Bad Credit Car Loan: Consolidate Payday Debt Canada 2026

Table of Contents

- Key Takeaways

- The Payday Loan Vortex: Why Escaping the Cycle is Crucial

- Understanding the High-Interest Trap and Its Mechanics

- The Domino Effect on Your Financial Health and Credit Score

- Leveraging a Vehicle Purchase: An Unconventional Debt Consolidation Strategy

- How a Secured Loan Differs from Unsecured Debt and Why It Matters

- The Mechanics of Rolling Payday Debt into a Car Loan: A Step-by-Step Overview

- When This Strategy Makes Sense (and When It Doesn't): A Candid Assessment

- Cracking the Code: Bad Credit, Car Loans, and Lender Psychology

- What 'Bad Credit' Truly Means to an Auto Lender: Risk Assessment

- Beyond the Score: Factors That Influence Your Approval Odds (Income, Stability, Down Payment)

- The Power of a Co-Signer (and its Risks): A Shared Responsibility

- The True Cost Unveiled: Interest Rates, Fees, and the Total Price Tag

- Decoding High-Interest Car Loans for Risky Borrowers: What to Expect

- Mandatory Fees vs. Negotiable Charges: Uncovering All Expenses

- The APR vs. Stated Interest Rate: What You REALLY Pay

- Your Approval Blueprint: Maximizing Your Chances with Challenged Credit

- Building a Strong Application Packet: Documentation and Preparation

- The Importance of a Down Payment (and How to Save For One)

