G2 License & Bad Credit Car Loan Approval 2026

Table of Contents

- G2 License & Bad Credit Car Loan Approval 2026

- The Ontario Driver's Dilemma: Navigating Car Loans with a G2 and Bad Credit in 2026

- Key Takeaways

- Unpacking the Double Whammy: G2 Licensing and Bad Credit Explained for Ontario Drivers

- The G2 License Reality Check: More Than Just Provisional Plates

- Decoding 'Bad Credit' in Canada: What Lenders See (and Fear)

- Beyond the 'No': Crafting Your Approval Strategy for G2 Drivers with Credit Challenges

- Building Your Borrower Profile: Essential Documentation for Ontario Lenders

- The Power of Your Down Payment: How It Opens Doors (Even with Bad Credit)

- Co-Signers & Guarantors: Leveraging Trusted Relationships in Ontario

- Navigating the Ontario Auto Market: Where G2 Drivers with Bad Credit Find Their Ride

- Dealerships vs. Banks vs. Online Lenders: Who's Your Best Bet in Toronto, Mississauga, and Beyond?

- The Vehicle Choice Conundrum: Smart Buys for G2 Drivers on a Budget

- The True Cost of Driving: Beyond the Sticker Price for G2 & Bad Credit Drivers

- Understanding Interest Rates: What to Expect When Your Credit Score is Low

- The G2 Insurance Premium Shock: Budgeting for Higher Rates in Ontario

- Hidden Fees and Charges: Protecting Your Wallet from Surprises

- Your Credit Comeback Plan: How a Car Loan Can Rebuild Your Financial Future by 2026

- From Bad to Better: Using Your Car Loan as a Credit-Building Tool

- Strategic Refinancing: When to Consider a Better Deal Down the Road

- Your Next Steps to Driving Away Confidently: A 2026 Action Plan

- Frequently Asked Questions (FAQ): Clarifying Common Concerns for G2 Drivers with Bad Credit

G2 License & Bad Credit Car Loan Approval 2026

The dream of driving freely across Ontario, from the bustling streets of Toronto to the scenic routes near Ottawa, is a powerful one. But for many G2 licensed drivers, especially those navigating the complexities of bad credit, that dream can feel like a distant highway. Can you truly get a car loan with a G2 license in Ontario with bad credit in 2026? The answer, unequivocally, is yes – but it requires a strategic approach. SkipCarDealer.com is here to be your co-pilot, guiding you through every turn.

The Ontario Driver's Dilemma: Navigating Car Loans with a G2 and Bad Credit in 2026

It’s a common frustration: you need a car for work, school, or personal independence, but your provisional G2 license and past credit challenges seem to be slamming the brakes on your plans. Many G2 drivers in Ontario believe they're automatically disqualified from securing a car loan, fearing lenders see them as too high-risk. This perception often leads to discouragement and missed opportunities. However, with the right knowledge and a clear strategy, securing car loan approval in 2026, even with a G2 license and bad credit, is not just possible—it's a path to greater independence and financial rebuilding. This comprehensive guide will illuminate the solutions, debunk the myths, and offer you genuine hope for driving away in your own vehicle.

Key Takeaways

- G2 License is Not a Deal Breaker: While G2 restrictions influence lender perception and insurance, they do not prevent car loan approval, especially with specialized lenders.

- Bad Credit is Manageable: 'Bad credit' is a broad term, but even with missed payments or no credit history, a strategic application can secure financing in 2026.

- Preparation is Paramount: Gather all necessary documents—proof of income, residency, and your G2 license—to present a strong, transparent application.

- Down Payments & Co-Signers Boost Odds: Even a modest down payment or a reliable co-signer significantly reduces lender risk and improves your chances of approval.

- Specialized Lenders are Your Best Bet: Dealerships specializing in bad credit or subprime loans are often more flexible and understanding than traditional banks.

- Budget for Higher Costs: Expect higher interest rates and insurance premiums with a G2 and bad credit, but view this as a temporary step towards rebuilding credit.

- Car Loan Can Rebuild Credit: Consistent, on-time payments on a bad credit car loan are a powerful tool for improving your credit score over time, paving the way for better financial opportunities.

Unpacking the Double Whammy: G2 Licensing and Bad Credit Explained for Ontario Drivers

Securing a car loan in Ontario with a G2 license and bad credit means understanding how each factor influences lenders. It’s not about being denied outright, but about navigating the perceived risks and presenting yourself as a reliable borrower in 2026.

