2026 $0 Down EV Loan: Bad Credit Blueprint | Ontario, Canada

Table of Contents

- Key Takeaways

- Debunking the 'Instant Approval' Promise: What It Really Means in 2026

- The 60-Second Scan: Unpacking Pre-Qualification

- Pre-Qualification vs. Underwriting: Why a 'Yes' Can Become a 'No'

- The Impact of Multiple Inquiries

- The 2026 EV Landscape: New Rules & New Cars for Subprime Buyers

- Market Outlook: Are Lenders Tightening or Loosening the Purse Strings?

- The New Wave of 'Affordable' EVs

- Deep Dive: How Government Rebates Affect Your Loan Structure

- Beyond the Score: Building a Bulletproof Application Lenders Can't Ignore

- The Income-to-Debt Trinity

- Expert Walkthrough: Calculate and Improve Your DTI in 30 Days

- Experience Scenario: 'Meet Alex.'

- The True Cost of Zero Down: A Deep Dive into High-Interest Loan Agreements

- APR vs. Interest Rate: Decoding the Hidden Fees

- The Amortization Trap

- Your Counter-Offensive

- Your Next Steps: A 5-Step Blueprint for Getting Approved in 2026

- Step 1: The Reconnaissance Mission

- Step 2: The 'All-In' Budget

- Step 3: The Pre-Approval Gauntlet

- Step 4: The Dealership Negotiation

- Step 5: The Final Review

- Frequently Asked Questions

The year is 2026. The hum of electric vehicles is no longer a novelty on Ontario's roads; it's the new standard. But for many, the dream of plugging in instead of gassing up feels out of reach, blocked by a three-digit number: their credit score. If you're staring at a sub-600 score and believe a zero-down EV loan is impossible, this blueprint is designed to change your perspective. It's not about magic; it's about strategy.

The landscape of auto finance, especially for bad credit, is shifting. Lenders are looking beyond past mistakes and focusing on your present financial stability. The promise of "zero down bad credit EV loan Canada instant approval" isn't a myth, but it's a path filled with nuances that can either cost you thousands or save you a fortune. This guide will arm you with the knowledge to navigate that path, turning your challenging credit situation into a powerful negotiating position.

Key Takeaways

- Approval is Realistic: Getting approved for a $0 down EV loan with a sub-600 credit score is possible, but hinges more on your income stability and debt-to-income ratio than the score itself.

- 'Instant' Isn't Final: 'Instant approval' is typically a pre-qualification. Final approval requires document verification and underwriting. Use it as a tool, not a guarantee.

- Cost vs. Convenience: A zero-down loan offers immediate access to a vehicle but results in a higher total cost of borrowing due to higher interest rates and financing the full vehicle value.

- The 2026 EV Market: An influx of new, more affordable EV models in 2026 may increase lender willingness to finance them, but criteria for subprime borrowers remain strict.

- Your Blueprint: The key to success is preparation. Securing an outside pre-approval before visiting a dealership is your most powerful negotiating lever.

Debunking the 'Instant Approval' Promise: What It Really Means in 2026

A zero-down bad credit EV loan in Canada with "instant approval" means you've passed a preliminary digital check. An algorithm scans your basic information against a lender's minimum criteria for income and credit. It's a pre-qualification, not a final, legally-binding loan offer. Final approval only comes after a human underwriter verifies your documents.

The 60-Second Scan: Unpacking Pre-Qualification

When you click "apply" for an instant approval, a lender's system isn't reading your entire life story. It's performing a rapid, automated check on a few key data points:

- Identity Verification: Does the name and address you provided match what's on your credit file?

- Credit Score Range: Does your score fall within their acceptable bracket for subprime lending (often 550+)?

- Major Red Flags: Are there active bankruptcies, recent repossessions, or accounts in collections that are immediate deal-breakers?

- Stated Income: Does the income you listed meet their minimum threshold (e.g., $2,200/month)?

It's a "go/no-go" gauge. A "go" simply means you're invited to the next stage; it's not a guarantee you'll cross the finish line.

Pre-Qualification vs. Underwriting: Why a 'Yes' Can Become a 'No'

The gap between pre-qualification and final approval is called underwriting. This is where the human element comes in, and it's where many applications falter. An underwriter will ask for proof of everything you claimed:

- Pay Stubs or Bank Statements: To verify your income is real, consistent, and matches what you stated.

- Employment Verification: They may call your employer to confirm your job status and length of employment.

- Debt-to-Income (DTI) Calculation: They will pull your full credit report, list all your monthly debt payments (credit cards, other loans, rent/mortgage), and compare it to your verified gross monthly income.

