The Canadian automotive landscape is undergoing its most significant transformation since the introduction of the assembly line. Walk onto any dealership lot from Halifax to Victoria, and you'll notice a distinct shift: the silent hum of electric motors is replacing the familiar rumble of internal combustion engines (ICE). With the federal government's mandate that all new light-duty vehicles sold in Canada must be zero-emission by 2035, the question for most Canadians is no longer if they will drive an electric vehicle (EV), but how they will pay for it.

Financing an EV or a hybrid isn't exactly like financing a gas-powered Honda Civic or Ford F-150. While the paperwork might look similar, the underlying math is fundamentally different. You are dealing with higher upfront sticker prices, significant government rebates that act as instant down payments, and a completely different depreciation curve. Lenders are also evolving, creating specialized "Green Loans" with interest rates that reward your environmental choice. Understanding these nuances is the difference between a high-interest headache and a streamlined approval that puts thousands of dollars back in your pocket.

Key Takeaways

- Incentive Stacking: You can combine federal iZEV rebates (up to $5,000) with provincial incentives in places like BC and Quebec to drastically reduce your loan principal.

- Green Loan Perks: Major Canadian banks now offer preferred interest rates specifically for electrified vehicles, often 0.5% to 1.5% lower than standard auto loans.

- TCO is King: Getting approved often requires showing lenders that your "Total Cost of Ownership" is lower because you've swapped a $400 monthly gas bill for a $40 electricity increase.

- Residual Value Shifts: EVs hold their value differently; while battery tech evolves, the high demand for used EVs in Canada is keeping resale values surprisingly robust.

Understanding the Basics: BEV, PHEV, and HEV Financing

Before you sit down with a finance manager, you need to know exactly what kind of "electric" vehicle you are buying, as it dictates the rebates you qualify for and how a bank views the asset's future value.

Battery Electric Vehicles (BEV)

These are fully electric cars like the Tesla Model 3, Hyundai IONIQ 6, or Ford Mustang Mach-E. They have no gasoline engine. From a financing perspective, these carry the highest "sticker shock" but qualify for the maximum federal rebate of $5,000. Lenders view these as the future of the market, which often makes them eligible for the most aggressive "Green" interest rates.

Plug-in Hybrids (PHEV)

PHEVs like the Mitsubishi Outlander PHEV or the Toyota RAV4 Prime have both a battery and a gas engine. You can drive 40-80 kilometres on pure electricity before the gas kicks in. These are the "sweet spot" for many Canadians. Because they have smaller batteries than BEVs, the federal rebate is typically capped at $2,500 (though longer-range PHEVs can sometimes hit the $5,000 mark). Financing these is often easier for first-time EV buyers because the purchase price is closer to traditional vehicles.

Traditional Hybrids (HEV)

Think of the classic Toyota Prius. You don't plug these in; they use regenerative braking to charge a small battery. While they are incredibly fuel-efficient, they generally do not qualify for federal iZEV rebates. When financing an HEV, you are essentially following the same path as a traditional ICE vehicle, though you still benefit from better resale value down the road.

The Financial Benefits of EV & Hybrid Financing in Canada

The "Truth" about EV financing is that the price tag on the window is rarely what you actually finance. Canada has some of the most aggressive incentive structures in North America, designed specifically to bridge the price gap between gas and electric.

Federal Incentives: The iZEV Program Explained

The Incentives for Zero-Emission Vehicles (iZEV) program is a point-of-sale incentive. This means the dealer applies the rebate directly to the price of the car after taxes and fees. It effectively acts as a down payment provided by the government. To qualify, the vehicle must be on the Transport Canada eligibility list. Generally, passenger cars must have a base MSRP under $55,000, while higher trims can go up to $65,000. For SUVs and trucks, the base must be under $60,000, with higher trims up to $70,000.

Provincial Incentives: BC, Quebec, and Beyond

The real magic happens when you "stack" rebates. If you live in Quebec, you could see up to an additional $7,000 (though this is phasing down). In British Columbia, the Go Electric program offers up to $4,000 based on income. When you add a $5,000 federal rebate to a $4,000 provincial rebate, you've just shaved $9,000 off your loan principal before you've even opened your wallet. This significantly lowers your monthly payments and makes the loan-to-value (LTV) ratio much more attractive to lenders.

