Refinance Car Loan with Disability Benefits in BC | Guide

Table of Contents

- Key Takeaways

- Key Takeaways: The 4 Crucial Facts for Refinancing on a Fixed Income

- Your Income Source Isn't a Barrier

- Credit Score is King

- Your Car's Value Matters

- Shopping Lenders is Non-Negotiable

- Is Refinancing Your Vehicle Loan the Right Financial Move for You?

- The Green Light: Scenarios Where Refinancing Makes Perfect Sense

- The Yellow Light: Situations Where You Should Pause and Re-evaluate

- Inside the Lender's Mind: What They Scrutinize When You're on Disability Income

- Deep Dive: Proving Income Stability and Longevity

- The Debt-to-Income (DTI) Calculation on a Fixed Income

- Loan-to-Value (LTV): The Risk Factor Tied to Your Vehicle

- Your Strategic Refinancing Playbook: A 4-Phase Action Plan for 2026

- Phase 1: The Pre-Application Audit

- Phase 2: The Lender Showdown (Credit Unions vs. Big Banks vs. Online Lenders)

- Phase 3: Submitting a Bulletproof Application

- Phase 4: Decoding the Offer and Closing the Deal

- The 2026 Outlook: How Economic Shifts Could Impact Your Refinancing Options

- Interest Rate Forecasts and Your Window of Opportunity

- The Rise of Fintech and AI-Powered Lending

- Potential Policy Watch: Government Programs and Credit Accessibility

- Your Next Steps: A Checklist for Securing a Lower Car Payment

- Frequently Asked Questions (FAQ)

Living in British Columbia on a fixed income from disability benefits requires sharp financial management. Your vehicle isn't a luxury; it's a lifeline to appointments, groceries, and community. But what if your current car payment is a source of stress, a relic of a time when your credit was weaker or interest rates were higher? You're likely asking: "Can I refinance my car loan with disability benefits in British Columbia?"

The answer is a definitive yes. This guide for 2026 is designed to move beyond simple answers and give you a strategic playbook. We'll dismantle the myths, reveal what lenders truly look for, and provide a step-by-step plan to help you lower your monthly payment and improve your financial well-being. At SkipCarDealer.com, we believe your income source shouldn't be a barrier to a fair deal.

Key Takeaways

- Your Income Source Isn't a Barrier: Lenders in BC prioritize stable, verifiable income and your overall financial health. Disability benefits like PWD or CPP-D are often seen as highly reliable, long-term income streams, which can be a significant advantage. The key is presenting it correctly.

- Credit Score is King: A strong credit score is your most powerful tool for unlocking lower interest rates. Even a 30-50 point improvement since your original loan can translate into thousands of dollars in savings over the life of your new loan.

- Your Car's Value Matters: Lenders will scrutinize the Loan-to-Value (LTV) ratio. If you owe significantly more than your car is currently worth (known as being "upside-down" or having negative equity), finding a lender to refinance can be challenging, but not impossible.

- Shopping Lenders is Non-Negotiable: Accepting the first offer you receive is a costly mistake. Rates and approval criteria vary dramatically between major banks, local credit unions, and specialized online lenders. A comprehensive search is essential to securing the best possible terms.

Key Takeaways: The 4 Crucial Facts for Refinancing on a Fixed Income

Yes, you can absolutely refinance your car loan in British Columbia while receiving disability benefits. Lenders are primarily concerned with your ability to make consistent payments, and verified disability income is often viewed as one of the most stable income sources available. Your success hinges on understanding the lender's criteria and presenting a strong financial profile.

Your Income Source Isn't a Barrier

Let's clear this up immediately: it is illegal in Canada for lenders to discriminate based on the source of your income, provided it is legal and verifiable. The name on the paystub—whether it's from an employer, CPP Disability (CPP-D), or a provincial program like Persons with Disabilities (PWD) benefits—is less important than its consistency and reliability.

