Toronto Essential: Collections? Drive *Anyway*.

Table of Contents

- Key Takeaways

- II. The Toronto Grind: Why a Car Isn't a Luxury, It's Survival for Essential Workers in 2026

- The Urban Reality

- The Essential Mandate

- The Collections Conundrum

- III. Debunking the Myth: 'You Can't Get a Car Loan with Active Collections'

- The Truth: While Harder, It's Not Impossible

- Understanding 'Active Collections'

- The Lender's Perspective

- IV. Your Financial Footprint: Preparing for the Application Blitz in 2026

- Know Thyself (Financially)

- Crafting Your Narrative

- The 'Essential Worker' Advantage

- Budgeting Realities

- V. Navigating the Lending Labyrinth: Where to Find Your Urgent Loan in 2026

- Beyond the Big Five (RBC, TD, CIBC, BMO, Scotiabank)

- The Specialized Lenders: Your Best Bet

- Dealership Financing (The Dealer Network)

- VI. Decoding the Dollars: Rates, Terms, and Hidden Costs with Collections in 2026

- Interest Rates: The Elephant in the Room

- Loan Terms and Payment Structures

- The True Cost of Ownership in Toronto

- Down Payments

- VII. The Application Playbook: From Documentation to Approval in 2026

- The Essential Document Checklist

- The Art of the Application

- The 'Urgent' Factor

- VIII. Driving Smarter: Choosing the Right Vehicle for Your Situation in 2026

- Reliability Over Luxury

- Maintenance History is Key

- Affordable Brands and Models

- Negotiation Tactics

- IX. Beyond the Loan: Rebuilding Your Financial Foundation in Ontario in 2026

- Making Payments On Time, Every Time

- Automating Payments

- Addressing the Collections

- Diversifying Your Credit

- The Long-Term View

- X. Your Next Steps to Approval: A Toronto Essential Worker's Action Plan for 2026

- XI. Frequently Asked Questions (FAQ)

In the bustling heart of Canada's largest city, essential workers are the backbone of Toronto. You keep the hospitals running, the shelves stocked, and the city moving, often battling shift work, sprawling distances, and the unique challenges of urban transit. But what happens when you need a reliable vehicle for your vital role, and active collections are casting a long shadow over your credit file?

The year is 2026, and the financial landscape can feel daunting. Many believe that securing a car loan with active collections is an impossible feat. At SkipCarDealer.com, we understand this frustration and are here to tell you that it's not only possible but, with the right strategy, entirely achievable. This comprehensive guide is designed specifically for Toronto's essential workers, providing a clear roadmap to getting approved for the urgent car loan you need, even with active collections.

We'll cut through the myths, equip you with actionable strategies, and empower you to drive forward, ensuring your essential work continues uninterrupted. Your financial past doesn't have to dictate your present or future mobility.

Key Takeaways

- The Core Message: Getting an urgent car loan with active collections in Toronto is challenging but achievable with the right strategy and realistic expectations. It's about preparedness, transparency, and targeting the right lenders.

- Strategic Pillars: Transparency is Your Ally, Beyond Big Banks, The 'Essential' Advantage, Preparation is Paramount, Focus on Affordability, Long-Term Credit Repair.

II. The Toronto Grind: Why a Car Isn't a Luxury, It's Survival for Essential Workers in 2026

For essential workers in Toronto in 2026, a car isn't merely a convenience; it's often a fundamental tool for survival and professional duty. The city's vast geography, coupled with the demands of shift work and public transit limitations, makes personal transportation indispensable.

In Toronto, a car is essential for workers because it provides reliable, flexible transportation critical for navigating the city's sprawl, meeting diverse shift schedules, and accessing workplaces often underserved by public transit, especially for those in healthcare, service, and frontline roles.

The Urban Reality

Toronto is a sprawling metropolis, stretching across vast distances from Scarborough to Etobicoke, and up into North York. For many essential workers, their homes are far from their workplaces, or their shifts begin and end when the TTC (Toronto Transit Commission) is less frequent or non-existent. Think about the healthcare professional finishing a late-night shift at Sunnybrook Hospital, or the grocery store worker starting before dawn in Mississauga.