The G2 License Reality Check: More Than Just Provisional Plates

The G2 license in Ontario is a crucial step towards full driving privileges, but it comes with specific restrictions designed to ensure safety for new drivers. These restrictions, while logical for road safety, can influence how lenders and insurance providers view you. * Passenger Restrictions (for under 19): If you're under 19, you cannot drive between midnight and 5 a.m. and for the first six months, you can only carry one passenger aged 19 or under. After six months, you can carry up to three passengers aged 19 or under. These rules do not apply to passengers who are immediate family members or licensed driving instructors. * BAC (Blood Alcohol Concentration) Restriction: As a G2 driver, you must maintain a zero blood alcohol level (BAC) at all times. * Supervision: You must not drive without an accompanying qualified driver (who has a full G license for at least four years, is over 21, and has a BAC under 0.05%) after midnight and before 5 AM, unless all passengers are immediate family members. * Vehicle Restrictions: Your vehicle must be in good working order, with seatbelts for all passengers. Lenders perceive G2 drivers as having less experience, which can translate to a higher risk of accidents. This isn't a judgment on your driving skills, but a statistical reality that influences their calculations. This perceived risk, combined with your age (if under 25, which many G2 drivers are), also significantly impacts insurance premiums.

Here's how G2 status generally impacts perceptions:

| Factor | G2 License Holder (Typical Perception) | Full G License Holder (Typical Perception) | Impact on Loan Approval & Insurance |

|---|---|---|---|

| Driving Experience | Limited, higher statistical risk of incidents. | More extensive, lower statistical risk. | Higher insurance premiums for G2. Lenders may see G2 as slightly higher risk for repayment if tied to employment stability due to driving restrictions. |

| Responsibility | Perceived as developing responsibility, especially if young. | Generally perceived as fully responsible. | A clean G2 record can mitigate this, but any infractions are magnified. |

| Insurance Premiums | Significantly higher due to inexperience and age (if applicable). | Lower, as experience builds and age increases. | Directly affects overall affordability of vehicle ownership, which lenders consider. |

| Lender Risk Assessment | Slightly elevated, especially if combined with low income or unstable employment. | Standard, based primarily on credit score and income. | May require stronger supporting documents or a larger down payment for G2 drivers. |

Decoding 'Bad Credit' in Canada: What Lenders See (and Fear)

'Bad credit' is a term that encompasses various financial situations, but for lenders in Canada, it boils down to one thing: risk. When you have bad credit, it signals to lenders that there's a higher probability you might default on your loan payments. What constitutes 'bad credit' in the Canadian context? * Missed or Late Payments: Consistently missing due dates on credit cards, utility bills, or previous loans is a major red flag. * High Debt-to-Income Ratio: If a significant portion of your income is already going towards debt payments, lenders worry about your ability to take on more. * Bankruptcies or Consumer Proposals: These are severe credit events that stay on your credit report for several years, indicating significant financial distress. For those who have recently gone through these processes, specialized lenders like SkipCarDealer.com understand your situation. Learn more about how a bankruptcy discharge can be your car loan's starting line or how a consumer proposal can unlock your car loan. * Collections Accounts: Unpaid debts that have been sent to collection agencies. * Foreclosures or Repossessions: Losing assets due to non-payment. * New Immigrants with No Credit History: This is a unique situation. While not 'bad credit' in the traditional sense, a lack of credit history (often called a 'thin file') makes it difficult for lenders to assess risk, often placing you in a similar category as someone with poor credit. Credit Score Ranges in Canada (Equifax & TransUnion): * Excellent: 760-900 * Very Good: 720-759 * Good: 660-719 * Fair: 600-659 * Poor: 300-599 If your score falls below 600, you're generally considered to have 'bad credit.' This significantly impacts auto loan eligibility in Ontario. Traditional banks (like RBC, TD, CIBC, BMO, Scotiabank) typically prefer borrowers with scores above 660. They see lower scores as too risky for their standard loan products, often resulting in outright denial or extremely high interest rates. The 'Bad Credit' Lender Difference: Specialized dealerships and subprime lenders, however, have different criteria. They understand that life happens and credit can take a hit. Their business model is built around assessing risk differently, focusing more on your current ability to pay (stable income) and your willingness to commit. While they will still look at your credit score, they're more likely to approve loans for individuals in the 300-599 range, albeit with higher interest rates to compensate for the increased risk. They often consider your overall financial picture, including employment stability, residency, and a potential down payment, much more holistically than a traditional bank.

Beyond the 'No': Crafting Your Approval Strategy for G2 Drivers with Credit Challenges

Don't let the dual challenge of a G2 license and bad credit deter you. With a focused strategy, you can significantly improve your chances of car loan approval in Ontario in 2026.

