Probation Period? That's Your Down Payment. Car Loan Approved, Montreal.

Table of Contents

- Probation Period? That's Your Down Payment. Car Loan Approved, Montreal.

- Introduction: The Montreal Grind – Landing Your Dream Job, Now What About the Wheels?

- Key Takeaways

- Deconstructing the Lender's Mind: Why 'New Job on Probation' and 'No Credit' Ring Alarm Bells

- The Probation Period Paradox: What it Really Means to Lenders

- The Blank Slate of No Credit History: The 'Invisible' Borrower

- Your Financial Arsenal: Building a Case for Approval (Even Without a Credit Score)

- The Unbeatable Power of the Down Payment: Your Ultimate Risk Reducer

- Pro Tip: The Power of Patience

- Ironclad Proof of Income & Stability: Beyond the Offer Letter

- The Co-Signer Advantage: A Bridge to Approval

- Alternative Data & Collateral: Painting a Fuller Picture

- Navigating the Canadian Landscape: Where to Find Lenders Who Understand Your Situation

- Dealership Financing: Your Primary Battleground for a Car Loan for New Job on Probation Canada No Credit History

- The Bank vs. Credit Union Conundrum: Traditional vs. Community-Focused

- Online Lenders & Specialty Finance Companies: The Digital Frontier

- The Application Deep Dive: What Documents You *Really* Need and How to Present Them

