Think Your Consumer Proposal Trapped Your Car Payments? Think Again, British Columbia.

Table of Contents

- Key Takeaways for British Columbia Drivers Post-Proposal

- Navigating the Post-Consumer Proposal Credit Landscape in British Columbia

- The True Impact of a Consumer Proposal on Your Credit Score (TransUnion & Equifax Canada)

- Lender Perception: Why Banks See You Differently (and How to Change Their Minds)

- The 'Secured Debt' Nuance Revisited: Why Your Car Loan is Unique

- Your Existing Car Loan: Strategies for Lowering Payments Post-Proposal in British Columbia

- Option 1: Renegotiating with Your Current Lender – A Direct Approach

- Option 2: Refinancing Your Car Loan – The Uphill Battle and How to Win It in British Columbia

- Option 3: Strategic Downsizing or Selling Your Vehicle – When Less is More

- Acquiring a New (or Different Used) Vehicle Post-Consumer Proposal in British Columbia

- Rebuilding Your Credit Score: A British Columbia-Specific Step-by-Step Guide

- The Power of a Down Payment: How It Changes Your Approval Odds and Loan Terms

- Co-Signers: A Double-Edged Sword for British Columbia Borrowers

- Navigating Dealerships vs. Private Sales vs. Online Platforms in British Columbia

- Understanding Loan Terms: APR, Loan Term, and Total Cost of Ownership

- Beyond the Loan: Holistic Strategies to Reduce Car Ownership Costs in British Columbia

- Insurance Premiums Post-Consumer Proposal: How They're Affected and Finding Better Rates

- Maintenance & Fuel Efficiency: Long-Term Savings That Add Up

- The 'Need vs. Want' Car Assessment: A Post-Proposal Reality Check

- Legal & Financial Safeguards for British Columbia Consumers

- Consumer Protection British Columbia: Your Rights as a Car Buyer and Borrower

- Understanding the Role of Your Licensed Insolvency Trustee (LIT) Post-Proposal

- Avoiding Predatory Lending Practices: Red Flags for British Columbia Borrowers

- Your Next Steps to Financial Freedom on Four Wheels: An Action Plan for British Columbia

- Frequently Asked Questions (FAQ) About Lowering Car Payments After a Consumer Proposal in British Columbia

You’ve made a brave financial decision with a Consumer Proposal, taking control of your debt and paving the way for a brighter future. But for many in British Columbia, the question lingers: 'What about my car payments?' It’s a common misconception that a Consumer Proposal traps you with high car costs or severely limits your options. This deep dive will dismantle that myth, offering practical, British Columbia-specific strategies to lower your car payments, whether you’re trying to save on an existing loan or secure a new one post-proposal. We’ll explore everything from refinancing tactics to credit rebuilding, empowering you to drive forward with confidence across the province, from the bustling streets of Vancouver to the serene roads of the Okanagan.

Key Takeaways for British Columbia Drivers Post-Proposal

- Your credit score will recover, and with it, your options for better car financing. Patience and strategic credit rebuilding are paramount.

- Refinancing an existing car loan is possible after a Consumer Proposal, but it requires diligent research, a strong case, and often, a strategic wait period.

- Specialized lenders, credit unions (like Vancity or Coast Capital Savings), and even some mainstream banks will consider applications from individuals post-proposal, especially with a solid down payment or co-signer.

- Lowering your car payments isn't just about the loan; it's also about insurance, maintenance, and choosing the right vehicle for your post-proposal budget in cities like Vancouver, Surrey, and Victoria.

- Understanding the 'secured debt' nature of car loans is crucial, as it dictates how they're handled both during and after a Consumer Proposal.

Navigating the Post-Consumer Proposal Credit Landscape in British Columbia

A Consumer Proposal is a powerful tool for debt relief, offering a manageable path to financial recovery. However, it undeniably impacts your credit profile. Understanding this impact, especially in the context of car financing, is the first step toward lowering your payments and regaining financial control. This section demystifies the credit recovery process specific to British Columbia, setting the stage for actionable strategies that will help you move forward.