Building Your Borrower Profile: Essential Documentation for Ontario Lenders

A well-organized and complete application package is your first step in demonstrating reliability to lenders. It shows you are serious and prepared, helping to mitigate the perceived risks associated with your G2 license and credit history. Here's a definitive checklist of required documents: * Proof of Stable Income: Lenders want to see that you can consistently afford your monthly payments. * Pay Stubs: The most recent 2-3 pay stubs. * Employment Letters: A letter from your employer confirming your position, start date, and annual salary. * T4s/Notice of Assessment: For self-employed individuals or those with varied income, your last 1-2 years of T4s or Notice of Assessment (NOA) from the CRA. * Benefit Statements: If you receive income from government benefits (e.g., EI, CPP, WSIB, ODSP), provide official statements. For more information on how EI income can secure your car loan, check out our guide. * Proof of Ontario Residency: Lenders need to confirm you live where you say you do. * Utility Bills: Hydro, gas, or internet bills (dated within the last 30-60 days). * Lease Agreements or Mortgage Statements: If you rent or own your home. * Bank Statements: Can also serve as proof of address if they show your current residential address. * Bank Statements: Often required for the last 90 days. These show consistent activity, demonstrate responsible money management (even with bad credit), and confirm direct deposit of income. * Valid G2 Driver's License: Your primary form of identification and proof of driving eligibility. Why is this so important? Presenting these documents thoroughly and accurately helps lenders build a complete picture of your financial situation, beyond just your credit score. It allows them to assess your current ability to pay and your stability, which are critical factors for bad credit car loan approval in 2026.

The Power of Your Down Payment: How It Opens Doors (Even with Bad Credit)

A down payment is one of the most effective tools for a G2 driver with bad credit to improve their car loan approval odds. It directly addresses the lender's primary concern: risk. * Reduced Lender Risk: When you make a down payment, you immediately reduce the total amount of money the lender needs to finance. This lowers their exposure and makes the loan less risky from their perspective. It also shows your commitment and ability to save. * Improved Approval Odds: Lenders are much more likely to approve a bad credit applicant who offers a down payment, as it demonstrates financial responsibility and reduces the loan-to-value (LTV) ratio of the vehicle. * Potentially Lower Interest Rates: While not guaranteed, a significant down payment can sometimes qualify you for a slightly lower interest rate, as the overall risk to the lender is decreased. * Lower Monthly Payments: A larger down payment means you're financing less, resulting in lower monthly loan payments, making the car more affordable in your budget. Practical Strategies for Saving for a Down Payment in Ontario: 1. Set a Realistic Goal: Even $500-$1000 can make a difference. Aim for 10-20% of the vehicle's price if possible. 2. Budgeting & Cutting Expenses: Track your spending and identify areas where you can cut back, even temporarily. 3. Part-Time Work/Side Hustle: Consider taking on extra work or a gig economy job (e.g., food delivery, ride-sharing) to boost your savings. 4. Sell Unused Items: Declutter your home and sell items you no longer need. Illustrative Example of Down Payment Impact:

| Loan Scenario (Vehicle Price: $15,000, 5-Year Term, 19.99% APR) | No Down Payment | $1,000 Down Payment | $2,000 Down Payment |

|---|---|---|---|

| Loan Amount | $15,000 | $14,000 | $13,000 |

| Estimated Monthly Payment | ~$397 | ~$370 | ~$344 |

| Total Interest Paid | ~$8,820 | ~$8,200 | ~$7,580 |

| Total Cost of Vehicle | ~$23,820 | ~$23,200 | ~$22,580 |

*These are estimates and actual rates/payments may vary based on credit profile and lender. As you can see, even a modest down payment can reduce your monthly burden and the total cost of the loan.

