EV Loan After Divorce? Your 2026 Approval Guide

Table of Contents

- Key Takeaways: Your Roadmap to an EV After Divorce

- The Starting Line: Redefining Your Financial Identity

- From 'We' to 'Me': The Lender's New Perspective

- Deep Dive: Auditing Your Post-Divorce Financial Health

- Untangling the Past: Neutralizing Joint Auto Loan Complications

- Scenario 1: Your Ex Keeps the Car (and the Loan)

- Scenario 2: You Keep the Car (and the Loan)

- Scenario 3: Selling the Vehicle to Clear the Slate

- The EV Equation: Is an Electric Vehicle a Smart Post-Divorce Purchase?

- Beyond the Sticker Price: Calculating Your EV's Total Cost of Ownership

- Deep Dive: How Government Rebates and Tax Credits *Actually* Work

- Building Your Bulletproof Application: The Lender's Checklist

- Proving Income: Beyond the Pay Stub

- The Credit Report Story: Explaining Divorce-Related Blemishes

- Choosing Your Loan Source: Bank vs. Credit Union vs. Dealership

- Your Next Steps to Approval: A 30-Day Action Plan

- Week 1: Financial Reconnaissance

- Week 2-3: Application Prep

- Week 4: The Purchase

- Frequently Asked Questions

Navigating life after a divorce is a journey of re-establishing your independence, and your finances are at the heart of that journey. You’re setting a new budget, managing new household expenses, and, for many, figuring out transportation. The question, "Can I get an electric vehicle loan after divorce in Canada?" isn't just about a car; it's about moving forward, making smart long-term decisions, and reclaiming control.

The answer is a resounding yes, but the path to approval looks different now. Lenders aren't seeing a couple's combined income or shared credit history anymore. They're looking at you—your individual financial strength, your stability, and your ability to manage debt on your own. This guide is designed to demystify that process for 2026 and beyond, turning what feels like a complex challenge into a clear, actionable plan to get you behind the wheel of your new EV.

Key Takeaways: Your Roadmap to an EV After Divorce

-

Financial Separation is Non-Negotiable

- Legally remove your name from joint debts as outlined in your separation agreement. This is not optional; a divorce decree does not automatically release you from a loan contract.

- Establish your individual credit profile immediately by opening accounts solely in your name.

- Your new Debt-to-Income (DTI) ratio is the single most important metric for lenders. Know this number before you apply.

-

EVs Have a Unique Financial Footprint

- Factor in total cost of ownership (TCO), not just the monthly payment. Fuel and maintenance savings are real and can strengthen your application.

- Government rebates can lower the principal loan amount, but understand if they are applied at the point of sale (like the federal iZEV program) or as a tax credit later.

- Lenders may scrutinize the higher sticker price of an EV more closely, making a solid application even more critical.

-

Documentation is Your Superpower

- Gather proof of new income sources like spousal or child support using court orders and bank statements.

- Prepare a letter of explanation for any credit issues that arose during the separation. A short, factual note can neutralize a lender's concerns.

- Get pre-approved from multiple sources *before* visiting a dealership. This gives you negotiating power and a clear budget.

The Starting Line: Redefining Your Financial Identity

Yes, you can absolutely get an electric vehicle loan after a divorce in Canada. The key is to demonstrate to lenders that you are a stable, independent financial entity. This involves formally separating all joint debts, calculating your new individual income and debt-to-income ratio, and providing clear documentation for all income sources, including spousal or child support.

From 'We' to 'Me': The Lender's New Perspective

When you applied for credit as part of a couple, lenders saw a combined financial picture. Two incomes, shared assets, and a joint credit history. Now, the lens has zoomed in entirely on you. This isn't a negative thing; it's just different. Lenders are looking for proof of two things: stability and independence.

- Demonstrating Stability: They want to see consistent income, a manageable debt load, and evidence that your financial situation has settled after the upheaval of divorce.

- Proving Independence: They need to know that you can handle the loan payments on your own, without reliance on your former spouse's income or credit.

The psychological shift for you is just as important. You're moving from shared financial goals to individual ones. This new EV isn't just a car; it's a major asset that you alone are responsible for. Embracing this mindset is the first step toward building a powerful loan application.

Deep Dive: Auditing Your Post-Divorce Financial Health

Before you even think about test-driving a Tesla in Toronto or a Bolt in Calgary, you need a crystal-clear picture of your new financial reality. It's time for a personal financial audit.

- Create a Personal Balance Sheet: List your assets (cash, investments, equity in your home) on one side and your liabilities (mortgage, credit card debt, student loans) on the other. This gives you your new net worth.

- Calculate Your Debt-to-Income (DTI) Ratio: This is the magic number for lenders. Add up all your monthly debt payments (rent/mortgage, credit cards, other loans) and divide it by your gross (pre-tax) monthly income. Most lenders look for a DTI below 40-43% *including* the potential new car payment.

