Your Bursary's 'Roller Coaster'? That's Your Car Loan Down Payment, Vancouver.

Table of Contents

- Key Takeaways

- Decoding Your Bursary: Income, Exemption, and Lender Perception in Canada

- The Bursary Paradox: Income vs. Exemption (The Canada.ca Nuance)

- Lender Lenses: What Financial Institutions Really See

- Stabilizing the Swings: Strategies for Presenting Inconsistent Bursary Income

- The Power of Predictability: Creating a Bursary-Based Budget

- The Savings Safety Net: Why a Dedicated Down Payment Fund is Your Best Friend, Especially in British Columbia

- Beyond the Bursary: Complementary Income Streams That Build Credibility

- The Down Payment Drive: Securing Your Car in High-Cost Vancouver

- Vancouver's Vehicle Vexation: Why a Strong Down Payment is Non-Negotiable

- The Equity Advantage: How a Larger Down Payment Reduces Lender Risk (and Your Interest Rates)

- Calculating Your Commitment: Practical Steps to Building Your Down Payment Fund

- Navigating the Lender Landscape: Who Will Say 'Yes' to Your Bursary?

- Traditional Banks vs. Credit Unions: A Head-to-Head for Student Loans

- Dealership Financing: Convenience vs. Cost for the Bursary Borrower

- Subprime Lenders: The Last Resort (and Why You Should Be Wary in Alberta and Beyond)

- The Co-Signer Compass: Leveraging Trust for Approval (and Protecting Relationships)

- Building Your Borrower Blueprint: Beyond Just Bursaries

- Credit Score Construction: The Student's Guide to a Strong Financial Foundation in Ontario

- Debt-to-Income Ratio Demystified: Keeping Your Financial Footprint Light

- The Vehicle Choice: Matching Your Wheels to Your Wallet (and Lender Expectations)