- The Essential Checklist: Don't Leave Home Without It

- Crafting Your Narrative: Explaining Your Unique Situation

- Preparing for the Interrogation: Anticipating Lender Questions

- Pro Tip: Organize for Impact

- Choosing Your Ride: Strategic Car Selection for First-Time Buyers on Probation

- Affordability First: Beyond the Monthly Payment

- Pro Tip: The 15-20% Rule

- New vs. Used: The Smart Choice for Your First Car Loan

- Reliability Over Luxury: Your Priority Checklist

- Insurance Implications: A Major Factor in Canadian Provinces

- Beyond Approval: Understanding Interest Rates, Terms, and Hidden Costs

- The Reality of Higher Interest Rates: What to Expect

- Loan Terms: The Short vs. Long Game

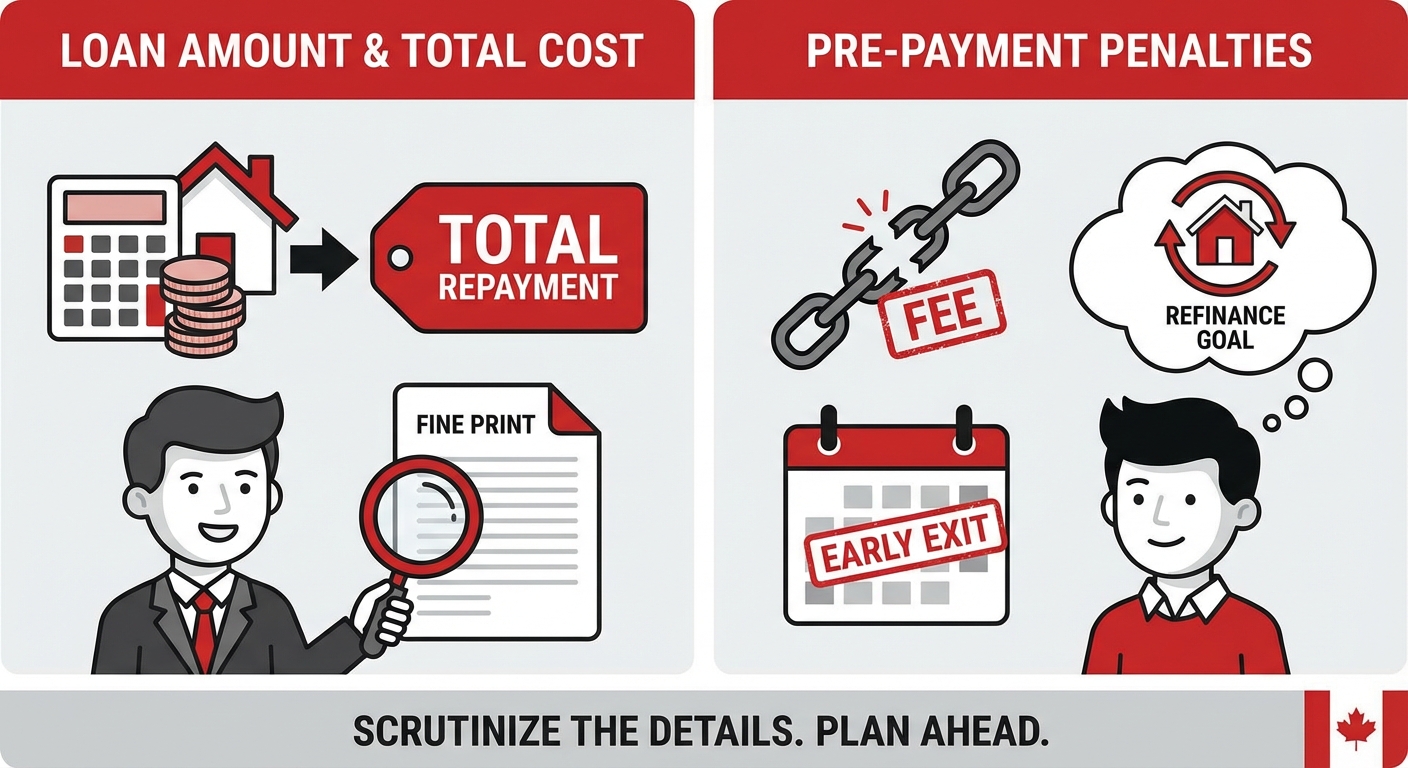

- Beware of Hidden Fees: Scrutinizing the Fine Print

- Building Your Credit Legacy: The Road Ahead After Your First Car Loan

- The Golden Rule: Making On-Time Payments, Every Time

- Diversifying Your Credit Portfolio (Carefully!)

- Pro Tip: Automate Your Payments

- Monitoring Your Credit: Your Financial Report Card

- Refinancing Opportunities: A Path to Lower Costs

- Your Next Steps to Approval: A Montreal Action Plan

- Frequently Asked Questions (FAQ): Addressing Your Car Loan Concerns

Probation Period? That's Your Down Payment. Car Loan Approved, Montreal.

Introduction: The Montreal Grind – Landing Your Dream Job, Now What About the Wheels?

There's an exhilarating rush that comes with securing a new role in a dynamic, bustling city like Montreal. The excitement of new challenges, a vibrant culture, and the promise of career growth fills the air. But quickly, that initial euphoria often gives way to a practical reality: how will you navigate this sprawling metropolis? Public transit is excellent, but for many, reliable personal transportation is essential for daily commutes, weekend getaways to the Laurentians, or simply managing life's demands. You’ve landed the dream job, but now you need the dream ride – and that's where the real challenge often begins.

You see, you're facing a unique double whammy, a common scenario for many ambitious Canadians. You're seeking a car loan for a new job on probation in Canada, and you might also have little to no credit history. This combination can feel like trying to climb Mount Royal in winter without proper gear: daunting, if not impossible, at first glance. Lenders, naturally risk-averse, tend to view new employment and a blank credit slate as red flags, making traditional approval routes seem closed off.

We understand the inherent difficulties. This isn't just about getting a car; it's about solidifying your independence, proving your stability, and truly settling into your new life in Montreal, Toronto, Vancouver, or wherever your new career takes you across Canadian provinces. This article isn't here to sugarcoat the situation, but rather to set realistic expectations while promising a comprehensive, strategic guide. We acknowledge the hurdles you face, but we believe they are surmountable.

Why is this article different? We're moving beyond generic advice. We're not just telling you whether you *can* get a car loan; we're showing you *how to strategically secure approval* despite the odds. We'll equip you with the knowledge, the documentation checklist, and the negotiation tactics needed to turn your probation period into a powerful statement of financial commitment. Your new job isn't a barrier; it's the foundation upon which you'll build your case for approval, and your down payment will be your strongest advocate.

