Your Pension is the New Pay Stub. Get Approved for a Car, Calgary.

Table of Contents

- Your Pension is the New Pay Stub. Get Approved for a Car, Calgary.

- Key Takeaways for Securing Your Car Loan on Pension Income

- Unlocking Your Mobility: Why Pension Income is a Lender's Dream (Yes, Really!)

- From Canada Pension Plan (CPP) to Old Age Security (OAS) and Private Annuities: The Power of Predictability.

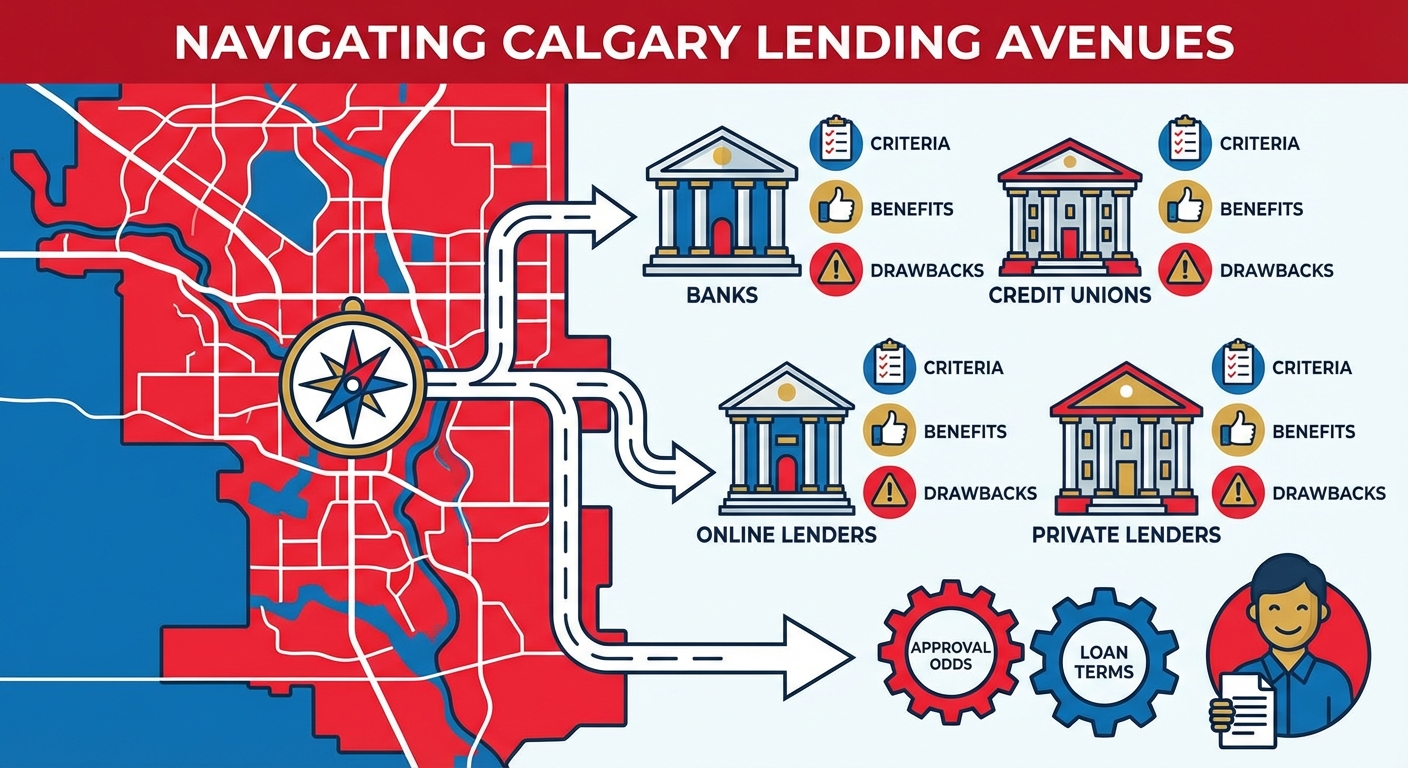

- Navigating the Lending Labyrinth: Where to Find Your Car Loan in Alberta

- Banks, Credit Unions, Dealerships, and Online Lenders: A Comprehensive Calgary Guide.

