Self-Employed: Car Collateral for Fast Cash 2026

Table of Contents

- Key Takeaways

- The Entrepreneur's Urgent Need: When Traditional Funding Streams Dry Up

- Unlocking Your Vehicle's Hidden Value: The Mechanics of Collateral-Backed Lending

- The True Cost of Fast Capital: Decoding Interest Rates, Fees, and Repayment Structures

- Example: Car Collateral Loan Costs & Repayment Scenarios (2026)

- Qualifying for Capital: What Lenders Really Scrutinize Beyond Your Credit Score

- The Paramount Importance of Vehicle Assessment:

- Assessing the Self-Employed Applicant:

- The Legal Landscape: Navigating Regulatory Frameworks and Borrower Protections

- The Repossession Reality: What Happens If You Can't Make Payments?

- Beyond the Loan: Strategic Financial Planning for the Self-Employed Entrepreneur

- Exploring other funding avenues for the self-employed:

- Building financial resilience:

- Improving your credit profile:

- Making an Informed Decision: Is Car Collateral Cash Right for Your Situation?

- A decision framework: assessing your urgent need against the long-term costs and risks.

- Your Next Steps to Approval: A Checklist for Confident Borrowing

- Frequently Asked Questions (FAQ)

As a self-employed Canadian, you know the hustle. You wear many hats, manage your own schedule, and build your own dreams. But when unexpected financial needs arise – a sudden business opportunity, an urgent repair, or a gap in income – traditional lenders often don't understand your unique financial rhythm. In 2026, for many entrepreneurs across Canada, from the bustling streets of Toronto to the scenic coasts of Vancouver, leveraging a personal asset for quick capital has become a practical solution. Enter the car collateral loan: a way to unlock the value of your vehicle without giving up your keys.

This comprehensive guide from SkipCarDealer.com will delve deep into how self-employed individuals can use their car as collateral to secure fast cash in 2026. We'll cover everything from the mechanics of these loans to the fine print of interest rates, the legal landscape, and crucial strategies for making an informed decision. Understanding this option could be the bridge you need to navigate the unpredictable waters of self-employment.

Key Takeaways

- Car collateral loans offer rapid access to funds, particularly for self-employed individuals with non-traditional income streams.

- While credit score can be a factor, the primary collateral is your vehicle's equity, allowing continued use of the car.

- These loans typically come with higher interest rates and fees, making them an expensive short-term solution.

- Regulatory oversight varies significantly, necessitating thorough research into lender practices and borrower rights within your specific jurisdiction.

- Understanding the full cost, potential risks (especially repossession), and exploring all alternatives is paramount before committing.

The Entrepreneur's Urgent Need: When Traditional Funding Streams Dry Up

The life of a self-employed individual in Canada is characterized by remarkable independence, but also by a distinct set of financial realities. Unlike salaried employees with predictable bi-weekly paycheques, entrepreneurs often experience fluctuating income streams. Project-based work, seasonal demands, or the inherent ebb and flow of small business can lead to periods of high revenue followed by leaner times. This unique financial landscape, coupled with a less traditional credit history that might not feature consistent employment records, often makes securing conventional financing a significant hurdle.

Why do conventional banks and credit unions often decline self-employed applicants for unsecured loans? Their rigid underwriting models are designed for W-2 income earners. They look for stable, verifiable employment history, a low debt-to-income ratio based on fixed earnings, and a pristine credit score. For a freelance graphic designer in Montreal, a contractor in Calgary, or a small business owner in Halifax, proving a steady income can be challenging, even if their overall financial health is robust. The lack of a traditional pay stub or a long-standing corporate credit history can instantly flag an application as high-risk, leading to frustrating rejections.

The pressure for immediate capital can be intense. Imagine an unexpected business expense that could derail a crucial project, a personal emergency requiring immediate funds, or the need to bridge an income gap between two major contracts. These aren't situations that allow for weeks of paperwork and lengthy approval processes. For many self-employed Canadians, waiting for a conventional loan simply isn't an option.

