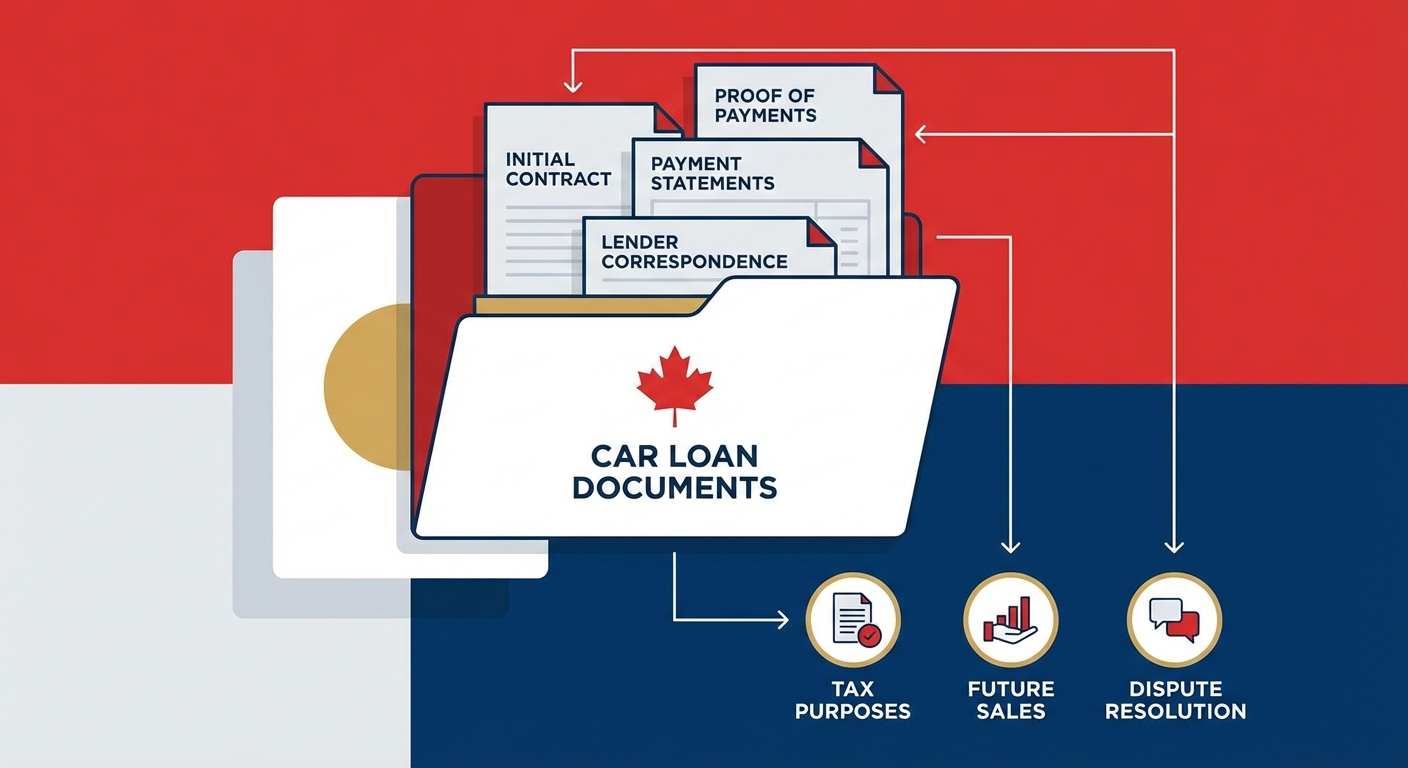

Create a dedicated folder, both physical and digital (cloud storage, external hard drive), for all car loan documents. This includes the initial contract, all payment statements, any correspondence with the lender or dealership, and proof of payments. This organized record is invaluable for tax purposes, future sales, or if any disputes arise.

Your Recourse & Protections: What to Do If You Suspect a Car Loan Scam in Canada

Gathering Evidence: The Paper Trail is Your Weapon

If you suspect you've been a victim of a car loan scam or deceptive practice, the first crucial step is to gather all available evidence. This includes:

- Your signed car loan contract and any related agreements.

- All monthly statements and payment history.

- Any advertisements, emails, or text messages from the dealership or lender.

- Notes from conversations, including dates, times, and names of individuals.

- Vehicle purchase agreement and any add-on contracts (warranties, insurance).

The more documentation you have, the stronger your case will be.

Who to Contact: Provincial Consumer Protection Agencies and Industry Regulators

Canada has robust consumer protection frameworks, primarily at the provincial level. These agencies are your first line of defense:

- Ontario: Contact OMVIC (Ontario Motor Vehicle Industry Council) for issues with registered dealers. For broader consumer protection, reach out to the Ministry of Public and Business Service Delivery (Consumer Protection Branch).

- British Columbia: Consumer Protection BC handles various consumer complaints.

- Alberta: AMVIC (Alberta Motor Vehicle Industry Council) regulates automotive businesses.

- Quebec: L'Office de la protection du consommateur is highly active in protecting consumer rights.

- Other Provinces: Each province has a consumer affairs or consumer protection department. A quick search for "consumer protection [Your Province]" will lead you to the relevant body.

These bodies can mediate disputes, investigate complaints, and in some cases, order restitution or penalties against non-compliant businesses.

Legal Advice: When to Consult a Lawyer Specializing in Consumer Law

While provincial agencies can help, for significant financial loss, complex legal issues, or if you feel your rights have been severely violated, it's wise to consult a lawyer specializing in consumer law. They can assess your case, explain your legal options, and represent you in negotiations or court. Many provincial law societies offer referral services to help you find a qualified lawyer.

Reporting Fraud: RCMP, Canadian Anti-Fraud Centre, and Local Police

If you believe you've been a victim of outright fraud (e.g., identity theft, criminal deception), it's essential to report it to law enforcement:

- Canadian Anti-Fraud Centre (CAFC): This national resource collects information on fraud and identity theft. Reporting to them helps track trends and prevent future crimes.

- Local Police: File a police report with your local detachment. This is crucial for documentation and can sometimes be a prerequisite for insurance claims.

- RCMP: For more severe or inter-provincial fraud cases, the Royal Canadian Mounted Police may become involved.

Timely reporting is critical to maximize your chances of recovery and to help protect other potential victims.

Your Next Steps to Approval: Driving Away with Confidence in 2026

A Checklist for Legitimate Car Loan Success: Your Final Safeguards

To ensure a legitimate car loan and drive away with confidence in 2026, keep this checklist handy:

- Check Your Credit Score: Know where you stand.

- Set a Realistic Budget: Include all ownership costs.

- Get Pre-Approved Independently: Your bank or credit union first.

- Research All Lenders: Verify legitimacy and reputation.

- Never Share SIN Prematurely: Protect your identity.

- Scrutinize the Contract: Read every line, verify APR, fees, and terms.

- Don't Be Pressured: Take your time to review.

- Document Everything: Keep a complete paper and digital trail.

- Compare Offers: Don't just take the first one.

- Review Statements Regularly: Catch discrepancies early.

Empowering Your Car Buying Journey: Knowledge is Your Best Asset

In the dynamic Canadian automotive market of 2026, an informed consumer is an empowered consumer. By understanding the mechanics of legitimate car loans, recognizing deceptive tactics, and proactively safeguarding your finances, you minimize your risk of falling victim to scams. Your knowledge is your best asset, allowing you to secure the best legitimate deal, protect your credit, and enjoy your new vehicle with complete peace of mind. Drive smart, drive safe, and drive with confidence.