- The Approval Blueprint: What Lenders Truly Scrutinize Beyond Your Pension Cheque

- Credit Scores, Debt-to-Income Ratios, and the Strategic Power of a Down Payment.

- Crunching the Numbers: Unmasking Interest Rates, Loan Terms, and Hidden Costs

- Securing Favourable Terms for Your Fixed Income Budget in Alberta.

- The Smart Choice: Picking the Right Vehicle for Your Pension-Powered Adventures

- New vs. Used, Reliability, and Budget-Friendly Options for Calgary Roads.

- Your Application Arsenal: Documents, Pre-Approval, and Negotiation Tactics

- Empowering Your Journey to Car Ownership in Calgary.

- Beyond the Purchase: Protecting Your Investment and Financial Future

- Insurance, Warranties, and Long-Term Budgeting for Seniors in Alberta.

- Your Next Steps to Approval: Driving Forward with Confidence in Calgary

- Frequently Asked Questions (FAQ) About Car Loans on Pension Income

Your Pension is the New Pay Stub. Get Approved for a Car, Calgary.

For many Calgary seniors, the idea of getting a car loan might seem like a distant dream, especially when living on a fixed pension income. There's a common misconception that once you're retired, your financial options shrink, and lenders view you with skepticism. At SkipCarDealer.com, we're here to shatter that myth. In fact, your pension isn't just an income; it's a powerful asset – arguably one of the most reliable 'pay stubs' a lender could ask for. Imagine the freedom of exploring the Canadian Rockies, visiting grandkids across Alberta, or simply navigating Calgary's vibrant communities without relying on public transit or rideshares. Personal mobility is not a luxury; it's a cornerstone of independence and quality of life. This article will demystify the process, demonstrating why your pension income makes you an excellent candidate for a car loan and how you can confidently drive off the lot in a vehicle that perfectly suits your needs.

Key Takeaways for Securing Your Car Loan on Pension Income

- Pension income, including CPP, OAS, and private pensions, is often seen as highly stable by lenders.

- Building or maintaining a strong credit score remains paramount, even with reliable income.

- A strategic down payment can significantly improve approval odds and loan terms.

- Exploring various lending options – from traditional banks to specialized dealerships – is vital.

- Understanding the total cost of ownership, beyond just monthly payments, is key for long-term financial health.

- Specific documentation related to your pension will be essential for application.

Unlocking Your Mobility: Why Pension Income is a Lender's Dream (Yes, Really!)

From Canada Pension Plan (CPP) to Old Age Security (OAS) and Private Annuities: The Power of Predictability.

Let's be clear: when it comes to lending, predictability is king. And what's more predictable than a guaranteed, consistent income stream that arrives like clockwork every month? This is precisely why your pension income, far from being a hindrance, is often considered a highly desirable asset by financial institutions across Canada, including those in Alberta. Lenders love stability, and fixed pension incomes provide just that.

Consider the Canada Pension Plan (CPP) and Old Age Security (OAS). These are government-backed programs, meaning their payments are as reliable as it gets. There's no risk of job loss, no fluctuating commissions, and no variable hours to contend with. Similarly, many private pensions and annuities from former employers offer a fixed, guaranteed payout for life or a set term. This contrasts sharply with the often volatile nature of employment income, which can be affected by economic downturns, industry shifts, or personal circumstances.

When you apply for a car loan, lenders perform a risk assessment. A primary component of this assessment is your ability to repay the loan. With a stable pension, your repayment capacity is clear and consistent. You're not just a senior; you're a low-risk borrower with a proven, reliable income source. This stability can often translate into more favourable loan terms, including lower interest rates, because the lender's risk is inherently reduced.

It's important to differentiate between various types of pension income, as lenders may perceive them slightly differently, though generally positively. Government pensions like CPP and OAS are universally recognized and accepted. Private pensions from large, established companies are also highly regarded. Even income from Registered Retirement Income Funds (RRIFs) or Life Income Funds (LIFs), if structured to provide consistent withdrawals, can be considered stable income. The key is demonstrating a clear, regular, and sufficient cash flow to comfortably cover your potential car loan payments.