This is where the allure of asset-backed lending, specifically car collateral loans, comes into play. When traditional avenues dry up, leveraging an existing asset like your vehicle offers a tangible path to quick financial relief. It's a way for entrepreneurs to tap into their own equity, bypassing the strict criteria that often exclude them from mainstream lending.

Unlocking Your Vehicle's Hidden Value: The Mechanics of Collateral-Backed Lending

A car collateral loan, often referred to as a vehicle equity loan or simply a car title loan, is a type of secured loan where your vehicle's value is used as security for the borrowed amount. For self-employed individuals in 2026, it offers a distinct advantage: fast access to funds based on an asset you already own, rather than solely on your credit history or traditional income proofs.

What is a car collateral loan? It's a loan where the lender places a lien on your vehicle's title in exchange for a cash advance. Crucially, you retain possession and use of your car throughout the loan term, which is a key differentiator from pawn loans where the item is physically held by the lender. This means your ability to commute, run your business errands, or pick up your kids isn't interrupted.

How does your vehicle serve as security? The core principle is borrowing against your car's equity. If you own your vehicle outright, or have significant equity in it (meaning its value substantially exceeds any outstanding loan balance), you can leverage that equity. The lender registers a lien against your vehicle's title, signifying their legal interest in the car until the loan is fully repaid. In some provinces, this might involve temporarily transferring the title into the lender's name, while in others, a lien is simply recorded against the existing title held by you. Once the loan, including all interest and fees, is satisfied, the lien is removed, and full, clear ownership is returned to you.

Distinguishing this from pawn loans or vehicle sales is vital. With a pawn loan, you surrender your physical vehicle to the lender, retrieving it only upon full repayment. Selling your vehicle, of course, means permanently parting with it for cash. A car collateral loan, however, allows for continued utility – your car remains your transportation, a critical tool for many self-employed professionals in cities like Vancouver or Edmonton. This continued utility is often the primary reason self-employed individuals consider this option, as it doesn't disrupt their daily operations.

Pro Tip 1: Understanding Lender Types

Explore the difference between direct lenders, brokers, and online platforms. Direct lenders fund the loans themselves, offering a more streamlined process. Brokers act as intermediaries, connecting you with various lenders, which can sometimes mean more options but also additional fees. Online platforms can be either, so clarify their role. Not all 'alternative lenders' are created equal; research their reputation and licensing with provincial regulators (e.g., consumer protection agencies in Ontario or Quebec). For more insights into identifying reputable lenders, check out our guide on Unmasking 'Bad Credit' Car Lenders: Red Flags You Miss, Quebec.

The True Cost of Fast Capital: Decoding Interest Rates, Fees, and Repayment Structures

While the promise of fast cash is appealing, it's paramount for self-employed Canadians to understand the true cost of a car collateral loan in 2026. These loans, by their nature, carry higher risks for lenders due to the applicant's potentially irregular income and often less-than-perfect credit. This increased risk is directly reflected in the interest rates and fees charged.

Beyond the advertised rate, you must dissect the Annual Percentage Rate (APR) versus simple interest. Simple interest is the basic interest rate charged on the principal amount. APR, however, gives you a more comprehensive picture, incorporating not just the interest rate but also most of the fees associated with the loan, expressed as an annual percentage. Always demand the APR, as it provides the most accurate reflection of the loan's overall cost. For car collateral loans, APRs can range significantly, often starting from 30-40% and soaring much higher, particularly for shorter terms or higher-risk borrowers, potentially reaching into the triple digits depending on provincial regulations and lender policies.

A comprehensive look at potential fees is crucial. These can significantly inflate the total repayment amount:

- Origination Fees: A charge for processing the loan, often a percentage of the loan amount.

- Administrative Charges: Fees for setting up and managing your account.

- Late Payment Penalties: Substantial fees if you miss a payment, often a flat rate or a percentage of the overdue amount.