Co-Signers & Guarantors: Leveraging Trusted Relationships in Ontario

If a down payment isn't feasible or you want an even stronger application, a co-signer or guarantor can be a game-changer for G2 drivers with bad credit. * What's the Difference? * Co-signer: Applies for the loan with you. They are equally responsible for the debt. If you miss payments, it impacts their credit, and the lender can pursue them for the full amount. * Guarantor: Guarantees the loan. They are only responsible for the debt if the primary borrower (you) defaults. Their credit is only affected if you default. * Who Qualifies as an Ideal Co-Signer/Guarantor? * Excellent or Good Credit Score: This is paramount. Their strong credit history essentially "lends" credibility to your application. * Stable and Sufficient Income: They must have a reliable income that can comfortably cover the loan payments if you're unable to. * Low Debt-to-Income Ratio: They shouldn't be overextended with their own debts. * Clear Understanding of Responsibilities: Both you and your co-signer/guarantor must fully understand the financial and credit implications. * How This Strategy Boosts Approval Chances: * Mitigates Risk: The presence of a creditworthy co-signer significantly reduces the lender's risk, as there's a second, financially strong party responsible for the loan. * Access to Better Terms: With a co-signer, you might qualify for a lower interest rate than you would on your own, saving you money over the life of the loan. * Build Your Own Credit: As long as payments are made on time, the loan will positively impact both your credit score and your co-signer's, helping you rebuild your own financial health. This strategy is particularly effective in major Ontario cities like Toronto or Mississauga, where the cost of living (and thus the perceived need for a reliable vehicle for work) is high, making lenders more amenable to well-supported applications.

Navigating the Ontario Auto Market: Where G2 Drivers with Bad Credit Find Their Ride

Finding the right lender and vehicle is crucial when you have a G2 license and bad credit in Ontario. Not all avenues are created equal.

Dealerships vs. Banks vs. Online Lenders: Who's Your Best Bet in Toronto, Mississauga, and Beyond?

Understanding the landscape of lending institutions is key to a successful car loan application in 2026.

| Lending Source | Pros for G2/Bad Credit | Cons for G2/Bad Credit | Best For... |

|---|---|---|---|

| Specialized Dealerships (e.g., SkipCarDealer.com) | ✔ Designed for bad credit/no credit. |

✖ Interest rates are typically higher than prime loans. |

G2 drivers with poor credit, no credit history, bankruptcy, or consumer proposals in any Ontario city (Toronto, Ottawa, London, Hamilton, Mississauga, etc.). |

| Local Credit Unions (e.g., Meridian Credit Union, Alterna Savings) | ✔ Often more flexible and community-focused than big banks. |

✖ Still have stricter credit requirements than specialized lenders. |

G2 drivers with fair-to-good credit (600-650 range) and stable income, who are already members or willing to join. |

| Traditional Banks (e.g., RBC, TD, CIBC) | ✔ Lowest interest rates for prime borrowers. |

✖ Very strict credit score requirements (typically 660+). |

G2 drivers with excellent credit and a long, positive credit history (rare for this demographic). Generally not recommended for bad credit. |

| Online Lenders (e.g., various aggregators) | ✔ Rapid application and approval processes. |

✖ Can be overwhelming with options. |

G2 drivers who are comfortable with online processes and want to quickly explore options from multiple subprime lenders. Ensure the platform is reputable and OMVIC registered in Ontario. |

For G2 drivers with bad credit in 2026, specialized dealerships are almost always your best bet. They have the expertise and the lending partnerships to work with challenging credit situations, focusing on your present ability to make payments. When dealing with any lender, especially in major Ontario hubs like Ottawa, London, or Hamilton, ensure they are OMVIC registered.

The Vehicle Choice Conundrum: Smart Buys for G2 Drivers on a Budget

Your choice of vehicle directly impacts your approval odds, loan terms, and overall cost of ownership, especially for a G2 driver with bad credit in Ontario.

* Prioritize Reliability and Fuel Efficiency: Lenders prefer financing reliable vehicles that are less likely to break down, as this reduces the risk of you missing payments due due to unexpected repair costs. Fuel-efficient cars also mean lower running costs for you, making payments more manageable.

* Lower-Cost Used Cars Over New or Luxury Models:

* New Cars: Depreciate rapidly, are more expensive, and lenders are less willing to finance them for high-risk borrowers.

* Luxury/Performance Cars: Come with significantly higher insurance premiums (a major deterrent for G2 drivers) and are generally out of reach for bad credit loans.

* Used Cars: Offer better value, slower depreciation, and are more aligned with the budgets and lending criteria for bad credit loans.

* How Vehicle Choice Impacts Insurance Premiums for G2 Drivers in Ontario:

* Make/Model: Certain makes and models are statistically more likely to be stolen or involved in accidents, leading to higher premiums. Avoid high-performance, sports cars, or highly modified vehicles.

* Safety Features: Vehicles with advanced safety features (e.g., anti-lock brakes, stability control, multiple airbags) can sometimes qualify for slight discounts.

* Age of Vehicle: Older vehicles can sometimes be cheaper to insure, but ensure they are still reliable.

