Trade Car After Consumer Proposal Discharge: The 2026 Exit Plan

Table of Contents

- Your Post-Proposal Trade-In: Key Takeaways

- The First 90 Days After Discharge: Setting the Stage for Success

- The 'Proof of Stability' Portfolio: What Lenders *Really* Want to See

- Deep Dive: Navigating Negative Equity on Your Trade-In

- Strategic Options for an 'Upside-Down' Loan in Ontario

- The Lender's Gauntlet: Who Will Approve Your Loan?

- Scenario C: In-House Dealership Financing & Subprime Lenders

- Your 3-Month Action Plan Before Stepping into a Dealership

- Month 3: The Shopping Strategy

- Driving Forward: Your New Loan is a Credit-Building Tool

- Frequently Asked Questions About Post-Proposal Car Trade-Ins

You have the discharge certificate in hand. The weight of the consumer proposal is finally lifted. But your current car is on its last legs, and the thought of walking into a dealership feels daunting. This isn't just another guide; this is your strategic roadmap to trading in your old car and securing a fair, affordable auto loan, turning your 2026 goal into a reality.

We'll dismantle the myths and walk you through the lender's mindset, the critical pre-approval steps, and the negotiation tactics that work in a post-proposal world, with specific insights for Canadians in provinces like Ontario and Alberta.

Your Post-Proposal Trade-In: Key Takeaways

- Discharge is Your Green Light: Your Certificate of Full Performance is the single most important document. Lenders see it as proof of a clean slate.

- Your Credit Score Isn't Everything: Lenders will focus more on your post-proposal payment history and income stability than the old R9 rating.

- Dealer vs. Bank: Dealership financing often has higher approval odds initially, but a pre-approval from your bank or a credit union in a city like Edmonton can give you powerful leverage.

- Down Payment is King: A significant down payment (10-20%) dramatically reduces lender risk and can slash your interest rate.

- Beware Negative Equity: If you owe more on your current car than it's worth, this 'negative equity' can complicate your trade-in. We'll show you how to handle it.

The First 90 Days After Discharge: Setting the Stage for Success

To successfully trade in your car after a consumer proposal discharge, you must demonstrate financial stability to lenders. This involves gathering key documents like your discharge certificate, proof of income, and proof of residence, while simultaneously rebuilding your credit with a secured credit card. This proactive approach significantly increases your chances of securing a fair loan rate.

The period immediately following your discharge is critical. What you do now directly impacts the interest rate you'll be offered in six months. It's about proving you're a new, reliable borrower.

The 'Proof of Stability' Portfolio: What Lenders *Really* Want to See

Beyond the credit score, which will take time to recover, lenders need to see stability. They are assessing risk, and the best way to reduce your perceived risk is to present a complete and organized portfolio of your current financial life. Think of it as your application's supporting evidence.

Start gathering these documents now:

- Certificate of Full Performance: This is non-negotiable. It's the official document proving your consumer proposal is complete. Have a digital and physical copy ready.

- Proof of Income: This is the most crucial element. Lenders want to see consistency. Gather your last 3-4 recent pay stubs. If you're self-employed in a place like Ontario, be prepared with your last two years of tax Notices of Assessment (NOAs). For more on this, our guide on Approval Secrets: Navigating the Best Used Car Finance Options for Ontario’s Self-Employed can be a lifesaver.

- Letter of Employment: A simple letter from your employer on company letterhead stating your position, start date, and annual salary or hourly wage is incredibly powerful. It confirms the story your pay stubs tell.

- Proof of Residence: A recent utility bill or bank statement matching the address on your driver's license shows stability.

- Bank Statements: Have the last 90 days of statements from your primary chequing account ready. Lenders look for consistent deposits and no Non-Sufficient Funds (NSF) charges.

In our experience, an applicant with a 620 credit score but a two-year job history and a complete document portfolio is often viewed more favourably than someone with a 680 score and a spotty, unverified income stream. Consistency trumps score at this stage.