Your job is to frame your disability benefits not as a limitation, but as a strength. Unlike employment income, which can fluctuate or end, long-term disability benefits are often guaranteed for years, making you a predictable and low-risk borrower in the eyes of an underwriter.

Credit Score is King

While your income stability is foundational, your credit score is the key that unlocks the door to the best interest rates. A lender sees your credit score as a direct reflection of your history with managing debt. A higher score signals lower risk, and lenders reward low risk with low rates.

Even small improvements matter. If your score has climbed from 620 to 670 since you first bought your car, you've moved into a new tier for many lenders. This alone could be enough to secure a rate that saves you $50-$100 per month.

Your Car's Value Matters

A car loan is a "secured" loan, meaning the vehicle itself is the collateral. If you stop making payments, the lender can repossess the car to recoup their losses. This is why they care deeply about its current market value. They use a metric called the Loan-to-Value (LTV) ratio.

If you want to refinance a $15,000 loan balance on a car that's only worth $12,000, your LTV is 125% ($15,000 / $12,000). Many lenders have a cap, often around 120-130%, making high-LTV situations difficult to approve. It's crucial to know your car's value early in the process. For more on this specific challenge, our guide on how to handle an Upside-Down Car Loan? How to Refinance Without a Trade 2026 provides specialized strategies.

Shopping Lenders is Non-Negotiable

The auto finance market is incredibly diverse. The bank where you have your chequing account, the local credit union in your neighbourhood, and an online-only auto finance company will all look at your application through a different lens and offer you a different rate.

Banks are often great for prime borrowers but can be rigid. Credit unions are member-focused and may offer more flexibility. Online lenders specialize in speed and convenience. Not comparing these options is like leaving money on the table—potentially thousands of dollars over your loan term.

Is Refinancing Your Vehicle Loan the Right Financial Move for You?

Before diving into applications, it's vital to determine if refinancing is the correct strategy for your specific situation. It's not a universal solution. Think of it as a financial tool that's highly effective when used at the right time for the right reasons.

The Green Light: Scenarios Where Refinancing Makes Perfect Sense

- Your credit score has improved significantly. This is the number one reason to refinance. If you've made 12-24 months of on-time payments and managed other debts well, your score has likely increased, making you eligible for much better rates.

- Interest rates have dropped. If market rates set by the Bank of Canada have fallen since you took out your original loan, you may be able to get a lower rate even if your personal credit profile hasn't changed.

- Your original loan was high-interest. If you were in a tough spot and had to accept a loan from a 'buy here, pay here' lot or a subprime lender, you're almost certainly paying a rate well above the market average. Refinancing can be a game-changer.

- You need to lower your monthly payment. For those on a fixed income, improving monthly cash flow is paramount. Extending your loan term (e.g., from 36 months remaining to 60 months) can dramatically reduce your payment, even if the interest rate savings are modest.

The Yellow Light: Situations Where You Should Pause and Re-evaluate

- Your car is older or has high mileage. Most lenders have restrictions. If your vehicle is more than 7-8 years old or has over 150,000 kilometres, finding a lender willing to refinance can be tough.

- You have significant negative equity. As mentioned with LTV, if you owe much more than the car is worth, you may need to pay down the balance or wait for the loan to amortize further before you can refinance.

- Your original loan has a steep prepayment penalty. While less common in Canada for auto loans, it's crucial to read your original contract. If there's a penalty for paying the loan off early, it could wipe out any potential savings from a lower interest rate.

- You have a year or less left on your loan. Most of the interest on a loan is paid in the early years. If you're near the end of your term, the savings from refinancing are often minimal and may not be worth the administrative effort.

Pro Tip: The '1% Rule'

Here's a simple heuristic to guide your decision: If you can't secure a new interest rate that's at least 1-2% lower than your current rate, the hassle and any minor administrative fees associated with refinancing may not be worth the minimal savings. Aim for a significant reduction to make the process worthwhile.