- Hunt Down and Close Joint Accounts: Go through your credit report with a fine-tooth comb. Are there old joint credit cards, lines of credit, or utility accounts still open? Even if your separation agreement says your ex is responsible, if your name is on the account, a missed payment by them will damage *your* credit. Close them or have your name formally removed.

Pro Tip: The Power of a Separation Agreement

Don't just tell a lender your finances are separate; show them. A clear, legally binding separation agreement that specifies exactly who is responsible for each debt from the marriage is a powerful tool. Provide a copy with your application. It proves to the underwriter that you have officially and legally untangled your finances, reducing their perceived risk.

Untangling the Past: Neutralizing Joint Auto Loan Complications

One of the most common and damaging financial remnants of a marriage is a joint auto loan. How you handle this existing loan is critical to getting approved for a new one. Here are the three most common scenarios we see and how to navigate them.

Scenario 1: Your Ex Keeps the Car (and the Loan)

This is the trickiest situation. A common mistake is assuming the divorce decree is enough. It's not. Your divorce decree is a court order between you and your ex; your loan contract is a legal agreement between you, your ex, and the lender. The lender doesn't care about your divorce agreement.

- The Goal: Refinancing. The only way to truly sever your liability is for your ex-spouse to refinance the vehicle loan solely in their name. This pays off the original joint loan and creates a new one for which you have zero responsibility.

- The Backup: A Release of Liability. If refinancing isn't possible, you can ask the lender for a "release of liability." This is a formal document from the lender that removes your name from the loan. They are not obligated to grant this and usually only do so if the remaining borrower has a very strong credit profile.

Until your name is off that loan contract, any late payment your ex makes will appear on your credit report and negatively impact your ability to get your new EV loan.

Scenario 2: You Keep the Car (and the Loan)

If you're keeping the jointly-financed car, your path is clearer. You must refinance the loan into your individual name. This process involves applying for a new loan from a bank, credit union, or specialist lender to pay off the old joint loan.

This can actually be a strategic move. By successfully refinancing and making on-time payments for a few months *before* you apply for your EV loan, you demonstrate to lenders that you can manage auto debt independently. It builds a positive, solo credit history right when you need it most.

Scenario 3: Selling the Vehicle to Clear the Slate

Often the cleanest option is to sell the car and pay off the joint loan completely. This removes the debt from both of your credit reports and provides a clean slate.

- Dealing with Negative Equity: What if you owe more on the loan than the car is worth? This is called negative equity. You will need to pay the difference out of pocket to the lender when you sell the car to close the loan. For example, if you owe $22,000 and the car sells for $19,000, you and/or your ex must come up with $3,000 to close the account.

- Document Everything: Once the loan is paid, get a "lien release" letter from the lender and ensure your credit report is updated to show the account as "Paid and closed." This is your proof that the joint debt is gone.

The EV Equation: Is an Electric Vehicle a Smart Post-Divorce Purchase?

With your finances in a state of transition, is now the right time to take on the typically higher sticker price of an electric vehicle? It might seem counterintuitive, but when you look at the total picture, an EV can be a very savvy financial move.