Pro Tip: Obtain a secured credit card the month you are discharged. Use it for a small, recurring bill (like Netflix or Spotify, under $25) and set up automatic payments to pay it off in full every month. This is the single fastest, most effective way to build a new, positive payment history that lenders can see within 3-6 months.

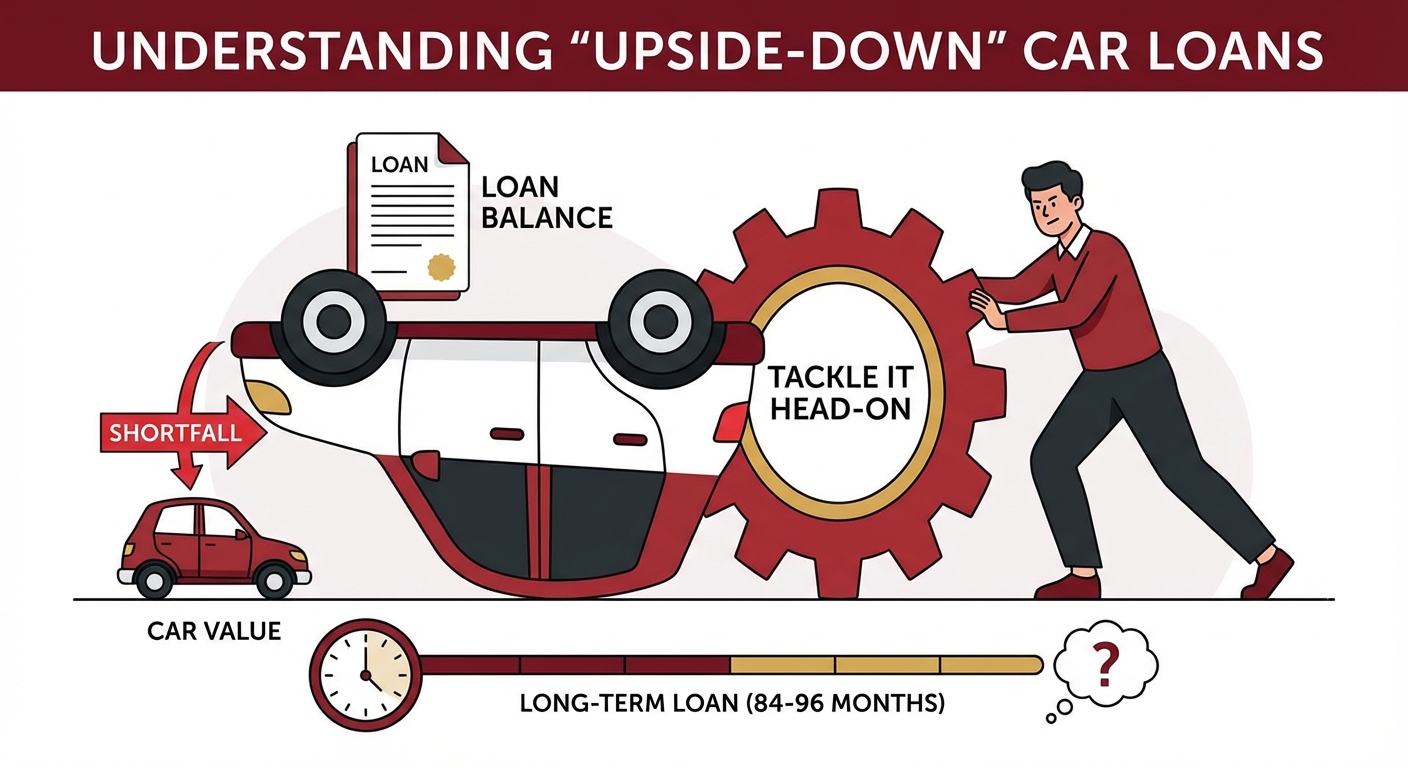

Deep Dive: Navigating Negative Equity on Your Trade-In

Trading in a car after a consumer proposal often comes with a hidden challenge: negative equity. This is where you owe more on your car loan than the vehicle's current market value. Here’s how to tackle it head-on.