- The Canadian Car Loan Canvas: Regional Nuances for Bursary Borrowers

- From Coast to Coast: How Lending Practices Differ Across Provinces

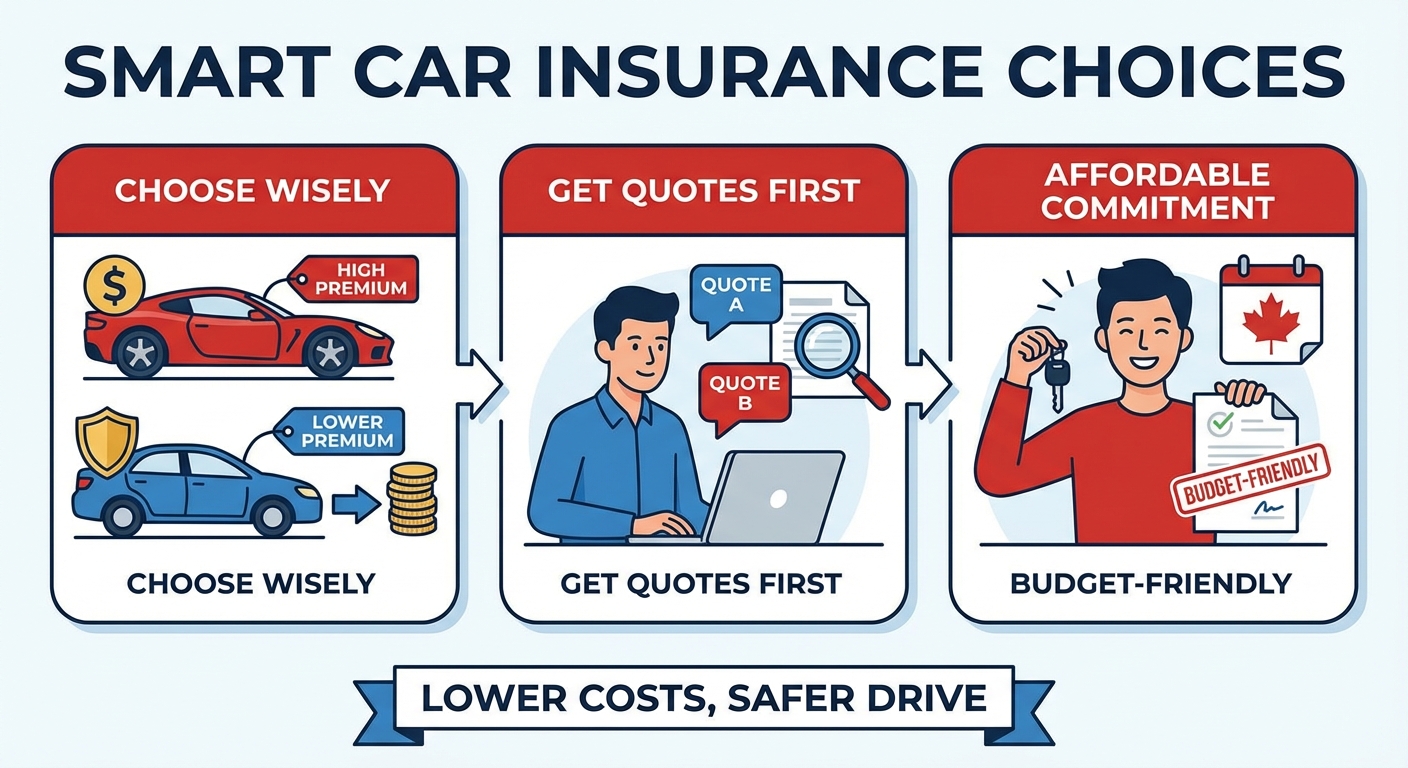

- Insurance Implications: Another Cost Consideration for Students in Every Province

- Your Next Steps to Approval: Turning the 'Roller Coaster' into a Smooth Ride

- The Pre-Approval Playbook: What to Gather and How to Present Your Case

- Negotiating Your Terms: Empowering Yourself at the Dealership

- Post-Approval Prudence: Managing Your Loan Responsibly for Future Financial Success

- Frequently Asked Questions (FAQ) for Bursary-Backed Car Loans in Canada

Key Takeaways

- Documentation is Gold: Every bursary deposit, scholarship letter, and part-time pay stub serves as crucial evidence of your financial stability. Lenders need to see a verifiable history.

- Down Payment Power: A substantial down payment is your strongest ally, especially in high-cost cities like Vancouver, helping to offset income inconsistency and reduce lender risk.

- Credit Score Matters: Even as a student, actively building and monitoring your credit score is vital. A good score can unlock better loan terms and lower interest rates.

- Lender Selection is Key: Not all lenders view bursaries equally. Credit unions and certain dealerships might offer more flexibility than traditional banks, understanding the unique student financial journey.

- Co-Signer Consideration: A financially stable co-signer can significantly improve your approval odds, provide a safety net, and help secure more favourable interest rates.

- Budget for the Long Haul: Demonstrating a clear, consistent budget despite fluctuating income shows responsibility and foresight to lenders, proving you can manage your finances.

Ah, Vancouver. A city of breathtaking beauty, vibrant culture, and for students, a unique financial tightrope walk. You’re balancing demanding studies, the allure of West Coast living, and perhaps, the dream of owning your own car to explore everything British Columbia has to offer. But there’s a catch, isn’t there? Your bursary income, while a lifeline, often feels like a financial 'roller coaster' – a generous deposit one semester, a leaner period the next. How do you convince a lender that this fluctuating income can support a steady car loan payment?

At SkipCarDealer.com, we understand this challenge. We know that the traditional path to car loan approval, which often hinges on consistent, salaried employment, doesn't always fit the reality for Canadian students. Especially in a city like Vancouver, where the cost of living is notoriously high, securing a car loan with irregular bursary income can seem like an uphill battle. But it's not impossible. In fact, with the right strategy, a solid down payment, and careful preparation, that 'roller coaster' can smooth out into a manageable, predictable journey towards car ownership.