Pro Tip: Lenders often prefer the predictable, non-volatile nature of pension income over variable commission-based salaries. Highlight your pension's consistency during applications and be ready to provide clear documentation of its regularity and amount.

Navigating the Lending Labyrinth: Where to Find Your Car Loan in Alberta

Banks, Credit Unions, Dealerships, and Online Lenders: A Comprehensive Calgary Guide.

Securing a car loan on a fixed pension income in Calgary, Alberta, means understanding the various avenues available to you. Each type of lender has its own criteria, benefits, and potential drawbacks. Knowing where to look can significantly impact your approval odds and the terms of your loan.

Let's break down your options:

Traditional Banks (e.g., RBC, TD, BMO, Scotiabank, CIBC)

Major banks are often the first stop for many Canadians. If you have an existing relationship with a bank – perhaps your pension is directly deposited there, or you've held accounts for years – you might find the process smoother. They often offer competitive interest rates for borrowers with strong credit histories. However, traditional banks can sometimes have stricter lending criteria, and their approval processes might take longer. They typically prefer applicants with excellent credit scores and a very low debt-to-income ratio. For existing customers, they might be more flexible or offer pre-approved options. For those on a fixed income, demonstrating a long history of responsible banking can be a significant advantage.

Credit Unions (e.g., Servus Credit Union, ConnectFirst Credit Union in Alberta)

Credit unions are community-focused financial institutions owned by their members. This structure often means they are more flexible and willing to work with individuals whose financial situations might not fit the rigid mould of a large bank. Credit unions in Alberta, such as Servus Credit Union or ConnectFirst Credit Union, often pride themselves on personalized service. If you've been a long-standing member, or if your pension is deposited with them, they might be more inclined to consider your unique circumstances, including the stability of your pension, even if other aspects of your financial profile aren't perfect. Their rates can be competitive, and their approval process might feel more accessible.

Dealership Financing (e.g., through Calgary car dealerships like SkipCarDealer.com)

Dealerships offer unparalleled convenience. When you're ready to buy a car, they can handle the financing in-house, often working with a network of lenders, including captive finance companies (e.g., Ford Credit, GM Financial) and other third-party banks and credit unions. This 'one-stop shop' approach saves you time and effort. Dealerships, especially those with 'special finance' departments, are often adept at finding solutions for a wide range of credit situations, including those on fixed incomes. They can leverage their relationships with multiple lenders to find the best possible terms for you. While the convenience is a major plus, it's always wise to compare their offers with any pre-approvals you might have from banks or credit unions to ensure you're getting a competitive rate.

Online Lenders (e.g., specialized platforms)

The digital age has brought forth a host of online lenders specializing in car loans. These platforms often boast speed and accessibility, allowing you to apply from the comfort of your Calgary home and receive a decision quickly. Some online lenders are more accustomed to working with non-traditional income sources, including pensions. However, it's crucial to exercise caution. While some online lenders are reputable and offer competitive rates, others might target borrowers with less-than-perfect credit, potentially offering higher interest rates. Always ensure any online lender is legitimate, transparent about their terms, and has positive reviews. Comparing offers from multiple online lenders can help you find the best deal.

When seeking approval in Calgary, it's wise to explore a few of these options concurrently. Getting a pre-approval from a bank or credit union gives you a benchmark, empowering you to negotiate more effectively at the dealership. Understanding the pros and cons of each will arm you with the knowledge to make the best financial decision for your fixed pension income.

The Approval Blueprint: What Lenders Truly Scrutinize Beyond Your Pension Cheque

Credit Scores, Debt-to-Income Ratios, and the Strategic Power of a Down Payment.

While your stable pension income is a huge asset, lenders don't stop there. They take a holistic view of your financial health to assess risk. Understanding these key factors will empower you to present the strongest possible application for a car loan in Calgary.

Credit Score Demystified

Your credit score is a three-digit number that summarizes your creditworthiness based on your borrowing and repayment history. In Canada, primary credit bureaus like Equifax and TransUnion calculate these scores. A higher score indicates a lower risk to lenders. Factors influencing your score include your payment history (paying bills on time is crucial), the amount of debt you owe, the length of your credit history, new credit applications, and the types of credit you use. For more on this, check out our guide on The Truth About the Minimum Credit Score for Ontario Car Loans.