The True Impact of a Consumer Proposal on Your Credit Score (TransUnion & Equifax Canada)

When you file a Consumer Proposal in Canada, it's reported on your credit file by major bureaus like TransUnion and Equifax. This isn't just about a temporary drop in score; it's about understanding the specific notations and how long they remain visible. Typically, a Consumer Proposal is listed on your credit report for three years after the date of your certificate of full performance, or six years from the date you filed the proposal, whichever comes first. During this period, your credit score will likely be lower, often categorized as 'R7' (for a Consumer Proposal) on your credit accounts. Lenders in British Columbia, whether in Vancouver, Victoria, or Prince George, will see this notation when they pull your report.

However, the key is that your score begins its recovery journey the moment you start making consistent payments on your proposal and any other remaining debts. Each on-time payment demonstrates renewed financial responsibility, slowly but surely rebuilding your creditworthiness. We'll discuss typical timelines for score improvement, but generally, the further you get from the proposal filing date and the more positive payment history you accumulate, the better your standing becomes.

Pro Tip: Check your credit report regularly (at least once a year, or more frequently post-proposal) through free services like Credit Karma or Borrowell. These platforms provide insights into your TransUnion and Equifax scores. Dispute any inaccuracies immediately, as even small errors can hinder your progress towards better car loan rates. Understanding what’s on your report is the first step to improving it.

Lender Perception: Why Banks See You Differently (and How to Change Their Minds)

Explore the psychology of lending post-Consumer Proposal. Lenders in British Columbia, from major banks headquartered in Toronto to local credit unions like Vancity in Vancouver or Coast Capital Savings in Surrey, assess risk differently. Initially, a Consumer Proposal signals a higher risk, as it indicates a past inability to manage debt. However, their perception isn't static. They look beyond just your score, evaluating factors such as:

- Your payment history *since* the proposal: Have you been diligently making all payments on your proposal and any other debts? Consistency is key.

- Your debt-to-income ratio: How much of your monthly income is consumed by debt payments? A lower ratio signals more disposable income and less risk.

- Job stability: A steady employment history in cities like Kelowna or Nanaimo demonstrates reliable income.

- Down payment: A substantial down payment on a car loan significantly reduces the lender's risk.

- Co-signer: Having a financially stable co-signer can greatly improve your chances and terms.

Learning what signals trust and responsibility to potential lenders empowers you to present a stronger case. It's about demonstrating that your Consumer Proposal was a turning point, not a permanent setback, and that you are now a responsible borrower.

The 'Secured Debt' Nuance Revisited: Why Your Car Loan is Unique

Unlike unsecured debts such as credit cards or lines of credit, your car loan is secured by the vehicle itself. This fundamental difference means it wasn't 'included' in your Consumer Proposal in the same way unsecured debts were. If you maintained payments on your car loan throughout your Consumer Proposal, the lender typically could not repossess the vehicle, as it was a secured asset. This distinction is vital for British Columbians to understand.

Your existing car loan obligations continue independently of your Consumer Proposal terms. This means that while your other debts are being restructured, your car payments remain as agreed upon with your lender. This unique status influences your options for lowering payments or securing new financing in British Columbia. It often gives you a stronger position when renegotiating with your current lender, as you've demonstrated a commitment to this specific debt throughout your financial restructuring.

- An infographic illustrating the difference between secured and unsecured debt, specifically showing a car as secured debt vs. a credit card as unsecured debt, with a timeline showing how a Consumer Proposal impacts each type over time.

- An infographic illustrating the difference between secured and unsecured debt, specifically showing a car as secured debt vs. a credit card as unsecured debt, with a timeline showing how a Consumer Proposal impacts each type over time.

Your Existing Car Loan: Strategies for Lowering Payments Post-Proposal in British Columbia

If you entered a Consumer Proposal with an existing car loan, you're likely feeling the pinch of its original terms, especially if your financial situation has evolved. This section focuses on actionable strategies for reducing those payments on your current vehicle, even with a recent proposal on your record. It's about being proactive and exploring every avenue available to British Columbia drivers.