- Demonstrating Financial Responsibility (Even with Past Issues): Current Habits

- Strategies for Explaining Past Credit Challenges: Honesty and Action Plans

- Navigating the Lender Landscape: Where to Seek Your Loan

- Specialty Auto Lenders: Their Role and Reach for Subprime Borrowers

- Dealership Financing: Convenience vs. Cost and Hidden Markups

- Traditional Banks and Credit Unions: The Hurdles and Potential Rewards

- Online Loan Aggregators: A Double-Edged Sword for Comparison Shopping

- The Smart Vehicle Choice: How Your Car Impacts Your Loan

- New vs. Used: Depreciation, Lending Risk, and Affordability

- Vehicle Value and Loan-to-Value Ratios: The Collateral Factor

- Understanding Collateral and Repossession Risks: A Sobering Reality Check

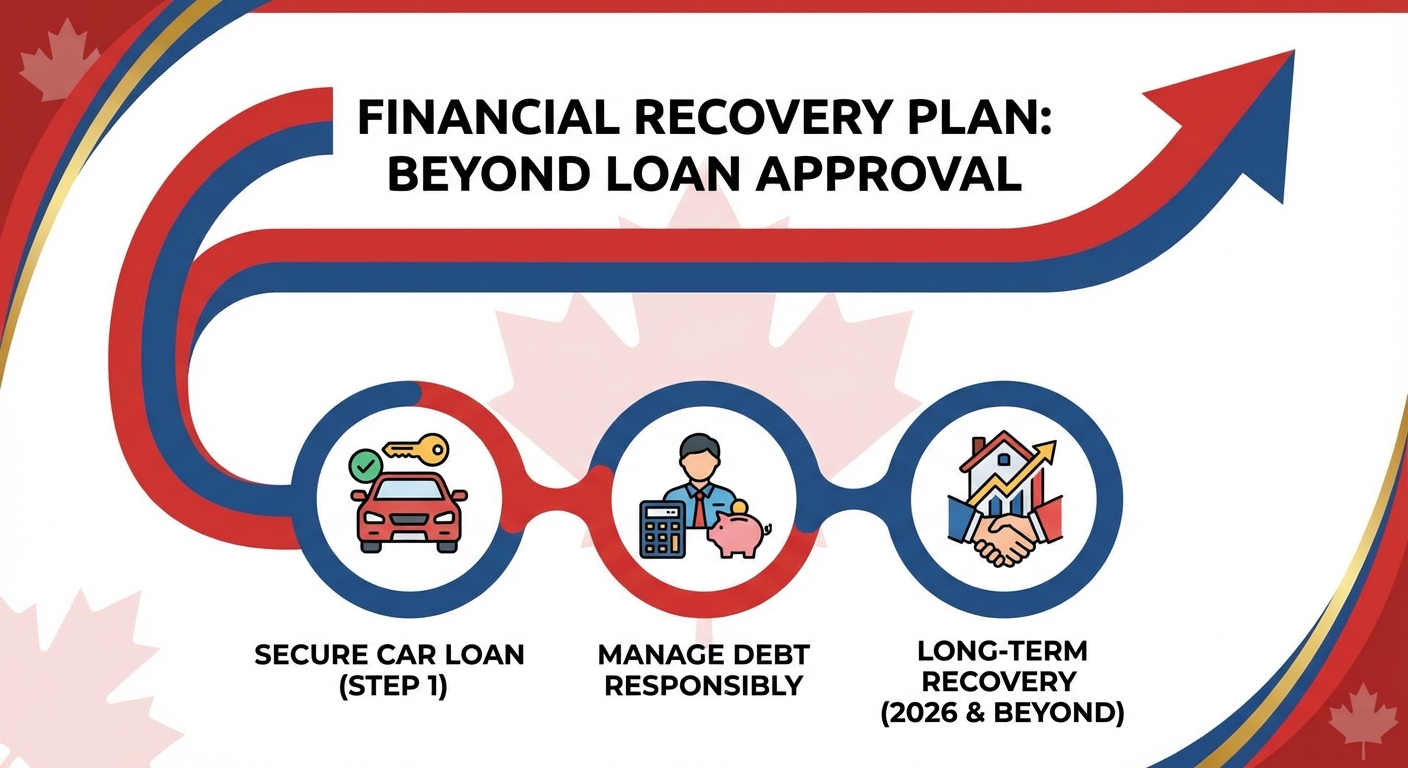

- Crafting Your Financial Recovery Plan: Beyond Loan Approval

- Budgeting for Your New Car Payment (and Life): Sustainable Living

- Strategies for Early Payoff and Interest Savings: Accelerating Freedom

- Rebuilding Your Credit Score Post-Consolidation: A Path to Better Terms

- Avoiding the Debt Cycle Reload: Future-Proofing Your Finances

- Safeguarding Your Investment: Essential Protections and Unexpected Expenses

- Mandatory Insurance Requirements: A Non-Negotiable Cost

- Extended Warranties: Are They Worth It for High-Risk Loans?

- Maintenance Costs: A Non-Negotiable Reality of Car Ownership

- Holistic Debt Relief: Exploring Complementary Strategies

- Credit Counseling and Financial Coaching: Expert Guidance

- Debt Management Programs (DMPs): When a Car Loan Isn't Enough

- Understanding the Broader Financial Ecosystem: All Your Options

- Your Journey Forward: Actionable Steps to a Debt-Free Future

- Frequently Asked Questions: Deep Dive into Common Concerns

In Canada, the struggle with high-interest payday loans is a reality for countless individuals, often compounded by the challenge of bad credit. As we navigate into 2026, many are seeking viable escape routes from this relentless debt cycle. One increasingly considered, albeit unconventional, strategy is leveraging a car loan to consolidate and pay off these predatory debts. This article delves deep into how a bad credit car loan can serve as a lifeline, outlining the mechanics, risks, rewards, and the crucial steps you need to take to make this strategy work for your financial recovery.

Key Takeaways

- Using a secured car loan can consolidate high-interest payday debt, potentially lowering your overall monthly payments and reducing astronomical APRs.

- Bad credit doesn't automatically disqualify you; lenders specializing in subprime auto loans consider income stability, down payments, and employment history.

- Expect higher interest rates on a bad credit car loan (often 15-29.99% in 2026), but these are significantly lower than payday loan APRs which can exceed 300-500%.

- A car loan for consolidation is a powerful tool for credit rebuilding if managed responsibly, but it comes with the risk of vehicle repossession if payments are missed.

- Thorough budgeting, understanding all costs (fees, insurance, maintenance), and making a smart vehicle choice are paramount for success.

The Payday Loan Vortex: Why Escaping the Cycle is Crucial

A bad credit car loan to consolidate payday loans in Canada for 2026 is a strategy where an individual with a low credit score obtains a secured auto loan that is large enough to cover the cost of a vehicle and also provides additional funds specifically earmarked to pay off existing high-interest payday loans, effectively converting multiple unsecured debts into a single, potentially more manageable, secured debt with a lower overall annual percentage rate.

Payday loans often appear as a quick fix for immediate financial shortfalls. However, their deceptive simplicity hides a brutal reality: they are designed to trap borrowers in a persistent cycle of debt. In Canada, payday loans are short-term, high-cost loans, typically for $1,500 or less, to be repaid on your next payday.

While provincial regulations attempt to cap fees, the annualized interest rates remain astronomical, making them one of the most expensive forms of credit available.