If your stated income was inflated, or if your credit report reveals more debt than the algorithm initially saw, that promising "instant approval" can be quickly reversed.

The Impact of Multiple Inquiries

Every time you formally apply for a loan, it results in a "hard inquiry" on your credit report, which can temporarily lower your score by a few points. However, credit scoring models are smart. They understand that people shop for rates on major purchases.

FICO and TransUnion models typically group all auto loan inquiries made within a 14 to 45-day window and treat them as a single event. This allows you to shop around with multiple lenders without pulverizing your score. The key is to do your rate shopping in a condensed timeframe.

Pro Tip: Always confirm a lender is using a 'soft pull' for pre-qualification. A soft pull (or soft inquiry) allows a lender to see a modified version of your credit report without affecting your score at all. This is the safest way to explore your options and see what rates you might qualify for before committing to a formal application and a hard inquiry.

The 2026 EV Landscape: New Rules & New Cars for Subprime Buyers

The electric vehicle market in 2026 is a different beast than it was just a few years ago. For buyers in Ontario with bruised credit, this presents both opportunities and new challenges.

Market Outlook: Are Lenders Tightening or Loosening the Purse Strings?

In our experience, lenders are cautiously optimistic. On one hand, economic uncertainty keeps underwriting criteria for subprime loans tight. On the other, the sheer volume of new EVs hitting the market, coupled with government mandates, means lenders *need* to finance these vehicles to stay competitive.

The result? Lenders are more willing to finance EVs than ever before, but they are scrutinizing the stability of the applicant more than ever. A steady job and a manageable debt load are your golden tickets.

The New Wave of 'Affordable' EVs

Lenders manage risk. A $90,000 luxury EV is a much bigger risk than a $45,000 mainstream model, especially for a subprime borrower. In 2026, lenders will be far more comfortable financing new, high-volume models with strong warranties and established resale values. Think vehicles like:

- Chevrolet Equinox EV

- Volvo EX30

- Forthcoming affordable models from Hyundai, Kia, and Honda

They are often less enthusiastic about financing older, out-of-warranty used EVs (especially from brands with high repair costs) or niche, high-depreciation models. The vehicle you choose has a direct impact on your approval odds.

Deep Dive: How Government Rebates Affect Your Loan Structure

This is a critical detail for Ontario buyers. The federal iZEV (Incentives for Zero-Emission Vehicles) program provides a rebate on new EVs. The crucial question is *how* that rebate is applied.

Most dealerships apply the federal rebate directly at the point of sale. This is the best-case scenario for you. For example:

Vehicle Price: $50,000

Federal iZEV Rebate: -$5,000

Amount to be Financed: $45,000

This directly reduces your loan principal, lowering your monthly payment and the total interest you'll pay. Always confirm with the dealership's finance manager that they apply the rebate "off the top" before you sign any paperwork. If a rebate is offered as a post-purchase tax credit, it won't help reduce your loan size, meaning you'll be financing the full, pre-rebate price of the car.

Beyond the Score: Building a Bulletproof Application Lenders Can't Ignore

Your credit score is a story of your past. Your income and debt-to-income (DTI) ratio tell the story of your present and future. In 2026, lenders are reading the second story much more closely.

The Income-to-Debt Trinity

For subprime lending, three factors now often outweigh a FICO score:

- Proof of Income: How much do you make? Is it verifiable through pay stubs or bank deposits?

- Stability of Income: How long have you been at your current job? Lenders love to see two or more years at the same employer. It signals stability. For those with a new job, a signed offer letter can be a powerful tool. For more on this, check out our guide on Job Offer's Catch? Your Car Loan Just Caught It. Drive to Work, Edmonton.

- Debt-to-Income (DTI) Ratio: What percentage of your gross monthly income is already spoken for by other debt payments? This is arguably the single most important number in your application.

Expert Walkthrough: Calculate and Improve Your DTI in 30 Days

Calculating your DTI is simple. First, add up all your monthly debt payments (rent/mortgage, minimum credit card payments, student loans, other car loans, personal loans). Do not include utilities, groceries, or gas. Second, find your gross monthly income (your income before any taxes or deductions). Then, divide your total monthly debts by your gross monthly income.

Formula: (Total Monthly Debt Payments / Gross Monthly Income) x 100 = DTI %

Example:

Rent: $1800

Credit Card Minimums: $150

Student Loan: $200

Total Debt: $2150

Gross Monthly Income: $5,000

DTI = ($2150 / $5000) x 100 = 43%

Most lenders want to see a DTI below 45% (including the new car payment). To improve your DTI before applying, focus on paying down small credit card balances to reduce your minimum payments. Even paying off a small $500 card can lower your DTI by a crucial percentage point or two.

