Apprentice Car Loans Ontario 2026: Get Your Trade Rolling

Table of Contents

- Key Takeaways

- The Apprentice's Edge: Why a Vehicle is More Than Just Transportation

- Driving Independence: Essential for Your Trade

- Beyond the Bus Route: Time, Tools, and Opportunity Costs

- Demystifying Apprentice Loans: What Lenders Really Look For

- The Apprentice Income Paradox: Steady Work, Emerging Credit

- Pro Tip: Document Everything: Your Apprenticeship is Your Proof of Stability

- Credit Score Fundamentals: Your Financial Footprint and How to Build It

- From Application to Approval: The Lender's Lens on Apprentices

- Navigating Lending Avenues: Where to Find Your Loan

- Traditional Banks vs. Credit Unions: A Head-to-Head Comparison for Apprentices

- Dealership Financing: Convenience vs. Cost and Negotiation Tactics

- Specialized Lenders and Online Platforms: Exploring Niche Options

- Pro Tip: Beyond the Big Banks: Explore All Avenues, But Vet Thoroughly

- The Canada Apprentice Loan: A Separate but Complementary Resource

- Decoding the Numbers: Interest Rates, Terms, and Total Cost

- Understanding Interest Rates: Fixed, Variable, and How They Impact Your Wallet

- Loan Terms and Amortization: Finding Your Sweet Spot for Monthly Payments

- The 'Hidden' Costs: Beyond the Monthly Payment and What to Expect

- Pro Tip: Total Cost of Ownership: Look Beyond the Sticker Price – Factor in Fuel, Insurance, and Maintenance

- Budgeting for Your Ride: A Practical Guide for Apprentices

- Boosting Your Approval Odds: Strategic Moves for Apprentices

- The Power of a Down Payment: Why It Matters to Lenders and Your Budget

- Co-Signers and Guarantors: Leveraging Support Wisely and Responsibly

- Demonstrating Stability: Employment Letters and Financial Records as Your Allies

- Pre-Approval Power: Shop with Confidence and Negotiation Leverage

- Pro Tip: Pre-Approval First: Your Negotiation Superpower in the Dealership

- Choosing Your Wheels: New vs. Used for the Tradesperson

- The Case for a Reliable Used Vehicle: Value, Depreciation, and Affordability

- New Car Allure: When It Might Be Worth It (and When It's a Risky Bet)

- Vehicle Types for the Trade: Trucks, Vans, and Fuel Efficiency Considerations

- Pro Tip: Function Over Flash: Choose Your Workhorse Wisely, Not Just a Fancy Ride

- Your Next Steps to Approval: Actionable Strategies for Success

- Building a Strong Financial Foundation: Credit and Savings for the Long Haul

- Refinancing Opportunities: Adapting Your Loan to Your Evolving Career

- The Road Ahead: Financial Freedom and Accelerated Career Growth

Are you an apprentice in Ontario, ready to level up your career and gain true independence? In the fast-paced world of skilled trades, reliable transportation isn't a luxury; it's a fundamental tool for success. You're navigating diverse job sites, hauling essential equipment, and committing to crucial technical training, often far from major transit hubs. This demanding lifestyle requires a vehicle that keeps pace with your ambition.

For tradesperson apprentices across Ontario, from the bustling sites of Toronto to the growing communities in Ottawa and Windsor, securing a car loan in 2026 might seem like a complex challenge. You're building your career, which often means building your credit history and income stability simultaneously. But don't let that deter you. Lenders understand the unique trajectory of an apprenticeship, recognizing it as a pathway to stable, high-demand employment.

This comprehensive guide from SkipCarDealer.com is specifically tailored to equip Ontario apprentices with the knowledge, strategies, and confidence needed to secure an auto loan and drive their career forward. We'll demystify the process, highlight what lenders look for, and provide actionable advice to get you on the road in 2026.

Key Takeaways

- Your Apprenticeship is Your Asset: Lenders value the structured income and clear career progression of an apprenticeship. Document everything to showcase stability.

- Credit Building is Key: Start monitoring and actively improving your credit score early. Even small steps make a big difference for future approvals.

- Down Payment Power: A significant down payment (10-20%) can dramatically improve your loan terms and approval odds, reducing risk for lenders.

- Explore All Avenues: Don't limit yourself to traditional banks. Dealership financing, credit unions, and specialized lenders each offer unique advantages for apprentices.

- Pre-Approval is Your Superpower: Get pre-approved before you shop to understand your budget, negotiate confidently, and avoid surprises at the dealership.

- Focus on Total Cost: Look beyond the monthly payment. Factor in insurance, fuel, and maintenance for a realistic budget that ensures long-term affordability.