- Processing Fees: Additional charges for verifying documents or funding the loan.

- Pre-payment Penalties: Some lenders charge a fee if you pay off the loan early, offsetting the interest they would have earned. Always ask if your loan has this.

- Lien Registration Fees: Costs associated with registering the lien on your vehicle's title.

Comparing short-term versus long-term loan structures highlights the impact on total cost and monthly payments. Shorter terms typically mean higher monthly payments but a lower total interest paid over the life of the loan. Longer terms offer more manageable monthly payments but accrue significantly more interest, making the loan much more expensive in the long run. Self-employed individuals need to carefully assess their cash flow to choose a term they can realistically manage without defaulting.

The risk of a 'debt spiral' is very real with high-cost loans. If you struggle to make payments, late fees and compounding interest can quickly balloon the outstanding balance, making it almost impossible to repay. This can lead to taking out another loan to cover the first, trapping borrowers in a cycle of debt that can eventually lead to repossession of their vehicle.

Let's look at some real-world examples of payment schedules and total repayment amounts for varying loan sizes, considering typical rates for car collateral loans in 2026 for self-employed individuals in Canada.

Example: Car Collateral Loan Costs & Repayment Scenarios (2026)

These examples illustrate how different loan amounts and terms, coupled with a representative high APR, can impact your total cost. We'll use an illustrative APR of 59.9%, which is common in this market segment, though rates can vary widely by province (e.g., lower in Quebec due to stricter regulations, potentially higher in Alberta).

| Loan Amount | Term (Months) | Illustrative APR | Estimated Monthly Payment | Total Interest Paid | Total Repayment Amount |

|---|---|---|---|---|---|

| $3,000 | 6 | 59.9% | $575 | $450 | $3,450 |

| $3,000 | 12 | 59.9% | $325 | $900 | $3,900 |

| $5,000 | 12 | 59.9% | $545 | $1,540 | $6,540 |

| $5,000 | 24 | 59.9% | $335 | $3,040 | $8,040 |

| $10,000 | 24 | 59.9% | $670 | $6,080 | $16,080 |

*These are illustrative examples. Actual rates and payments will vary based on lender, provincial regulations, your specific vehicle, and your financial profile. They typically do not include additional fees like origination or administrative charges, which would further increase the total cost.

As you can see, even a seemingly small loan can incur significant interest, especially over longer terms. Always request a detailed loan agreement that clearly outlines all charges and the full repayment schedule before committing.

Qualifying for Capital: What Lenders Really Scrutinize Beyond Your Credit Score

For self-employed Canadians seeking fast cash in 2026, the good news is that car collateral lenders focus on different metrics than traditional banks. While your credit score isn't entirely irrelevant, the primary focus shifts to your vehicle and your ability to demonstrate income, even if it's non-traditional.

The Paramount Importance of Vehicle Assessment:

Your vehicle is the cornerstone of a car collateral loan. Lenders meticulously assess its value, as this directly determines how much they are willing to lend you.

- Make, model, year, mileage, and overall condition: These factors are critical. Newer vehicles with lower mileage and in excellent condition will command higher loan offers. A well-maintained 2020 Honda Civic will likely qualify for more than a 2010 model with 300,000 kilometres.

- Market value vs. loan value: It's important to understand that you won't get 100% of your car's retail market value. Lenders typically offer 50-70% of the wholesale or "liquidation" value, reflecting the risk they take and the potential cost of repossession and resale. This buffer protects them in case of default.

- Specific car brands and models: Yes, certain vehicles command higher loan offers. Popular, reliable brands with strong resale value (e.g., Toyota, Honda, Ford, certain luxury brands) are more attractive to lenders because they are easier to sell if repossessed. Niche or older, less common models might receive lower offers or be declined entirely.

- Proof of ownership: You must have a clear title to your vehicle. This means the car must be fully paid off, and there should be no existing liens against it from previous loans. If there's an outstanding balance, you'll need to pay it off or have sufficient equity for the new lender to pay it off and register their own lien.