This comprehensive guide is designed to empower you, the Vancouver student, to navigate the complexities of securing a car loan when your primary income source is bursaries. We’ll delve deep into how lenders perceive your income, strategies to present your financial picture favourably, and why a robust down payment isn't just helpful – it's often the key to unlocking your dream car in the Lower Mainland.

Decoding Your Bursary: Income, Exemption, and Lender Perception in Canada

The Bursary Paradox: Income vs. Exemption (The Canada.ca Nuance)

Understanding how your bursary is viewed is crucial, and it starts with differentiating between tax implications and lending criteria. While bursaries are generally considered 'income' by the Canada Revenue Agency (CRA), many are eligible for the 'scholarship exemption' as per Canada.ca guidance. This exemption means that, often, you don't pay income tax on the full amount of your bursary if you're a full-time student. This is fantastic for your personal finances!

However, this tax exemption doesn't directly translate to how lenders perceive your income for a car loan. Lenders care about your *gross* income availability – the total amount of money you have coming in, regardless of its taxable status. They want to assess your capacity to make regular loan payments. So, while you might not owe tax on it, the bursary *is* income in their eyes, but its inconsistency is the real hurdle. It's also important to distinguish between a bursary, which is typically needs-based and can be inconsistent, and a scholarship, which is often merit-based and might offer a more predictable schedule of payments.

Lender Lenses: What Financial Institutions Really See

Different financial institutions in Canada approach non-traditional and inconsistent income sources with varying degrees of flexibility. For major Canadian banks like Royal Bank of Canada (RBC), TD Canada Trust, and Scotiabank, the preference is always for consistent, verifiable income – think regular pay stubs from a full-time job. Bursaries, being lump-sum or irregular, often don't fit neatly into their traditional underwriting models, making approval more challenging without additional, stable income.

Credit unions, however, often adopt a more flexible, relationship-based approach. Institutions like Vancity and Coast Capital Savings in British Columbia, or Meridian Credit Union in Ontario, are deeply embedded in their communities and often have a better understanding of student financial realities. They might be more willing to consider your overall financial picture, including your academic standing, future earning potential, and a comprehensive budget. They place a 'stability premium' on income – meaning consistent, verifiable income is always preferred over lump-sum or irregular payments, but they may be more open to strategies that demonstrate stability, even with fluctuating funds.

Pro Tip 1: Document Everything – The Bursary Paper Trail

This cannot be stressed enough: treat every financial document as a piece of evidence. Collect all official award letters outlining the bursary amount, the institution granting it, and the payment schedule (even if it's irregular). Keep meticulous bank statements showing every bursary deposit for at least the past 6-12 months. Any correspondence that proves the legitimacy and frequency of these payments, even if intermittent, is critical. This paper trail helps demonstrate a pattern of income, building reliability in the eyes of a lender, even when the amounts fluctuate.

Stabilizing the Swings: Strategies for Presenting Inconsistent Bursary Income

The Power of Predictability: Creating a Bursary-Based Budget

When your income is a 'roller coaster,' demonstrating responsible financial management becomes paramount. Lenders want to see that you can budget effectively, even with fluctuating funds. The 'lump sum allocation' method is highly effective here: when a large bursary payment arrives, instead of spending it all at once, allocate specific amounts for each month until your next anticipated payment. This creates a pseudo-monthly income stream for your budget.

Presenting a detailed, realistic budget to a lender shows foresight and responsibility. Clearly outline your monthly expenses (rent, utilities, groceries, tuition, transportation, entertainment) and how your bursary funds, combined with any other income, are allocated to cover them. Highlight any savings or emergency funds you've built. This visual representation of your financial planning helps lenders feel more confident in your ability to manage a car loan.

The Savings Safety Net: Why a Dedicated Down Payment Fund is Your Best Friend, Especially in British Columbia

In a high-cost region like British Columbia, a significant down payment isn't just an advantage; it's often a necessity for students with inconsistent income. A substantial down payment directly mitigates lender risk. By putting down a larger sum upfront, you reduce the total amount you need to borrow, which in turn lowers your monthly payments. This makes the loan more manageable for you and less risky for the lender, significantly increasing your approval odds. For more on how even a smaller down payment can make a difference, check out our guide on Your Down Payment Just Called In Sick. Get Your Car.