The Apprentice's Edge: Why a Vehicle is More Than Just Transportation

For an apprentice in Ontario, a car loan isn't just about financing a vehicle; it's about investing in your future. It's about securing the mobility that underpins every aspect of your professional growth and personal independence in 2026.

An apprentice car loan in Ontario provides the financial means for tradespeople to acquire a reliable vehicle, essential for job site access, tool transport, and career advancement, especially for those with developing credit histories.

Driving Independence: Essential for Your Trade

The life of a tradesperson apprentice is inherently mobile. You might be working on a residential build in Brampton one week, a commercial development in Mississauga the next, and attending technical training at a college campus in Barrie or Waterloo. Public transit simply cannot keep up with this dynamic schedule, nor can it accommodate the tools and equipment you need to carry.

Imagine being a plumbing apprentice needing to transport a pipe cutter, a welding apprentice with your gear, or an electrician carrying specialized testing equipment. A personal vehicle, whether it's a practical sedan, a robust SUV, or a small truck, becomes an extension of your toolkit. It ensures you arrive on time, prepared, and ready to contribute effectively. This reliability is crucial for impressing employers, securing steady work, and progressing swiftly through your apprenticeship levels. Without it, you face constant logistical hurdles that can slow your career trajectory and even limit your earning potential.

Beyond the Bus Route: Time, Tools, and Opportunity Costs

The true value of a personal vehicle for an apprentice extends far beyond just getting from point A to B. Consider the time saved. Relying on public transit can add hours to your commute, cutting into valuable study time, rest, or personal commitments. A personal vehicle means you can accept early morning shifts, stay late to finish a critical task, or take on weekend side jobs without worrying about transit schedules.

Think about the opportunity cost: missing out on a higher-paying job because the site is inaccessible by bus, or having to turn down overtime because you can't get home. A vehicle expands your work radius significantly, opening doors to more diverse projects and potentially higher wages. For many apprentices in cities like Toronto or Calgary, a car is the difference between working within a limited urban core and accessing lucrative opportunities in sprawling suburban or rural areas. It enhances your overall quality of life during what can be a demanding training period, offering flexibility and reducing stress. The ability to carry your own tools efficiently also means you're always prepared, boosting your productivity and professionalism on any job site.

Demystifying Apprentice Loans: What Lenders Really Look For

Securing a car loan as an apprentice in Ontario involves understanding what lenders prioritize. While your situation is unique, it's far from impossible. Lenders are looking for a clear picture of your financial stability and your commitment to repayment.

The Apprentice Income Paradox: Steady Work, Emerging Credit

One of the primary challenges for apprentices is demonstrating a stable income and a robust credit history. You're in a unique position: you have a guaranteed pathway to increasing income and a structured employment model, but your current earnings might be lower than a journeyperson's, and your credit file might be relatively thin. Lenders understand that apprenticeships are a commitment to a well-paying future.

They evaluate your employment status by looking at your apprenticeship agreement, union letters, and pay stubs. They want to see consistent employment and a clear progression path. Even if your credit history is short, the stability of your apprenticeship is a significant positive factor. For more on how to navigate financing with limited credit, you might find our article No Credit? Great. We're Not Your Bank. insightful.

Pro Tip: Document Everything: Your Apprenticeship is Your Proof of Stability

When applying for a loan, gather all documents related to your apprenticeship: your official apprenticeship agreement, letters from your employer or union confirming your enrollment and expected progression, and recent pay stubs. These documents are crucial for demonstrating your structured income and long-term earning potential, which lenders value highly.

Credit Score Fundamentals: Your Financial Footprint and How to Build It

Your credit score is a three-digit number that represents your creditworthiness. It's a snapshot of your financial reliability, based on your history of borrowing and repaying money. For an apprentice, a developing credit score is common, but it's vital to understand how it impacts your loan application and interest rates.

Even if you have a limited credit history, there are proactive steps you can take. Start with a secured credit card, make all payments on time, and keep your credit utilization low. Even small utility bills paid consistently can contribute positively to your credit file. Monitoring your credit score through free services is also essential to catch any errors and track your progress. Understanding your credit score is key to unlocking better loan terms; to delve deeper, read our guide The Truth About the Minimum Credit Score for Ontario Car Loans.

From Application to Approval: The Lender's Lens on Apprentices

When you apply for a car loan, lenders assess several key criteria, often with a specific understanding of the apprentice's journey. Here’s what they typically look for:

- Income Verification: Pay stubs, employment letters detailing your hourly wage, and confirmation of your apprenticeship level.

- Employment Stability: Letters from your employer or union confirming your status, the length of your apprenticeship, and the expected completion date. This demonstrates a secure future income.

- Debt-to-Income Ratio: Lenders assess how much of your monthly income goes towards existing debt payments. Keeping other debts low is crucial.

