The Canadian automotive landscape has shifted dramatically over the last few years. If you bought a car between 2020 and 2022, you likely dealt with record-high prices and limited inventory. As we move through the post-2023 stabilization period, many Canadian drivers are finding themselves ready for a change, yet they face a common hurdle: they still owe money to a lender. If you are looking at your driveway and wondering how to move on from a vehicle that still has an active loan, you aren't alone. In fact, a significant portion of late-model vehicles on Canadian roads are financed, meaning the "owner" is actually sharing the title with a bank or credit union.

Selling or trading a car while financing adds a layer of complexity that doesn't exist in a cash transaction. You have to navigate the world of liens, payout statements, and the dreaded "negative equity." However, it is entirely possible-and often financially savvy-to make the switch. Whether you are looking to upgrade to a larger SUV for a growing family or downsizing to an EV to save on fuel costs, understanding the mechanics of the Canadian lending system is your first step toward a successful transaction.

Key Takeaways

- Legality: You can legally sell or trade a financed car, but the lien must be cleared before ownership is officially transferred to the new party.

- The Tax Shield: Trading in your vehicle at a dealership offers a massive tax advantage in most provinces, as you only pay GST/HST on the "price difference" between the new car and your trade.

- Negative Equity: If you owe more than the car is worth, you'll need to pay the difference out of pocket or "roll" the debt into a new loan-a move that requires careful consideration.

- Payout Statements: Your lender's 10-day payout statement is the single most important document in this process.

- Private Sales: While they offer the highest sale price, private sales are the most difficult to execute when a lien is involved due to buyer trust issues.

Understanding the Lien: Why You Don't Fully 'Own' Your Car Yet

In Canada, when you finance a vehicle, the lender registers a "lien" against the car. Think of a lien as a legal claim or a "security interest." It tells the world-and specifically the provincial government-that the vehicle serves as collateral for a debt. Until that debt is paid in full, the lender has a legal right to the asset. This is why you cannot simply sign over the registration (the "pink slip" or ownership) to a buyer and walk away; the provincial registry will not allow the transfer of title if an active lien is detected.

The way these liens are recorded varies by province. In most of English-speaking Canada, lenders use the Personal Property Security Act (PPSA) registry. In Quebec, the system is known as the RDPRM (Registre des droits réels mobiliers). These registries are public records that dealerships and savvy private buyers check before handing over any money. If you try to sell a car without disclosing a lien, you could face significant legal trouble, and the buyer would be left with a car they cannot legally register.

Option 1: Trading In Your Financed Car to a Dealership

For the vast majority of Canadians, trading in a financed car to a dealership is the preferred route. The reason is simple: convenience. When you trade in a car, the dealership's finance department takes over the communication with your lender. They will call your bank (e.g., RBC, TD, or Scotiabank), obtain the payout amount, and handle the wire transfer to clear the lien. You simply sign a few documents, and the debt is settled as part of your new purchase.

The appraisal process at a dealership is straightforward. A used car manager will inspect your vehicle, check its history, and offer you a "Wholesale Value." This value is typically lower than what you would get in a private sale because the dealer needs to account for reconditioning, safety inspections, and their own profit margin. However, the convenience and the financial benefits often outweigh the lower offer.

The Hidden Benefit: The Canadian Tax Advantage

This is where the math starts to favour the dealership route. In most Canadian provinces, you only pay sales tax on the cash difference between your trade-in and your new vehicle. This is often referred to as the "Tax Shield."

Let's look at how this works in Ontario, where the HST is 13%. Imagine you are buying a new SUV for $50,000 and your current financed car is worth $20,000.

| Scenario | New Car Price | Trade-In Value | Taxable Amount | Tax (13% HST) | Total Cost (Before Loan Payoff) |

|---|---|---|---|---|---|

| No Trade-In | $50,000 | $0 | $50,000 | $6,500 | $56,500 |

| With Trade-In | $50,000 | $20,000 | $30,000 | $3,900 | $33,900 (+$20k trade) |

In this example, by trading in the car, you saved $2,600 in taxes ($6,500 minus $3,900). If you had sold the car privately for $21,000, you might think you came out ahead, but you actually lost money because the private sale didn't provide that $2,600 tax credit. To beat the dealer's $20,000 offer in a private sale, you would actually need to sell the car for more than $22,600 just to break even.

Option 2: Selling to Online Retailers (The 'Clutch' Model)

The Canadian market has seen a surge in digital-first retailers like Clutch or Cardoor. These platforms offer a middle ground between the low effort of a dealership trade-in and the higher price of a private sale. These companies use algorithms to provide an "Instant Offer" based on your VIN and a few photos.

The process is remarkably smooth for financed cars. Once you accept an offer, these companies typically send a representative to your home to verify the car's condition. They handle the lien payout directly with your lender and e-transfer you any remaining equity. It removes the need to visit multiple dealerships for appraisals or deal with "tire kickers" on Kijiji. The downside? Their offers are often firm, and you may lose out on the provincial tax credit if you aren't buying your next car through their specific platform.