Specific saving strategies for students include setting up automatic transfers from your chequing account to a dedicated savings account each time a bursary arrives. Consider cutting back on non-essential spending, selling unused items, or taking on temporary side gigs to bolster this fund. Every dollar saved for your down payment is a dollar that speaks volumes to a lender about your commitment and financial prudence.

Beyond the Bursary: Complementary Income Streams That Build Credibility

While bursaries are important, layering on additional, even small, income streams can dramatically strengthen your financial picture. Part-time employment, gig economy work (such as food delivery services like DoorDash or SkipTheDishes in cities like Toronto, Montreal, or Calgary, or ride-sharing), or freelance projects all contribute to a more robust income profile. Even if these jobs are intermittent, showing a pattern of actively seeking and earning income outside of your bursary demonstrates ambition and financial resourcefulness.

Document these additional income sources meticulously: provide pay stubs from part-time jobs, contracts for freelance work, and bank statements showing regular deposits from gig economy platforms. The cumulative effect of multiple income streams, even if individually small, can create a more stable and reliable financial narrative for lenders. For those leveraging gig economy earnings, our article on Your Deliveries Are Your Credit. Get the Car. offers further insights into how these deposits can be used to secure a loan.

The Down Payment Drive: Securing Your Car in High-Cost Vancouver

Vancouver's Vehicle Vexation: Why a Strong Down Payment is Non-Negotiable

Vancouver and the entire Lower Mainland present a unique challenge for car ownership. The elevated cost of living extends to vehicle ownership – from higher car prices to some of the most expensive insurance rates in Canada. Lenders are acutely aware of these factors, and they scrutinize your debt-to-income (DTI) ratio even more closely in such an expensive urban environment. A higher down payment directly addresses these concerns. It signals to the lender that you are serious, financially prudent, and that the total amount you need to finance is more manageable within Vancouver's economic context. It's the psychological advantage that shows serious commitment and financial prudence, reducing the lender's perceived risk.

The Equity Advantage: How a Larger Down Payment Reduces Lender Risk (and Your Interest Rates)

The more money you put down upfront, the more equity you have in the vehicle from day one. This means less risk for the lender. If, for any reason, you're unable to continue payments, the lender has a better chance of recouping their investment through the resale of the vehicle. This reduced risk often translates directly into better loan terms for you, including lower interest rates. Lenders prioritize lower loan-to-value (LTV) ratios, especially for borrowers with non-traditional income. An LTV ratio below 80% (meaning you've put down 20% or more) is particularly attractive, as it demonstrates significant personal investment.

Calculating Your Commitment: Practical Steps to Building Your Down Payment Fund

Setting realistic savings goals is the first step. While 10-20% of the vehicle's purchase price is a typical down payment, for students with inconsistent income, aiming for 25% or even more significantly improves your chances and terms. Consider temporary additional work during breaks, selling items you no longer need, or even modest family contributions (if applicable and documented as gifts, not loans, to avoid additional debt). Every dollar saved chips away at the loan amount and builds your credibility.

Pro Tip 2: The Down Payment as a Credit Booster

A significant down payment can compensate for a thin credit file or a lower credit score. For students who are just starting to build their credit history, a large down payment acts as a powerful signal to lenders that you are a responsible borrower and mitigates the risk associated with a less established credit profile. It often opens doors that might otherwise remain closed, even for individuals looking to get a start with Zero Credit Score. Zero Problem. Your Car Loan Starts Now, Vancouver.

Navigating the Lender Landscape: Who Will Say 'Yes' to Your Bursary?

Traditional Banks vs. Credit Unions: A Head-to-Head for Student Loans

When seeking a car loan as a student with bursary income, understanding the differences between lenders is paramount. Traditional banks, while offering competitive rates for conventional applicants, often have stricter lending criteria. They prefer predictable, T4-based income and a robust credit history. Their automated systems may struggle to properly assess the nuances of bursary income.