Even with a strong pension, a poor credit score can deter lenders or lead to higher interest rates. Actionable steps to improve or maintain your score include:

- Pay Bills On Time, Every Time: This is the single most important factor.

- Keep Credit Utilization Low: Try to use less than 30% of your available credit limits.

- Check Your Credit Report: Review it annually for errors or fraudulent activity that could negatively impact your score. You can get free copies from Equifax and TransUnion.

- Avoid Opening Too Many New Accounts: Each application can cause a temporary dip in your score.

It's important to remember that while a good credit score is ideal, it's not the only factor. For those wondering, Alberta Car Loan: What if Your Credit Score Doesn't Matter? delves into situations where other factors can outweigh a less-than-perfect score.

Debt-to-Income (DTI) Ratio

Your DTI ratio is a critical metric for fixed-income earners. It's the percentage of your gross monthly income that goes towards paying your monthly debt payments. Lenders calculate it by dividing your total monthly debt payments (including your prospective car loan) by your gross monthly pension income. For example, if your total monthly pension income is $3,000 and your existing monthly debt payments (credit cards, lines of credit, mortgage, etc.) plus the estimated car loan payment total $1,000, your DTI would be 33% ($1,000 / $3,000). Lenders generally prefer a DTI below 40%, and often lower for car loans. A lower DTI indicates you have more disposable income to manage your new loan.

Strategies to lower your DTI before applying:

- Pay Down Existing Debts: Focus on high-interest credit cards or small loans.

- Avoid Taking on New Debt: Don't open new credit cards or lines of credit just before applying.

- Consider a More Affordable Vehicle: A lower car payment directly reduces your DTI.

The Down Payment Advantage

A down payment is a significant portion of the car's price that you pay upfront, reducing the amount you need to borrow. For seniors on a fixed pension, a strategic down payment can be a game-changer. It signals financial responsibility, reduces the lender's risk, and can lead to better loan terms, including lower interest rates and more manageable monthly payments. A substantial down payment also means you'll owe less than the car is worth sooner, avoiding negative equity.

Strategies for a down payment:

- Savings: Utilize a portion of your retirement savings, ensuring you still maintain an emergency fund.

- Trade-in: An older vehicle can serve as an excellent down payment, reducing your out-of-pocket expense.

- Selling Assets: Consider selling non-essential assets if you need to boost your down payment.

Remember that your credit score is individual. As the article Your Ex's Score? Calgary Says 'New Car, Who Dis? reminds us, your financial history stands on its own.

Vehicle Choice

The type, age, and value of the car you choose also significantly impact approval and interest rates. Lenders are more comfortable financing newer, more reliable vehicles that hold their value well. An older, high-mileage vehicle might be harder to finance or come with higher rates because its resale value is lower, and the risk of mechanical issues is greater. Opting for a sensible, reliable vehicle within your budget demonstrates prudence to lenders.

Pro Tip: Even a modest down payment of 10-20% can signal financial responsibility and significantly reduce your interest rate. Consider selling an older vehicle or using savings to boost your down payment.

Crunching the Numbers: Unmasking Interest Rates, Loan Terms, and Hidden Costs

Securing Favourable Terms for Your Fixed Income Budget in Alberta.

Understanding the financial intricacies of a car loan is crucial, especially when you're managing a fixed pension income. It’s not just about the monthly payment; it’s about the total cost and ensuring it fits comfortably within your long-term budget in Alberta.

Annual Percentage Rate (APR)

The Annual Percentage Rate (APR) is the true cost of borrowing money. It includes not just the interest rate but also any additional fees charged by the lender, expressed as a yearly percentage. A lower APR means you pay less over the life of the loan. For pensioners, factors influencing your APR include your credit score, the loan term, the down payment amount, and the lender's overall assessment of your risk. A strong credit history and a significant down payment can help you secure a much more favourable APR. Always ask for the APR, not just the interest rate, to get the full picture.