Option 1: Renegotiating with Your Current Lender – A Direct Approach

Is your current lender willing to play ball? Often, a direct conversation can yield surprising results. Lenders prefer to keep a performing loan rather than deal with default or repossession, even post-proposal. We'll guide you through the process of approaching your existing car loan provider:

- Prepare your case: Gather all relevant financial documents, including proof of income, your Consumer Proposal completion certificate (if applicable), and a clear, updated budget.

- Highlight your commitment: Emphasize your diligent payments on the Consumer Proposal and your car loan, demonstrating improved financial management.

- Propose a solution: Clearly state what you're seeking, such as an extended loan term (which lowers monthly payments but increases total interest), a temporary payment reduction during a specific financial hardship, or a small interest rate adjustment if your credit has shown significant improvement.

While a drastic interest rate cut might be unlikely without refinancing, your current lender might offer concessions to keep you as a customer. The pros of this direct negotiation include potentially avoiding credit checks associated with new loans and maintaining your existing relationship. The cons are that their flexibility might be limited compared to a new loan with a different lender, and they might not offer the most competitive rates available.

Pro Tip: Before you call, have a clear understanding of your current car's market value (e.g., via Canadian Black Book) and your revised budget. This shows your lender you've done your homework and are serious about a sustainable solution. Knowing your car's value also helps if you need to discuss options related to equity.

Option 2: Refinancing Your Car Loan – The Uphill Battle and How to Win It in British Columbia

Refinancing can offer significantly lower interest rates and payments, especially if your original loan was taken out when your credit was at its lowest. However, it's often the hardest path post-proposal, requiring time and strategic effort. We'll detail the specific hurdles and how to overcome them in British Columbia.

Credit Rebuilding Prerequisites: What to Do Before You Apply (Secured Credit Cards, Small Installment Loans in British Columbia)

Before you even consider refinancing, focus on rebuilding your credit. Lenders will want to see a history of responsible borrowing *since* your Consumer Proposal. This includes:

- Secured Credit Cards: Open a secured credit card with a local credit union like Vancity or Coast Capital Savings, or a major bank. Use it for small, regular purchases and pay it off in full every month.

- Small Installment Loans: Consider a small, manageable installment loan (e.g., a credit builder loan) from a reputable lender. Consistently making payments on time will further boost your credit profile.

- Impeccable Payment History: Ensure all your bills, not just credit-related ones, are paid on time.

Finding Willing Lenders: Beyond the Big Banks – Exploring Credit Unions, Specialized Auto Lenders, and Online Platforms in British Columbia

While major banks might be hesitant, there are other avenues in British Columbia:

- Credit Unions: Local credit unions (like Vancity, Coast Capital Savings, Island Savings, G&F Financial Group) often have a more community-focused approach and may be more willing to work with members rebuilding credit, especially if you have an existing relationship with them in Surrey or Victoria.

- Specialized Auto Lenders: Many lenders specialize in 'subprime' or 'rebuild' loans. These are designed for individuals with less-than-perfect credit. While rates might be higher than prime, they can still be better than your existing high-interest loan.

- Online Platforms: Many online loan aggregators work with a network of lenders, some of whom specialize in post-proposal financing. They can help you compare offers, but always read the fine print.

For more detailed insights on how to navigate this process, you might find our article on Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit particularly helpful.

Understanding the New Terms: APRs, Loan Terms, and Hidden Fees – What to Watch Out For to Ensure True Savings

When refinancing, pay close attention to the Annual Percentage Rate (APR), the new loan term, and any associated fees. A lower monthly payment due to an extended loan term might mean paying significantly more interest over the life of the loan. Always compare the total cost of borrowing, not just the monthly payment. Beware of hidden fees that can eat into your savings.

Option 3: Strategic Downsizing or Selling Your Vehicle – When Less is More

Sometimes, the most effective way to lower car payments is to change the car itself. This section explores the difficult but potentially highly beneficial decision to sell your current vehicle and replace it with something more affordable. This is a pragmatic approach for British Columbians looking to significantly reduce their financial burden.