Credit unions, on the other hand, frequently offer a more relationship-based lending approach. Institutions like Vancity or Coast Capital Savings in British Columbia, or Meridian Credit Union in Ontario, often review applications on a case-by-case basis. They may be more willing to understand your individual circumstances, consider your overall financial picture, and factor in your potential future earnings. They are often more receptive to seeing your bursary as legitimate income, provided you can demonstrate consistency through documentation and a solid budget. Here's a quick comparison:

| Feature | Traditional Banks (e.g., RBC, TD, Scotiabank) | Credit Unions (e.g., Vancity, Coast Capital Savings) |

|---|---|---|

| Income Preference | Strong preference for consistent, verifiable T4 income. Bursaries seen as less stable. | More flexible; willing to consider bursaries with strong documentation and budgeting. |

| Lending Approach | Often relies on automated scoring, less personalized assessment. | Relationship-based, individualized assessment, community focus. |

| Credit History | Requires established, good credit history for best rates. | May be more forgiving of thin credit files if other factors are strong (e.g., co-signer, down payment). |

| Flexibility | Less flexible for non-traditional income types. | Generally more flexible and understanding of unique financial situations. |

Dealership Financing: Convenience vs. Cost for the Bursary Borrower

Dealership financing offers undeniable convenience – it's a one-stop shop where you can select your car and arrange financing simultaneously. Dealerships often work with a network of lenders, including those who specialize in 'higher-risk' profiles, which might make approval easier for a student with bursary income. However, this convenience can sometimes come at a cost. Interest rates might be higher than what you could secure directly from a bank or credit union, and the terms might be less personalized. Always compare dealership offers with any pre-approvals you've secured independently.

Subprime Lenders: The Last Resort (and Why You Should Be Wary in Alberta and Beyond)

Subprime lenders cater to individuals with poor credit or highly irregular income, making them a potential option for some students. However, this comes with significantly higher interest rates, often leading to a much higher total cost of borrowing. In provinces like Alberta, where economic fluctuations can impact employment, subprime lending can be a prevalent, but often expensive, option. The dangers of predatory lending practices are real, with hidden fees and restrictive terms. You should consider subprime lending only as a last resort and, if you do, ensure you thoroughly understand every single term and condition. Focus instead on strengthening your application with a down payment, co-signer, or additional income to avoid this costly path.

The Co-Signer Compass: Leveraging Trust for Approval (and Protecting Relationships)

A financially stable co-signer – typically a parent or guardian with a strong credit history and consistent income – can significantly bolster your car loan application. Their good credit and financial stability act as a guarantee for the lender, drastically improving your approval odds and often securing much better interest rates. However, it's crucial to understand the responsibilities: a co-signer is equally responsible for the debt. If you miss payments, it impacts their credit score, and they are legally obligated to make the payments. Choose your co-signer wisely and ensure open communication to protect both your financial future and your relationship.

Pro Tip 3: The Power of a Pre-Approval

Getting pre-approved for a car loan from a bank or credit union *before* you step into a dealership gives you immense negotiating power. It clearly defines your budget, allows you to focus on the car's price rather than getting tangled in financing details, and shows the dealership you're a serious buyer with financing already secured. This puts you in the driver's seat, metaphorically and literally!

Building Your Borrower Blueprint: Beyond Just Bursaries

Credit Score Construction: The Student's Guide to a Strong Financial Foundation in Ontario

Your credit score is a numerical representation of your creditworthiness, and it's a critical factor in car loan approvals. For students, especially in bustling provinces like Ontario (with major financial hubs like Toronto and Ottawa), actively building and monitoring this score is essential. It's calculated based on several factors: payment history (the most important), credit utilization, length of credit history, new credit, and credit mix.

Strategies for building good credit as a student include:

- Secured Credit Cards: These require a deposit, which becomes your credit limit, making them less risky for lenders and a great way to show responsible usage.

- Student Credit Cards: Designed for students, often with lower limits and specific perks. Use them sparingly and pay the full balance on time, every time.