- Residency: Proof of stable residency in Ontario, often through utility bills or rental agreements.

- Down Payment: A substantial down payment significantly reduces risk for the lender and can improve your interest rate.

Preparing these essential documents in advance will streamline your application process and present you as a responsible, organized borrower. Lenders in cities like Vancouver or Montreal also consider the local job market for trades, which is generally robust, further strengthening your application.

Navigating Lending Avenues: Where to Find Your Loan

As an apprentice, you have several options when it comes to securing a car loan. Each avenue has its own advantages and considerations, and understanding them will help you make the best choice for your financial situation in 2026.

Traditional Banks vs. Credit Unions: A Head-to-Head Comparison for Apprentices

Traditional Banks: Large national banks (like RBC, TD, CIBC, Scotiabank, BMO) often have competitive rates for applicants with strong credit histories. However, for apprentices with emerging credit or a shorter financial footprint, they might be more stringent. They tend to rely heavily on automated credit scoring systems, which may not fully capture the nuance of an apprenticeship's long-term stability. If you have a primary banking relationship, it's worth checking with them first, as they might be more willing to lend to existing customers.

Credit Unions: These member-owned financial institutions, common across Ontario (e.g., Meridian Credit Union, Alterna Savings), are often more flexible and community-focused. They may be more willing to consider your individual circumstances, including your apprenticeship status and future earning potential, rather than solely relying on your credit score. They might offer slightly better rates or more personalized service for those with developing credit. Building a relationship with a credit union can be highly beneficial for apprentices seeking financing.

Here’s a comparative look:

| Feature | Traditional Banks | Credit Unions |

|---|---|---|

| Typical Rates (Prime) | 6.99% - 8.99% | 6.49% - 8.49% |

| Flexibility for Apprentices | Less flexible, score-driven | More flexible, relationship-based |

| Credit Score Requirement | Generally higher | Potentially lower/more forgiving |

| Personalized Service | Less personalized | More personalized, community-focused |

| Application Process | Often online, faster for strong credit | Can be more hands-on, great for unique cases |

Dealership Financing: Convenience vs. Cost and Negotiation Tactics

Dealerships often offer on-site financing, which provides significant convenience. You can shop for a car and arrange financing all in one place, sometimes even with special programs or incentives from manufacturers. They also work with a network of lenders, which can increase your chances of approval, especially if you have a less-than-perfect credit score.

However, this convenience can sometimes come at a cost. Dealerships may mark up interest rates to earn a commission, or they might push you towards a loan product that isn't the most competitive. It’s crucial to be prepared to negotiate. Always know your budget and ideally, get a pre-approval from an external lender (like a bank or credit union) before you walk onto the lot. This gives you a benchmark and leverage to ensure you're getting a fair deal on both the vehicle and the financing.

Specialized Lenders and Online Platforms: Exploring Niche Options

Beyond traditional banks and dealerships, a growing number of specialized lenders and online platforms cater to individuals with unique financial situations, including apprentices with developing credit or those new to Canada (like in Vancouver or Montreal). These lenders often have more flexible underwriting criteria, focusing on your current income, employment stability, and future earning potential rather than solely relying on your credit score.

While these options can be a lifesaver for approval, it’s critical to exercise due diligence. Research their reputation, read reviews, and carefully compare interest rates, fees, and terms. Ensure they are legitimate and transparent. SkipCarDealer.com, for instance, connects you with a network of lenders who understand the nuances of various credit profiles, including those of apprentices, aiming to find you competitive rates.

Pro Tip: Beyond the Big Banks: Explore All Avenues, But Vet Thoroughly

Don't assume traditional banks are your only option. Credit unions and specialized online lenders often offer more flexible terms for apprentices. However, always verify their credentials, read reviews, and ensure full transparency regarding interest rates and fees before committing to any loan agreement.

The Canada Apprentice Loan: A Separate but Complementary Resource

It's important to clarify that the Canada Apprentice Loan (CAL) is specifically designed to help apprentices cover the costs associated with their technical training periods, such as tuition, tools, and living expenses during in-school training. It is not intended for direct car purchases.

However, utilizing the interest-free Canada Apprentice Loan (while you are in training) can indirectly support your car loan goals. By covering your training expenses, the CAL frees up your personal earnings, allowing you to save more for a down payment, manage your existing debts more effectively, or simply have more disposable income to comfortably make your car loan payments. This enhanced financial stability makes you a more attractive borrower to car loan lenders, improving your overall chances of approval and potentially securing better terms.

Decoding the Numbers: Interest Rates, Terms, and Total Cost

Understanding the financial specifics of your car loan is paramount. It’s not just about the monthly payment; it’s about the total cost of borrowing and ensuring it fits comfortably within your apprentice budget in 2026.