Key Takeaways

- Probation isn't a dead end; it's a hurdle requiring strategic proof of stability. Lenders need reassurance, and you can provide it.

- No credit history means focusing on income, down payment, and alternative data. Your financial narrative extends beyond a score.

- Local lenders and dealerships in cities like Montreal, Toronto, or Vancouver often offer more flexibility. Relationships matter.

- A significant down payment is your most powerful ally. It directly mitigates risk for the lender and shows your commitment.

- Patience and meticulous preparation are non-negotiable. This isn't a quick approval process; it's a strategic mission.

Deconstructing the Lender's Mind: Why 'New Job on Probation' and 'No Credit' Ring Alarm Bells

To successfully navigate the car loan process, you first need to understand the perspective of the lender. Why do these two seemingly innocent factors – a new job on probation and a lack of credit history – make them hesitant? It all boils down to risk assessment.

The Probation Period Paradox: What it Really Means to Lenders

From a lender's perspective, a probation period isn't just a formality; it signifies perceived job insecurity. It means that while you have an employment offer, your position isn't fully guaranteed. You're still being evaluated, and there's a higher potential for early termination compared to a tenured employee. This lack of proven commitment to the role, and the employer's commitment to you, makes lenders nervous about your long-term ability to make consistent loan payments.

Typical probation lengths in Canada can vary, but commonly range from 3 to 6 months. In Quebec, for example, a standard probation period might be three months, while in Ontario or British Columbia, it could extend to six. This timeline critically impacts loan application viability. If you're only a few weeks into a six-month probation, lenders will see a much higher risk than if you're four months into a three-month probation, with a strong performance record. The closer you are to successfully completing probation, the better your chances. Different industries and job types are also evaluated differently. A salaried professional in a high-demand field in Ottawa might be seen as less risky than an hourly contract worker in Calgary, even if both are on probation, simply due to the perceived stability and transferability of skills.

The Blank Slate of No Credit History: The 'Invisible' Borrower

Now, add "no credit history" to the mix, and you become what lenders sometimes call an "invisible" borrower. Why do traditional lenders rely so heavily on credit scores? Because they provide a standardized, quick, and (they believe) accurate assessment of risk. Your credit score and report offer a snapshot of your past payment behaviour, indicating your reliability and financial responsibility. It tells them if you pay bills on time, how much debt you carry, and how long you've managed credit.

The challenge of being 'invisible' to major Canadian credit bureaus like Equifax and TransUnion is that there's simply no data for them to assess. Automated approval systems, which many banks use, have nothing to evaluate, making direct, quick approvals nearly impossible. This isn't to say you're a bad borrower; it just means you're an unknown quantity. It's a fundamental distinction: no credit vs. bad credit. While bad credit shows a history of missed payments or financial trouble, a complete lack of history can sometimes be an even harder sell. At least with bad credit, there's data, albeit negative, that a lender can try to work with. With no credit, they're taking a leap of faith based on your current income and other factors alone. For more insights on navigating challenging credit situations, you might find our article on Flat Tire, Flat Credit? Toronto, We've Got Your Fix. helpful, even if your issue is absence rather than damage.

Your Financial Arsenal: Building a Case for Approval (Even Without a Credit Score)

Facing these hurdles doesn't mean defeat. It means you need to be strategic and present a compelling case that addresses the lender's concerns head-on. Your financial arsenal, even without a credit score, is more robust than you might think.

The Unbeatable Power of the Down Payment: Your Ultimate Risk Reducer

If there's one piece of advice to engrave into your memory, it's this: a substantial down payment is your most powerful ally. For someone seeking a car loan for a new job on probation in Canada with no credit history, it is the single most effective way to mitigate lender risk. Why? Because it directly reduces the amount the lender has at stake. If you default, their potential loss is smaller. Moreover, it demonstrates significant financial commitment and stability on your part. It shows you've been responsible enough to save money, and you have a vested interest in the vehicle.

Aim for 10-20% or even more of the vehicle's value. The higher the percentage, the stronger your application. A larger down payment doesn't just reduce the loan amount; it often unlocks better terms, potentially a lower interest rate, and significantly increases your approval odds.