Selling vs. Trading In: Which Option Maximizes Your Return, Especially with Negative Equity?

If you owe more on your car than it's worth (negative equity), this decision becomes more complex. For more on this topic, even if specific to another province, the principles discussed in Negative Equity in Ontario? Your 'No' Just Became 'Yes'. can provide valuable context.

- Selling Privately: Generally yields the highest price for your vehicle, as you cut out the dealership's profit margin. However, it requires more effort, time, and potential hassle, including arranging test drives, dealing with paperwork, and finding a buyer who can secure their own financing.

- Trading In: Offers convenience, as the dealership handles the sale and often rolls any negative equity into your new loan (though this increases your new loan amount). You'll likely get less for your trade-in compared to a private sale, but it streamlines the process of getting into a new, more affordable vehicle. Dealerships in major British Columbia cities like Vancouver or Kelowna are well-versed in trade-ins.

Voluntary Surrender: The Last Resort and Its Implications for Your Credit and Future Car Ownership

Voluntarily surrendering your vehicle to the lender is a last resort. While it avoids the immediate stress of payments, it has significant negative implications. The lender will sell the car, and if the sale price doesn't cover the outstanding loan balance, you will still be responsible for the deficiency. This action will severely damage your credit score, making it extremely difficult to secure any financing for several years. It should only be considered if all other options have been exhausted and you fully understand the long-term consequences.

Pro Tip: If considering selling, explore online car valuation tools like Canadian Black Book or Kelley Blue Book and get multiple quotes from dealerships in your area (e.g., Vancouver, Kelowna) to ensure you get the best possible price. Transparency about your Consumer Proposal status is crucial if dealing with a dealership for a trade-in, as it impacts their assessment of your creditworthiness for a new loan.

Acquiring a New (or Different Used) Vehicle Post-Consumer Proposal in British Columbia

Perhaps your existing car is too expensive, or you need a new vehicle after a Consumer Proposal, either because your old one is at the end of its life or you didn't have one previously. This section provides a roadmap for securing affordable car financing in British Columbia, even with a recent proposal on your credit report. It's about smart planning and strategic execution.

Rebuilding Your Credit Score: A British Columbia-Specific Step-by-Step Guide

Before you even think about a new car loan, focus on rebuilding. This isn't just a generic piece of advice; it's the foundation for accessing better rates and terms. We'll outline practical steps for British Columbians to improve their credit score post-proposal:

- Utilizing Secured Credit Cards: As mentioned, these are excellent tools. Secure one from a local credit union (Vancity, Coast Capital Savings) or a major bank. Use it for small, predictable expenses like groceries or gas, and pay the full balance every month before the due date. This demonstrates consistent, responsible credit usage.

- Taking Out Small, Manageable Installment Loans: A small loan from a reputable lender, repaid over a short term, can also help. The key is that the payments must be affordable and made on time.

- Maintaining Impeccable Payment History: This is non-negotiable. Every single payment on every single bill – your Consumer Proposal, utilities, phone, any remaining debts – must be on time. Late payments are credit score killers.

- Showing Financial Stability and Responsibility: Lenders look at the bigger picture. A stable job, a consistent address, and a good debt-to-income ratio all contribute to a positive impression. If you're receiving employment insurance (EI), demonstrating consistent income from it can also be a factor, as discussed in our article, British Columbia EI? Your Car Loan Just Called 'Shotgun'.

Pro Tip: Consider opening a secured credit card with a local credit union in British Columbia (e.g., Vancity, Coast Capital Savings) or a major bank. Use it for small, recurring expenses and pay it off in full every month. This is a powerful, low-risk way to demonstrate responsible credit use and build positive history quickly.

The Power of a Down Payment: How It Changes Your Approval Odds and Loan Terms

A significant down payment is your strongest ally when seeking a car loan post-Consumer Proposal. Here's why it's so powerful:

- Reduces Lender Risk: A larger down payment means you're borrowing less, which inherently reduces the lender's risk. If you default, they have less to recover.