Beyond the Sticker Price: Calculating Your EV's Total Cost of Ownership

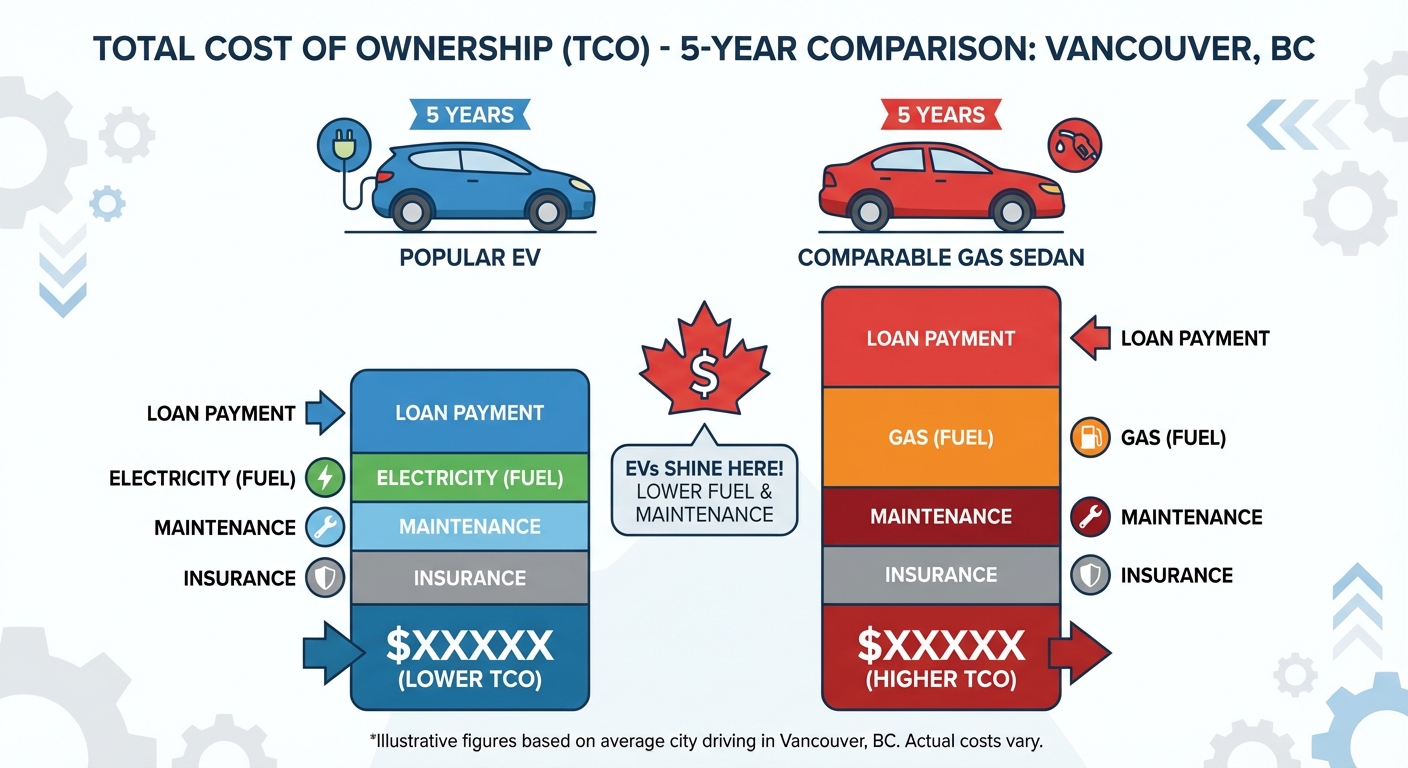

Lenders care about your monthly payment, but *you* should care about your total monthly transportation cost. This is where EVs shine. The Total Cost of Ownership (TCO) includes not just the loan payment, but fuel, maintenance, and insurance.

Let's compare a popular EV with a comparable gas sedan over five years in a city like Vancouver, BC.

| Cost Factor (5-Year Estimate) | 2026 Honda Civic Sedan (Gas) | 2026 Tesla Model 3 RWD (EV) |

|---|---|---|

| Purchase Price (MSRP) | ~$32,000 | ~$54,000 |

| Federal/Provincial Rebates | $0 | -$8,000 (iZEV + BC) |

| Effective Price for Loan | $32,000 | $46,000 |

| Fuel / Charging Costs* | $10,200 (@ $1.90/L, 7.5L/100km) | $2,250 (@ $0.15/kWh, home charging) |

| Maintenance | $3,500 (oil changes, brakes, filters) | $1,000 (tires, cabin filters) |

| Insurance (Estimate) | $9,000 ($150/mo) | $10,800 ($180/mo) |

| Total 5-Year Cost of Ownership | $54,700 | $60,050 |

*Assumes 15,000 km driven per year. Excludes major unexpected repairs.

While the EV's total cost is still higher in this example due to the purchase price, the gap is much smaller than the initial sticker shock suggests. Crucially, the monthly *operating* cost is significantly lower, which frees up cash flow in your new budget.

Deep Dive: How Government Rebates and Tax Credits *Actually* Work

Understanding Canadian EV incentives is key. They aren't just free money; they directly impact your loan.

- Point-of-Sale Rebates: The federal iZEV (Incentives for Zero-Emission Vehicles) program and many provincial rebates (like those in Quebec and British Columbia) are applied directly at the dealership. This means the rebate amount is taken off the price of the car *before* taxes and financing. If a car is $55,000 and qualifies for a $5,000 rebate, you are only financing $50,000.

- Post-Purchase Tax Credits: Some incentives may function as tax credits you claim at the end of the year. This means you have to finance the full price of the vehicle and then get the money back later. It's vital to know which type of incentive you're getting so you can accurately calculate your required loan amount.

Pro Tip: Present a TCO Calculation to Your Lender

When you apply for your loan, don't just submit the application. Include a simple, one-page Total Cost of Ownership calculation like the one above. Show the lender you've done your homework. By demonstrating that the EV's higher monthly payment will be partially offset by significant savings on gas and maintenance, you prove you're making a responsible, well-researched financial decision. This can be a tie-breaker for an underwriter on the fence.

Building Your Bulletproof Application: The Lender's Checklist

Once your financial house is in order, it's time to assemble an application that leaves no room for doubt. An underwriter is looking for a story of stability and reliability. Your job is to provide them with a clear, well-documented narrative.