Pro Tip: The Power of Patience

Consider saving for an extra month or two to increase your down payment. Even a small percentage boost (e.g., going from 5% to 10%) can dramatically improve your approval chances and secure more favourable interest rates. This short-term patience can lead to significant long-term savings and a smoother approval process.

Ironclad Proof of Income & Stability: Beyond the Offer Letter

Since your credit history is a blank slate, your income and employment stability become paramount. Lenders need concrete proof that you have a consistent, reliable source of funds to cover your monthly payments. Required documentation goes beyond just an offer letter:

- Recent Pay Stubs: At least 2-3 recent pay stubs showing consistent income. The more you have, the better.

- Official Employment Verification Letter: This letter from your HR department should detail your salary, start date, and, crucially, ideally include a projected end date for your probation period, or state that performance is satisfactory.

- Bank Statements: 3-6 months of bank statements showing consistent direct deposits of your paycheques. This verifies the income stated on your pay stubs and offers a glimpse into your spending habits.

- Previous Employment History: If you've just started a new job but have a history of stable employment in previous roles, highlight this. It demonstrates a pattern of consistent income and commitment, even if the current role is new.

Understanding your debt-to-income (DTI) ratio is also vital. Lenders look for a DTI that suggests you can comfortably afford new debt. Generally, they prefer your total monthly debt payments (including the new car loan) to be no more than 35-40% of your gross monthly income. Present your financial picture favourably by minimizing other debts before applying, if possible.

The Co-Signer Advantage: A Bridge to Approval

If you have a trusted individual with established, excellent credit and stable income (e.g., a family member), a co-signer can be your golden ticket. A co-signer essentially guarantees the loan, promising to make payments if you fail to. This significantly reduces the lender's risk, as they now have two parties responsible for the debt.

It's crucial that the co-signer fully understands their responsibilities and the risks involved. They are legally obligated to repay the loan if you cannot, and it will appear on their credit report. A strong co-signer can bridge the gap for a car loan for new job on probation in Canada with no credit history, making approval far more likely and potentially securing a better interest rate.

Alternative Data & Collateral: Painting a Fuller Picture

While not traditional credit, other consistent payment habits can serve as supplementary evidence of your reliability:

- Utility Bills: Showing consistent, on-time payments for electricity, internet, or phone bills over a sustained period.

- Rent Payments: If you have a formal lease agreement and can provide proof of consistent rent payments (e.g., through bank statements or a letter from your landlord), this demonstrates financial responsibility.

Secured loans, where you use an existing asset as collateral, are less common for first-time car buyers but can be an option if you have valuable assets. However, for most, focusing on a strong down payment and robust income proof is the primary strategy.

Navigating the Canadian Landscape: Where to Find Lenders Who Understand Your Situation

Finding the right lender is as crucial as preparing your application. Not all lenders are created equal, especially when dealing with unique financial profiles like a new job on probation and no credit history.

Dealership Financing: Your Primary Battleground for a Car Loan for New Job on Probation Canada No Credit History

For many, dealerships, particularly larger auto groups in major cities like Montreal, Toronto, Vancouver, and Edmonton, will be your primary battleground. Why? Because they often have a broader network of lenders. This includes not just traditional banks, but also specialized finance companies that cater to subprime or non-traditional financing situations. These lenders are more willing to look beyond strict credit scores and consider the bigger picture of your financial stability and potential.

The finance manager at the dealership plays a crucial role. Their job is to 'shop' your application to multiple lenders, leveraging their relationships and understanding of each lender's specific criteria. This significantly increases your chances of approval compared to applying to a single bank. Furthermore, focusing on used car dealerships can be advantageous. They are often more flexible and willing to work with higher-risk profiles due to the lower asset value of used vehicles, which translates to less risk for the lender.

The Bank vs. Credit Union Conundrum: Traditional vs. Community-Focused

When considering traditional financial institutions:

- Traditional Banks (e.g., RBC, TD, CIBC, Scotiabank, BMO): Generally have stricter criteria. They typically prefer applicants with an established credit history and stable employment well beyond any probationary period. While you can apply, your chances might be lower without a strong co-signer or a very substantial down payment.