Inside the Lender's Mind: What They Scrutinize When You're on Disability Income

To get approved, you need to think like an underwriter. They aren't trying to deny you; they're trying to assess risk. Your application needs to answer their three biggest questions confidently: Can you prove your income? Can you afford the payment? Is the collateral (your car) worth the loan amount?

Deep Dive: Proving Income Stability and Longevity

This is where you shine. An underwriter's main fear with employment income is that the applicant could lose their job. Your income source mitigates this fear. You need to provide clear documentation that proves its stability.

Your Document Checklist:

- T4A(P) Slip: This is the official government document for your CPP Disability benefits.

- Letter of Entitlement: A letter from the provincial or federal body administering your benefits that confirms the amount and duration. If your benefits are permanent, this letter is gold.

- Bank Statements: Provide the last 3-6 months of statements from your primary chequing account. Highlight the consistent, recurring direct deposits from "Gov. of Canada" or the relevant provincial ministry. This is undeniable proof of cash flow.

When you present this package, you're not just showing income; you're demonstrating reliability that many other applicants can't match. This is a similar principle for those on other assistance programs, as detailed in our guide Approval Secrets: Financing a Vehicle on AISH or Disability in Alberta, showing this is a recognized process across provinces.

The Debt-to-Income (DTI) Calculation on a Fixed Income

Your DTI ratio is a critical metric. It's the percentage of your gross monthly income that goes toward paying your monthly debt obligations. Lenders use it to gauge your ability to handle a new payment.

The Formula: (Total Monthly Debt Payments / Gross Monthly Income) x 100 = DTI Ratio

Let's walk through an example for someone in BC:

- Gross Monthly Income: $1,900 (e.g., from CPP-D and/or PWD)

- Monthly Debt Payments:

- Rent: $950

- Credit Card Minimum Payment: $50

- Student Loan Payment: $0 (currently in deferment)

- Total Monthly Debt: $1,000

- Calculation: ($1,000 / $1,900) x 100 = 52.6% DTI

In this scenario, a 52.6% DTI is high. Most lenders prefer a DTI under 45%. Because your income is fixed, you have less room for unexpected expenses, so lenders scrutinize this number even more closely. Lowering your DTI by paying off a small credit card balance before you apply can significantly improve your chances.