Experience Scenario: 'Meet Alex.'

Let's compare two applicants. Alex has a 570 credit score, tarnished by a medical collection from three years ago. However, Alex has worked at the same factory in Mississauga for two years, brings home a steady $4,800/month, and has a DTI of 35%.

Now meet Ben. Ben has a "better" 620 credit score. But Ben is a gig worker with fluctuating income and a high DTI of 48% due to maxed-out credit cards.

In 2026, a lender will almost always approve Alex over Ben. Alex's application screams stability and ability to pay. Ben's application signals risk, despite the higher score. Lenders see that Alex has the proven cash flow to handle a new payment, a history that is crucial for those who have gone through credit challenges like a consumer proposal. For a deeper look at this scenario, read The Consumer Proposal Car Loan You Were Told Was Impossible.

Pro Tip: If you're a gig worker or self-employed in cities like Toronto or Vancouver, your bank statements are your best friend. Lenders struggle with variable income. Make their job easy by using 12-24 months of bank statements to create a simple profit and loss (P&L) statement. Show your total deposits (revenue) and business-related expenses. The result is a clear 'net income' figure that translates your hustle into a language lenders understand and trust. If you rely on gig work, our guide on 'Empty Wallet' Car Loans for Gig Workers, Ontario is a must-read.

The True Cost of Zero Down: A Deep Dive into High-Interest Loan Agreements

The convenience of a $0 down loan comes at a price. By not providing a down payment, you are financing 100% of the vehicle's value (plus taxes and fees), which increases the lender's risk. To compensate for this risk, especially with a low credit score, they will charge a higher interest rate. Understanding exactly how this works is key to managing your loan effectively.

APR vs. Interest Rate: Decoding the Hidden Fees

The interest rate is simply the cost of borrowing the money. The Annual Percentage Rate (APR) is the true cost of the loan. It includes the interest rate PLUS any additional lender fees, such as loan origination or administration fees, rolled into the loan.

Always compare loans based on APR, not the interest rate. A loan with a lower interest rate but high fees could have a higher APR (and be more expensive) than a loan with a slightly higher rate but no fees.

| Credit Tier | Typical Credit Score Range | Example APR on a New EV | Notes |

|---|---|---|---|

| Prime Plus (Tier 1) | 780+ | 5.99% - 7.99% | Eligible for manufacturer's promotional financing. |

| Prime (Tier 2) | 680 - 779 | 8.00% - 10.99% | Good rates from major banks and credit unions. |

| Near-Prime (Tier 3) | 620 - 679 | 11.00% - 15.99% | Where specialized lenders and some dealership financing begin. |

| Subprime (Tier 4/5) | 550 - 619 | 16.00% - 24.99%+ | Requires specialized lenders focusing on DTI and income stability. |