Understanding the High-Interest Trap and Its Mechanics

The core mechanism of a payday loan trap lies in its fee structure. For instance, in Ontario as of 2026, the maximum cost to borrow a payday loan is $15 for every $100 borrowed. While this might seem manageable for a two-week loan, annualizing that fee reveals the true cost. Let's break it down:

- Borrow $500 for 14 days.

- Fee: $15 per $100 = $75.

- Total repayment: $575.

- If you were to roll over this loan every two weeks for a year, the effective annual interest rate (APR) would be over 390%.

This exorbitant rate makes it incredibly difficult to pay off the principal amount. Borrowers frequently find themselves extending or re-borrowing, incurring new fees each time, merely to cover the interest, never truly reducing the original debt. This creates a relentless cycle where a small initial loan balloons into an unmanageable financial burden.

The Domino Effect on Your Financial Health and Credit Score

The reliance on payday loans has far-reaching consequences beyond just the immediate financial drain:

- Erosion of Savings: Funds that could go towards savings or investments are instead consumed by loan fees.

- Increased Stress: The constant pressure of high-interest debt takes a significant toll on mental and emotional well-being.

- Credit Score Damage: While payday lenders themselves don't always report to credit bureaus, defaulting on these loans can lead to collections, which severely impacts your credit score. This makes it harder to secure conventional loans, mortgages, or even rental agreements in the future.

- Limited Future Borrowing: A history of payday loan usage can signal financial instability to traditional lenders, making future credit harder to obtain at reasonable rates.

Pro Tip: Calculating Your True Payday Loan Cost: Don't just look at the fee; annualize it to understand the astronomical APR you're actually paying. Multiply the fee-to-principal ratio by the number of repayment periods in a year (e.g., 26 for bi-weekly loans) to reveal the shocking true cost.

Leveraging a Vehicle Purchase: An Unconventional Debt Consolidation Strategy

Given the dire consequences of payday loans, finding an exit strategy is paramount. For those with bad credit, traditional consolidation options like personal loans or lines of credit might be out of reach. This is where an unconventional approach, using a secured car loan, comes into play in 2026.

The idea is to structure a car loan not just for the vehicle itself, but to include an additional amount sufficient to pay off your outstanding payday loans. This rolls multiple high-interest, unsecured debts into a single, lower-interest, secured payment.

How a Secured Loan Differs from Unsecured Debt and Why It Matters

The fundamental difference between a secured loan (like a car loan) and unsecured debt (like payday loans or credit cards) lies in collateral.

- Secured Loan: Backed by an asset, in this case, the vehicle itself. If you default on the loan, the lender has the right to repossess the car to recover their losses. This collateral reduces the lender's risk.

- Unsecured Debt: Not backed by any specific asset. Lenders take on more risk, which is why interest rates are typically higher, especially for those with bad credit. Payday loans are a prime example, often relying solely on your promise to repay from your next paycheck.

Because a car loan is secured, lenders are often more willing to approve applicants with bad credit, even in 2026, as they have a tangible asset to fall back on. This reduced risk for the lender often translates to a lower interest rate for the borrower compared to unsecured options for the same credit profile.

The Mechanics of Rolling Payday Debt into a Car Loan: A Step-by-Step Overview

Here's how this strategy typically unfolds:

- Application: You apply for a car loan, indicating your intention to include funds for debt consolidation.

- Lender Assessment: The lender evaluates your financial situation, including your income, employment stability, debt-to-income ratio, and credit history. They'll also consider the value of the vehicle you intend to purchase.

- Loan Structure: If approved, the loan amount will cover the cost of the car plus the amount needed to pay off your payday loans. For example, if you're buying a $20,000 car and have $3,000 in payday debt, you'd apply for a $23,000 loan.

- Disbursement: Upon loan approval and vehicle purchase, the lender typically disburses the portion designated for payday loans directly to you or, in some cases, directly to the payday lenders. This ensures the funds are used for their intended purpose.

- Single Payment: You are then left with one consolidated monthly payment for your car loan, at a fixed interest rate over a set term (e.g., 48-84 months).

When This Strategy Makes Sense (and When It Doesn't): A Candid Assessment

This approach is not a universal solution and requires careful consideration:

When it Makes Sense:

- Significantly Lower APR: If the car loan's APR, even with bad credit, is substantially lower than your annualized payday loan APRs (which it almost always will be).

- Manageable Payments: If the new consolidated monthly payment is truly affordable within your budget, without stretching you too thin.

- Credit Rebuilding Goal: If you are committed to making on-time payments to rebuild your credit score.