Loan-to-Value (LTV): The Risk Factor Tied to Your Vehicle

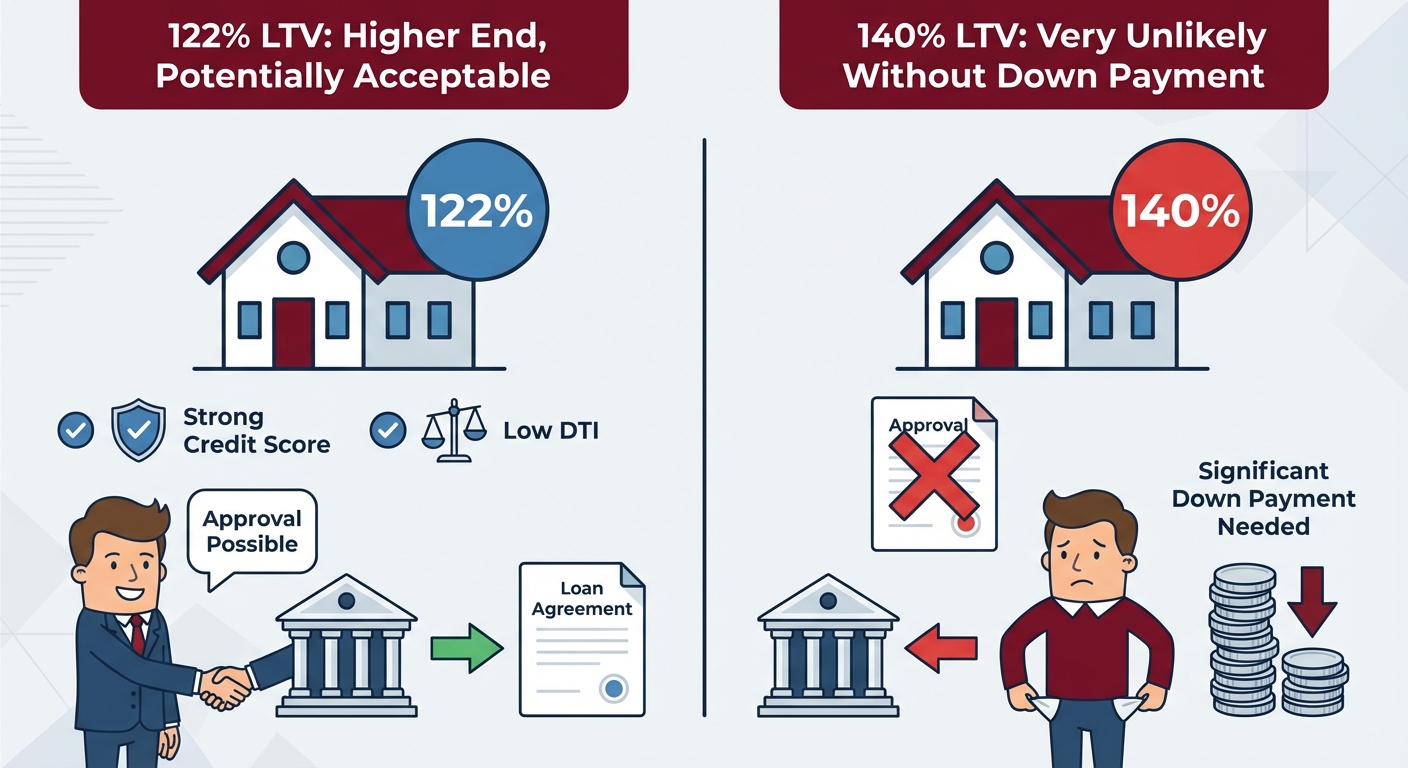

As we covered, LTV measures the loan amount against the car's value. Lenders see a high LTV as a major risk. If the borrower defaults, repossessing and selling the car might not cover the outstanding loan balance, leading to a loss for the lender.

The Formula: (Refinance Loan Amount / Car's Current Market Value) x 100 = LTV Ratio

Example:

- Current Loan Payoff Amount: $22,000

- Car's Value (from Canadian Black Book): $18,000

- Calculation: ($22,000 / $18,000) x 100 = 122% LTV

An LTV of 122% is on the higher end but may be acceptable to some lenders, especially if you have a strong credit score and low DTI. If your LTV were 140%, approval would be very unlikely without a significant down payment to reduce the loan amount.

Your Strategic Refinancing Playbook: A 4-Phase Action Plan for 2026

Ready to take action? Follow this structured plan to navigate the refinancing process efficiently and secure the best possible outcome.

Phase 1: The Pre-Application Audit

Before you speak to a single lender, get your financial house in order. This preparation phase is the most important part of the process.

- Get Your Credit Report: Request your free credit report from both Equifax and TransUnion. Review it line by line for any errors. A simple mistake could be costing you valuable points.

- Dispute Errors: If you find an inaccuracy (e.g., a debt that isn't yours, a late payment that was actually on time), file a dispute immediately.

- Calculate Your Numbers: Use the formulas above to calculate your current DTI and LTV. Knowing these numbers puts you in a position of power.

- Gather Your Documents: Create a digital folder on your computer. Scan or download your T4A, letter of entitlement, last three months of bank statements, driver's license, and a copy of your current loan statement. Being organized makes a great first impression.