- Navigating Toronto's sprawling geography: Reaching facilities and service areas across the Greater Toronto Area (GTA) can be a multi-hour ordeal via public transit.

- Diverse shift schedules: Essential workers often operate outside of traditional 9-5 hours, with early mornings, late nights, and weekend shifts. The TTC, while extensive, simply cannot match the flexibility required.

- Often-strained public transit (TTC challenges, late-night routes and accessibility): Even during peak hours, the TTC can be unpredictable. During off-peak or late-night hours, service frequency drops significantly, making commutes excessively long or impossible.

The Essential Mandate

From the nurses and doctors in Toronto's world-class hospitals to the service industry staff ensuring our communities function, and the frontline workers delivering vital services, these individuals are the bedrock of our society. Their roles demand punctuality, reliability, and often, the ability to transport equipment or navigate to multiple locations. This isn't just a Toronto phenomenon; it's mirrored in cities across Ontario like Mississauga, Brampton, and even Ottawa.

- Healthcare professionals need to be on time for critical shifts.

- Service industry staff often carry tools or supplies.

- Frontline workers provide indispensable services that cannot wait for transit delays.

The Collections Conundrum

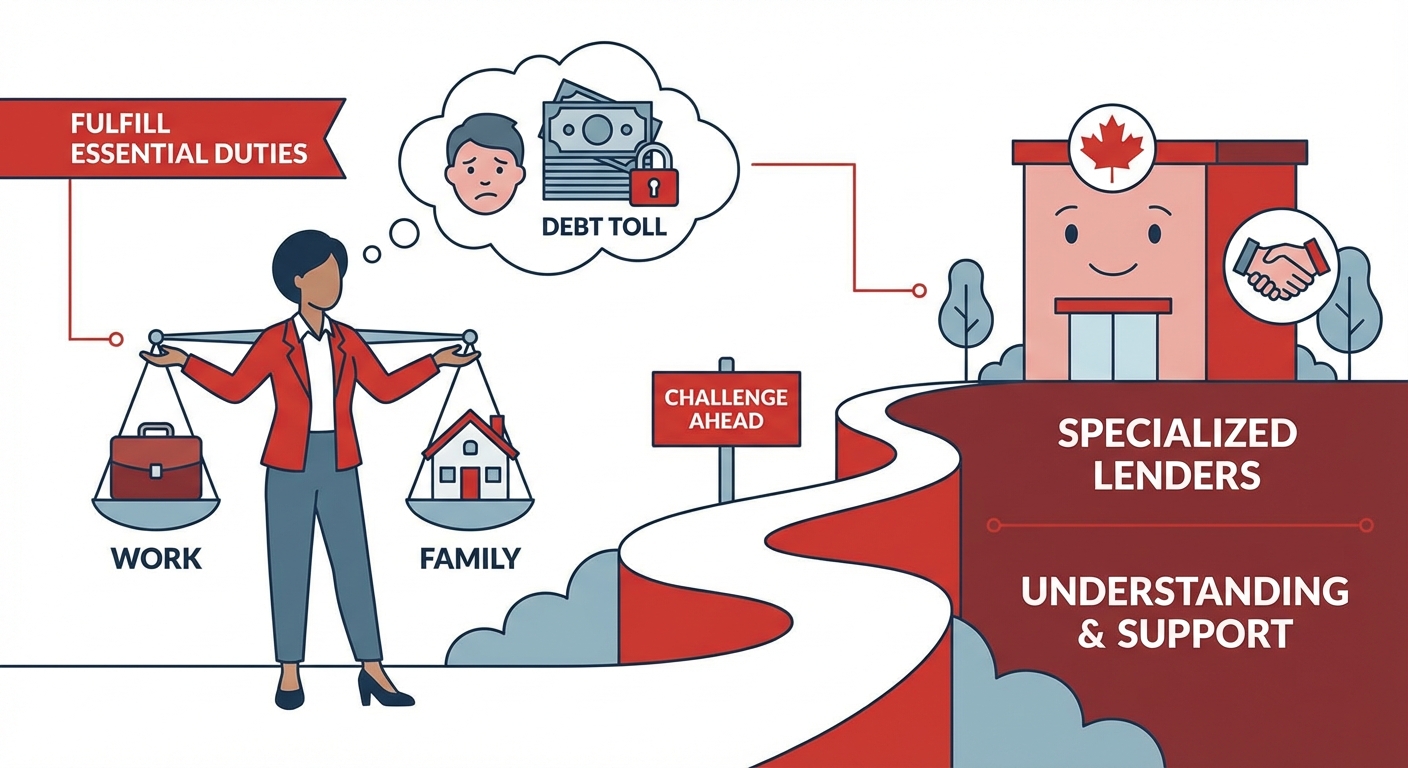

Imagine the immense pressure: you are dedicated to your essential role, but simultaneously grappling with the stress of past financial difficulties. Active collections represent a significant hurdle, signaling to traditional lenders a higher risk. This creates a double burden – the inherent need for a car to fulfill your essential duties, coupled with the emotional and practical toll of dealing with outstanding debts. It's a challenging position, but one that many Canadians face, and one that specialized lenders are increasingly equipped to understand.

III. Debunking the Myth: 'You Can't Get a Car Loan with Active Collections'

It's a common misconception that having active collections immediately disqualifies you from obtaining a car loan. This belief often leads essential workers to give up before even exploring their options. While it certainly makes the process more complex, it is far from impossible, especially in 2026 with a evolving lending landscape.

The Truth: While Harder, It's Not Impossible