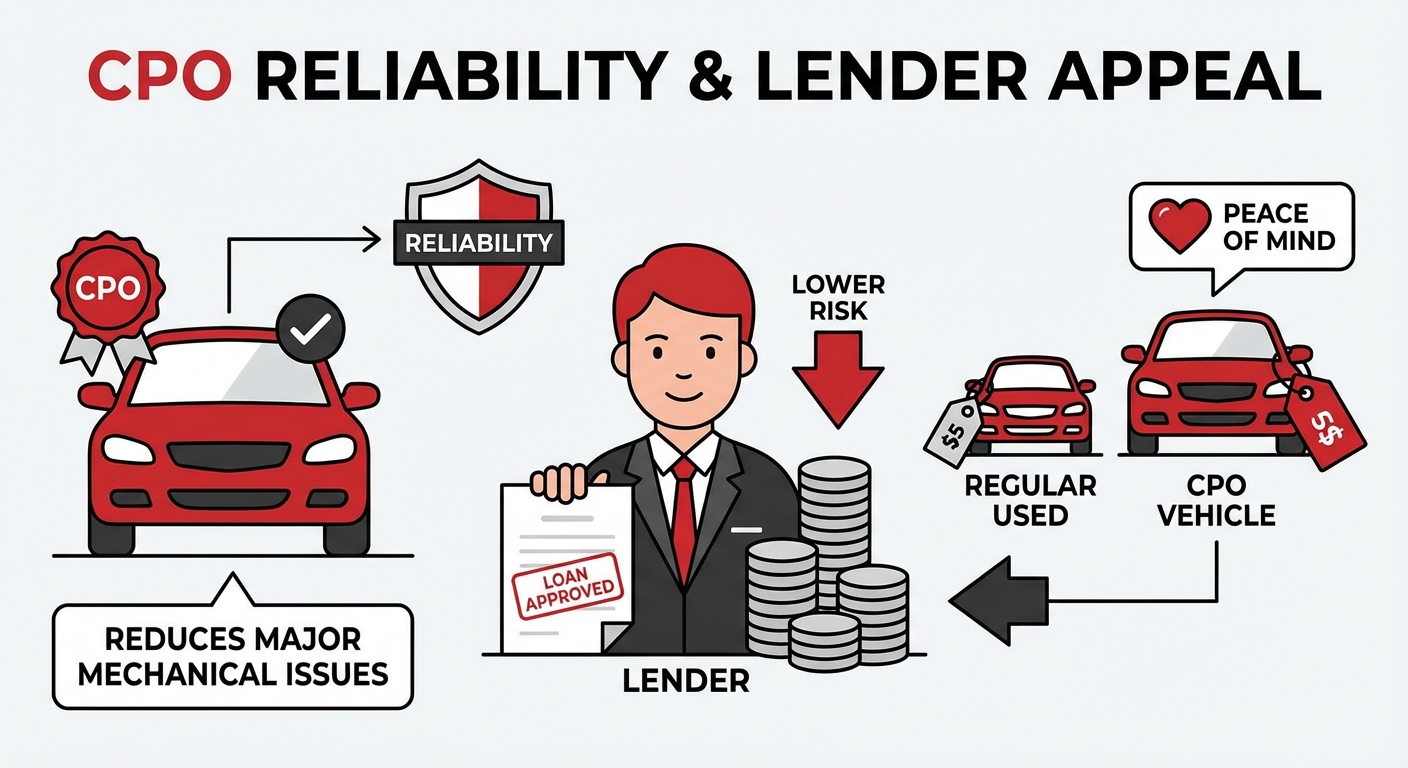

* Benefits of Certified Pre-Owned (CPO) Vehicles from a Lender's Perspective:

* CPO vehicles undergo rigorous inspections and often come with extended warranties from the manufacturer.

* This added assurance of quality and reliability makes CPO vehicles more attractive to lenders, as it reduces their risk of the borrower facing major mechanical issues and defaulting on the loan. While slightly more expensive than regular used cars, the peace of mind can be worth it.

The True Cost of Driving: Beyond the Sticker Price for G2 & Bad Credit Drivers

When you're a G2 driver with bad credit in Ontario, the price tag of the car is just the beginning. Understanding the full financial picture is essential for sustainable car ownership in 2026.