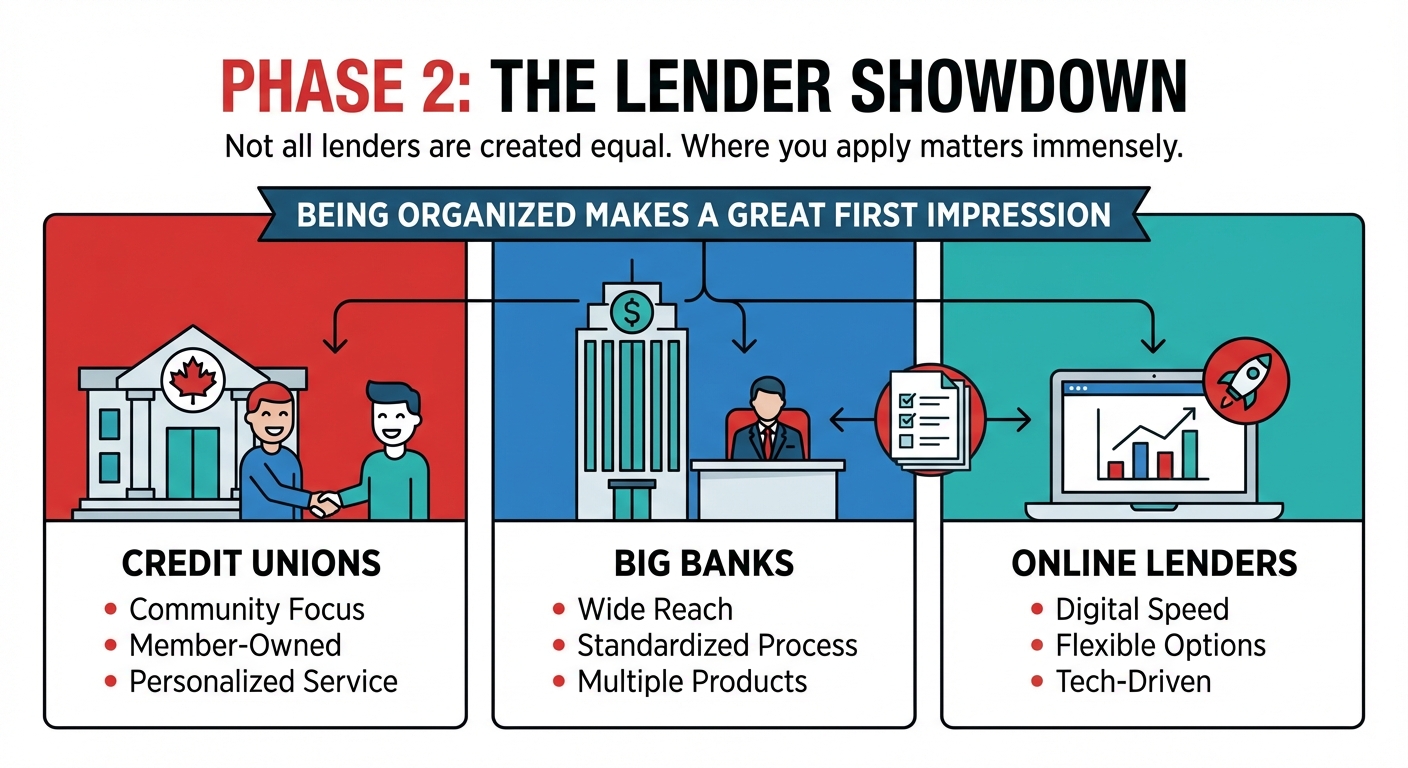

Phase 2: The Lender Showdown (Credit Unions vs. Big Banks vs. Online Lenders)

Not all lenders are created equal. Where you apply matters immensely, especially with a non-traditional income source.

Pro Tip: The Power of Pre-Qualification

Look for lenders who offer "pre-qualification" or "pre-approval" with a soft credit check. A soft check does NOT impact your credit score. This allows you to see what interest rates you're likely to be offered from multiple sources without any risk. Once you've chosen the best offer, you can proceed with a formal application, which will involve a hard credit check.