Understanding Interest Rates: Fixed, Variable, and How They Impact Your Wallet

The interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. For apprentices, especially those with developing credit, initial rates might be higher than for established borrowers. Here’s a breakdown:

- Fixed Interest Rate: Your interest rate remains the same throughout the life of the loan. This provides predictability in your monthly payments, making budgeting easier. It's generally recommended for apprentices who need stability.

- Variable Interest Rate: Your interest rate can fluctuate based on market conditions (e.g., changes to the Bank of Canada's prime rate). While it might start lower, it carries the risk of increasing, which would raise your monthly payments. This option is generally riskier for apprentices on a tight budget.

In 2026, with interest rates potentially stabilizing, securing a fixed rate offers peace of mind. For an apprentice, rates can range significantly. With strong documentation and a good down payment, you might qualify for rates in the 8-12% range. Without these, rates could climb to 15-20% or even higher, depending on the lender and your specific credit profile. Every percentage point makes a difference over the life of the loan.

Loan Terms and Amortization: Finding Your Sweet Spot for Monthly Payments

The loan term is the duration over which you repay the loan, typically expressed in months (e.g., 60, 72, 84 months). Amortization refers to how your payments are structured over this period.

- Shorter Term (e.g., 48-60 months): Results in higher monthly payments but you pay less interest over the life of the loan. You own the car outright faster.

- Longer Term (e.g., 72-96 months): Lowers your monthly payments, making the car seem more affordable in the short term. However, you pay significantly more in total interest and extend the period you're making payments, sometimes even beyond the car's useful life.

For an apprentice, finding the "sweet spot" means balancing an affordable monthly payment with the desire to minimize total interest paid. A 60-72 month term is often a good compromise. Consider a vehicle that fits within a shorter term if possible, as your income will likely increase significantly as you progress, making those earlier, slightly higher payments more manageable in the long run.

Example Loan Scenarios for a $20,000 Used Vehicle in 2026 (assuming a 10% down payment, borrowing $18,000):

| Interest Rate | Loan Term (Months) | Estimated Monthly Payment | Total Interest Paid | Total Cost of Loan |

|---|---|---|---|---|

| 9.00% | 60 | $374 | $4,440 | $22,440 |

| 12.00% | 72 | $354 | $7,488 | $25,488 |

| 15.00% | 84 | $339 | $10,476 | $28,476 |

As you can see, a longer term lowers the monthly payment but drastically increases the total interest. An apprentice in Toronto or Vancouver should consider their future earning potential and try to opt for the shortest term they can comfortably afford.

The 'Hidden' Costs: Beyond the Monthly Payment and What to Expect

The sticker price and monthly loan payment are just the beginning. Many first-time car owners, especially apprentices, overlook critical "hidden" costs that can quickly strain a budget. These include:

- Administrative Fees: Dealerships often charge documentation fees, PPSA (Personal Property Security Act) registration fees, and other administrative costs. These can add a few hundred dollars to your purchase.

- Mandatory Insurance: Auto insurance is non-negotiable in Ontario. As a new driver or someone younger, your premiums can be substantial, especially in higher-risk areas like certain parts of Montreal or Calgary. Get insurance quotes *before* you buy.

- Fuel Costs: Factor in your daily commute and work-related driving. Fuel prices fluctuate, so budget conservatively.

- Maintenance: Regular oil changes, tire rotations, and unexpected repairs are inevitable. Set aside a monthly amount for maintenance.

- Optional Extended Warranties: While they offer peace of mind, they add to your total cost. Carefully evaluate if they are truly necessary for your chosen vehicle.

Pro Tip: Total Cost of Ownership: Look Beyond the Sticker Price – Factor in Fuel, Insurance, and Maintenance

When budgeting for a vehicle, calculate the total cost of ownership, not just the monthly loan payment. Get insurance quotes early, estimate fuel consumption based on your driving habits, and set aside funds for routine maintenance and unexpected repairs. A reliable car with lower operating costs is often better than a cheaper car with high upkeep.

Budgeting for Your Ride: A Practical Guide for Apprentices

Creating a realistic budget is the most crucial step for sustainable vehicle ownership. Here's a step-by-step approach for apprentices:

- Calculate Your Net Income: Determine your actual take-home pay after taxes and deductions.

- List All Fixed Expenses: Rent, utilities, phone bill, existing loan payments (student loans, credit cards).

- Estimate Variable Expenses: Groceries, entertainment, personal care.