- Genuine Need for a Vehicle: If you genuinely need a reliable vehicle for work, family, or daily life in cities like Vancouver, Toronto, or Calgary, and not just as a means to consolidate debt.

- Limited Other Options: If traditional consolidation loans are unavailable due to your credit history. For those who've experienced severe credit challenges like a consumer proposal, this can be a viable path. For more on this, check out our guide on Post-Proposal Car Loan: Your Credit Score Just Got a Mulligan.

When it Doesn't Make Sense:

- Buying an Unnecessary Car: If you don't actually need a car, or are buying a more expensive one than you can afford, the new debt could exacerbate your financial problems.

- High Loan-to-Value (LTV): If the amount you need to consolidate is very high relative to the car's value, some lenders might be hesitant, or the loan terms could be less favourable.

- Risk of Repossession: If you are unsure about your ability to consistently make car loan payments, you risk losing your vehicle, which serves as collateral.

- Adding More Debt: This strategy should consolidate existing debt, not add to it. If you continue to take out payday loans after consolidating, you're digging a deeper hole.

Cracking the Code: Bad Credit, Car Loans, and Lender Psychology

Understanding how lenders view applicants with bad credit is crucial when seeking a car loan for debt consolidation in 2026. It's not just about a low credit score; it's about the perceived risk you present.

What 'Bad Credit' Truly Means to an Auto Lender: Risk Assessment

To an auto lender, "bad credit" signals a higher likelihood of default. They assess this risk by looking at several elements on your credit report:

- Payment History: Missed or late payments, especially on previous loans or credit cards, are a major red flag.

- Credit Utilization: Maxed-out credit cards indicate a reliance on credit and potential financial strain.

- Public Records: Bankruptcies, consumer proposals, or collection accounts are significant indicators of past financial distress.

- Length of Credit History: A short history, especially with limited positive accounts, makes it harder for lenders to assess your reliability.

- Types of Credit: A mix of credit (revolving, installment) can be positive, but a history dominated by high-interest, predatory loans is a concern.

For more detailed information on credit score requirements, especially in Ontario, you might find our article on The Truth About the Minimum Credit Score for Ontario Car Loans helpful.

Beyond the Score: Factors That Influence Your Approval Odds (Income, Stability, Down Payment)

While your credit score is important, it's not the only factor. Lenders, particularly those specializing in subprime auto loans, look at a holistic picture:

- Stable Income: This is paramount. Lenders want to see a consistent, verifiable source of income sufficient to cover the new car payment plus existing expenses. This could be employment income, disability income, or even certain government benefits. For example, our article on Disability Income? Bad Credit? Your Car Loan Just Got Its Green Light, Toronto highlights how various income sources can be considered.

- Employment History: A long, stable employment history (e.g., 2+ years with the same employer) signals reliability.

- Residential Stability: Living at the same address for an extended period can also be seen positively.

- Debt-to-Income (DTI) Ratio: This measures how much of your gross monthly income goes towards debt payments. Lenders prefer a lower DTI (e.g., below 40-50%). Consolidating payday debt can actually improve your DTI if the new car loan payment is lower than the sum of your previous payday loan payments.

- Down Payment: A significant down payment reduces the loan amount, lowers the lender's risk, and can increase your approval chances while potentially securing a better interest rate.

The Power of a Co-Signer (and its Risks): A Shared Responsibility

If your credit history is particularly challenging, a co-signer can significantly improve your approval odds. A co-signer is someone with good credit who agrees to take legal responsibility for the loan if you default. This provides an additional layer of security for the lender.

Benefits:

- Increased chance of approval.

- Potentially lower interest rates.

Risks for the Co-Signer:

- Full legal responsibility for the debt if you can't pay.

- Their credit score will be impacted if payments are missed.

- Can strain personal relationships.

It's a serious commitment for a co-signer and should only be considered if both parties fully understand the implications.

Pro Tip: Pre-qualify, Don't Just Apply Everywhere: Use pre-qualification tools offered by many lenders. This allows you to gauge your chances and get an idea of potential rates without impacting your credit score with multiple hard inquiries, which can further damage bad credit.

The True Cost Unveiled: Interest Rates, Fees, and the Total Price Tag

When you're dealing with bad credit in 2026, the car loan you secure for consolidation will come with specific costs. It's vital to understand every component to avoid surprises and ensure the strategy is genuinely beneficial.

Decoding High-Interest Car Loans for Risky Borrowers: What to Expect

For borrowers with bad credit in Canada, interest rates on car loans are considerably higher than for prime borrowers. While someone with excellent credit might secure a rate of 4.99% to 7.99% in 2026, those with challenged credit can expect rates to be significantly higher.