Specialized 'Green' Interest Rates

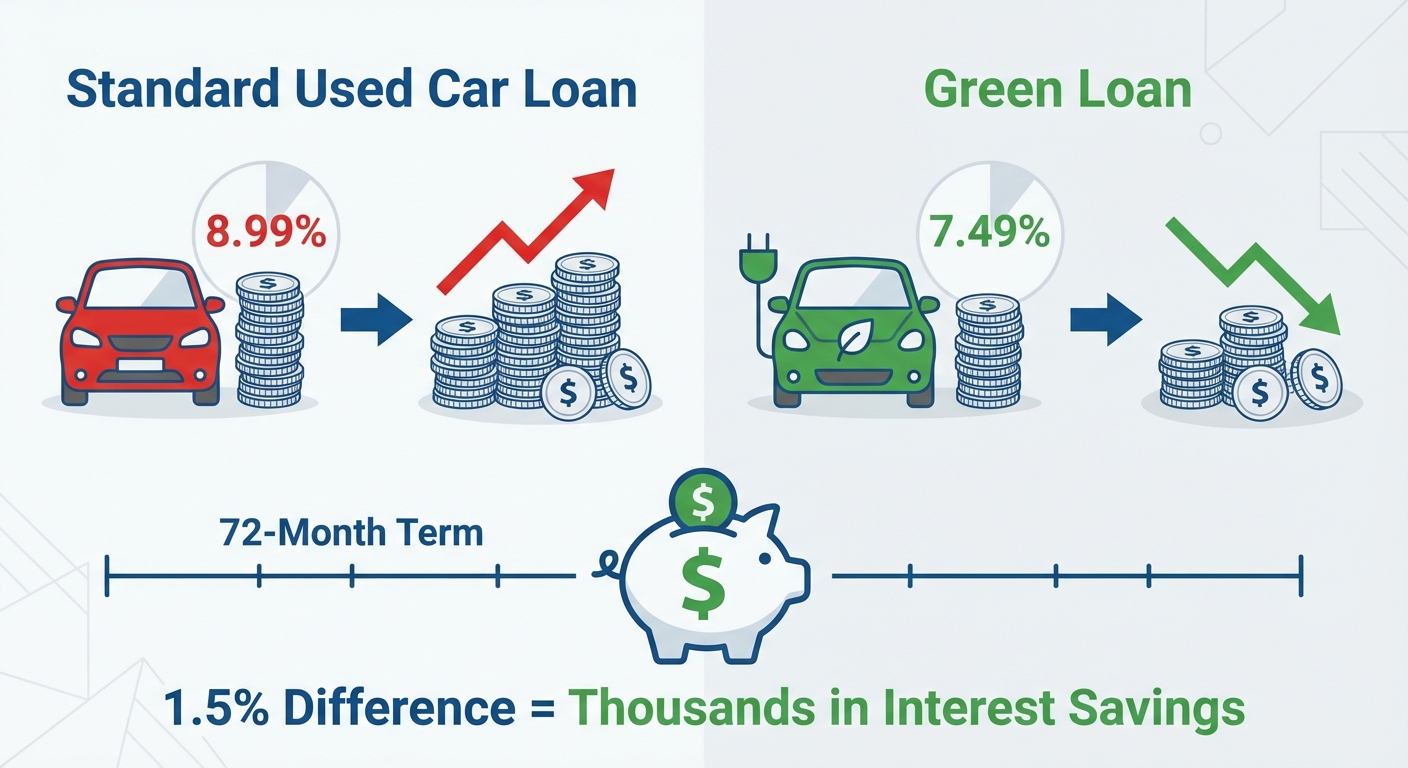

Canadian financial institutions like RBC, TD, and Scotiabank have realized that EV owners typically have higher-than-average credit scores and lower default rates. As a result, many offer "Green Auto Loans." These loans often feature a lower interest rate than their standard counterparts. For example, if a standard used car loan is 8.99%, a Green Loan might be offered at 7.49%. Over a 72-month term, that 1.5% difference can save you thousands in interest charges.

| Feature | Traditional ICE Vehicle | Electric Vehicle (EV) |

|---|---|---|

| Average Purchase Price | $45,000 | $55,000 |

| Government Rebates | $0 | Up to $12,000 (Stacked) |

| Effective Loan Principal | $45,000 | $43,000 |

| Monthly Fuel/Energy Cost | $250 - $400 | $40 - $60 |

| Maintenance (3 Years) | $1,200 (Oil, Plugs, etc.) | $300 (Cabin filter, Tires) |

The Approval Process: What Lenders Look For

When you apply for an EV loan, the lender is looking at the same three pillars as any other loan: Credit, Capacity, and Collateral. However, there are nuances specific to the Canadian EV market that you can use to your advantage.