- Credit Unions: These are often more community-focused and can be more flexible than large banks. If you're an existing member, they might be more willing to look beyond strict credit scores, considering your overall relationship with them. In Quebec, Desjardins is a prominent example; in Ontario, Alterna Savings could be an option. Their localized decision-making can sometimes offer a more personalized approach.

Online Lenders & Specialty Finance Companies: The Digital Frontier

The rise of online platforms has opened up new avenues. Many online lenders and specialty finance companies cater specifically to challenging credit situations or those seeking a car loan for a new job on probation in Canada with no credit history. They often have more lenient approval criteria and faster application processes.

Pros: Unparalleled convenience, quick pre-approval processes, and a willingness to consider a wider range of financial profiles. Cons: Potentially higher interest rates due to the perceived higher risk, and careful vetting is required to ensure you're dealing with a reputable lender. Always check reviews, verify their licensing, and ensure transparency in their terms and conditions. Look for clear communication and avoid any lender that pressures you or demands upfront fees. Many legitimate online lenders operate across Canada, including provinces like Nova Scotia and British Columbia.

The Application Deep Dive: What Documents You *Really* Need and How to Present Them

Preparation is key. Walking into a dealership or submitting an online application with all your ducks in a row not only streamlines the process but also signals to the lender that you are organized, serious, and financially responsible. This is where your meticulousness truly pays off.

The Essential Checklist: Don't Leave Home Without It

Gathering these documents beforehand will make your application process significantly smoother:

- Government-Issued ID: Your valid Canadian driver's license (absolutely crucial for a car loan) and/or passport.

- Proof of Residency: Recent utility bills (electricity, gas, internet), a lease agreement, or a property tax statement. This is especially important in cities like Montreal or Halifax to confirm your stability and address.

- Proof of Employment:

- Official offer letter detailing your position, salary, and start date.

- Your employment contract.

- Recent pay stubs (at least two, ideally three or more).

- A letter from your Human Resources department confirming your employment status and, if possible, a projected end date for your probation period, or a statement that your performance is satisfactory.

- Proof of Income:

- Bank statements from the last 3-6 months showing consistent direct deposits of your pay.

- T4s from the previous year, if applicable, to demonstrate a history of earnings, even if from a different employer.

- Reference Contacts: Provide a few personal and professional references who can vouch for your reliability and character.

- Proof of Down Payment Funds: A bank statement clearly showing the available cash in your account designated for the down payment.

For a more detailed look at what paperwork is typically required, especially in specific regions, you might want to consult resources like Approval Secrets: Exactly What Paperwork You Need for Alberta Car Financing, as many of the requirements are universal across Canada.

Crafting Your Narrative: Explaining Your Unique Situation

Don't just present documents; present a story. Consider writing a concise, compelling cover letter to accompany your application. In this letter, explain your new job with enthusiasm, highlight your career growth, emphasize your commitment to financial responsibility, and clearly state your intention to build a strong credit history with this loan. Being proactive and transparent about your probation and lack of credit can turn potential negatives into positives by showcasing your maturity and forward-thinking approach.

Preparing for the Interrogation: Anticipating Lender Questions

Lenders *will* ask pointed questions about your job stability, your probation status, and your lack of credit history. Anticipate these and prepare confident, transparent answers. For example, if asked about probation, explain your performance, your commitment to the company, and your long-term career goals. If asked about no credit, explain that you're eager to start building a positive history and see this car loan as your first major step. Honesty and preparedness build trust.

Pro Tip: Organize for Impact

Print all your documents, organize them neatly in a folder, and consider creating a table of contents. Presenting a well-organized package demonstrates your attention to detail and seriousness, leaving a positive impression on the finance manager or loan officer.

Choosing Your Ride: Strategic Car Selection for First-Time Buyers on Probation

The type of car you choose significantly impacts your approval chances and long-term financial health. For first-time buyers on probation with no credit history, strategic car selection isn't just about preference; it's about practicality and affordability.