Typical 2026 Car Loan Interest Rate Ranges (Canada):

| Credit Tier | Credit Score Range (Approx.) | Estimated Interest Rate Range (2026) |

|---|---|---|

| Excellent | 760+ | 4.99% - 7.99% |

| Good | 660 - 759 | 8.00% - 14.99% |

| Fair/Average | 580 - 659 | 15.00% - 24.99% |

| Bad/Subprime | Below 580 | 25.00% - 29.99% (or higher, up to provincial maximums) |

While these rates seem high, remember they are still dramatically lower than the annualized APRs of payday loans (which can exceed 300%). The goal here is to reduce the overall cost of borrowing and create a more manageable repayment structure.

Mandatory Fees vs. Negotiable Charges: Uncovering All Expenses

Beyond the interest rate, car loans come with various fees that can add to the total cost. It's crucial to identify them:

- Documentation/Admin Fees: Charged by dealerships or lenders for processing paperwork. These can range from $200-$700 and are often non-negotiable.

- PPSA Registration Fee: Personal Property Security Act (PPSA) registration ensures the lender's claim on the vehicle as collateral. This is a small, mandatory provincial fee (e.g., $10-$50).

- Sales Tax (GST/PST/HST): Applied to the vehicle purchase price in your province (e.g., 13% HST in Ontario, 5% GST + 9.975% QST in Quebec). This is a significant, unavoidable cost.

- Licensing and Registration Fees: Provincial fees for plates and vehicle registration.

- Extended Warranties/Protection Plans: Often offered by dealerships. These are optional but can be costly. While they offer peace of mind, consider if they are truly necessary, especially if they significantly inflate your loan.

- Loan Origination Fee: Some lenders charge a fee for initiating the loan, particularly for subprime borrowers.

Always ask for a full breakdown of all costs before signing any agreement. Some fees might be negotiable; others are fixed.

The APR vs. Stated Interest Rate: What You REALLY Pay

Understanding the difference between the stated interest rate and the Annual Percentage Rate (APR) is critical. The interest rate is simply the cost of borrowing the principal amount.

The APR is the true annual cost of your loan, encompassing the interest rate PLUS most fees and other charges associated with the loan. It provides a more comprehensive picture of your total borrowing cost.

Example:

| Loan Detail | Stated Interest Rate | APR |

|---|---|---|

| Car Loan (Bad Credit) | 25.00% | 27.50% (includes documentation fees, PPSA, etc. spread over the loan term) |

Always compare loans based on their APR, not just the stated interest rate, to understand the true cost of borrowing in 2026.

Pro Tip: Request a Full Loan Disclosure Before Signing: Always ask for a detailed breakdown of all costs, including the APR, total interest paid, and any fees, before committing. This is your right as a borrower and ensures full transparency.

Your Approval Blueprint: Maximizing Your Chances with Challenged Credit

Securing a car loan with bad credit, especially one that includes funds for debt consolidation, requires strategic preparation. Here’s how to build a strong application in 2026.

Building a Strong Application Packet: Documentation and Preparation

Lenders need to verify your identity, income, and stability. Having your documents ready demonstrates seriousness and efficiency.

- Proof of Income: Recent pay stubs (2-3 months), employment letters, T4s, or tax assessments. If you're self-employed, bank statements can often serve as income proof. For more on this, read our article: Bank Statements: The Only Resume Your Car Loan Needs. Drive, Alberta!

- Proof of Residency: Utility bills, rental agreements, or mortgage statements showing your current address.

- Identification: Valid driver's license, passport, or other government-issued ID.

- Banking Information: Void cheque or pre-authorized debit form for loan payments.

- List of Debts: Be prepared to provide details of your payday loans, including amounts owed and lender contact information.

The Importance of a Down Payment (and How to Save For One)

A down payment is one of the most powerful tools you have to improve your approval chances and secure better terms with bad credit.

- Reduces Lender Risk: A down payment reduces the amount of money the lender needs to finance, making the loan less risky for them.

- Lowers Monthly Payments: A smaller principal loan amount means lower monthly payments, making the loan more affordable.

- Potentially Better Rates: Lenders may offer slightly better interest rates if you have a significant down payment.

- Reduces Loan-to-Value (LTV): A lower LTV ratio (loan amount vs. car value) is always favourable.

How to Save: Even a small down payment (5-10% of the car's value) can make a difference. Consider selling unused items, picking up extra shifts, or temporarily cutting non-essential expenses to build a down payment fund.