Credit Score Requirements for EV Loans

Because EVs are generally more expensive, lenders often look for "Prime" credit scores (680 and above). If your score is in the "Subprime" range (below 620), you can still get approved, but you may not qualify for the specialized "Green" rates. In these cases, the government rebate becomes your best friend, as it provides the equity needed to reduce the lender's risk.

Debt-to-Income (DTI) Ratios: Factoring in Fuel Savings

This is where savvy buyers can win. Standard lending software calculates your ability to pay based on your gross income versus your existing debts. It doesn't usually account for the fact that you will no longer be spending $300 a month at the Shell station. If your DTI is tight, some specialized lenders and credit unions in Canada allow for a "holistic review" where you can demonstrate that your disposable income is actually higher because of the lack of fuel costs. While not every bank does this, it is becoming more common in the EV space.

Proof of Residency and Employment

In the Canadian context, lenders want to see stability. If you are an newcomer to Canada or a first-time buyer, you might find it easier to get approved for a hybrid rather than a high-end Tesla. Lenders prefer to see at least six months of consistent employment in the same field and a valid Canadian address. For EVs, they also occasionally look at whether you own your home, as this implies you have a place to install a charger (though this is not a strict requirement).

Leasing vs. Financing: Which is Right for an EV?

This is the "million-dollar question" in the EV world. The technology is moving fast. The battery in an EV today is significantly better than one from five years ago, and the ones five years from now will be even better. This creates a unique dynamic for financing.

The Technology Obsolescence Factor

When you lease an EV, you are essentially "renting" the battery technology for 3 or 4 years. At the end of the term, you hand the keys back and walk away. If a new solid-state battery comes out that doubles the range of cars, you aren't stuck owning "old" tech. This makes leasing a very popular option for BEVs. However, keep in mind that the federal iZEV rebate is prorated for leases. You only get the full $5,000 if your lease term is 48 months or longer. A 24-month lease might only net you $2,500.

Residual Value Realities

Historically, people feared that EVs would have terrible resale value because of battery degradation. In Canada, the opposite has often been true. Because supply has been low and demand high, used EVs have held their value remarkably well. Financing (owning) makes more sense if you plan to keep the vehicle for 7+ years, as the "fuel" savings eventually pay for the vehicle itself.

Kilometre Limits and EV Road Trips

If you plan on using your EV for a cross-country Canadian road trip every summer, watch your lease limits. Most Canadian leases allow for 16,000 to 24,000 kilometres per year. If you go over, the penalties can be steep ($0.10 to $0.20 per km). If you are a high-mileage driver, traditional financing is almost always the better financial move.

Total Cost of Ownership (TCO): The Secret to Getting Approved

If you only look at the monthly car payment, an EV might look more expensive than a gas car. But a car payment is only one part of your monthly transportation budget. To get a true sense of what you can afford, you must calculate the Total Cost of Ownership.

Maintenance Savings: No Oil Changes, Fewer Moving Parts

An internal combustion engine has hundreds of moving parts, all of which eventually break. An electric motor has about twenty. There are no oil changes, no spark plugs, no timing belts, and no mufflers. Even your brakes last longer because of "regenerative braking," which uses the motor to slow the car down. When you present your budget to a lender, highlighting these reduced maintenance costs can help prove that you can handle a slightly higher monthly payment.

Fuel vs. Electricity: Calculating your monthly 'Energy' budget

In Ontario, charging an EV overnight during off-peak hours can cost as little as $2.00 for a full "tank." Compare that to $80.00 for a tank of gas. Even in provinces with higher electricity rates, the cost per kilometre is a fraction of gasoline. On average, Canadian EV drivers save between $1,500 and $2,500 per year on energy alone. If you divide that by 12, that's nearly $200 a month in "hidden" savings that make your car loan much more affordable than it appears on paper.

Insurance Premiums for EVs in Canada

One thing to watch out for is insurance. Some EVs are more expensive to insure because they are faster and can be more costly to repair after an accident. However, many Canadian insurers (like Aviva or Desjardins) offer "Green Vehicle" discounts. Always get an insurance quote before finalizing your financing so there are no surprises in your monthly budget.

Hidden Costs to Include in Your Financing Plan

To get a "truthful" approval, you need to account for the costs that aren't on the bill of sale. If you don't budget for these, you might find your finances stretched thin after the purchase.