Proving Income: Beyond the Pay Stub

For many people navigating a divorce, income isn't just a simple pay stub from a 9-to-5 job. You need to document every source meticulously.

- Spousal and Child Support: This is qualifying income. Do not leave it out. Provide a copy of the court order or separation agreement that specifies the amounts and duration, along with 3-6 months of bank statements showing the deposits being made consistently. For more on this, check out our guide on Your Child Tax Benefit: The Unexpected Car Loan Key in Vancouver.

- New or Inconsistent Income: If you've recently started a new job or have variable income (e.g., gig work), provide a signed employment letter stating your salary or hourly rate, and supplement with bank statements. The more proof of consistent deposits, the better.

- Employment Stability: Lenders typically like to see at least 3-6 months at a current job. If you've changed jobs recently due to the divorce (e.g., moving to a new city like Montreal), be prepared to explain this and show that you've stayed within the same industry.

The Credit Report Story: Explaining Divorce-Related Blemishes

Divorce is messy, and sometimes credit reports reflect that. A few late payments on a joint utility bill during the chaos of separation can happen. The key is to address it head-on.

- Write a Letter of Explanation: This is a short, factual letter that accompanies your application. State the facts clearly. For example: "The late payments on the Rogers account from May-July 2025 occurred during my legal separation. As per my separation agreement, my former spouse was responsible for this bill. The account has since been closed, and all my individual accounts are in good standing."

- Blip vs. Pattern: Lenders can distinguish between a temporary "blip" related to a major life event and a long-term pattern of financial irresponsibility. Your letter helps them categorize those divorce-related issues as a one-time event, not a habit. If your credit situation is more complex, perhaps involving a consumer proposal, specialized lenders have pathways to help. For an in-depth look, read The Consumer Proposal Car Loan You Were Told Was Impossible.

Choosing Your Loan Source: Bank vs. Credit Union vs. Dealership

Where you get your loan matters. Each source has pros and cons for a post-divorce applicant.

| Loan Source | Pros | Cons | Best For... |

|---|---|---|---|

| Major Bank | Potentially lowest interest rates (6-9%) for strong credit. | Very strict underwriting; less flexible on income verification or credit blemishes. | Applicants with a strong, established solo credit history and stable T4 income. |

| Credit Union | More relationship-based; may be more willing to listen to your story and consider the context of your situation. | Rates can be slightly higher than major banks; you must be a member. | Applicants with a good-but-not-perfect profile who can benefit from a personal banking relationship. |

| Dealership / Specialist Lender | Highest approval rates; experienced with complex situations (divorce, new credit, non-traditional income). One-stop shopping. | Interest rates are higher (9-29%+) to compensate for increased risk. | Applicants who are rebuilding credit, have no solo credit history, or need a lender who understands unique income like support payments. |

Pro Tip: Leverage Your Pre-Approval

Always try to get pre-approved from your bank or a credit union first, even if you think you'll be denied. If you're approved, you walk into the dealership with a firm rate and budget, giving you immense negotiating power. If you're denied, you know where you stand and can work with a dealership finance expert who has access to lenders, like us at SkipTheCarDealer, who specialize in your exact situation. Starting with zero credit history can feel daunting, but it's a blank slate. Learn more in our guide: Zero Credit? Perfect. Your Canadian Car Loan Starts Here.

Your Next Steps to Approval: A 30-Day Action Plan

Feeling overwhelmed? Don't be. Break the process down into manageable weekly tasks. Here is a simple 30-day plan to take you from reading this article to driving your new EV.

Week 1: Financial Reconnaissance

- Obtain your full credit report from both major bureaus in Canada, Equifax and TransUnion. Review every single line item.

- Finalize the closure or refinancing of all remaining joint accounts. Get confirmation in writing.

- Create your detailed personal budget and calculate your Debt-to-Income (DTI) ratio. This will determine how much car you can realistically afford.

Week 2-3: Application Prep

- Gather all income documentation: 3 months of pay stubs, your employment letter, court orders for support, and corresponding bank statements. Organize them in a single digital folder.

- Write your Letter of Explanation (if needed). Keep it short, factual, and professional.

- Apply for pre-approval from your own bank or a trusted credit union to get a baseline interest rate and loan amount.

Week 4: The Purchase

- Use your pre-approval as a powerful negotiation tool at the dealership. Let them know you have financing secured and ask if they can beat the rate.

- Focus on negotiating the total price of the vehicle, not the monthly payment.

- Test drive your chosen EVs. Make sure the one you choose fits your new lifestyle.

- Review the final loan documents and bill of sale carefully before signing. Check the interest rate, loan term, and total amount financed.

Taking control of your finances after a divorce is a powerful act of self-reliance. Securing a loan for a new, efficient, and reliable electric vehicle isn't just a purchase; it's a milestone on your journey to a new and independent future.