Demonstrating Financial Responsibility (Even with Past Issues): Current Habits

Lenders understand that past mistakes don't define your present. Showcase current positive financial behaviours:

- Consistent Bill Payments: Ensure all current bills (rent, utilities, phone) are paid on time.

- Stable Employment: Highlight any long-term employment or consistent work history.

- Reduced Spending: Show you've cut back on unnecessary expenses and are living within your means.

- Emergency Fund (even small): Demonstrating you have a small buffer indicates financial prudence.

Strategies for Explaining Past Credit Challenges: Honesty and Action Plans

Don't hide your credit history. Be transparent with lenders. Prepare to explain past challenges honestly and concisely.

- Take Responsibility: Acknowledge past issues without making excuses.

- Explain the Cause: Briefly explain *why* your credit suffered (e.g., job loss, medical emergency, divorce).

- Show Your Action Plan: Crucially, explain what you've done to address the issues and what steps you're taking to prevent them from recurring. Emphasize your commitment to rebuilding credit through on-time payments for this new car loan.

Navigating the Lender Landscape: Where to Seek Your Loan

Not all lenders are created equal, especially for those with bad credit looking to consolidate payday debt in 2026. Understanding the different types can help you find the best fit.

Specialty Auto Lenders: Their Role and Reach for Subprime Borrowers

These lenders, often called "subprime" or "non-prime" lenders, specialize in providing car loans to individuals with bad credit, limited credit history, or unique income situations. They are generally more flexible than traditional banks.

- Pros: Higher approval rates for bad credit; more understanding of unique financial situations; often work directly with dealerships.

- Cons: Generally higher interest rates; may have stricter requirements regarding income stability or vehicle age/mileage.

Companies like SkipCarDealer.com work with a network of these specialty lenders across Canada, from Montreal to Vancouver, who are specifically geared towards helping individuals in challenging financial situations.

Dealership Financing: Convenience vs. Cost and Hidden Markups

Many dealerships offer in-house financing or work with a network of lenders, including subprime ones. This can be very convenient, as you can handle the car purchase and financing in one place.

- Pros: One-stop shop; often have relationships with multiple lenders, increasing your chances; can sometimes offer incentives.

- Cons: Dealers may mark up interest rates for their profit; less transparency on lender options; focus might be more on selling the car than finding the absolute best loan terms for you.

Traditional Banks and Credit Unions: The Hurdles and Potential Rewards

Major banks (e.g., RBC, TD, BMO) and credit unions typically offer the most competitive interest rates for car loans. However, their lending criteria are much stricter.

- Pros: Lowest interest rates if approved; established reputation.

- Cons: Very difficult to qualify with bad credit; stringent credit score requirements; less flexibility for unique income situations.

It's generally worth checking with your existing bank or credit union first, but be prepared for a potential rejection if your credit score is significantly low.

Online Loan Aggregators: A Double-Edged Sword for Comparison Shopping

Online aggregators connect you with multiple lenders by submitting a single application. They can be efficient for comparison shopping.

- Pros: Saves time; provides multiple offers for comparison; often includes specialty lenders.

- Cons: Need to be wary of scams or predatory lenders; ensure the platforms are reputable; some may perform hard credit inquiries with each potential lender, which can negatively impact your score.

Pro Tip: Research Lender Reviews Specific to Bad Credit Borrowers: Before committing, look for online reviews and testimonials from other bad credit borrowers for any lender you're considering. Focus on transparency, customer service, and fairness of terms, not just approval rates.

The Smart Vehicle Choice: How Your Car Impacts Your Loan

The type of vehicle you choose in 2026 plays a significant role in your loan approval, terms, and overall financial outcome when consolidating payday debt with a car loan.

New vs. Used: Depreciation, Lending Risk, and Affordability

- New Cars:

- Pros: Reliability, warranty, latest features.

- Cons: Rapid depreciation (loses value quickly), higher price tag, higher insurance, typically harder to secure with bad credit due to the larger loan amount.

- Used Cars:

- Pros: More affordable, slower depreciation, lower insurance costs, easier to approve with bad credit due to smaller loan amount.

- Cons: Potential for higher maintenance costs, less warranty coverage (if any).

For someone with bad credit aiming to consolidate debt, a reliable, affordable used car is almost always the smarter choice. It minimizes the loan amount, thereby reducing risk for the lender and making the monthly payments more manageable for you.

Vehicle Value and Loan-to-Value Ratios: The Collateral Factor

The loan-to-value (LTV) ratio is a critical factor. It's the total loan amount divided by the car's market value. Lenders prefer a lower LTV because it means they have more equity in the collateral.