Loan Terms (e.g., 36, 48, 60, 72 months)

The loan term refers to the length of time you have to repay the loan. Common terms range from 36 months (3 years) to 72 months (6 years) or even longer.

Here's a breakdown of the trade-offs:

| Loan Term | Monthly Payments | Total Interest Paid | Pros for Pensioners | Cons for Pensioners |

|---|---|---|---|---|

| Shorter (36-48 months) | Higher | Lower | Pay off debt faster, less total interest, quicker path to ownership. | Higher monthly commitment, may strain a fixed budget. |

| Medium (48-60 months) | Moderate | Moderate | Good balance between payment and total cost, manageable for many. | Still requires careful budgeting. |

| Longer (60-72+ months) | Lower | Higher | Very affordable monthly payments, easier to fit into a fixed budget. | More interest paid over time, risk of negative equity, car may need more maintenance towards the end of the loan. |

For individuals on a fixed pension income, longer loan terms often seem attractive due to their lower monthly payments. However, it's vital to understand that a longer term means you'll pay significantly more in total interest over the life of the loan. Finding a balance that keeps your monthly payments affordable without incurring excessive interest is key. Always use an online loan calculator to see how different terms affect both your monthly payment and the total interest paid.

Fees and Charges

Beyond the principal and interest, car loans can come with various fees. These 'hidden costs' can add up and surprise you if you're not prepared. Common fees include:

- Administration Fees: Charged by the dealership or lender for processing paperwork.

- Documentation Fees: For preparing sales and financing documents.

- Lien Registration Fees: To register the lender's security interest in the vehicle.

- PPSR (Personal Property Security Registration) Fee: A provincial fee for registering a security interest against personal property.

- Extended Warranty Pitches: Often presented as a mandatory add-on, these are usually optional and should be evaluated carefully against your budget and the car's reliability.

- Taxes: GST/PST (if applicable) on the vehicle price, which can also be financed.

Always ask for a full breakdown of all fees and charges before signing any agreement. Reputable lenders and dealerships will be transparent about these costs.

Insurance Implications

Don't forget about insurance! Vehicle insurance is mandatory in Alberta, and its cost can vary wildly based on the type of vehicle, your driving record, age, location within Calgary, and the coverage you choose. A new or financed vehicle will typically require comprehensive and collision coverage, which is more expensive than basic liability. Get quotes for insurance before finalizing your car purchase to ensure it fits into your monthly budget. For example, a reliable sedan might cost $150-$250 per month to insure in Calgary for a senior, while a luxury SUV could be significantly higher. Factoring this into your overall monthly cost is non-negotiable for long-term financial health.

A realistic monthly payment for someone on a typical pension income in Calgary might aim for 15-20% of their total gross pension, including all loan-related costs and insurance, ensuring plenty of room for other living expenses.

The Smart Choice: Picking the Right Vehicle for Your Pension-Powered Adventures

New vs. Used, Reliability, and Budget-Friendly Options for Calgary Roads.

Choosing the right vehicle is paramount when you're on a fixed pension income. It's not just about what you can afford monthly, but what makes long-term financial sense for your adventures across Alberta and within Calgary. A sensible choice can save you thousands over the life of your ownership.

New vs. Certified Pre-Owned vs. Used

- New Cars: While shiny and exciting, new cars suffer rapid depreciation the moment they leave the dealership lot. This means they lose a significant portion of their value very quickly. For someone on a fixed income, the higher purchase price, higher insurance costs, and faster depreciation often make new cars a less financially prudent choice.

- Certified Pre-Owned (CPO) Vehicles: This category often represents the sweet spot for pensioners. CPO vehicles are typically late-model used cars that have undergone rigorous multi-point inspections by the manufacturer or dealership, come with a manufacturer-backed warranty, and sometimes include roadside assistance. They offer much of the reliability and peace of mind of a new car but at a significantly lower price point, with less depreciation. This makes them an excellent value proposition, combining reliability with budget-friendliness.

- Used Cars: The broadest category, offering the most variety in price and condition. While you can find excellent deals on used cars, they come with a higher risk of unexpected repairs and may not have a warranty. If opting for a used car that isn't CPO, a thorough independent inspection by a trusted mechanic is non-negotiable.