The reality is, many lenders specialize in 'second-chance' financing. These are institutions that understand life happens. They recognize that a period of financial difficulty, even one resulting in active collections, doesn't necessarily mean you're an unreliable borrower today. They look beyond just your credit score, taking into account your current employment stability, income, and willingness to rebuild.

For more insights into navigating challenging financial situations, consider reading our guide on Your 'Impossible' Car Loan Just Got Approved. Self-Employed, Poor Credit.

Understanding 'Active Collections'

To tackle the problem, you first need to understand it. In Canada, when an account (like a credit card, utility bill, or personal loan) goes unpaid for a significant period, the original creditor may sell the debt to a collection agency. When this happens, it becomes an 'active collection' on your credit report. This impacts your credit score significantly and signals to lenders that there's a history of missed payments.

- What it means for your credit report in Canada (Equifax, TransUnion): Both Equifax and TransUnion, Canada's primary credit bureaus, will record active collections. This negative mark remains on your report for up to six years from the date of the last activity, even if paid.

- How it impacts your credit score: Collections are a major negative factor, often dropping your score by dozens, if not hundreds, of points.

- The difference between an old charge-off and a currently active collection: An old charge-off (where the original creditor wrote off the debt) might be less impactful than a currently active collection account, which indicates ongoing attempts to recover the debt. Lenders often view current activity as a higher risk.

The Lender's Perspective

When lenders review your credit history, active collections are indeed a red flag. They suggest a higher risk of default. However, this doesn't automatically mean a denial. Specialized lenders understand that:

- Life events (job loss, medical emergencies, divorce) can lead to collections.

- An applicant's current financial stability and income can mitigate past issues.

- A car loan, if managed responsibly, can be a crucial step in credit rebuilding.

They will scrutinize the number and age of collections, the amounts owed, and your overall payment history. Your goal is to provide context and demonstrate a renewed commitment to financial responsibility.

IV. Your Financial Footprint: Preparing for the Application Blitz in 2026

Preparation is paramount. Before you even think about applying for a car loan in 2026, you need to understand your financial standing thoroughly. This self-assessment will not only help you identify potential issues but also prepare you to present the most compelling case to lenders.