- If you're buying a $15,000 car and have $3,000 in payday debt, you're looking for an $18,000 loan. Your LTV would be 120% ($18,000 / $15,000).

- While a high LTV is common for consolidation loans, lenders will want to ensure the vehicle's value is sufficient to cover the loan if repossession becomes necessary.

- A down payment helps reduce the LTV, making your application more attractive.

Understanding Collateral and Repossession Risks: A Sobering Reality Check

This is arguably the most critical aspect of using a car loan for debt consolidation. Your vehicle serves as collateral. If you fail to make your loan payments as agreed, the lender has the legal right to repossess the car. This means:

- You lose your transportation.

- You could still owe money if the sale of the repossessed car doesn't cover the full outstanding loan balance (a "deficiency balance").

- Your credit score will take a severe hit, making future borrowing even harder.

This strategy should only be pursued if you are highly confident in your ability to make every single payment on time.

Pro Tip: Focus on Reliable, Affordable Models: Choose a vehicle that is known for reliability and has a lower price point to reduce loan amount, interest, and maintenance costs. A five-year-old Honda Civic or Toyota Corolla is often a much wiser choice than a luxury SUV for someone rebuilding credit.

Crafting Your Financial Recovery Plan: Beyond Loan Approval

Securing the car loan is only the first step. The true success of this strategy in 2026 lies in your ability to manage the new debt responsibly and use it as a springboard for long-term financial recovery.

Budgeting for Your New Car Payment (and Life): Sustainable Living

A realistic budget is your most powerful tool. It must accommodate your new car payment while ensuring all other essential expenses are met without relying on further debt.

- Calculate Total Monthly Outgoings: List every single expense: rent/mortgage, utilities, groceries, transportation (gas, insurance), phone, internet, and now, your new car payment.

- Track Income: Know exactly how much comes in each month.

- Identify & Cut Non-Essentials: Be ruthless. Subscriptions, dining out, entertainment – trim these back to create breathing room.

- Allocate Funds: Ensure enough is left for your car payment, plus a small buffer for unexpected expenses.

The goal is to create a budget that is not just functional, but sustainable, preventing a return to the payday loan cycle.

Strategies for Early Payoff and Interest Savings: Accelerating Freedom

Paying off your car loan faster than the scheduled term can save you a significant amount in interest, especially with a higher bad credit interest rate.

- Round Up Payments: If your payment is $450, try to pay $500. The extra $50 goes directly to the principal.

- Make Bi-Weekly Payments: Instead of one monthly payment, pay half every two weeks. This results in one extra full payment per year, significantly shortening your loan term.

- Apply Windfalls: Use bonuses, tax refunds, or unexpected income to make lump-sum payments against the principal.

- Refinance: Once your credit score improves (after 12-18 months of on-time payments), explore refinancing for a lower interest rate, further accelerating your payoff and savings.

Rebuilding Your Credit Score Post-Consolidation: A Path to Better Terms

The car loan, if managed correctly, is a powerful credit-building tool. Consistently making on-time payments for a secured installment loan like a car loan demonstrates financial responsibility to credit bureaus.

- Positive Payment History: Every on-time payment is reported to credit bureaus, positively impacting your score.

- Credit Mix: A car loan diversifies your credit mix, which is viewed favourably.

- Reduced High-Interest Debt: By eliminating payday loans, you remove a major drain on your finances and a potential source of negative credit reporting.

Over time, a rebuilt credit score will open doors to better financial products, lower interest rates on future loans, and greater financial freedom.

Avoiding the Debt Cycle Reload: Future-Proofing Your Finances

Consolidating payday debt should be a one-time event, not a recurring strategy. Future-proofing your finances involves:

- Building an Emergency Fund: Start small, but aim for 3-6 months of living expenses. This fund will prevent you from needing high-interest loans for unexpected costs.

- Financial Literacy: Continuously educate yourself on budgeting, saving, and investing.

- Responsible Credit Use: If you use credit cards, pay them off in full each month. Avoid carrying balances.

- Professional Advice: Don't hesitate to seek advice from non-profit credit counsellors if you feel overwhelmed.

Safeguarding Your Investment: Essential Protections and Unexpected Expenses

Owning a car comes with costs beyond the loan payment. Budgeting for these in 2026 is critical to ensure your debt consolidation strategy remains viable.