- Factor in Car Costs:

- Monthly Loan Payment (from your loan estimate)

- Insurance Premiums (actual quote)

- Fuel Costs (estimate based on kilometres driven and current prices, add a buffer)

- Maintenance Fund (e.g., $50-$100 per month, saved for future repairs)

- Assess Affordability: Can you comfortably cover all these expenses with your net income, while still having some savings? A common rule of thumb is that total vehicle costs (payment, insurance, fuel, maintenance) should not exceed 10-15% of your net monthly income.

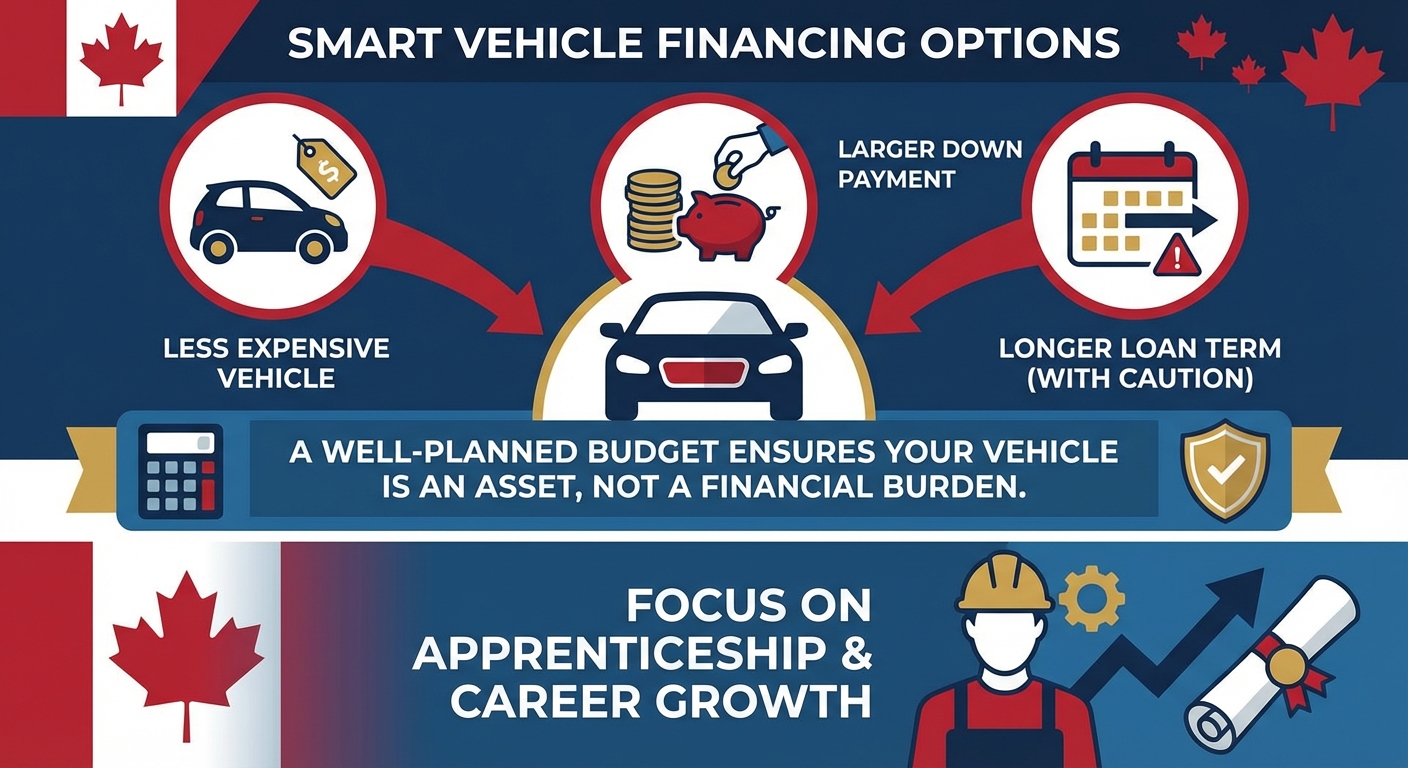

- Adjust as Needed: If the numbers don't add up, consider a less expensive vehicle, a larger down payment, or a slightly longer loan term (with caution).

A well-planned budget ensures your vehicle is an asset, not a financial burden, allowing you to focus on your apprenticeship and career growth.

– A dynamic image of an apprentice (e.g., in work attire with tools) confidently walking towards a reliable vehicle (e.g., a practical sedan or small truck), symbolizing independence and the critical link between reliable transport and career advancement in the trades.

Boosting Your Approval Odds: Strategic Moves for Apprentices

Even with developing credit, apprentices have powerful strategies at their disposal to significantly increase their chances of loan approval and secure more favourable terms in 2026. Proactive steps make all the difference.