Assessing the Self-Employed Applicant:

Since traditional pay stubs aren't usually available, lenders have adapted their income verification methods for self-employed individuals:

- Alternative income verification methods: Be prepared to provide bank statements (personal and/or business) for the last 3-6 months, demonstrating consistent deposits. Tax returns (Notice of Assessment from CRA) for the past 1-2 years, invoices, client contracts, and a detailed business account history can all serve as proof of income and business viability. Lenders want to see a pattern of cash flow that suggests you can afford the repayments. For more on demonstrating income, read our article on Your Brand New Business? That's Your Car Loan Resume. Get Approved, Manitoba.

- Residency and identification requirements: Standard identity verification (government-issued ID like a driver's license or passport) and proof of residency (utility bills, lease agreements) are always required. You must be a Canadian resident and of legal age in your province.

- The role of credit history: While not always disqualifying, a better credit score can influence terms. Lenders offering car collateral loans are generally more flexible with credit than banks. However, a stronger credit profile might qualify you for slightly lower interest rates or a higher loan amount. A poor credit score won't necessarily prevent approval, but it will likely result in higher rates to mitigate perceived risk.

Pro Tip 2: Boosting Your Approval Odds

Ensure your vehicle is well-maintained and clean for assessment – a good first impression can positively influence the appraisal. Have organized financial records (bank statements, tax returns, invoices) ready to demonstrate income stability, even if it's irregular. Transparency about your financial situation, including any existing debts, can build trust with the lender. Highlighting long-term client relationships or consistent contract work can also strengthen your application.

The Legal Landscape: Navigating Regulatory Frameworks and Borrower Protections

The regulatory environment for car collateral loans in Canada can be a complex patchwork. Unlike federally regulated banks, alternative lenders offering these types of secured loans often fall under provincial jurisdiction. This means there are significant variations in oversight from one province to another, from British Columbia to Quebec and the Atlantic provinces, leading to distinct rules for collateral loans.

For instance, some provinces might have specific caps on interest rates for high-cost credit products, while others might have less stringent limits. Understanding these provincial nuances is crucial for any self-employed borrower in 2026. Lenders are typically required to be licensed and registered within the province they operate. What to look for to ensure legitimacy includes checking for a valid provincial license number, which should be displayed on their website or in their office. Reputable lenders will also be transparent about their terms and conditions, complying with consumer protection laws.

Understanding your rights as a borrower is paramount. These can include:

- Disclosure requirements: Lenders must provide a clear, comprehensive loan agreement outlining the principal amount, interest rate, APR, all fees, repayment schedule, and consequences of default.

- Cooling-off periods: Some provinces may offer a short cooling-off period during which you can cancel the loan without penalty.

- Complaint procedures: Knowing how to file a complaint with the relevant provincial consumer protection agency if you believe a lender has acted unfairly or illegally.

The lien process is fundamental to these loans. When a lender registers their interest in your vehicle, it creates a legal claim against the asset. This registration is typically done through the provincial motor vehicle registry (e.g., Ontario's Ministry of Transportation, BC's ICBC). This lien ensures that if you default on the loan, the lender has the legal right to repossess and sell your vehicle to recover their losses.