Reliability and Maintenance Costs

This is where smart choices truly pay off. Focus on vehicles known for their longevity and lower maintenance expenses. While we won't name specific brands, vehicles from certain Asian and North American manufacturers have a strong reputation for reliability, readily available parts, and reasonable service costs. Researching repair histories and consumer reports for specific models is highly recommended. A car that constantly breaks down will quickly erode any savings from a lower purchase price, putting a strain on your fixed budget. Consider models that are simpler in design, as complex electronic systems can be costly to repair.

Fuel Efficiency

With fluctuating fuel prices in Alberta, an economical vehicle can lead to substantial long-term savings. Hybrid vehicles, smaller sedans, and compact SUVs generally offer better fuel efficiency than larger trucks or performance vehicles. Calculate your estimated annual fuel costs based on your driving habits and the vehicle's advertised fuel economy ratings. Every litre saved is money in your pocket.

Features vs. Needs

It's easy to get swayed by luxury features, but for a fixed income, prioritizing essential needs over wants is crucial. Do you truly need a panoramic sunroof, a premium sound system, or oversized wheels? These add to the vehicle's purchase price, often increase insurance costs, and can be more expensive to maintain or repair. Focus on safety features, comfortable seating, ease of entry/exit, good visibility, and sufficient cargo space for your lifestyle. A comfortable, reliable, and practical vehicle will serve you far better than one laden with expensive, unnecessary extras.

Pro Tip: Focus on vehicles with a strong resale value and a reputation for reliability. A slightly older, well-maintained model often provides excellent value and lower insurance costs, perfectly suiting a pension budget.

Your Application Arsenal: Documents, Pre-Approval, and Negotiation Tactics

Empowering Your Journey to Car Ownership in Calgary.

Approaching the car loan application process well-prepared is like having a secret weapon. For seniors on a fixed pension income in Calgary, knowing what to bring, understanding the power of pre-approval, and mastering negotiation tactics can significantly smooth your path to car ownership.

Essential Documentation

Before you even step foot in a dealership or apply online, gather your "application arsenal." Having these documents readily available demonstrates your preparedness and can expedite the approval process:

- Government-Issued ID: Driver's license, passport, or provincial ID card.

- Proof of Residence: Utility bill (electricity, gas, water) or property tax statement showing your Calgary address.

- Proof of Pension Income: This is paramount. Bring official statements from CPP/OAS, pension stubs from former employers, annual pension statements, or bank statements showing consistent direct deposits of your pension. Lenders want clear, verifiable evidence of your stable income.

- Bank Statements: Recent statements (3-6 months) to show consistent income and responsible money management.

- Credit Report: While the lender will pull their own, having a recent copy for your own review helps you understand your standing and correct any errors beforehand.

- Social Insurance Number (SIN): For credit checks and identification.

- Trade-in Information (if applicable): Vehicle registration, proof of ownership, and service records for your current car.

The Power of Pre-Approval

Getting pre-approved for a car loan by a bank or credit union before you visit a dealership is one of the smartest moves you can make. Here's why:

- Clarity on What You Can Afford: Pre-approval gives you a clear maximum loan amount and an estimated interest rate, allowing you to shop for cars within a realistic budget.

- Negotiating Leverage: You walk into the dealership as a cash buyer, not just another potential borrower. This shifts the focus from "Can I get approved?" to "What's the best price for this car?"

- Separates Financing from Purchase: You can focus on negotiating the best price for the vehicle, knowing your financing is already secured. This prevents confusion or being rushed into less favourable terms.

- Saves Time: The financing paperwork is largely done, streamlining the purchase process at the dealership.

Negotiation Strategies

Negotiating for a car can feel daunting, but with your pre-approval in hand and your pension as a stable income, you have a strong position. Here are key tips:

- Never Discuss Your Monthly Payment First: This is a common mistake. If you focus on monthly payments, the dealer might stretch the loan term or add costly extras to achieve it, costing you more in the long run. Negotiate the total purchase price of the vehicle first.

- Negotiate the Purchase Price: Aim to get the best possible price for the car itself. Use online research (e.g., Canadian Black Book, AutoTrader) to understand fair market value.