Affordability First: Beyond the Monthly Payment

It's easy to get caught up in just the monthly car payment. However, realistic budgeting means calculating the *total* cost of car ownership. This includes:

- Monthly Car Payment: Your loan principal and interest.

- Insurance: This can be substantial for new drivers or those in high-cost provinces like Ontario or British Columbia. Get quotes *before* you commit to a car.

- Fuel: Especially crucial for daily commutes in bustling urban centres like Montreal, Toronto, or Vancouver.

- Routine Maintenance: Oil changes, tire rotations, and unexpected repairs.

Pro Tip: The 15-20% Rule

Aim for a total car expense (payment + insurance + fuel + maintenance savings) that's no more than 15-20% of your net monthly income. This ensures you have enough buffer for other living expenses and emergencies, preventing financial strain.

New vs. Used: The Smart Choice for Your First Car Loan

While the allure of a brand-new car is strong, a reliable used car (e.g., 3-5 years old) is almost always a better entry point for someone seeking a car loan for a new job on probation in Canada with no credit history. Here's why:

- Lower Price Point: A used car means a smaller overall loan amount, which translates to less risk for the lender and a more manageable payment for you.

- Less Depreciation: New cars lose a significant portion of their value the moment they're driven off the lot. Used cars have already absorbed much of this initial depreciation, meaning your investment holds its value better.

Reliability Over Luxury: Your Priority Checklist

When selecting a vehicle, prioritize dependability. Focus on brands and models known for lower maintenance costs, good fuel efficiency, and higher resale value. Japanese and some Korean brands often fit this bill. Fuel efficiency is a critical consideration, especially with fluctuating gas prices and long commutes. Think about your daily needs – do you need an SUV, or would a compact sedan suffice?

Insurance Implications: A Major Factor in Canadian Provinces

Do not underestimate the cost of car insurance. New drivers, those with no prior insurance history, and individuals with new loans can face significantly higher premiums. This is particularly true in provinces with higher insurance rates, such as Ontario and British Columbia. Getting insurance quotes *before* committing to a vehicle purchase is not just recommended; it's absolutely critical. A cheap car with expensive insurance can quickly become unaffordable.

Beyond Approval: Understanding Interest Rates, Terms, and Hidden Costs

Congratulations, you've secured approval! But the journey isn't over. Now, you need to thoroughly understand the terms of your loan to ensure you're making a financially sound decision and setting yourself up for success.

The Reality of Higher Interest Rates: What to Expect

It's important to be realistic: as a 'high-risk' applicant (new job on probation, no credit history), you will face elevated interest rates compared to established borrowers with excellent credit. Lenders compensate for the increased risk by charging more. Understanding APR (Annual Percentage Rate) is crucial; it represents the true annual cost of borrowing, including any fees, and its profound impact on the total cost of your loan over its lifetime cannot be overstated.

What's a 'reasonable' rate to expect in your specific situation? It's hard to give an exact number, as it varies widely based on the lender, province, vehicle, and strength of your application (especially your down payment). However, be prepared for rates that could be in the double digits. Your focus should be on securing approval and then diligently building your credit to explore refinancing opportunities later. Always identify and avoid predatory rates, which might be excessively high (e.g., 30% or more, depending on provincial regulations) or come with unreasonable fees. Legitimate lenders will be transparent about their APR.

Loan Terms: The Short vs. Long Game

The loan term is the length of time you have to repay the loan. This is often presented as a trade-off:

- Longer Terms (e.g., 72 or 84 months): Offer lower monthly payments, making the car seem more affordable in the short term. However, you pay significantly more interest over the life of the loan.

- Shorter Terms (e.g., 36 or 48 months): Result in higher monthly payments, but you pay much less interest overall and own the car outright sooner. This also helps you build credit faster.

Strategize for the shortest term you can comfortably afford. This minimizes the total interest paid and helps you build credit more quickly by showing a faster repayment of a significant debt. Use a loan calculator to see the impact of different terms on your total cost.

Beware of Hidden Fees: Scrutinizing the Fine Print

Before signing anything, demand a full, itemized breakdown of *all* costs. Be vigilant for common fees:

- Administration Fees: For processing your loan.