Know Thyself (Financially)

Your credit report is your financial resume. Pulling it and understanding its contents is your first, most crucial step.

- Pulling your Canadian credit report from Equifax and TransUnion: You are entitled to a free copy of your credit report from both bureaus annually. Access them online or by mail.

- Identifying all active collections: Scrutinize every detail. Who are they with? What are the original amounts? What is their current status (e.g., still active, settled, disputed)?

- Pro Tip: Dispute any inaccuracies immediately. Even minor corrections can boost your score. Contact the credit bureau with supporting documentation to have errors removed. This small step can significantly improve your standing.

Understanding your credit report is also key if you've been through a consumer proposal. For more on navigating such situations, check out Your Consumer Proposal? We're Handing You Keys.

Crafting Your Narrative

Lenders are people too, and they understand that life can throw curveballs. Having a clear, honest, and concise explanation for your collections can make a significant difference.

- How to honestly and effectively explain the circumstances behind your collections: Was it a job loss, a medical emergency, a divorce, or another unexpected life event? Be truthful without making excuses. Focus on what you learned and how your situation has changed.

- Lenders appreciate transparency and a plan: Demonstrate that you're aware of the collections, have a plan to address them (even if it's after securing the car loan), and are committed to responsible financial management moving forward.

The 'Essential Worker' Advantage

Your status as an essential worker is a powerful asset. It signals stable employment and a vital role, which can significantly offset the risk associated with collections.

- Documenting stable employment: Provide recent pay stubs, an employment letter, and T4s to demonstrate consistent income.

- Consistent income: Highlight the reliability of your earnings.

- The vital nature of your role: Emphasize that your job is not only stable but also crucial, making reliable transportation a necessity, not a luxury.

Budgeting Realities

Before you even look at cars, know what you can genuinely afford. Toronto's cost of living is high, and a car comes with many expenses beyond the monthly payment.

- Determining what you can *truly* afford: Factor in car payments, insurance, fuel, maintenance, and potential parking costs. Create a detailed monthly budget.

- Toronto's high cost of living: Be realistic about how a car payment fits into your overall expenses. Over-extending yourself now will only lead to future financial stress.

V. Navigating the Lending Labyrinth: Where to Find Your Urgent Loan in 2026

Finding the right lender is crucial when you have active collections. In 2026, the lending landscape is diverse, and knowing where to look can save you significant time and frustration. Traditional banks often have stricter criteria, making specialized lenders your most promising avenue.

Beyond the Big Five (RBC, TD, CIBC, BMO, Scotiabank)

While Canada's major banks are prominent, their lending criteria for high-risk profiles, such as those with active collections, tend to be very stringent. They typically prefer applicants with excellent credit scores and a spotless payment history.

- Why traditional banks, like RBC, may be a tougher sell for you: Their automated systems often flag active collections, leading to quick denials. They are less equipped to handle individual narratives and unique circumstances.

- Their stricter lending criteria for high-risk profiles: High credit scores, low debt-to-income ratios, and a lack of any negative marks are generally prerequisites.

Even for essential workers, navigating past bankruptcy can be tough with traditional banks. Our article Essential Worker, Ontario. Bankruptcy? Your Car Just Got Promoted. offers further insights into overcoming severe credit challenges.

The Specialized Lenders: Your Best Bet

This is where essential workers with active collections will find the most success. Specialized lenders, often referred to as subprime lenders or bad credit car loan specialists, are designed to work with individuals facing credit challenges.

- Understanding subprime lenders and 'bad credit car loan' specialists in Ontario: These lenders assess risk differently. They consider your current income, employment stability, and ability to make payments now, often placing less emphasis on past credit issues if you can demonstrate a path forward.

- Identifying reputable non-bank lenders and credit unions: Look for lenders with positive reviews and a strong track record of helping people rebuild credit. Credit unions, being community-focused, sometimes offer more flexible options.