- Better Interest Rates: Reduced risk often translates to better interest rates, saving you hundreds or thousands of dollars over the life of the loan.

- Improved Approval Chances: Lenders are more likely to approve applicants with a substantial down payment, even with a recent Consumer Proposal on their record.

- Avoids Negative Equity: A good down payment helps you avoid owing more than the car is worth, a common pitfall.

Strategies for saving up a substantial down payment in British Columbia include setting aside a portion of every paycheque, selling unused items, or temporarily cutting back on non-essential expenses. Even saving a few thousand dollars can make a huge difference in Vancouver or Surrey.

Co-Signers: A Double-Edged Sword for British Columbia Borrowers

A co-signer can dramatically improve your chances of approval and secure better rates, especially if their credit is excellent. However, it's a significant responsibility for the co-signer. They become equally responsible for the debt, meaning if you miss payments, their credit score will suffer, and they will be legally obligated to pay. This can strain relationships if not handled carefully. We'll discuss:

- Who might be a suitable co-signer: Typically a close family member or trusted friend with excellent credit and stable finances.

- The risks involved for them: Damage to their credit, potential legal action, and financial obligation.

- How to ensure this arrangement benefits both parties: Clear communication, a written agreement between you and the co-signer, and absolute commitment on your part to make all payments on time.