- Documentation Fees: For preparing sales and loan paperwork.

- Lien Registration Fees: To register the lender's interest in the vehicle.

- Optional Add-ons: Be wary of being pushed into expensive extended warranties, rustproofing, paint protection, or credit protection packages that you may not need or fully understand. While some may offer value, they significantly increase your loan amount and total cost.

Always scrutinize the fine print for details on pre-payment penalties. Some loans charge a fee if you pay off your loan early. For those looking to refinance down the line, this is a crucial clause to understand.

Building Your Credit Legacy: The Road Ahead After Your First Car Loan

Securing your first car loan, especially under challenging circumstances, is more than just getting a vehicle; it's a monumental first step in establishing your credit legacy in Canada. This loan is your foundational credit-building tool.

The Golden Rule: Making On-Time Payments, Every Time

This cannot be stressed enough: the paramount importance of consistent, on-time payments. Every single payment you make on time reports positively to Canadian credit bureaus like Equifax and TransUnion. This regular, positive reporting is how your credit score begins to form and grow. Missed or late payments, even by a few days, can severely damage your nascent credit history, making it much harder to secure future loans or better terms. Treat your car loan payment as your top financial priority.

Diversifying Your Credit Portfolio (Carefully!)

Once your car loan is established and you've made several months of on-time payments, you can begin to cautiously explore other credit-building tools. A secured credit card is an excellent option. You put down a deposit, which becomes your credit limit, effectively eliminating risk for the issuer while allowing you to demonstrate responsible credit use. Small personal loans, if needed, can also contribute to a diverse credit mix, but a word of caution: avoid taking on too much new debt too quickly. This can negatively impact your nascent credit score, signaling to lenders that you might be over-extending yourself.

Pro Tip: Automate Your Payments

Set up automatic payments for your car loan directly from your bank account. This is the single best strategy for ensuring you never miss a due date, removing human error from the equation and guaranteeing consistent positive reporting to credit bureaus. It's a simple step with profound credit-building benefits.

Monitoring Your Credit: Your Financial Report Card

Regularly checking your credit report is essential. You are entitled to a free annual credit report from both Equifax Canada and TransUnion Canada. Review these reports for accuracy and to understand what makes up your credit score. Familiarize yourself with factors like payment history, credit utilization, length of credit history, and types of credit, all of which contribute to your score's improvement over time.

Refinancing Opportunities: A Path to Lower Costs

Once your probation period is successfully completed, and you have a solid track record of 12-18 months of consistent, on-time car loan payments, you should absolutely explore refinancing options. With an established payment history and a more stable employment status, you'll be a much more attractive borrower. Refinancing can potentially lead to a significantly lower interest rate, reducing your monthly payments and the total cost of your loan over its remaining term. This is your reward for responsible financial behaviour. For more detailed strategies on this, check out our guide on Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit.

Your Next Steps to Approval: A Montreal Action Plan

You've just embarked on a new chapter in Montreal, and securing reliable transportation is a crucial step towards cementing your independence and success. While navigating a car loan with a new job on probation and no credit history presents unique challenges, it is far from impossible with the right strategy.

To recap the core strategies: prioritize maximizing your down payment – it's your most powerful negotiating tool. Meticulously gather all comprehensive documentation, proving your income and stability beyond a shadow of a doubt. And seriously consider the advantage of a co-signer if you have a willing and creditworthy individual in your life. This combination significantly de-risks your application for lenders.

Leverage local resources here in Montreal and across Canada. Visit reputable dealerships known for working with diverse financial profiles. Research specific credit unions in Quebec, like Desjardins, which might offer more flexible terms for their members. Explore credible online lenders who specialize in helping individuals with challenging credit situations. Don't be afraid to ask questions and compare offers.

Don't wait – start gathering your documents today. Get pre-qualified where possible to understand your options without impacting your (non-existent) credit score. Approach this process with confidence, armed with preparation, and a clear understanding of what lenders need to see. Securing a car loan for a new job on probation in Canada with no credit history is undoubtedly challenging, but with the strategic approach outlined here, it is an entirely achievable goal. Your new job is your foundation; let your down payment be your leverage.