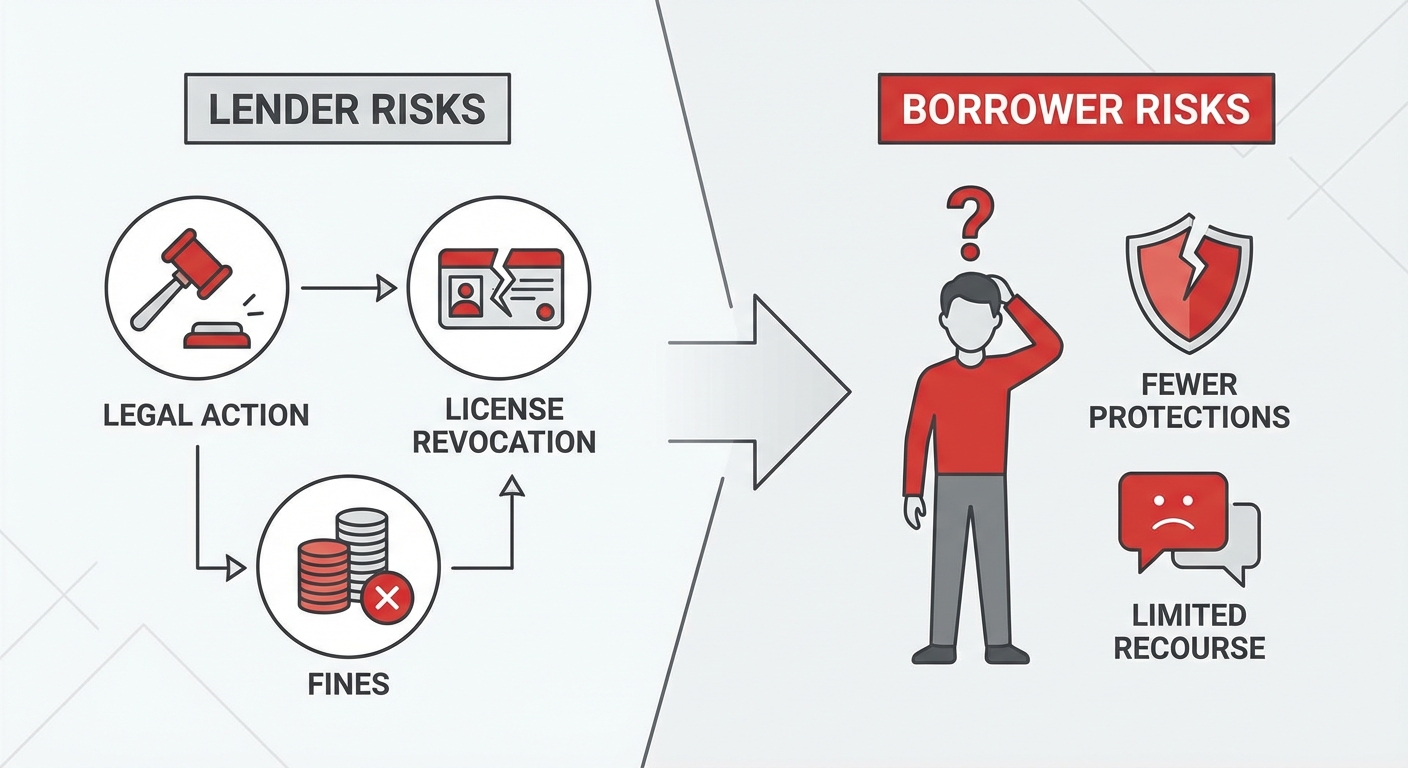

Consequences of non-compliance can be severe for lenders. Operating outside regulations can lead to heavy fines, suspension or revocation of licenses, and legal action from consumers. For borrowers, dealing with an unlicensed or non-compliant lender puts you at significant risk, as you may have fewer legal protections and recourse in case of a dispute.

The Repossession Reality: What Happens If You Can't Make Payments?

The most significant risk associated with car collateral loans is the ultimate consequence of default: losing your primary mode of transportation and a vital business asset. For a self-employed individual, losing your vehicle can cripple your ability to earn income, attend client meetings, transport equipment, or make deliveries, creating a cascade of financial and professional problems.

The repossession process is a legal one, governed by provincial laws. While specific steps and timelines can vary, it generally involves:

- Notification requirements: Lenders are typically required to provide you with a notice of default and an opportunity to rectify the missed payments before initiating repossession.

- The act of repossession: If you fail to cure the default, the lender or their authorized agent can legally seize your vehicle. This can happen without prior warning in some cases, though they cannot breach the peace (e.g., break into your garage).