Phase 3: Submitting a Bulletproof Application

How you fill out the application can preemptively answer an underwriter's questions and smooth the path to approval.

- Employer Field: Don't leave this blank. Enter "Government of Canada - CPP Disability" or "BC Ministry of Social Development - PWD Program." This looks professional and clear.

- Income Type: If there's an option, select "Fixed Income," "Pension," or "Other." In the notes, specify it as "Permanent Disability Income."

- Be Honest and Accurate: Double-check all numbers. A small typo can cause delays or even a denial. Disclose all your debts as requested; they will see them on your credit report anyway.

Phase 4: Decoding the Offer and Closing the Deal

Once you have an offer, review it carefully before signing.

- APR vs. Interest Rate: The Annual Percentage Rate (APR) is the true cost of borrowing. It includes the interest rate plus any mandatory fees. Always compare offers based on APR.

- Look for Junk Fees: Question any fees you don't understand, such as "loan processing fees" or "acquisition fees." These are sometimes negotiable.

- Confirm the Details: Ensure the loan term (e.g., 60 months), monthly payment, and total loan amount match what you discussed.

- The Final Steps: Once you sign the new loan documents, the new lender will pay off your old lender directly. You'll simply start making your new, lower payments to the new finance company on the agreed-upon date.

The 2026 Outlook: How Economic Shifts Could Impact Your Refinancing Options

The financial landscape is always changing. Staying aware of upcoming trends can help you time your refinancing decision perfectly.

Interest Rate Forecasts and Your Window of Opportunity

After a period of rate hikes, the Bank of Canada is signaling a potential shift. As we move through 2026, many economists predict that interest rates may begin to stabilize or even decrease slightly. If you refinance now, you can lock in a better rate than you have. If rates drop further in 6-12 months, you could even consider refinancing again. The key is to act when the opportunity presents itself.

The Rise of Fintech and AI-Powered Lending

New technology is revolutionizing how lenders assess risk. Traditional underwriting relied heavily on a few key data points. Modern AI-powered systems can analyze a much broader range of information, including your banking history and payment consistency.

This is great news for applicants with fixed incomes. An AI model can recognize the extreme stability of government-issued benefits more effectively than a traditional scorecard, potentially leading to more approvals and better rates from tech-forward online lenders.

Potential Policy Watch: Government Programs and Credit Accessibility

There is an ongoing conversation in Canada about financial inclusion. Governments and regulators are increasingly focused on ensuring fair access to credit for all Canadians, regardless of their income source. While no major policy changes are imminent, the trend is toward greater acceptance and understanding of incomes like disability benefits. This evolving regulatory environment will continue to make it easier for applicants like you to be treated fairly in the credit marketplace. Successfully navigating debt programs is also a factor, something we explore in our Get Car Loan After Debt Program Completion: 2026 Guide.

Your Next Steps: A Checklist for Securing a Lower Car Payment

Information is only powerful when you act on it. Here is a simple, time-bound checklist to turn this guide into real savings.

- This Week: Get Your Numbers.

Pull your free credit report from Equifax or TransUnion. Use a free online tool like Canadian Black Book to get a realistic valuation for your vehicle. Use our examples to calculate your DTI.

- Next Week: Gather Your Proof.

Log into your online banking and download the last three months of statements. Find your most recent T4A or the official letter confirming your benefits. Save everything in one digital folder.

- Within 30 Days: Shop Smart.

Armed with your information, apply for pre-qualification with at least three lenders: one credit union, one major bank, and one reputable online lender. Do this within a 14-day window to minimize the impact of hard inquiries on your credit score.

- Final Step: Make the Call.

Compare the APRs, terms, and fees from your offers. Choose the one that provides the most savings, notify your current lender you are paying them out, and finalize the paperwork. Then, enjoy your new, lower car payment.