Understanding Interest Rates: What to Expect When Your Credit Score is Low

Interest rates are the cost of borrowing money, and for borrowers with bad credit, these rates will be significantly higher than for those with excellent credit. This is how lenders compensate for the increased risk they are taking. * Demystifying Annual Percentage Rate (APR): APR is the total cost of borrowing money, expressed as a yearly percentage. It includes the interest rate plus any other fees associated with the loan. This is the number you should compare across different loan offers. * Realistic Ranges for Bad Credit Car Loans in Ontario (2026): * Prime/Excellent Credit (660+): 6.99% - 10.99% APR * Fair/Good Credit (600-659): 11.99% - 17.99% APR * Bad Credit (Below 600): 18.99% - 29.99% APR (or even higher in some high-risk situations) * No Credit History: Often falls into the bad credit range due to lack of assessable risk. Example Loan Payment Scenarios (Illustrative):

| Credit Tier | Interest Rate (APR) | Loan Amount ($15,000) | Loan Term (60 months) | Estimated Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| Excellent Credit | 8.99% | $15,000 | 60 months | ~$311 | ~$3,660 |

| Bad Credit (G2) | 24.99% | $15,000 | 60 months | ~$436 | ~$11,160 |

As you can see, the difference in total interest paid is substantial. * How the Loan Term Affects Total Interest Paid: * Shorter Terms (e.g., 36-48 months): Higher monthly payments but significantly less total interest paid over the life of the loan. This is generally preferred if you can afford it. * Longer Terms (e.g., 72-84 months): Lower monthly payments, making the car more "affordable" on a monthly basis. However, you will pay much more in total interest over the longer term. For bad credit loans, longer terms amplify the high interest rate, costing you significantly more. * Tips on Negotiating Rates, Even with Bad Credit: * Get Pre-Approved: Shop around and get pre-approvals from a few specialized lenders to compare offers. * Highlight Strengths: Emphasize your stable income, down payment, or co-signer. * Be Prepared to Walk Away: If the rate is truly unmanageable, be willing to consider other options or wait. * Focus on the APR: Don't just look at the monthly payment; understand the total cost. * Consider a 'Starter' Loan: Sometimes, taking a slightly higher rate on a less expensive car for a year or two can help you rebuild credit for a better deal later.

The G2 Insurance Premium Shock: Budgeting for Higher Rates in Ontario

This is often the most significant "hidden" cost for G2 drivers. Insurance premiums in Ontario are notoriously high, and for inexperienced G2 drivers, they can be staggering. * Why G2 Drivers Face Higher Premiums: * Inexperience: Statistically, new drivers are more prone to accidents. * Perceived Risk: Insurance companies use vast amounts of data to assess risk. Young, inexperienced drivers with provisional licenses fall into a high-risk category. * Factors Influencing Rates in Ontario: * Vehicle Type: High-performance, luxury, or frequently stolen cars cost more to insure. * Location: Premiums vary wildly across Ontario. Downtown Toronto, Brampton, and Mississauga often have some of the highest rates due to higher traffic density, theft rates, and accident claims. Rural Ontario typically sees lower rates. * Age: Drivers under 25 typically pay the highest premiums. * Driving Record: A clean record is crucial. Even minor infractions can significantly increase rates. * Gender: Historically, male drivers under 25 faced higher rates, though this is changing with gender-neutral pricing in some provinces. * Coverage Levels: Basic third-party liability is cheapest, but comprehensive and collision coverage add significant cost. * Deductible: A higher deductible typically means lower premiums. * Daily Commute: Longer commutes or driving in high-traffic areas can increase rates. Actionable Strategies to Mitigate High Insurance Costs for G2 Drivers: 1. Compare Multiple Quotes: Always get quotes from at least 3-5 different insurance providers across Ontario. Rates can vary by hundreds of dollars. 2. Choose a "Low Risk" Vehicle: Opt for a reliable, older, fuel-efficient sedan or compact SUV that is known for being affordable to insure. 3. Bundle Policies: If you have tenant or home insurance, bundling it with your car insurance can often lead to discounts. 4. Telematics Programs (Usage-Based Insurance): Consider installing a telematics device (black box) or using a mobile app that monitors your driving habits. Safe driving can earn you discounts. 5. Defensive Driving Courses: Some insurers offer discounts for completing approved defensive driving courses. 6. Increase Your Deductible: Be prepared to pay more out-of-pocket in case of a claim, but enjoy lower monthly premiums. 7. Consider Being a Secondary Driver: If possible, be listed as a secondary driver on a family member's policy with a clean record (though this may not build your own history as effectively). 8. Ask About Discounts: Always inquire about student discounts, good student discounts (if applicable), winter tire discounts, loyalty discounts, etc.