The Power of a Down Payment: Why It Matters to Lenders and Your Budget

A down payment is arguably the most impactful factor an apprentice can control. It's the upfront cash you pay towards the vehicle's purchase price. Here's why it's so powerful:

- Reduces Lender Risk: A larger down payment means you're borrowing less money, reducing the lender's risk. This makes them more willing to approve your loan, especially if your credit history is limited.

- Lowers Principal: You borrow less, which means lower monthly payments.

- Improves Interest Rate: With less risk, lenders are often willing to offer a lower interest rate, saving you thousands over the life of the loan.

- Builds Equity Faster: You start with more equity in the vehicle, reducing the chances of being "underwater" on your loan (owing more than the car is worth).

Aim for a 10-20% down payment if possible. Saving up for this is an excellent financial goal for any apprentice. Even a smaller down payment, say 5%, shows commitment and can still make a difference. For example, on a $25,000 vehicle, a 10% down payment is $2,500. This might seem like a lot, but it's a worthwhile investment in your financial future and loan success.

Co-Signers and Guarantors: Leveraging Support Wisely and Responsibly

If you have limited credit history or a lower income, a co-signer or guarantor can significantly boost your approval odds. A co-signer (often a parent or trusted family member) legally agrees to be responsible for the loan payments if you default. This adds their stronger credit history and income to your application, making the loan less risky for the lender.

- Benefits: Can help you get approved when you otherwise wouldn't, or secure a much lower interest rate.

- Responsibilities: Both you and your co-signer are equally responsible for the debt. If you miss payments, it impacts both your credit scores. It's crucial to have open communication and a clear understanding of the commitment before entering such an agreement.

Leveraging a co-signer wisely means understanding your own repayment capabilities and ensuring you fulfill your obligations to protect their credit. This can be a strategic move for apprentices to get started, with the goal of eventually refinancing the loan into your name alone once your credit improves.

Demonstrating Stability: Employment Letters and Financial Records as Your Allies

As an apprentice, your stable employment is one of your greatest assets. Lenders look beyond just your current pay stub to understand your career trajectory. Here’s what to gather:

- Official Apprenticeship Agreement: Provides proof of your enrollment and the structure of your program.

- Employer Letter: A letter from your employer (on company letterhead) confirming your employment, start date, current hourly wage, typical hours, and expected progression within your apprenticeship.

- Union Letter (if applicable): Similar to an employer letter, this can confirm your union membership, apprentice status, and future wage increases according to collective agreements.

- Recent Pay Stubs: Show consistent income.

- Bank Statements: Demonstrate responsible money management and consistent income deposits.

- Proof of Residency: Utility bills, rental agreements, or property tax statements.

Presenting a comprehensive package of these documents clearly demonstrates your income consistency, job stability, and future earning potential, which lenders in places like Montreal and Vancouver value highly when assessing apprentice applications.

Pre-Approval Power: Shop with Confidence and Negotiation Leverage

Getting pre-approved for a car loan *before* you step into a dealership is one of the smartest moves an apprentice can make. Pre-approval means a lender has already assessed your financial situation and agreed to lend you a specific amount at a certain interest rate, subject to final vehicle selection.

- Know Your Budget: You'll know exactly how much you can afford, preventing you from falling in love with a car outside your price range.

- Negotiation Leverage: Walking into a dealership with a pre-approval means you're essentially a cash buyer. The dealership knows you're serious and already have financing, which allows you to focus solely on negotiating the best possible price for the vehicle itself, rather than getting caught up in financing details.

- Streamlined Process: It speeds up the buying process and reduces stress, as a significant hurdle (financing) is already cleared.

Don't underestimate the power of pre-approval. It puts you in the driver's seat of the buying process. For more insights on this, check out our article Skip the Dealership. Pre-Approved for Your Neighbour's Car, Ontario.

Pro Tip: Pre-Approval First: Your Negotiation Superpower in the Dealership

Before you even look at cars, get pre-approved for a loan from a bank or credit union. This tells you your budget and gives you significant leverage at the dealership, allowing you to negotiate the car price more effectively, as you're not reliant on their financing options.

Choosing Your Wheels: New vs. Used for the Tradesperson

Once you're confident in your financing prospects, the next crucial step for an apprentice in 2026 is selecting the right vehicle. This decision should balance your budget with the practical demands of your trade.

The Case for a Reliable Used Vehicle: Value, Depreciation, and Affordability

For most apprentices, a reliable used vehicle makes the most financial sense. Here’s why:

- Slower Depreciation: New cars lose a significant portion of their value (20-30%) in the first year alone. A used car has already absorbed much of this rapid depreciation, meaning you get more car for your money.

- Lower Purchase Price: Used vehicles are simply more affordable, allowing you to get into a newer model year or a higher trim level than you could afford new, all while staying within your budget.