- Pro Tip: Beware of predatory lenders. Research reviews thoroughly, check their licensing with provincial authorities (e.g., Ontario's Financial Services Regulatory Authority - FSRA), and ensure they are transparent about all fees and interest rates. A reputable lender will never pressure you into signing immediately or demand excessive upfront fees.

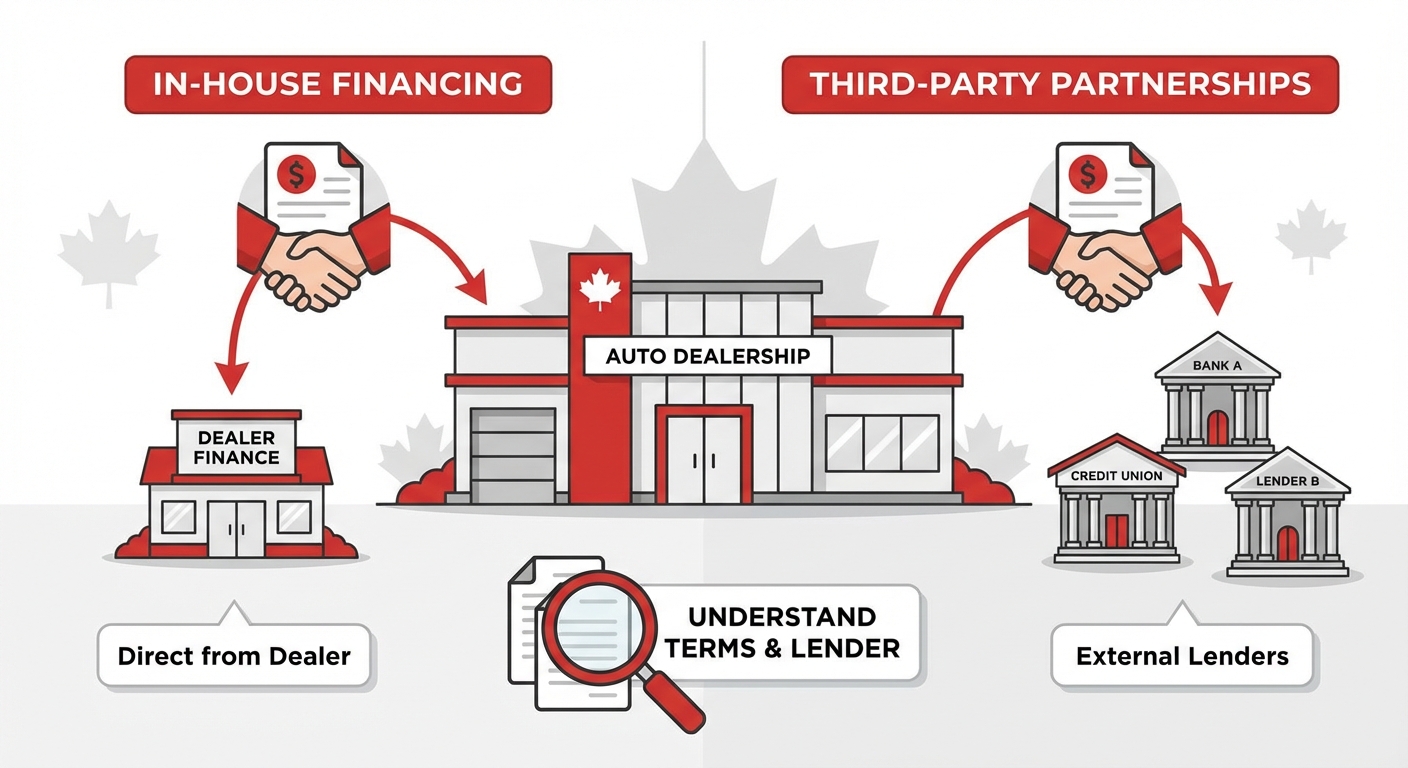

Dealership Financing (The Dealer Network)

Many dealerships, like SkipCarDealer.com, have extensive networks of lenders, including those specializing in challenging credit situations. This can be a significant advantage.