- Sale of the vehicle: Once repossessed, the lender will usually sell the vehicle at auction or through other means to recover the outstanding loan balance.

Beyond the loss of your car, there are additional costs associated with repossession that you, the borrower, will likely be liable for. These can include towing fees, storage fees for the impounded vehicle, and significant sale fees or auction costs. These expenses are added to your outstanding loan balance, increasing the amount you owe.

A critical concept to understand is the deficiency balance. If your car is sold for less than the amount you owe on the loan (including all the added repossession costs), you will still be legally responsible for paying the difference. For example, if you owe $7,000, and your car sells for only $4,000 after repossession costs, you would still owe the lender $3,000. This deficiency balance can then be pursued through collections, further impacting your financial stability and credit score.

The impact on your credit score and future borrowing capacity is severe. A repossession will be noted on your credit report for several years, making it extremely difficult to obtain any form of credit in the future, including mortgages, other car loans, or even credit cards. It signals a high-risk borrower to future lenders.

Before reaching this dire stage, explore alternatives to repossession. Many lenders would prefer to work with you than go through the costly and time-consuming repossession process. Options might include:

- Refinancing: If your financial situation has slightly improved, you might be able to refinance the loan with the same or a different lender to get more manageable terms. For guidance on this, consider our article on Underwater Car Loan? Perfect. We'll Refinance It, Toronto!

- Payment plans: Negotiate a temporary hardship payment plan with your current lender, potentially reducing monthly payments for a short period.

- Voluntary surrender: While still impacting your credit, voluntarily surrendering your vehicle can sometimes reduce some of the additional fees associated with forced repossession and might be a slightly less damaging mark on your financial record.

Beyond the Loan: Strategic Financial Planning for the Self-Employed Entrepreneur

While car collateral loans can provide immediate relief, they are best viewed as a short-term bridge, not a sustainable long-term financial strategy. For self-employed entrepreneurs in 2026, building robust financial resilience means exploring other funding avenues and proactive planning.

Exploring other funding avenues for the self-employed:

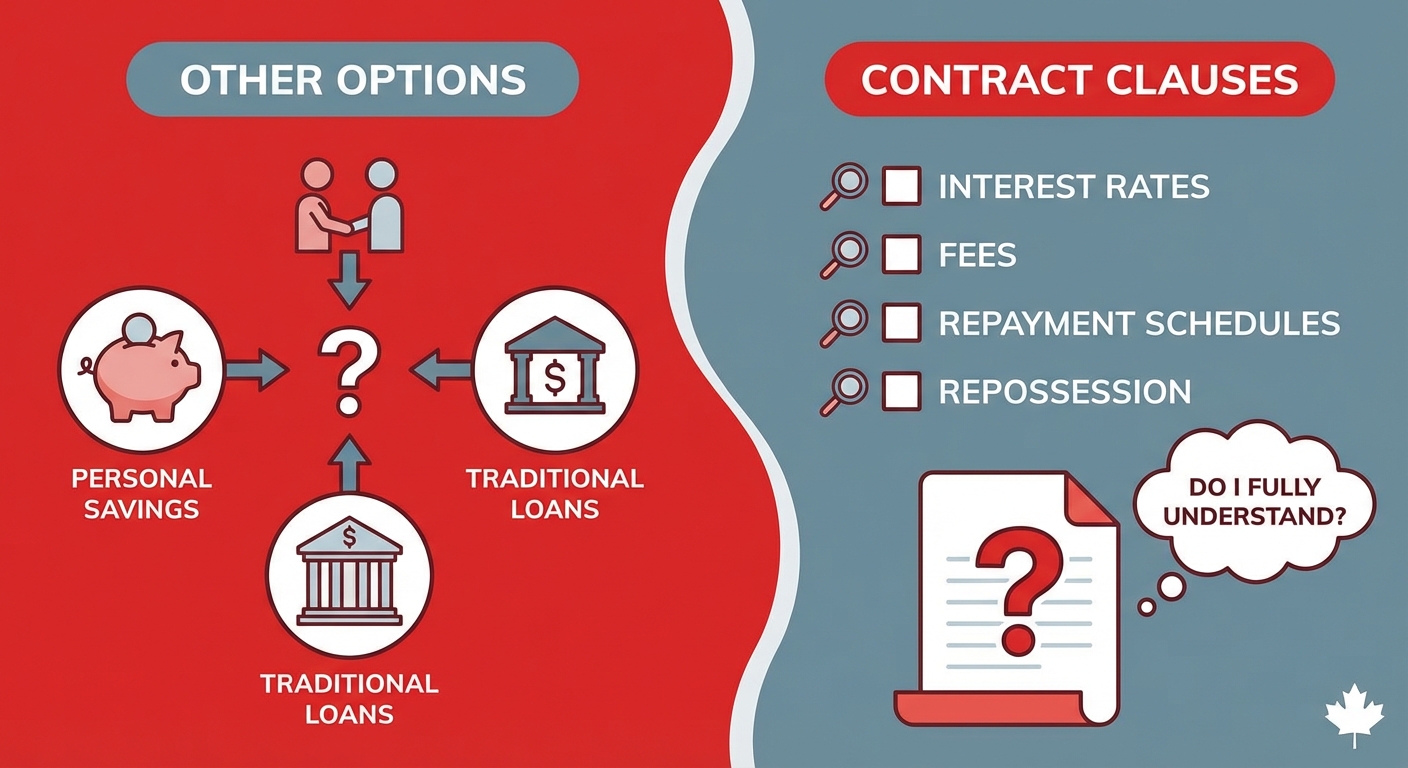

Before resorting to high-cost collateral loans, consider these alternatives:

- Secured vs. unsecured business loans: If your business has assets (equipment, inventory, accounts receivable), a secured business loan might offer better rates. Unsecured business loans are harder to get for startups but become more accessible with a proven track record.

- Lines of credit: A business line of credit provides flexible access to funds up to a certain limit, which can be invaluable for managing cash flow fluctuations without taking out a full loan each time.

- Microloans: Various organizations across Canada offer microloans specifically for small businesses and startups, often with more flexible criteria than traditional banks.

- Grants and crowdfunding: Depending on your industry or business type, you might qualify for government grants or find success through crowdfunding platforms.

Building financial resilience:

Long-term financial health for the self-employed hinges on proactive strategies:

- Emergency funds: Prioritize establishing an emergency fund that covers at least 3-6 months of essential personal and business expenses. This acts as a buffer against income gaps or unexpected costs.

- Diversified income streams: Relying on a single client or service can be risky. Explore ways to diversify your income, perhaps through different clients, service offerings, or passive income ventures. For more on managing varied income, consider our article on Your Irregular Income Just Qualified You for an EV. Seriously, Quebec.

- Robust budgeting: Implement strict personal and business budgeting. Track every dollar, categorize expenses, and forecast income to better anticipate lean periods and allocate funds efficiently.

Improving your credit profile:

Even as a self-employed individual, building strong credit is achievable and opens doors to more affordable financing:

- Separate business finances: Keep personal and business finances distinct. Open a dedicated business bank account and consider a business credit card to build a business credit history.

- Pay bills on time: This is the most crucial factor for both personal and business credit scores.

- Use secured credit cards: If your credit is poor, a secured credit card can help rebuild it by reporting your responsible payments to credit bureaus.

- Monitor your credit report: Regularly check your credit report for errors and understand the factors affecting your score.

Pro Tip 3: Building a Financial Safety Net

Prioritize establishing an emergency fund equivalent to 3-6 months of essential expenses. This cash reserve can prevent the need for high-cost loans during lean times. Explore setting up a business line of credit before you desperately need it, even if it's a small amount, to have a fallback without leveraging personal assets. Think of it as an insurance policy for your cash flow.