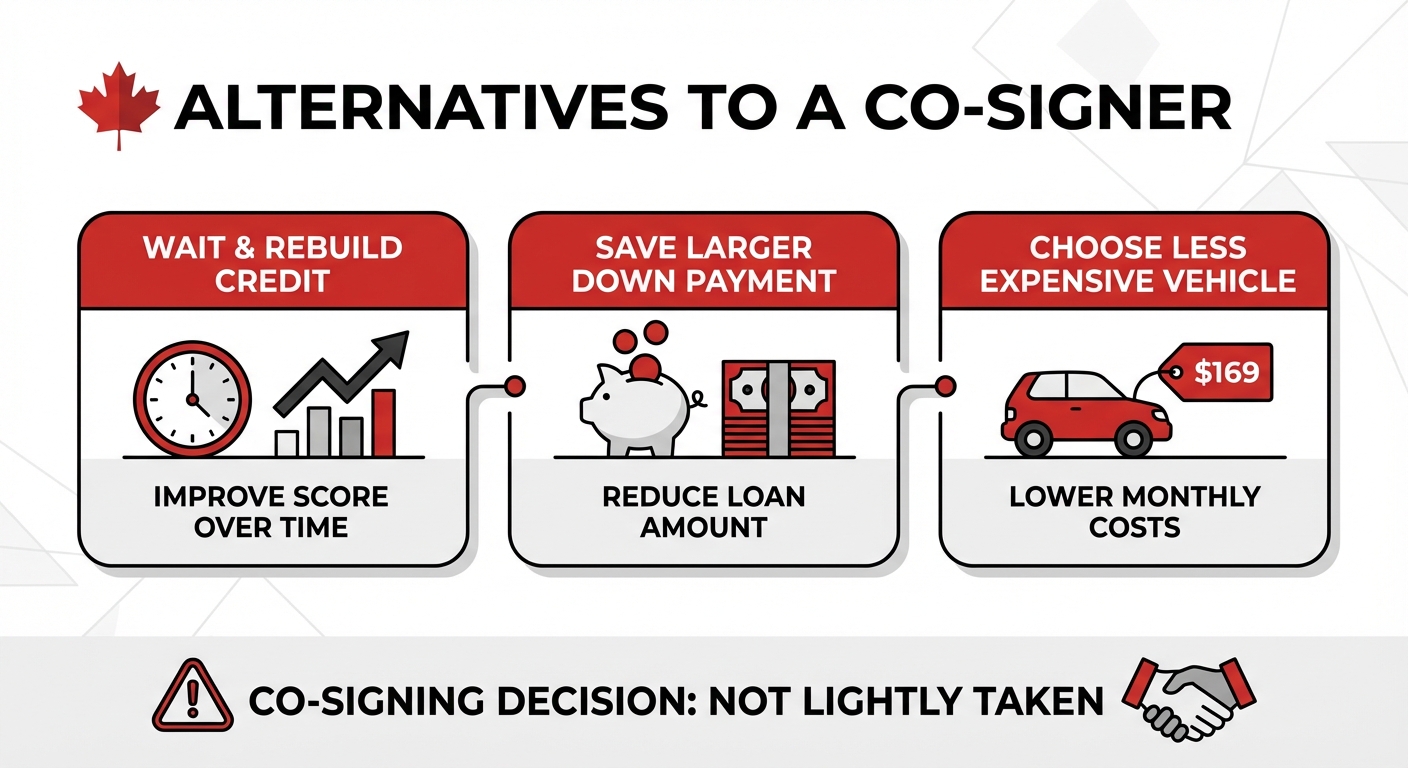

Consider alternatives if a co-signer isn't an option, such as waiting longer to rebuild your credit, saving a larger down payment, or opting for a less expensive vehicle. The decision to involve a co-signer should never be taken lightly.

- A visual depicting two hands shaking over a loan document, symbolizing a co-signer agreement, with a cautionary overlay about the shared responsibility.

- A visual depicting two hands shaking over a loan document, symbolizing a co-signer agreement, with a cautionary overlay about the shared responsibility.

Navigating Dealerships vs. Private Sales vs. Online Platforms in British Columbia

Where you buy your next car matters, especially after a Consumer Proposal. Each channel has its pros and cons for British Columbians.

Specialty 'Bad Credit' Dealers: What to Expect and How to Identify Reputable Ones in Vancouver, Surrey, and Kelowna

Many dealerships, particularly in larger urban centers like Vancouver, Surrey, and Kelowna, have 'special finance' departments or work with lenders who specialize in subprime auto loans. These can be an option for those with challenged credit. What to expect:

- Higher Interest Rates: Rates will likely be higher than prime loans due to increased risk.

- Loan Terms: Be wary of overly long loan terms (e.g., 84 months or more) that reduce monthly payments but significantly increase the total interest paid.

- Reputable vs. Predatory: Identify reputable ones by checking reviews, ensuring transparent pricing, and avoiding pressure tactics. A good dealership will still explain all terms clearly.

While these options exist, always exercise caution, compare offers, and understand that the goal is to rebuild credit so you can access better rates later. For more information on finding approval after a proposal, check out They Said 'No' After Your Proposal? We Just Said 'Drive!'.

Credit Unions and British Columbia-Specific Lenders: Exploring Local Options for Competitive Rates and Personalized Service

Don't overlook local credit unions like Island Savings or G&F Financial Group. They often offer more personalized service and may be more flexible with members who have a Consumer Proposal on their record, especially if you have an existing banking relationship. Their rates can be competitive, and they prioritize member well-being.

Private Sales and Online Marketplaces

Buying privately or through online marketplaces (like Craigslist British Columbia, Facebook Marketplace) can sometimes yield a better price on the vehicle itself. However, securing financing for a private sale can be more challenging post-proposal, as you'll likely need pre-approved financing from a bank or credit union before approaching a seller. Dealerships often have more lending partners, including subprime ones, making financing more accessible. Weigh the savings on the car against the difficulty of securing the loan.

Pro Tip: Get pre-approved for a loan *before* you start serious car shopping. This gives you negotiating power, clarifies your budget, and prevents you from falling in love with a car you can't afford or that has unfavourable terms. It also streamlines the purchasing process, whether at a dealership or from a private seller.

Understanding Loan Terms: APR, Loan Term, and Total Cost of Ownership

Don't just look at the monthly payment. It's crucial to break down the elements of a car loan agreement to understand the true cost over time, whether you're in Victoria or Nanaimo. Here's what to consider:

- Annual Percentage Rate (APR): This is the true cost of borrowing, expressed as an annual rate. It includes the interest rate plus any fees. A lower APR is always better.