- Broader Selection: The used car market offers a vast array of makes and models, increasing your chances of finding a vehicle that perfectly suits your trade-specific needs.

- Lower Insurance: Insurance premiums are often lower for used vehicles compared to new ones.

When buying used, focus on vehicles with a strong reputation for reliability, a clear service history, and a pre-purchase inspection by a trusted mechanic. Models from 3-5 years old often offer the best balance of modern features and depreciated value. This approach is particularly effective for apprentices in economically diverse regions like Calgary or Edmonton, where used car markets are robust.

New Car Allure: When It Might Be Worth It (and When It's a Risky Bet)

The appeal of a new car is undeniable: that new car smell, the latest technology, and a full manufacturer's warranty. While attractive, a new vehicle is generally a risky financial bet for an apprentice, especially given the rapid initial depreciation and higher purchase price.

- Pros: Full warranty coverage (reducing unexpected repair costs initially), latest safety features, potentially lower interest rates if you have excellent credit (though rare for apprentices), and the peace of mind of being the first owner.

- Cons: Significantly higher purchase price, rapid depreciation, higher insurance costs, and potentially more expensive maintenance once the warranty expires.

For an apprentice, investing in a new car often means taking on a larger loan, higher monthly payments, and a greater risk of being "underwater" on the loan. Unless you have a very substantial down payment, an exceptional interest rate, and a clear, immediate path to significantly higher income, a new car might tie up too much of your budget, diverting funds from other critical financial goals like saving for tools or a home down payment.

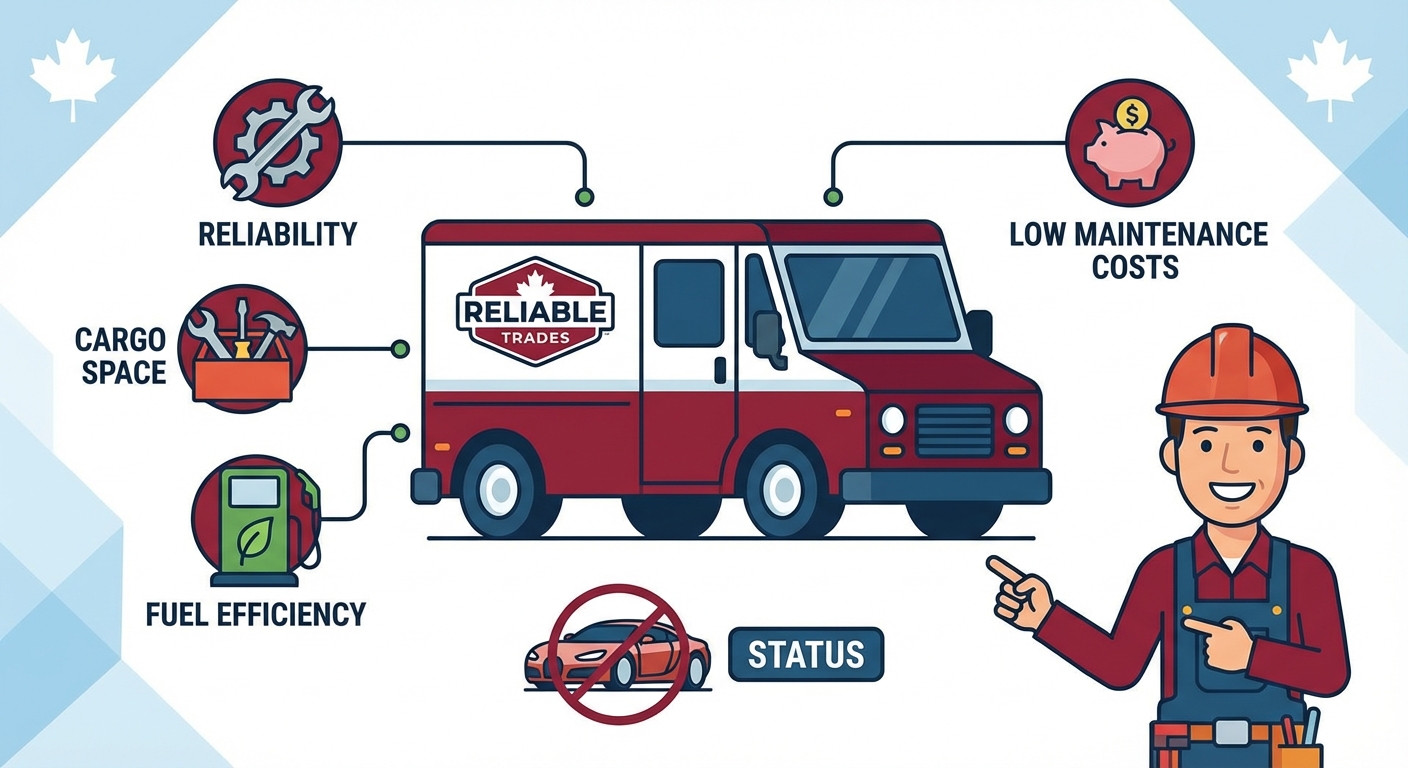

Vehicle Types for the Trade: Trucks, Vans, and Fuel Efficiency Considerations

Your trade dictates your vehicle choice. Think about function over flash:

- Trucks: Essential for trades requiring heavy hauling, towing, or transporting large equipment (e.g., carpenters, landscapers, welders). Consider payload capacity, bed length, and towing capabilities. Fuel efficiency can be a concern, so research engine options.

- Vans (Cargo or Minivans): Ideal for trades needing enclosed cargo space, organization for tools, and protection from the elements (e.g., electricians, plumbers, HVAC technicians). They offer excellent utility and often better fuel economy than trucks.

- SUVs/Crossovers: A good compromise for apprentices needing some cargo space and all-weather capability, but not heavy hauling. They often offer a more comfortable ride and better fuel efficiency than larger trucks.

- Practical Sedans: For apprentices who primarily need to commute to job sites and carry minimal tools, a reliable, fuel-efficient sedan can be the most economical choice.

Always prioritize reliability ratings, fuel economy, and projected maintenance costs. A vehicle that breaks down frequently or costs a fortune to fuel and repair will quickly negate any benefits it offers. For those working in regions like Quebec where fuel costs can be higher, fuel efficiency might be a top priority.

Pro Tip: Function Over Flash: Choose Your Workhorse Wisely, Not Just a Fancy Ride

As an apprentice, your vehicle is a tool for your trade. Prioritize reliability, cargo space for tools, fuel efficiency, and low maintenance costs over luxury features or brand status. A practical, dependable vehicle will serve your career much better in the long run.

– A clear, infographic-style image comparing key aspects of different loan options (e.g., 'Bank vs. Dealership vs. Credit Union') or illustrating the impact of a down payment on total interest paid and monthly payments, using simple visuals and key data points relevant to apprentice finances.

Your Next Steps to Approval: Actionable Strategies for Success

Securing your apprentice car loan in Ontario for 2026 is a significant step, but it's also an opportunity to build a strong financial foundation for your entire career. The strategies you employ now will pay dividends for years to come.

Building a Strong Financial Foundation: Credit and Savings for the Long Haul

Your car loan journey is just one part of your broader financial health. Beyond getting approved, focus on:

- Consistent Credit Building: Continue to make all payments on time, keep credit card balances low, and avoid unnecessary new credit applications. Your car loan itself, paid responsibly, will be a powerful credit builder. For strategies on using loans to rebuild credit, consider our article What If Your Car Loan *Was* Your Best Credit Card? (Post-Proposal Speed-Rebuild, Toronto).

- Emergency Savings: Aim to build an emergency fund of 3-6 months' worth of living expenses. This protects you against unexpected job interruptions, vehicle repairs, or other financial shocks.

- Debt Management: Prioritize paying down higher-interest debts (like credit cards) to improve your debt-to-income ratio and free up cash flow.

- Future Goals: Start planning for future financial goals, such as saving for a home down payment or investing in your trade's specialized tools.

By focusing on these long-term strategies, you're not just getting a car; you're setting yourself up for overall financial freedom and stability.

Refinancing Opportunities: Adapting Your Loan to Your Evolving Career

As an apprentice, your financial situation is dynamic. Your income will increase with each level of your apprenticeship, and your credit score will improve as you responsibly manage your car loan and other debts. This creates opportunities for refinancing.

Refinancing involves taking out a new loan to pay off your existing car loan, ideally with better terms. Once you've completed a few years of your apprenticeship, your income is substantially higher, or you've achieved journeyperson status, and your credit score has significantly improved, you might qualify for a lower interest rate. This could reduce your monthly payments or allow you to pay off the loan faster, saving you a considerable amount in interest over time. Keep an eye on market rates and your own financial progress, especially around the halfway mark of your original loan term.

The Road Ahead: Financial Freedom and Accelerated Career Growth

Securing and responsibly managing a car loan as an apprentice in Ontario is more than just buying a vehicle; it's a foundational step towards greater financial independence and accelerated career growth in 2026 and beyond. A reliable vehicle empowers you to take on more diverse projects, access better training, and expand your professional network across cities like Toronto, Ottawa, and even rural Ontario.

By understanding the lending landscape, preparing your documentation, making strategic financial choices, and committing to responsible repayment, you can turn your ambition into reality. Your vehicle will be a loyal workhorse, driving you not just to job sites, but towards a successful and prosperous career in the skilled trades.