Home Charging Infrastructure (Level 2 Stations)

While you can charge an EV from a standard 110v wall outlet (Level 1), it is painfully slow-taking up to 20 hours for a full charge. Most owners want a Level 2 station (240v), which requires a dedicated circuit similar to a clothes dryer. The unit itself costs $500-$1,000, and installation by a licensed electrician can range from $500 to $1,500 depending on your home's electrical panel. Some provinces and municipalities offer grants to cover these costs, but you should consider rolling this cost into your auto loan if the lender allows for "accessories" to be included.

Winter Performance and Battery Efficiency

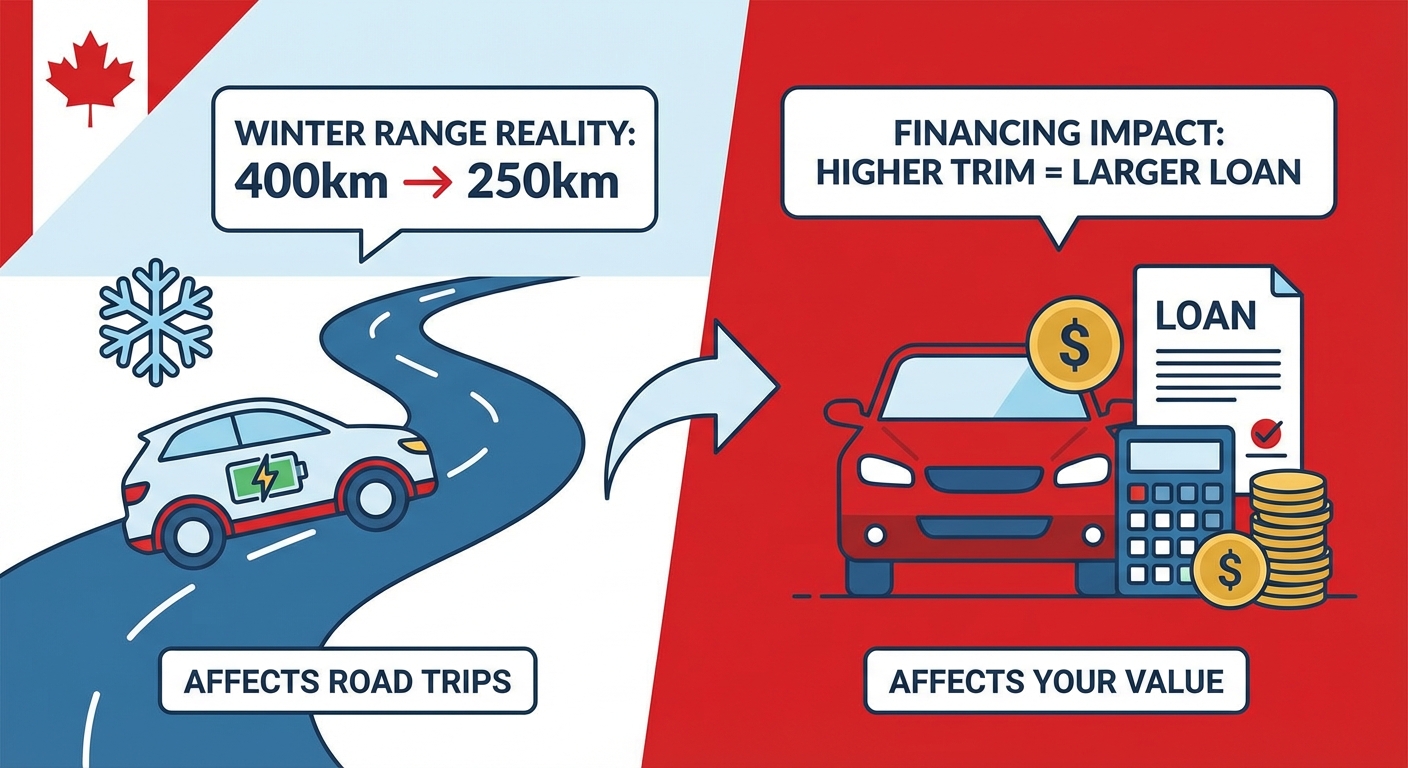

Canada is cold. There is no way around it. In -20°C weather, an EV can lose 30% to 50% of its range because the battery has to work to keep itself and the cabin warm. This doesn't just affect your road trips; it affects your value. When financing, consider that a car with a 400km range is effectively a 250km car in January. If your commute is long, you may need a higher-trim model with a larger battery, which means a larger loan.