- Loan Term (Length): This is how long you have to repay the loan, typically in months (e.g., 60, 72, 84 months). A longer term means lower monthly payments but significantly more interest paid over time.

- Total Cost of Ownership: This includes the purchase price, interest paid over the loan term, insurance, maintenance, fuel, and depreciation.

Consider this comparison:

| Loan Feature | Shorter Term (e.g., 60 months) | Longer Term (e.g., 84 months) |

|---|---|---|

| Monthly Payment | Higher | Lower |

| Total Interest Paid | Lower | Significantly Higher |

| Equity Build-up | Faster | Slower (higher risk of negative equity) |

| Risk of Negative Equity | Lower | Higher |

| Vehicle Value at Payoff | Higher residual value | Lower residual value |

Learn how to compare offers effectively and avoid common pitfalls that can lead to higher overall expenses. Prioritize a balance between affordable monthly payments and a reasonable total cost.

Beyond the Loan: Holistic Strategies to Reduce Car Ownership Costs in British Columbia

Lowering car payments isn't solely about the loan itself. Smart British Columbia drivers know that reducing the overall cost of car ownership involves several factors beyond the monthly financing charge. This holistic approach ensures long-term financial stability.

Insurance Premiums Post-Consumer Proposal: How They're Affected and Finding Better Rates

While a Consumer Proposal doesn't directly impact your insurance risk profile in British Columbia, your credit score *can* play a role in some private insurance providers' premium calculations. ICBC, the public insurer, primarily assesses driving history, vehicle type, and location. However, if you previously had a private insurer who factored credit into your premiums, and your score has dropped, you might see a slight increase.

We'll discuss how to shop for the best car insurance rates in British Columbia:

- Compare Quotes: Always get multiple quotes from different private insurers (if applicable) and understand ICBC's options.

- Explore Discounts: Ask about discounts for good driving records, bundling with home insurance, alarm systems, or lower annual kilometres driven.

- Adjust Coverage: Consider increasing your deductible or re-evaluating optional coverage levels to save on premiums, especially for older vehicles.

Whether you're in Vancouver, Victoria, or Kelowna, being proactive about your insurance ensures you're not paying more than necessary.

Maintenance & Fuel Efficiency: Long-Term Savings That Add Up

Choosing a reliable, fuel-efficient vehicle and adhering to a strict maintenance schedule can save you thousands over the life of your car. Neglecting maintenance often leads to costly repairs down the road, negating any savings from lower car payments.

- Research Vehicle Reliability: Look for models known for their dependability and lower maintenance costs. Consumer reports and online reviews are valuable resources.

- Understand Service Costs: Factor in the cost of routine maintenance (oil changes, tire rotations) and potential major repairs for any vehicle you consider.

- Adopt Fuel-Saving Driving Habits: Accelerate gently, maintain a steady speed, avoid excessive idling, and keep your tires properly inflated. These habits are particularly relevant to British Columbia's diverse terrain, from mountain passes to urban commutes.

Pro Tip: When considering a used car, always get a pre-purchase inspection from an independent mechanic. This small investment (typically $100-$200) can save you from buying a vehicle with costly hidden issues, ensuring your 'lower payment' doesn't get negated by unexpected repair bills down the line.

The 'Need vs. Want' Car Assessment: A Post-Proposal Reality Check

Re-evaluate your automotive needs. Do you truly need that large SUV, or would a more economical sedan or compact SUV suffice for your daily commute and family needs? This section encourages a pragmatic approach to vehicle choice, aligning it with your new financial reality and long-term goals for stability in British Columbia. Often, the car that gets you from A to B reliably and affordably is the best choice for a healthy financial recovery.

Legal & Financial Safeguards for British Columbia Consumers

Protecting yourself from predatory practices and understanding your rights is crucial, especially when navigating financing post-Consumer Proposal. Informed consumers are empowered consumers.