Option 3: The Private Sale While Financing (The High-Effort Path)

If you have a rare vehicle, a car in pristine condition, or simply want every last dollar out of the transaction, the private market is your best bet. However, selling a financed car privately in Canada is a challenge of trust. A buyer is naturally nervous about giving $30,000 to a stranger who still owes $25,000 to a bank. What if the seller takes the money and doesn't pay off the loan? The bank could then repossess the car from the new, innocent owner.

How to Execute a Private Sale Safely

To overcome this "Trust Gap," you must be extremely transparent. The best way to handle this is to conduct the final transaction at your bank's branch. If you finance through TD, meet the buyer at a TD branch. The buyer can provide a bank draft, and the bank teller can immediately apply those funds to the loan and provide a receipt showing the loan is closed. This gives the buyer peace of mind that the lien will be released.

| Feature | Dealership Trade-In | Online Retailer | Private Sale |

|---|---|---|---|

| Effort Level | Low | Medium-Low | High |

| Sale Price | Wholesale | Competitive Wholesale | Full Market Value |

| Tax Advantage | Yes (Significant) | Sometimes | No |

| Lien Handling | Professional/Automatic | Professional/Automatic | Manual/Complex |

Navigating Negative Equity ('Being Upside Down')

Negative equity is a term that strikes fear into many Canadian car owners. It occurs when your vehicle's market value is lower than the amount you still owe on your loan. This is common in Canada due to long-term financing (84 or 96-month terms) and the rapid depreciation of certain luxury or high-volume vehicles.

If you are "upside down" by $5,000, that money doesn't just disappear when you sell the car. You are still legally responsible for it. You have three primary ways to handle this:

Strategy A: Paying the 'Shortfall' Out of Pocket

This is the cleanest method. If you owe $25,000 and the car is worth $20,000, you simply pay the $5,000 difference to the lender from your savings. This clears the lien and allows you to move on with a clean slate.

Strategy B: Rolling Negative Equity into a New Loan

Most Canadian dealerships will offer to "roll" your negative equity into the financing of your next vehicle. While this is convenient, it is a dangerous financial cycle. You are now financing the remaining $5,000 of your old car plus the full price of your new car. Canadian banks have "Loan-to-Value" (LTV) limits, usually capped at 120% to 140%. If your negative equity is too high, the bank may refuse the new loan because the total debt far exceeds the value of the new asset.

Strategy C: Keeping the Car until the 'Break-Even' Point

Sometimes, the best financial move is to do nothing. If you are deep in negative equity, continuing to make payments for another year or two will eventually bring the loan balance in line with the car's value. This is the "Break-Even Point."

Step-by-Step Guide: How to Sell/Trade Your Financed Car

If you've decided to move forward, follow these steps to ensure you don't hit any legal or financial snags.

- Request a 10-Day Payout Statement: Call your lender and ask for a formal payout statement. This document will show the exact amount needed to close the loan, including any daily interest. It is usually valid for 10 days.

- Determine your 'True' Market Value: Use tools like the Canadian Black Book or browse local listings on AutoTrader.ca to see what similar cars are actually selling for in your specific city.

- Gather your documents: You will need your NVIS (for new cars), current registration, and a complete history of service records. Buyers and dealers in Canada value a well-maintained car significantly higher.

- Choose your path: Decide if the tax savings of a trade-in outweigh the potential extra cash from a private sale.