Hidden Fees and Charges: Protecting Your Wallet from Surprises

Beyond the sticker price and interest rate, several other costs can inflate the total price of your car and loan. Be diligent in understanding these. * Administrative Fees: Dealerships often charge administrative or documentation fees for processing paperwork. These can range from $199 to $599+. Ask for a breakdown. * PPSA (Personal Property Security Act) Registration Fees: This is a provincial fee to register the lender's interest in the vehicle as collateral. It's typically a small fee (e.g., $10-$20 in Ontario) but is often passed on to the buyer. * Extended Warranties: While some CPO vehicles come with warranties, dealers often push additional extended warranties. Evaluate if these are truly necessary for a reliable used car and if the cost outweighs the benefit. They can add thousands to your loan. * Rust Proofing/Undercoating: Often an overpriced dealer add-on. Research if it's genuinely needed for the specific vehicle and if aftermarket options are more cost-effective. * Tire & Rim Protection: Another common upsell. Consider your driving habits and local road conditions before committing. * Leasing Fees (if applicable): If you consider a lease buyout after a proposal, remember there are often specific fees involved. Your 'Impossible' Just Became Our 'Tuesday'. * Taxes: HST (Harmonized Sales Tax) in Ontario (13%) applies to the vehicle purchase price and is added to the total. Protecting Your Wallet: * Read the Fine Print: Thoroughly review the entire purchase agreement and loan contract before signing. * Ask Direct Questions: Don't hesitate to ask for clarification on any fee you don't understand. "What is this fee for?" "Is this mandatory?" "Can it be removed or negotiated?" * Get Everything in Writing: Ensure all agreed-upon prices, fees, and terms are clearly documented. * Budget for Unexpected Maintenance: Even with a reliable used car, set aside a small emergency fund for potential repairs.

Your Credit Comeback Plan: How a Car Loan Can Rebuild Your Financial Future by 2026

Getting a car loan with a G2 license and bad credit isn't just about immediate transportation; it's a strategic move to improve your financial standing.