Consumer Protection British Columbia: Your Rights as a Car Buyer and Borrower

Familiarize yourself with the consumer protection laws and resources available in British Columbia. Consumer Protection British Columbia (CPBC) is a provincial organization that provides information and resources to help consumers and businesses understand their rights and responsibilities. We'll highlight key regulations related to vehicle sales, financing disclosures, and dispute resolution:

- Full Disclosure: Lenders and dealerships must provide clear, easy-to-understand information about loan terms, interest rates, and all associated fees.

- Cooling-Off Periods: Understand if any cooling-off periods apply to vehicle purchases or financing agreements in British Columbia, giving you time to reconsider.

- Dispute Resolution: Know your avenues for resolving disputes with dealerships or lenders.

Ensuring you're empowered to make informed decisions and avoid being taken advantage of is paramount to your financial recovery.

Understanding the Role of Your Licensed Insolvency Trustee (LIT) Post-Proposal

Your Licensed Insolvency Trustee (LIT) isn't just there during the proposal process; they can offer valuable guidance on managing your finances post-proposal, including advice on major purchases like vehicles. They are experts in Canadian insolvency law and financial rehabilitation. We'll discuss how and when to consult your LIT for ongoing support:

- Before Major Purchases: Discuss the implications of taking on new debt, like a car loan, with your LIT.

- Budgeting Advice: Your LIT can help you refine your post-proposal budget to accommodate new payments responsibly.

- Understanding Your Obligations: They can clarify how new loans interact with your Consumer Proposal obligations.

Pro Tip: Don't hesitate to reach out to your LIT if you're unsure about the implications of a new car loan or refinancing on your Consumer Proposal. They are a valuable resource for maintaining your financial recovery and ensuring you make sound financial decisions.

Avoiding Predatory Lending Practices: Red Flags for British Columbia Borrowers

The post-proposal period can make you vulnerable to high-interest, exploitative loan offers. We'll equip you with the knowledge to identify red flags, understand usurious rates, and steer clear of lenders who prioritize profit over your financial well-being. This includes:

- 'Guaranteed Approval' without a Proper Credit Check: Be extremely wary of any lender promising guaranteed approval regardless of your credit history. Legitimate lenders always perform a credit assessment.

- Excessively High Interest Rates: While rates will be higher post-proposal, understand what constitutes a reasonable subprime rate versus an exploitative one. If the APR seems astronomical, walk away.

- Pressure Tactics: High-pressure sales tactics or rushing you through paperwork are major red flags.

- Hidden Fees: Scrutinize all documents for undisclosed fees or charges that inflate the loan cost.

- Unsolicited Offers: Be cautious of unsolicited loan offers, especially those that seem too good to be true.

Your financial recovery in British Columbia depends on making smart, informed choices and protecting yourself from those who would take advantage of your situation.

Your Next Steps to Financial Freedom on Four Wheels: An Action Plan for British Columbia

You've absorbed a wealth of information. Now, let's distill it into a clear, actionable plan to lower your car payments after a Consumer Proposal in British Columbia:

- Step 1: Get Your Financial House in Order – Review your budget meticulously, check your credit reports from TransUnion and Equifax, and identify areas for immediate savings. Know your income, expenses, and current debt obligations inside out.

- Step 2: Prioritize Credit Rebuilding – Actively use secured credit cards, make all payments on time, every time, and consider a small, manageable installment loan to demonstrate consistent reliability to future lenders.

- Step 3: Assess Your Current Vehicle Situation – Determine if renegotiating with your current lender, refinancing (after credit improvement), or strategically selling and downsizing is your most viable and financially responsible path.

- Step 4: Research, Research, Research – Compare lenders (credit unions, specialized auto lenders, dealerships), understand all loan terms (APR, length, total cost), and explore vehicle options that genuinely fit your new, sustainable budget.

- Step 5: Be Patient and Persistent – Financial recovery takes time, often 12-24 months of consistent effort post-proposal before significantly better rates become available. However, consistent positive actions will lead to better car financing options and lower payments.

- Step 6: Seek Professional Advice – Consult your Licensed Insolvency Trustee, a reputable financial advisor, or a credit counsellor if you need personalized guidance on your specific situation or assistance with budgeting and debt management.