- How dealerships often have access to a wider network of lenders: Dealerships work with a variety of banks, credit unions, and subprime lenders. They act as intermediaries, matching your profile with a lender most likely to approve you.

- The difference between in-house financing and third-party partnerships: Some dealerships offer their own in-house financing, while others partner with external lenders. Both can be viable options, but always understand who the ultimate lender is and what terms they are offering.

| Feature | Traditional Banks (e.g., RBC, TD) | Alternative Lenders / Subprime Specialists |

|---|---|---|

| Credit Score Requirements | Generally 680+ (Good to Excellent) | Often 500+ (Fair to Poor), focus on current income |

| Flexibility with Collections | Very Low (often an automatic denial) | High (willing to consider explanations and current stability) |

| Interest Rates | Lower (Prime rates) | Higher (Reflects increased risk) |

| Approval Odds | Low for applicants with collections | Significantly Higher for applicants with collections |

| Speed of Approval | Can be slower due to strict review processes | Often faster due to specialized focus |

| Focus of Assessment | Primarily credit history and score | Current income, employment stability, debt-to-income ratio, ability to pay |

VI. Decoding the Dollars: Rates, Terms, and Hidden Costs with Collections in 2026

Securing a car loan with active collections in 2026 means facing certain financial realities. It's crucial to approach this process with open eyes, understanding that the terms might not be as favourable as for someone with perfect credit. Transparency about these factors will help you make informed decisions.

Interest Rates: The Elephant in the Room

Let's be frank: you should expect higher interest rates with active collections. This isn't a penalty; it's how lenders mitigate the increased risk associated with your credit profile.

- Expect higher rates with active collections: Your credit score, income, and the car's value all play a role, but active collections will push rates upwards.

- Understanding why and what's considered 'reasonable' versus exorbitant: Rates for subprime loans can range significantly, often starting in the high single digits and potentially reaching 20% or more, depending on your specific situation. Anything significantly higher than that, or rates that seem to constantly change, should raise a red flag.

- The impact of your credit score, income, and the car's value on the rate: A higher income and a substantial down payment can help secure a slightly better rate, even with collections. The car's age and value also factor into the lender's risk assessment.

Loan Terms and Payment Structures

The length of your loan also impacts your overall cost and monthly payments.

- Shorter terms vs. longer terms (e.g., 36 vs. 60 vs. 72 months): A shorter term means higher monthly payments but less interest paid over the life of the loan. Longer terms reduce monthly payments but significantly increase the total interest cost. With active collections, some lenders might push for longer terms to make payments more "affordable" on paper, so be cautious.

- Their impact on total cost and monthly payments: Always calculate the total cost of the loan (principal + interest) for different terms before committing.

- Balloon payments or other non-standard structures to watch out for: Be wary of unusual payment structures that could lead to a large lump sum payment at the end, or escalating payments. Stick to traditional, fixed-rate loans if possible.

The True Cost of Ownership in Toronto

Many first-time car buyers or those returning to car ownership underestimate the full cost, especially in a city like Toronto.

- Beyond the loan: Insurance premiums, maintenance, fuel, parking, and registration are significant expenses.

- Insurance premiums (especially in the Greater Toronto Area): Toronto and the GTA are notorious for some of the highest auto insurance rates in Canada. Your driving record, age, and the type of vehicle all play a role.

- Pro Tip: Get insurance quotes BEFORE finalizing your car purchase. Toronto insurance can be shockingly high, easily adding hundreds of dollars to your monthly expenses. Knowing this upfront will prevent budget shock and help you choose an affordable vehicle.

- Maintenance, fuel, parking, and registration: Factor in regular oil changes, potential repairs, gasoline costs, and if you live in an apartment or condo, monthly parking fees.

Down Payments

A down payment is your secret weapon when applying for a loan with active collections.

- Why a down payment significantly improves your chances and can lower your interest rate: It reduces the amount you need to borrow, lowering the lender's risk. It also shows your commitment and financial discipline.