Making an Informed Decision: Is Car Collateral Cash Right for Your Situation?

Deciding whether a car collateral loan is the right financial move for your self-employed venture in 2026 requires careful consideration. This isn't a decision to be taken lightly, as the stakes are high, potentially involving your vehicle, your credit, and your financial future.

A decision framework: assessing your urgent need against the long-term costs and risks.

Start by honestly evaluating the urgency and nature of your financial need. Is it a true emergency that cannot wait for other funding sources? Is it an investment that will genuinely generate enough return to comfortably cover the loan, or is it simply patching a hole in your budget?

When it might be a viable, albeit costly, short-term bridge:

- You have a clear, immediate, and significant income source or payment expected within the loan term that will allow for easy repayment.

- The funds are for a critical business expense that, if delayed, would result in a greater financial loss than the cost of the loan (e.g., repairing essential equipment, securing a lucrative contract).

- You have exhausted all other, more affordable financing options.

When it's a last resort that could lead to further financial distress:

- You're using it to cover everyday living expenses without a clear repayment plan.

- You're already struggling with existing debt and this loan would just add to the burden.

- The interest rates and fees make the loan unaffordable given your projected cash flow.

- You're unsure about your ability to make consistent payments due to highly unpredictable income.

The importance of a clear exit strategy cannot be overstated. How exactly do you plan to repay the loan? Is it from an upcoming client payment, the sale of an asset, or a seasonal boost in business? Having a realistic, detailed plan for repayment, including a buffer for unexpected delays, is critical to avoid default and repossession.

Before signing any agreement, ask yourself these crucial questions:

- Can I truly afford this loan, including all interest and fees, without straining my finances?

- What's my backup plan if my expected income doesn't materialize as anticipated?

- Have I explored every single other option, including personal savings, family assistance, or more traditional small business loans?

- Do I fully understand every clause in the contract, especially those related to interest rates, fees, repayment schedules, and repossession?

Your Next Steps to Approval: A Checklist for Confident Borrowing

If, after careful consideration, you determine that a car collateral loan is the appropriate solution for your urgent financial need in 2026, approach the process with diligence and confidence. Here’s a checklist to guide your next steps:

- Step 1: Assess Your Vehicle's Value – Get independent appraisals from reputable sources (e.g., Kelley Blue Book Canada, Canadian Black Book, or local dealerships) to understand your car's true market value. This gives you a baseline for what to expect from lenders and helps ensure you're getting a fair offer.

- Step 2: Organize Your Financial Documentation – Prepare a comprehensive package of income proof specific to self-employment. This includes recent bank statements (personal and business, typically 3-6 months), your last two years of tax returns (Notice of Assessment from CRA), current invoices, client contracts, and any relevant business licenses or registrations.

- Step 3: Research Lenders Thoroughly – Don't just go with the first offer. Compare at least 3-5 different lenders. Check their provincial licenses, read online reviews (Google, BBB), and understand their reputation. Ask about their customer service and how they handle disputes.

- Step 4: Understand the Full Cost – Demand a clear, itemized breakdown of all fees, including origination, administrative, processing, and potential late payment or pre-payment penalties. Most importantly, ensure you are provided with the Annual Percentage Rate (APR) for the loan, which combines interest and most fees.

- Step 5: Read the Contract Meticulously – Never sign anything you don't fully understand. Pay close attention to clauses related to the lien process, repossession terms, repayment schedules, and any default provisions. If anything is unclear, ask for clarification in writing. Consider seeking independent legal advice if the loan amount is substantial.

- Step 6: Plan Your Repayment – Develop a realistic and achievable strategy to repay the loan on time. Factor in your projected income and expenses, and ideally, build in a buffer for unexpected delays. Missing payments can lead to severe consequences, including repossession.

By following these steps, you can navigate the process of securing fast cash using your car as collateral with greater awareness and protection, ensuring it truly serves as a temporary solution rather than a long-term financial burden.