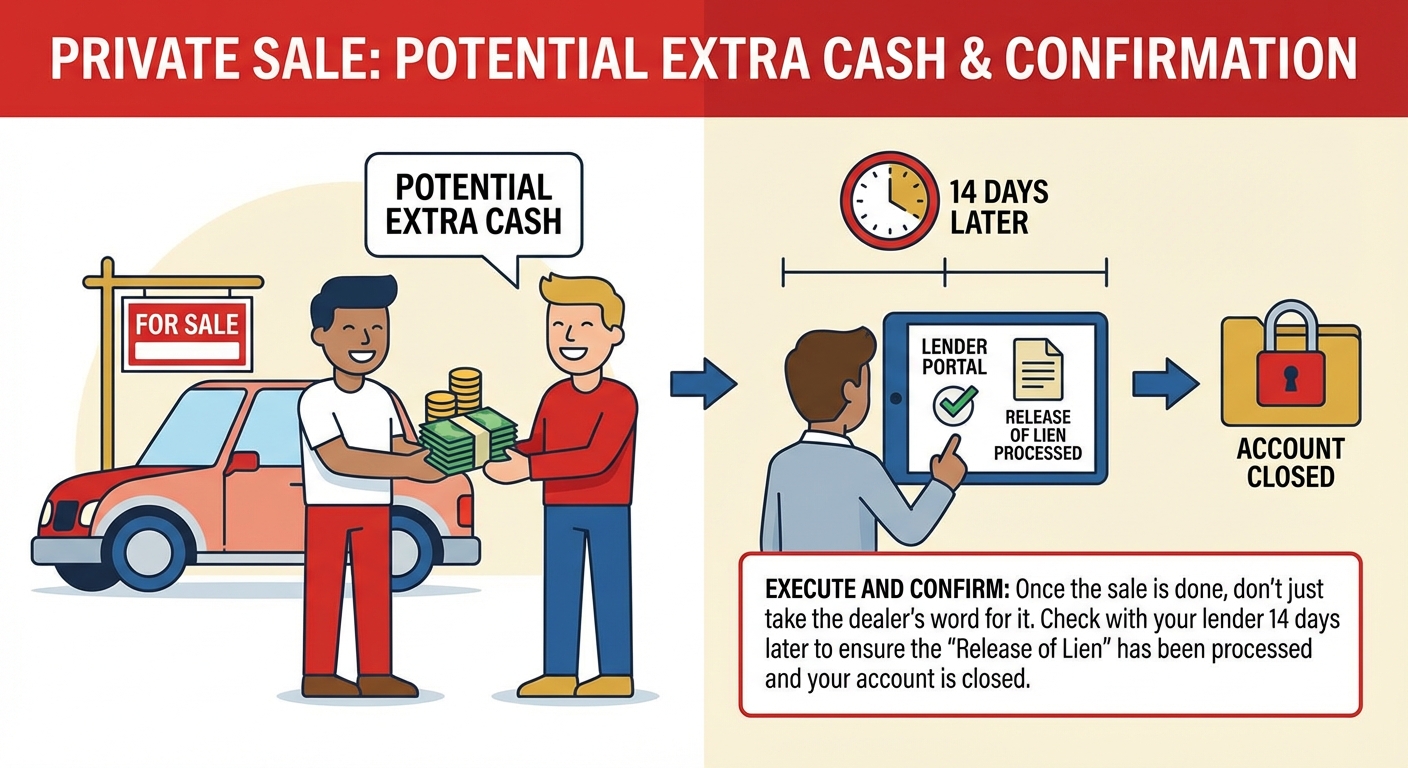

- Execute and Confirm: Once the sale is done, don't just take the dealer's word for it. Check with your lender 14 days later to ensure the "Release of Lien" has been processed and your account is closed.

Provincial Variations You Must Know

Canada is a federal state, but automotive regulations are provincial. Where you live matters immensely for your bottom line.

Ontario: You are required to provide a Used Vehicle Information Package (UVIP) for private sales. This package includes the lien history, though it is still wise to get a separate CarFax. The HST is 13%, making the trade-in tax shield very valuable.

British Columbia: BC has a unique tax structure for vehicles. Depending on the price of the car, provincial sales tax (PST) can range from 7% to 20% for luxury vehicles. Trading in can save you a massive amount in PST compared to other provinces.

Quebec: The Consumer Protection Act in Quebec is quite robust. Lenders must follow strict rules regarding the RDPRM registry. Additionally, Quebec has specific laws regarding "instalment sales" that differ from the rest of Canada.

Alberta: Alberta is the "easy" province for car sales. There is no provincial sales tax (only 5% GST). However, this also means the "Tax Shield" benefit is much smaller than in Ontario or BC, as you are only saving the 5% GST on the trade-in value.

Pro Tips for Maximizing Your Return

To get the best possible deal, you need to think like a pro. Here are three insider tips to help you keep more money in your pocket.

Frequently Asked Questions (FAQ)

Can I sell my car if I have a 0% interest loan?

Yes, you can. However, 0% loans often have the "interest" baked into the higher purchase price of the car. This means you might find yourself with more negative equity than someone who had a higher interest rate but a lower initial purchase price. The process for clearing the lien remains the same.

How long does it take for a lien to be removed from the public record after payment?

While the bank may be paid instantly, the provincial registry (PPSA or RDPRM) can take anywhere from 2 to 4 weeks to update the public record. Always keep your "Letter of Release" or final statement from the bank as proof that the debt is settled during this transition period.

What happens if my insurance payout is less than my loan after an accident?

This is a classic negative equity situation. If your car is totalled and the insurance check doesn't cover the loan, you are responsible for the "gap." This is why many Canadians opt for "Gap Insurance" or "Limited Waiver of Depreciation" endorsements on their insurance policies.

Can I trade in a financed car for a cheaper one and get cash back?

Yes, this is known as "trading down." If your car is worth $30,000 and you owe $10,000, you have $20,000 in equity. If you buy a $15,000 car, the dealer can apply $15,000 to the new car and cut you a check for the remaining $5,000 (after the loan is paid off).

Do I have to pay off the loan before I list the car for sale?

No, you do not. Most people cannot afford to pay off a $30,000 loan just to list a car. You can list the car while it is financed, as long as you have a clear plan (and a payout statement) for how the loan will be settled at the moment of sale.

Making the Financially Sound Choice

Selling or trading a financed car in Canada is a balancing act between time, effort, and money. The dealership route offers the highest level of security and a significant tax advantage that many people overlook. On the other hand, a private sale can put more raw cash in your pocket if you are willing to navigate the complexities of bank meetings and buyer skepticism.

The most important factor is transparency. Whether you are talking to a dealer or a private buyer, being upfront about your loan balance and having your payout statement ready will make the process smoother and faster. By understanding the lien system and the provincial tax implications, you can move from your current car to your next one without the financial stress that often accompanies automotive debt. Prioritize your credit health, do the math on the tax shield, and choose the path that aligns with your personal goals.