The Amortization Trap

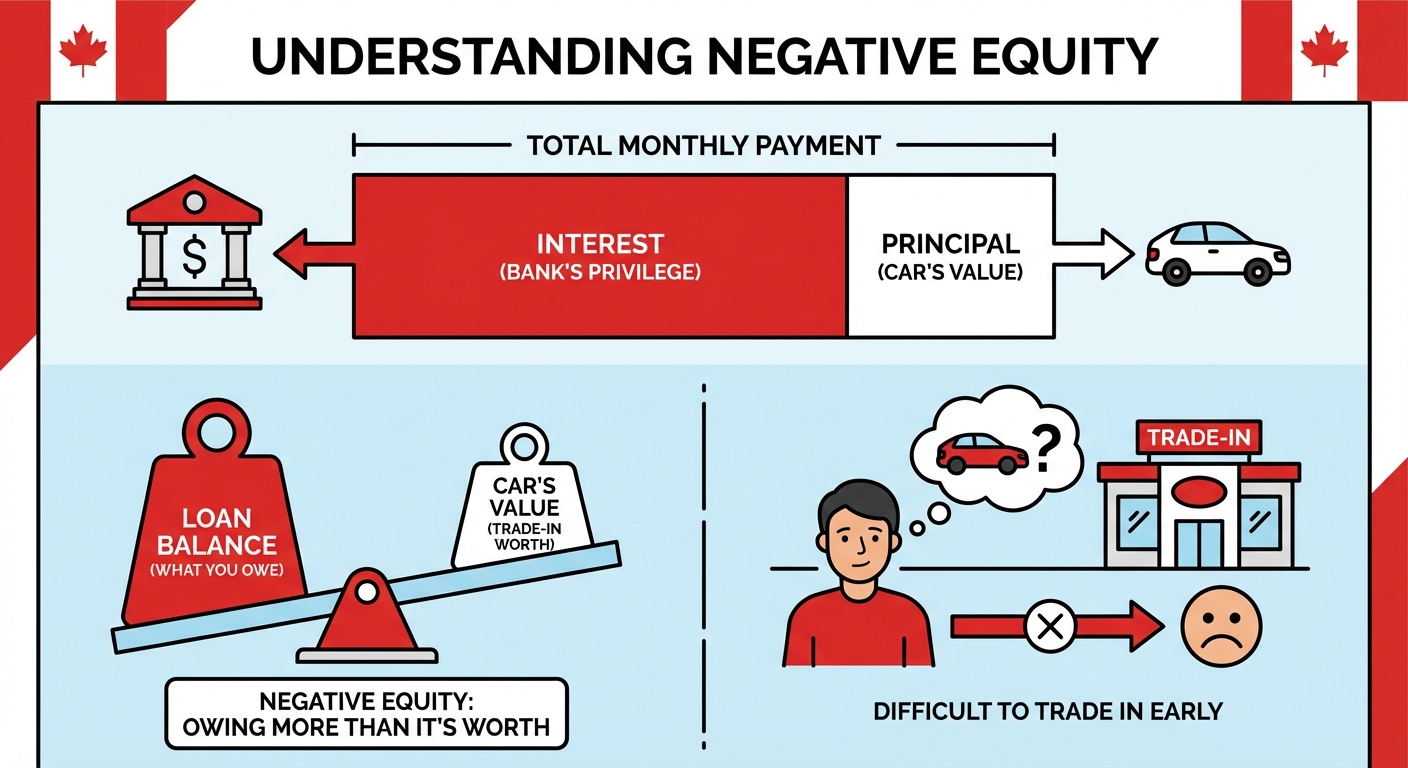

Amortization is how your loan payments are allocated between principal (the money you borrowed) and interest (the cost of borrowing). On a high-interest loan, your payments are heavily skewed towards interest in the early years.

This means for the first 18-24 months, you are barely making a dent in what you actually owe on the car. You're primarily paying the bank for the privilege of the loan. This is why it can be difficult to trade in a vehicle early in a high-interest loan; you often owe more than the car is worth (known as negative equity).

Your Counter-Offensive

You are not powerless against high interest. Here are two key strategies:

- Switch to Bi-Weekly Payments: If your loan is $800/month, switch to paying $400 every two weeks. Because there are 26 bi-weekly periods in a year, you'll end up making 13 full monthly payments instead of 12. This extra payment goes directly to the principal, saving you significant interest and shortening your loan term.

- Set a Refinancing Reminder: After 12-18 months of perfect, on-time payments, your credit score will likely have improved significantly. Set a calendar reminder to explore refinancing your auto loan. Securing a lower interest rate can slash your monthly payment and the total cost of borrowing.

Your Next Steps: A 5-Step Blueprint for Getting Approved in 2026

Knowledge is potential; action is power. Follow this five-step blueprint to move from research to the driver's seat of your new EV.

Step 1: The Reconnaissance Mission

Before you talk to any lender, pull your own credit report from both Equifax and TransUnion. You can do this for free. Go through it line by line. Are there errors? Accounts you don't recognize? Understanding exactly what the lender will see prevents surprises and allows you to address any issues upfront.

Step 2: The 'All-In' Budget

Don't just budget for the car payment. Calculate the total cost of ownership. Call your insurance provider and get a quote for the specific EV model you're considering; insurance on a new, financed EV is often significantly higher than on an older gas car. Factor in the cost of a home charger installation or your estimated monthly public charging costs. This "all-in" number is your true budget.

Step 3: The Pre-Approval Gauntlet

This is the most important step. Before you ever set foot in a dealership, apply for a pre-approval with at least two different online lenders that specialize in bad credit auto loans, like us at SkipCarDealer.com. If you belong to a credit union, apply with them as well. This process will give you a realistic baseline for the interest rate and loan amount you can expect.

Step 4: The Dealership Negotiation

With a pre-approval letter in your hand, you walk into the dealership not as a supplicant, but as a cash buyer. The conversation changes completely. It's no longer, "Can you please get me a loan?" It becomes, "Here is the loan I have. Can your finance department offer me a better rate to earn my business?" This creates competition and puts you in control.

Step 5: The Final Review

You've negotiated the price and the financing. Before you sign the final bill of sale and loan agreement, have the finance manager physically point to three numbers on the contract:

- The final Annual Percentage Rate (APR).

- The total cost of borrowing (the total interest you will pay over the life of the loan).

- The loan term in months.

Make sure these numbers match exactly what you agreed to. This final check ensures there are no last-minute changes or hidden fees.