- Strategies for saving one quickly: Even a small down payment (5-10% of the car's value) can make a difference. Consider selling unused items, temporarily cutting non-essential expenses, or working extra shifts.

VII. The Application Playbook: From Documentation to Approval in 2026

Once you've done your homework and understood the financial realities, it's time to put your application strategy into action for your 2026 car loan. Being prepared with the right documentation and approaching the process strategically will significantly improve your chances of approval.

The Essential Document Checklist

Having all your paperwork organized and ready will streamline the application process and demonstrate your seriousness to lenders.

- Proof of identity and residency:

- Valid Ontario driver's license (or other provincial license if recently moved).

- Utility bills (hydro, gas, internet) or bank statements showing your current Toronto address.

- Proof of employment:

- Recent pay stubs (2-3 months).

- An employment letter from your employer, verifying your position, start date, and annual income.

- T4s from the past two years.

- Proof of income:

- Bank statements (to show consistent income deposits and manageability, even with collections).

- Tax returns (Notice of Assessment) if self-employed or for additional income verification.

- Explanation of collections: Your prepared narrative outlining the circumstances behind your collections and your plan moving forward.

- Pro Tip: Have everything organized in a digital folder for quick submission. Scan or photograph all documents clearly. This preparedness makes a strong positive impression and speeds up the entire process.

The Art of the Application

Don't just apply everywhere. Be strategic.

- Applying strategically: Don't spray and pray: Each "hard" credit inquiry can slightly lower your credit score. Apply to 2-3 carefully chosen lenders known for working with bad credit, or through a dealership that can submit your application to multiple lenders with a single inquiry.

- Understanding soft vs. hard credit inquiries: A "soft" inquiry (like checking your own credit) doesn't affect your score. A "hard" inquiry (when a lender checks your credit for an application) does.

- The role of a co-signer (if available and willing): If you have a trusted friend or family member with good credit who is willing to co-sign, it can dramatically improve your approval odds and secure a much better interest rate. A co-signer takes on equal responsibility for the loan, so ensure they understand the commitment.

The 'Urgent' Factor

While you need a car urgently, avoid appearing desperate. Lenders want to see a responsible borrower, not someone making rash decisions.

- How to communicate your urgency without appearing desperate: Clearly explain your essential work role and why reliable transportation is a necessity for your employment. Focus on your stability and commitment, not just the immediate need.

- What realistic timelines to expect for approval and vehicle acquisition: While some approvals can happen quickly (within 24-48 hours), allow a few days for the full process, especially if multiple lenders are involved. Vehicle acquisition depends on availability and your chosen dealer.

VIII. Driving Smarter: Choosing the Right Vehicle for Your Situation in 2026

With active collections, your priority should be securing reliable transportation that fits your budget, not a luxury vehicle. In 2026, the used car market offers many excellent, affordable options.

Reliability Over Luxury

Your goal is to get from point A to point B safely and consistently for your essential work. This means prioritizing dependability.

- Why a dependable, fuel-efficient used car is your best friend right now: Used cars are more affordable, reducing the loan amount and associated interest. Opt for models known for longevity and lower maintenance costs.

Maintenance History is Key

A car's history can tell you a lot about its future reliability.

- Insisting on vehicle history reports (CarFax, CarProof): These reports reveal past accidents, repair history, and odometer discrepancies.

- Pre-purchase inspections: Always have an independent mechanic inspect the vehicle before purchase. This small investment can save you thousands in future repairs.

Affordable Brands and Models

Certain manufacturers consistently produce reliable, cost-effective vehicles.

- Researching vehicles known for lower insurance costs and maintenance expenses in Canada: Honda Civic, Toyota Corolla, Hyundai Elantra, Mazda 3 are often recommended for their reliability, fuel efficiency, and reasonable insurance premiums in Canada.

Negotiation Tactics

Even with challenging credit, you still have room to negotiate the car's price.