From Bad to Better: Using Your Car Loan as a Credit-Building Tool

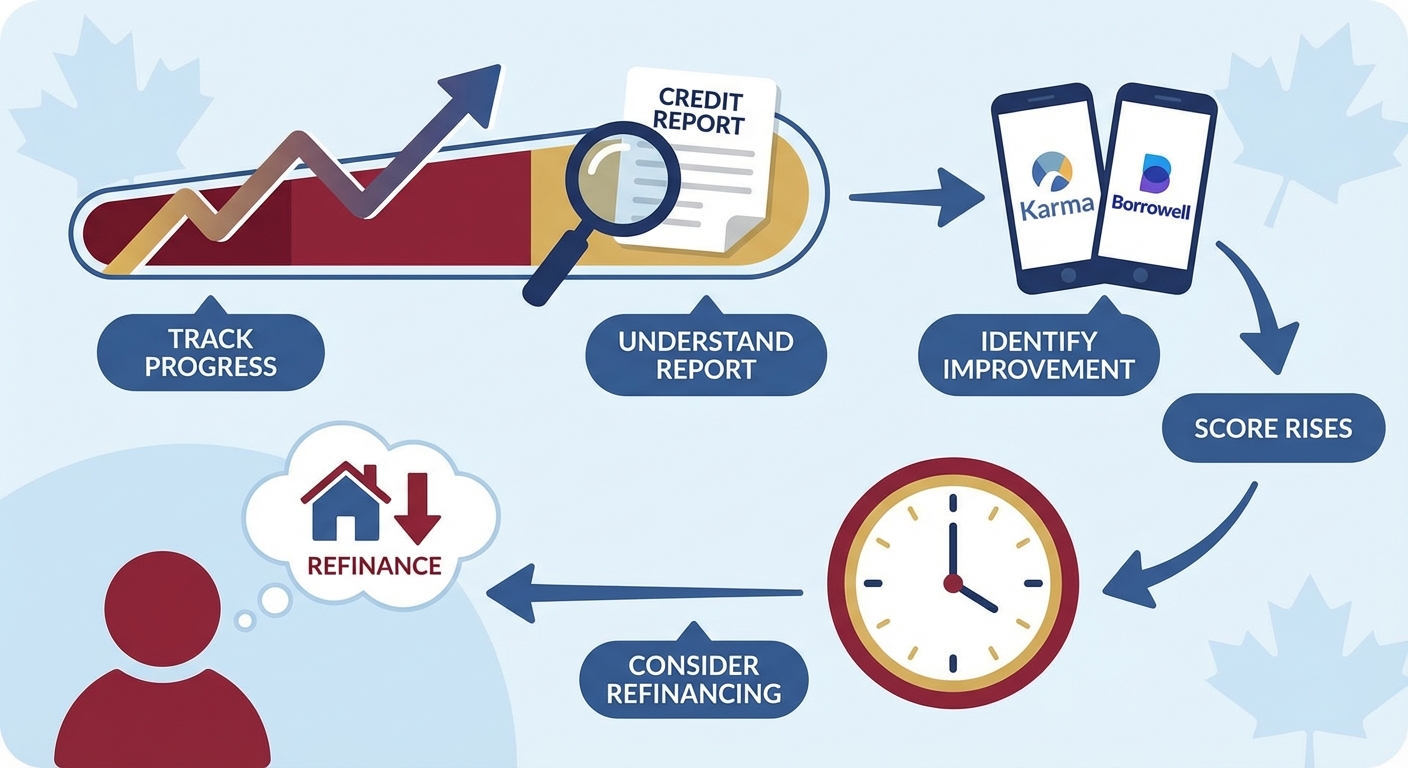

A bad credit car loan, when managed responsibly, can be a powerful instrument for credit repair. * Mechanics of Credit Reporting in Canada (Equifax and TransUnion): * Every major lender in Canada reports your payment activity (both positive and negative) to the two primary credit bureaus: Equifax and TransUnion. * Your credit report details your credit accounts, payment history, inquiries, and public records (like bankruptcies). * Your credit score is a numerical representation of the information in your credit report, indicating your creditworthiness. * How Consistent, On-Time Payments Improve Your Credit Score: * Payment History (35% of your score): This is the single most important factor. Making every car loan payment on time, every month, demonstrates reliability and responsibility to future lenders. * Credit Mix (10% of your score): Having a mix of credit types (e.g., a car loan, a credit card) can positively influence your score, showing you can manage different forms of credit. * Length of Credit History (15% of your score): As your car loan ages with a perfect payment history, it contributes positively to the length of your credit file. * Framing the Car Loan as an Investment: View this car loan not just as a means to get a vehicle, but as a strategic investment in your future financial health. Over 12-24 months of consistent, on-time payments, you can expect to see a noticeable improvement in your credit score. This improvement can lead to: * Better Rates on Future Loans: For subsequent car loans, personal loans, or even mortgages. * Easier Access to Other Credit Products: Like credit cards with lower interest rates or higher limits. * Increased Financial Freedom: A strong credit score opens doors and provides more options.

Strategic Refinancing: When to Consider a Better Deal Down the Road

Once you've diligently made payments on your bad credit car loan, you might qualify for better terms. * When to Consider Refinancing: * After 12-24 Months of Perfect Payments: This is typically the sweet spot. By this time, your credit score should have improved significantly due to your consistent payment history. * Market Interest Rates Have Dropped: If overall rates have decreased since you got your initial loan. * Your Financial Situation Has Improved: You have a higher income, less debt, or a larger emergency fund. * Benefits of Refinancing: * Lower Interest Rate: The most compelling reason. A lower APR means less money paid in interest over the life of the loan. * Lower Monthly Payments: If you get a lower rate and/or extend the term slightly, your monthly payments can decrease, freeing up cash flow. * Reduced Total Interest Paid: A lower rate directly translates to substantial savings over the loan's duration.

Your Next Steps to Driving Away Confidently: A 2026 Action Plan

Getting a car loan with a G2 license and bad credit in Ontario in 2026 is not a pipe dream; it's an achievable goal with the right approach. You have the power to take control of your mobility and your financial future. Here's your concise action checklist to get approved: 1. Gather All Documents: Collect your pay stubs, employment letter, bank statements, proof of residency, and your valid G2 license. Organize them meticulously. 2. Research Specialized Lenders: Focus on dealerships and online platforms in your Ontario city (e.g., Toronto, Vaughan, London) that specialize in bad credit or subprime auto loans. They are your most likely path to approval. 3. Prepare for a Down Payment: Start saving, even a modest amount. Every dollar you put down reduces risk and improves your terms. 4. Consider a Co-Signer: If you have a trusted friend or family member with good credit, discuss the possibility of them co-signing or guaranteeing your loan. 5. Obtain Insurance Quotes: Before committing to a car, get multiple insurance quotes for the specific vehicle you're considering. This will give you a realistic picture of the total monthly cost. 6. Be Prepared to Negotiate: Don't be afraid to ask questions about interest rates, fees, and add-ons. Knowledge is power. 7. Apply with Confidence: Present yourself as a responsible, committed borrower. Your journey to independent driving in 2026 starts now. Don't let past credit challenges or your G2 license hold you back. With SkipCarDealer.com, you have a partner dedicated to helping you achieve your goals and drive away confidently.