This situation, often called being "upside-down," is common, especially if the original loan was stretched over a long term (84 or 96 months). It creates a shortfall that must be dealt with before you can finance a new vehicle.

Understanding the Negative Equity Calculation

Let's break down how this impacts your next purchase with a clear example.

| Scenario | Current Loan Balance | Trade-In Value | Equity Position | Impact on New Loan |

|---|---|---|---|---|

| Positive Equity | $8,000 | $10,000 | +$2,000 | Your $2,000 in equity acts as a down payment, reducing the amount you need to finance. |

| Negative Equity | $12,000 | $10,000 | -$2,000 | The $2,000 shortfall must be paid off or added to your new loan, increasing the amount you finance. |

Strategic Options for an 'Upside-Down' Loan in Ontario

If you find yourself in a negative equity position, don't panic. You have several strategic options, each with its own pros and cons, especially for drivers in provinces like Ontario with specific regulations.

- Roll the Negative Equity into the New Loan: This is the most common solution offered by dealerships. They add the shortfall (the $2,000 from our example) to the price of the new car. While convenient, this is a dangerous path. You start the new loan even more upside-down, making it harder to trade in the vehicle later. You're effectively paying interest on the debt from your old car.

- Pay the Difference in Cash: This is the financially wisest move. If you can, pay the $2,000 difference out of pocket. This clears the slate, allowing you to start your new loan with zero or even positive equity if you also have a down payment.

- Sell the Car Privately: In many cases, you can get a better price selling your car privately than the wholesale value a dealer will offer. In Ontario, this requires providing the buyer with a Used Vehicle Information Package (UVIP). You would then use the proceeds to pay off the loan, covering any small shortfall yourself. This takes more effort but can save you thousands.

The key is to know your numbers *before* you go to the dealership. The sooner you know you can get a loan, the more power you have. The good news is that for many, as our guide Discharged? Your Car Loan Starts Sooner Than You're Told. explains, this can be sooner than you think.

Pro Tip: Before visiting a dealer, get an online quote from a service like Clutch or Canada Drives. This gives you a realistic, data-backed baseline for your car's wholesale value. When a dealership makes a trade-in offer, you'll immediately know if it's fair or a lowball tactic.

The Lender's Gauntlet: Who Will Approve Your Loan?

Not all lenders view a discharged consumer proposal the same way. Understanding the differences between your options is key to securing the best terms. Your goal isn't just to get approved; it's to get approved with a rate that doesn't punish you for the past.

We often hear from clients in Calgary or Toronto who were declined by their primary bank and assumed all doors were closed. That's rarely the case. You just need to know which door to knock on.

Lender Comparison for Post-Proposal Applicants

| Lender Type | Approval Odds | Typical Interest Rate Range | Key Requirement | Best For... |

|---|---|---|---|---|

| Big 5 Banks (RBC, TD, etc.) | Low to Moderate | 8% - 14% | At least 1-2 years of re-established credit history and a strong relationship with the bank. | Borrowers who are 2+ years post-discharge with a strong down payment. |

| Credit Unions | Moderate | 7% - 13% | Membership and a holistic view of your financial situation (stable income, local ties). | Community-focused borrowers who prefer a personal relationship and fair rates. |

| In-House Dealership Finance | High | 12% - 29.9% | Proof of stable income and a reasonable down payment. They specialize in this. | Borrowers needing immediate approval and a one-stop-shop experience. |

Scenario C: In-House Dealership Financing & Subprime Lenders

For most people fresh out of a proposal, this is the most likely path to approval. These lenders specialize in what the industry calls "non-prime" or "special financing." Their entire business model is built around assessing risk based on current income and stability, not just a past credit event.