Mandatory Insurance Requirements: A Non-Negotiable Cost

When you finance a car, lenders require comprehensive and collision insurance coverage to protect their investment (the vehicle). This is in addition to the mandatory third-party liability insurance required by law in Canada.

- Cost Factor: Insurance premiums can be substantial, especially for newer drivers, those with a history of claims, or residents of high-cost areas like Toronto or Vancouver.

- Budgeting: Always get insurance quotes *before* finalizing your car purchase to factor this significant cost into your monthly budget.

Extended Warranties: Are They Worth It for High-Risk Loans?

Extended warranties are service contracts that cover certain repairs after the manufacturer's warranty expires. They are often heavily pushed by dealerships.

- Pros: Peace of mind, protection against unexpected major repair costs, especially for used vehicles.

- Cons: Can be very expensive, often have limitations or deductibles, and may not cover all components. Adding the cost to your loan increases your principal and interest paid.

For someone consolidating debt with bad credit, adding an expensive extended warranty to your loan might be counterproductive. Prioritize affordability and consider a separate, more affordable emergency fund for repairs instead.

Maintenance Costs: A Non-Negotiable Reality of Car Ownership

All cars require regular maintenance and will eventually need repairs. Neglecting maintenance leads to more expensive problems down the line.

- Routine Maintenance: Oil changes, tire rotations, brake inspections, fluid checks. Budget at least $50-$100 per month for these.

- Unexpected Repairs: Batteries, tires, unforeseen mechanical issues. These can run into hundreds or even thousands of dollars.

Factor these costs into your budget. An emergency fund is invaluable here, preventing you from having to resort to high-interest loans again when an unexpected repair bill arrives.

Holistic Debt Relief: Exploring Complementary Strategies

While a car loan can be an effective tool for consolidating payday debt, it's essential to understand that it's part of a broader financial toolkit. It may not be the only solution, and sometimes, other strategies might be more appropriate or complementary in 2026.

Credit Counseling and Financial Coaching: Expert Guidance

Non-profit credit counselling agencies across Canada offer invaluable resources and guidance. They can:

- Assess Your Situation: Provide a neutral, expert review of your entire financial picture.

- Develop a Budget: Help you create a realistic and sustainable budget.

- Explore All Options: Discuss all available debt relief options, including debt management programs, consumer proposals, or even bankruptcy, without bias.

- Negotiate with Creditors: Sometimes, they can help negotiate lower interest rates or payment plans with unsecured creditors.

Seeking professional advice is a sign of strength, not weakness, and can provide clarity when you feel overwhelmed.

Debt Management Programs (DMPs): When a Car Loan Isn't Enough

If your overall unsecured debt (beyond just payday loans) is substantial, a Debt Management Program (DMP) through a credit counselling agency might be a better fit, or a complementary step.

- How DMPs Work: The agency works with your creditors to create a single monthly payment plan, often with reduced interest rates, to pay off your unsecured debts.

- Pros: Consolidates multiple debts, reduces interest, provides a structured repayment plan.

- Cons: Requires consistent payments, can slightly impact your credit score (though less severely than bankruptcy), and not all creditors participate.

A DMP might be a suitable alternative or a step to consider before or after consolidating specific debts with a car loan, depending on your overall financial picture.

Understanding the Broader Financial Ecosystem: All Your Options

Beyond DMPs, it's important to be aware of other debt relief options, even if they seem drastic:

- Consumer Proposal: A legally binding agreement with your creditors to pay back a percentage of your unsecured debt over a set period (up to 5 years). It avoids bankruptcy and offers significant debt reduction.

- Bankruptcy: A legal process that eliminates most unsecured debts but has a severe, long-lasting impact on your credit score.

These options are typically considered as last resorts but can provide a fresh start for those in severe financial distress. The key is to explore all avenues and choose the most appropriate solution for your unique circumstances.

Your Journey Forward: Actionable Steps to a Debt-Free Future

The journey out of payday loan debt, especially with bad credit, is challenging but entirely possible. Using a car loan as a consolidation tool in 2026 offers a unique pathway, but it demands careful planning, informed decision-making, and unwavering commitment.

Start by honestly assessing your financial situation. Understand the true cost of your payday loans. Research lenders who specialize in bad credit car loans, like SkipCarDealer.com, and prepare a strong application with all necessary documentation. Choose a reliable, affordable vehicle that fits your budget, not your desires.

Most importantly, once approved, commit to your new consolidated payment. Every on-time payment is a step towards not just owning your vehicle, but rebuilding your credit, gaining financial stability, and escaping the cycle of high-interest debt for good. This isn't just about a car; it's about driving towards a brighter financial future.