- Don't shy away from negotiating the car price: Focus on the out-the-door price, not just the monthly payment. Research market values for similar vehicles to ensure you're getting a fair deal.

IX. Beyond the Loan: Rebuilding Your Financial Foundation in Ontario in 2026

Securing an essential car loan with active collections is a significant achievement, but it's also the beginning of a new chapter. This loan, if managed wisely, becomes a powerful tool for rebuilding your financial health in Ontario in 2026 and beyond.

Making Payments On Time, Every Time

This is the single most important step you can take to repair your credit.

- The most crucial step to rebuilding your credit score: Every on-time payment is reported to the credit bureaus, gradually improving your payment history and, consequently, your credit score.

Automating Payments

Remove the risk of forgetfulness.

- Set it and forget it to avoid missed deadlines: Arrange for automatic withdrawals from your bank account on or before the due date.

Addressing the Collections

While you're managing your new car loan, don't ignore your existing collections. Actively working to resolve them will further boost your credit score over time.

- Strategies for actively working to resolve existing collections while managing your new car loan:

- Settling for less: Many collection agencies are willing to settle for a percentage of the original debt, especially if you can offer a lump sum.

- Payment plans: If a lump sum isn't feasible, negotiate a manageable payment plan.

- Credit counselling services (e.g., Credit Counselling Society in Ontario): Non-profit credit counselling agencies can help you create a debt management plan and negotiate with creditors on your behalf.

Diversifying Your Credit

Once you've established a consistent payment history with your car loan, consider other steps to diversify your credit mix.

- Once established, consider a secured credit card or small credit-builder loan: These products are designed for individuals with poor or no credit and can further demonstrate your ability to manage different types of credit responsibly.

The Long-Term View

Your essential car loan isn't just about getting from A to B; it's a stepping stone.

- How this essential car loan, managed responsibly, becomes a powerful tool for financial recovery and future opportunities: A well-managed car loan will open doors to better interest rates on future loans, mortgages, and other financial products. It's a testament to your renewed financial responsibility. For those who've gone through significant financial restructuring, such as a consumer proposal, this disciplined approach to a car loan can be a true "mulligan" for your credit score, as highlighted in Post-Proposal Car Loan: Your Credit Score Just Got a Mulligan.

X. Your Next Steps to Approval: A Toronto Essential Worker's Action Plan for 2026

The journey to securing an urgent car loan with active collections in Toronto for 2026 might seem daunting, but by breaking it down into manageable steps, you can achieve your goal. This action plan summarizes everything you need to do to drive forward.

- Step 1: Financial Self-Assessment. Pull your credit reports from Equifax and TransUnion. Identify and understand all active collections. Dispute any inaccuracies immediately.

- Step 2: Budget Realism. Determine exactly what you can afford for a monthly car payment, insurance, fuel, and maintenance in Toronto's high-cost environment.

- Step 3: Craft Your Narrative. Prepare a clear, honest explanation for your collections, focusing on current stability and your plan for the future.

- Step 4: Gather Documents. Compile all necessary proof of identity, residency, employment, and income into an organized digital folder.

- Step 5: Target Lenders Wisely. Focus on specialized lenders or dealerships with extensive networks that work with challenging credit. Avoid randomly applying to big banks.

- Step 6: Consider a Down Payment & Co-signer. If possible, save a down payment and explore the option of a co-signer to improve your approval odds and interest rate.

- Step 7: Prioritize Practicality. When choosing a vehicle, emphasize reliability, fuel efficiency, and lower maintenance costs over luxury. Always get a vehicle history report and pre-purchase inspection.

- Step 8: Plan for Long-Term Credit Repair. Commit to making all car loan payments on time, every time. Actively work towards resolving existing collections.

Remember, your essential role in Toronto is vital, and reliable transportation is often a necessity for that. With preparedness, careful selection of lenders, and a commitment to financial discipline, you can overcome past hurdles and secure the car loan you need. We're here to help you navigate this process and get you on the road in 2026.