- Negotiate Trade-in Value Separately: If you have a trade-in, negotiate its value independently of the new car's price.

- Compare Offers: Don't be afraid to walk away or tell the dealership you have a better offer from another lender or dealership. Competition works in your favour.

- Be Prepared to Say No: To extended warranties, rustproofing, or other add-ons that you haven't researched or don't truly need.

Beyond the Purchase: Protecting Your Investment and Financial Future

Insurance, Warranties, and Long-Term Budgeting for Seniors in Alberta.

Congratulations, you've secured your car loan and driven off the lot in your new (or new-to-you) vehicle in Calgary! But the journey doesn't end there. Protecting your investment and ensuring its long-term affordability within your fixed pension budget requires ongoing vigilance and smart planning.

Comprehensive Insurance

In Alberta, adequate car insurance is not just a legal requirement; it's a financial safeguard. For any new or financed vehicle, lenders will typically mandate comprehensive and collision coverage. This protects against damage from accidents, theft, vandalism, and natural disasters. While it adds to your monthly expenses, skimping on insurance can lead to devastating financial consequences if an unforeseen event occurs. Shop around for the best rates from various providers, as premiums can vary significantly. Consider bundling home and auto insurance for potential discounts. Regular review of your policy ensures you have appropriate coverage without overpaying.

Extended Warranties

Extended warranties are often offered at the point of sale. For seniors on a fixed pension, they present a balanced view of pros and cons.

Pros:

- Peace of Mind: Can cover unexpected, costly repairs after the manufacturer's warranty expires, protecting your budget from sudden large expenses.

- Budget Stability: Predictable monthly or upfront cost for potential repairs.

Cons:

- Cost: Can be expensive and may not cover all types of repairs.

- Overlap: May overlap with existing manufacturer's warranty for a period.

- Exclusions: Often have deductibles, exclusions, and specific terms that can make claims difficult.

An extended warranty might be valuable if you're buying an older used vehicle known for specific, expensive issues, or if the thought of a major repair bill causes significant stress. However, for a reliable CPO vehicle with a good manufacturer warranty, it might be an unnecessary expense. Read the fine print carefully and calculate if the cost outweighs the potential benefits for your specific vehicle and financial situation.

Budgeting for Ongoing Costs

The car loan payment and insurance are just two pieces of the puzzle. A truly smart financial plan for your vehicle must encompass all ongoing costs. These include:

- Fuel: Factor in your estimated weekly or monthly fuel consumption based on your driving habits and current gas prices in Calgary.

- Maintenance: Regular oil changes, tire rotations, brake inspections, and scheduled servicing are crucial for longevity. Set aside a small amount monthly for these predictable costs.

- Tires: Tires wear out and need replacing, which can be a significant expense every few years, especially for all-season or winter tires in Alberta.

- Unexpected Repairs: Even the most reliable car can have an unexpected issue. Having an emergency fund or a small buffer in your budget for these unforeseen events is wise.

- Registration and Licensing: Annual fees to keep your vehicle legally on the road.

By comprehensively budgeting for all these expenses, you ensure that your car remains an asset that enhances your life, rather than becoming a financial burden throughout the loan term and beyond.

Your Next Steps to Approval: Driving Forward with Confidence in Calgary

As we've explored, your pension income is a testament to your financial stability and a powerful asset in your pursuit of car ownership in Calgary. Far from being a limitation, it represents a consistent, reliable income stream that many lenders view very favourably. You have the potential to secure a car loan that provides the mobility and independence you deserve, whether it's for visiting friends in Edmonton, exploring the stunning landscapes of Banff, or simply running errands around your neighbourhood.

Your next steps are clear and actionable: start by gathering all your essential documents, especially those verifying your stable pension income. Take the time to check your credit report and understand your credit score. Explore your lending options, from traditional banks and credit unions to specialized dealerships like SkipCarDealer.com, and consider getting pre-approved to strengthen your negotiating position. With careful planning, a sensible vehicle choice, and an understanding of the financial mechanics, car ownership is absolutely achievable for those on a fixed pension income in Calgary and throughout Alberta. Don't let old myths hold you back; seize the wheel and drive forward with confidence!