Step-by-Step Guide to Getting Approved for EV & Hybrid Financing

Step 1: Research the iZEV Eligibility List

Don't assume every hybrid is eligible. Check the official Transport Canada list to ensure the specific trim level you want qualifies for the $2,500 or $5,000 rebate. This is your "free" down payment.Step 2: Check your Credit Report (Equifax/TransUnion)

In Canada, your credit score is the primary driver of your interest rate. If you see errors, fix them before applying. A 20-point jump in your score could save you $40 a month on an EV loan.Step 3: Calculate your 'Green' Budget

Don't just look at the MSRP. Calculate the "Post-Rebate" price, add the cost of a home charger, and subtract your monthly gas savings. This gives you your "True Monthly Cost."Step 4: Compare Dealer Financing vs. Bank Green Loans

Ask the dealer for their best rate, then call your bank and ask about their "Eco-friendly" or "Green" loan products. Pick the one with the lowest Annual Percentage Rate (APR), not just the lowest monthly payment.Step 5: Finalizing the Rebate Paperwork at Point-of-Sale

The dealer handles the federal iZEV paperwork. You just sign. However, for provincial rebates (like in BC), you may need to apply yourself or provide proof of income. Ensure all this is settled before you drive off the lot.

Common Pitfalls to Avoid

Even with the best intentions, Canadian car buyers often fall into a few common traps when financing their first electrified vehicle.

Ignoring the 'Luxury Tax': Since 2022, Canada has a federal luxury tax on vehicles priced over $100,000. If you are financing a high-end Tesla Model X or a Porsche Taycan, this tax can add a significant chunk to your loan principal. It applies to the amount over $100,000, so budget accordingly.

Forgetting the Home Charger: Many people spend their entire budget on the car and then realize they can't afford the $1,500 electrical upgrade for their garage. Try to include the charger in your financing package if possible, or set aside a portion of your down payment specifically for the "fuel station" in your home.

Overestimating Resale Value: While used EVs are hot right now, the market is maturing. Don't assume your car will be worth 80% of its value in four years. Use conservative residual value estimates when deciding whether to lease or buy.

Frequently Asked Questions (FAQ)

Do I need a special credit score for an EV loan?

No, you don't need a "special" score, but because EVs often have higher price points, lenders prefer scores in the "Good" to "Excellent" range (680+). However, the government rebates act as a down payment, which helps those with lower scores get approved by reducing the total amount borrowed.

Can I get the iZEV rebate on a used EV?

Generally, no. The federal iZEV program is designed for new vehicles. However, some provinces have their own programs for used EVs. For example, Quebec has historically offered incentives for used fully electric vehicles, provided they meet certain criteria and haven't already received a provincial rebate.

How do cold Canadian winters affect my EV's resale value?

Resale value in Canada is more affected by battery health than the weather itself. While range drops in winter, the battery isn't permanently damaged. As long as you maintain the battery (avoiding leaving it at 0% or 100% for long periods), the resale value remains competitive with ICE vehicles.

Is it better to finance through the dealer or a bank like RBC?

It depends on the incentives. Manufacturers (dealers) often offer promotional rates (like 0.9% or 1.9%) to move specific models. Banks, on the other hand, offer "Green Loans" that might be better if you are buying a model that doesn't have a manufacturer promotion. Always compare the two.

Are there specific loans for home charging stations?

Some Canadian credit unions and banks offer "Home Energy Loans" or "Green Improvement Loans" which can be used for EV chargers, heat pumps, or solar panels. These often have lower rates than a personal line of credit. You can also sometimes roll the cost of the charger into your primary auto loan.

Navigating the Future of Canadian Auto Finance

The shift toward sustainable driving is more than just an environmental choice; it's an economic one. As the 2035 mandate approaches, the infrastructure for charging will continue to expand, and the financial products available for EV buyers will become even more specialized. Right now, we are in a "sweet spot" where government incentives are high and banks are eager to grow their green portfolios.

By focusing on the Total Cost of Ownership rather than just the sticker price, you can secure a financing deal that reflects the true value of an EV. Leveraging federal and provincial "stacking" opportunities allows you to walk into a dealership with a massive "virtual" down payment, making your approval faster and your monthly payments more manageable. The future of Canadian driving is electric, and with the right financing strategy, you can get behind the wheel of a vehicle that saves you money every single time you bypass the gas station. Take the time to audit your credit, calculate your energy savings, and compare the green loan options available to you. The road to 2035 is already paved, and it's never been more affordable to start your journey.