However, this world has two sides. You have reputable special finance departments at major brand dealerships (like Honda, Toyota, or Ford) that work with a portfolio of respected lenders. Then, you have predatory "bad credit, no problem!" lots that may use high-pressure tactics and exorbitant rates.

A good dealership finance manager will use a tiered approval system. They'll submit your application to multiple lenders to find the best rate you qualify for. They understand that getting you a reasonable payment means you're more likely to be a repeat customer. If you've been told 'no' elsewhere, don't give up. As we often say, They Said 'No' After Your Proposal? We Just Said 'Drive!

Your 3-Month Action Plan Before Stepping into a Dealership

Success is in the preparation. Follow this checklist to walk into any dealership in Canada with the confidence of a cash buyer and leave with a deal you can actually afford.

Month 1: Foundation & Credit Building

- Get Your Documents: Gather every item listed in the 'Proof of Stability' portfolio. Organize them in a physical folder and a digital one on your computer.

- Apply for a Secured Card: Apply for a secured card from a provider like Capital One or a major bank. Put down a deposit of $300-$500.

- Set It and Forget It: Link a small subscription to the card and enable auto-pay. Do not use it for anything else. The goal is to build a perfect payment history.

- Check Your Credit Reports: Pull your free reports from Equifax and TransUnion. Ensure the consumer proposal is reported correctly as completed and paid. Dispute any errors immediately.

Month 2: Budgeting & Saving

- Determine Your Down Payment: Aim for at least 10% of your target vehicle price. For a $20,000 vehicle, that's $2,000. The more, the better. This is the single biggest factor in lowering your interest rate.

- Calculate Your 'All-In' Budget: Don't just think about the car payment. Calculate the total monthly cost: payment + insurance + fuel + estimated maintenance. This is your true affordability.

- Get a Car Insurance Quote: Contact an insurance broker and get quotes for the types of vehicles you're considering. A sporty coupe might have an insurance payment as high as the car loan itself.

Month 3: The Shopping Strategy

This is where your preparation pays off. You are no longer just a browser; you are a strategic buyer.

Research reliable, cost-effective vehicles known for their low cost of ownership. Think Honda Civic, Toyota Corolla, Hyundai Elantra, or Mazda3. Avoid complex luxury vehicles or large trucks that come with higher insurance and repair costs.

Identify 2-3 specific cars at different dealerships. Use their online inventory to find vehicles that fit your budget. Contact their internet sales manager or Business Development Centre (BDC) first. Send a polite, professional email: "Hello, I am interested in Stock #12345. I have recently been discharged from a consumer proposal, have a $3,000 down payment, and stable income. I am looking to confirm the vehicle's availability and your best 'out-the-door' price."

This approach does two things: it saves you time by pre-screening dealerships, and it frames the conversation around the total price, not a monthly payment. It shows you're a serious, educated buyer. Remember, as we explain in our guide Your Credit Score is NOT Your Rate. Get a Fair Loan, Toronto., the focus should always be on the total cost of borrowing.

Pro Tip: When the dealership asks, "How much can you afford per month?", do not answer directly. This is a negotiation tactic. Instead, say, "I'm focused on the total out-the-door price and a fair interest rate. Once we agree on that, we can look at the monthly payments for different term lengths." This shifts the negotiation power to you and prevents them from hiding fees or high interest rates in a long-term loan that has a deceptively low monthly payment.

Driving Forward: Your New Loan is a Credit-Building Tool

Securing this car loan isn't the end of the journey; it's a major milestone in your financial recovery. Every on-time payment from here on out is a powerful signal to the credit bureaus that you are a responsible borrower. An auto loan is considered a significant piece of credit history, often weighted more heavily than a credit card.

This loan, managed correctly, will be the key that unlocks even better rates on future mortgages and loans, long before the proposal is purged from your record in a few years. You're not just buying a car; you're buying your way back to a prime credit rating. Make every payment on time, consider bi-weekly payments to pay it off faster, and within 12-18 months, you'll be in a position to potentially refinance at an even better rate.