- Paying Bills On Time: While not all utility bills directly impact your credit, demonstrating consistent on-time payments for anything from your phone bill to rent can informally build trust, and sometimes these can be reported.

Regularly monitor your credit score by requesting free credit reports from Equifax Canada and TransUnion Canada. Understanding your score and actively working to improve it, as discussed in articles like Your Ex's Score? Calgary Says 'New Car, Who Dis?, is crucial for better loan terms.

Debt-to-Income Ratio Demystified: Keeping Your Financial Footprint Light

Your Debt-to-Income (DTI) ratio is a critical metric lenders use to assess your ability to manage monthly payments. It's the percentage of your gross monthly income that goes towards servicing your monthly debt payments. A low DTI signals to lenders that you have plenty of disposable income to cover new loan payments. To calculate it, sum up all your monthly debt payments (credit card minimums, student loan payments, etc.) and divide that by your gross monthly income. Lenders typically prefer a DTI below 36%, though some might go up to 43% for well-qualified borrowers. Strategies to keep it low include paying off other small debts before applying for a car loan and avoiding new debt.

The Vehicle Choice: Matching Your Wheels to Your Wallet (and Lender Expectations)

Your choice of vehicle plays a significant role in the loan approval process. Lenders are more comfortable financing an affordable, reliable car that aligns with your financial capacity. Opting for an expensive, luxury vehicle when your income is inconsistent is a red flag. Consider a reliable used car, which generally has a lower purchase price and depreciates less rapidly than a new one. Lenders view lower loan amounts and vehicles with stable resale value as less risky. Also, factor in fuel efficiency and estimated maintenance costs, as these contribute to the overall affordability of the vehicle.

Pro Tip 4: Don't Apply Everywhere – Strategic Credit Inquiries

Every time a lender pulls your credit report for a loan application, it's recorded as a 'hard inquiry,' which can slightly (and temporarily) lower your credit score. Multiple hard inquiries in a short period signal to lenders that you might be desperate for credit, making you appear riskier. Instead of applying to every lender you find, research carefully and apply to 2-3 carefully chosen lenders within a concentrated timeframe (e.g., 14-45 days). Credit scoring models are often designed to recognize this as 'rate shopping' for a single loan, minimizing the negative impact.

The Canadian Car Loan Canvas: Regional Nuances for Bursary Borrowers

From Coast to Coast: How Lending Practices Differ Across Provinces

Canada's vast geography means that lending practices, while broadly similar, can have regional nuances influenced by local economic factors and provincial regulations. For example, in British Columbia, particularly Vancouver, the higher average car prices and insurance costs mean lenders might require stronger applications (larger down payments, better credit) to mitigate risk. In Ontario, with its competitive financial markets in Toronto and Ottawa, you might find more diverse lending options, but also greater scrutiny due to the sheer volume of applications.

Quebec has its own distinct civil law system and consumer protection laws, which can influence loan agreements and terms. In Alberta's Calgary and Edmonton, the economy, often tied to oil and gas, can impact lender confidence and interest rates during downturns. Even smaller markets like Nova Scotia might have a more localized, community-focused approach to lending, similar to credit unions. Understanding these regional differences can help you tailor your application and expectations.

Insurance Implications: Another Cost Consideration for Students in Every Province

The cost of car insurance is a significant and often underestimated component of vehicle ownership, particularly for younger drivers. This cost varies dramatically by province and even by city. Ontario and British Columbia are known for some of the highest car insurance rates in Canada, while provinces like Quebec or Alberta might offer slightly lower premiums depending on various factors. Lenders don't just consider your ability to make car payments; they assess the total cost of car ownership, including insurance, when determining affordability.

As a student, you can explore several strategies to reduce insurance costs: inquire about good grades discounts, consider telematics programs (where your driving habits are monitored for potential savings), and bundle your car insurance with other policies if possible. Choosing a less expensive, safer vehicle model can also lead to lower premiums. Always get insurance quotes before finalizing your car purchase to ensure you can comfortably afford the full monthly financial commitment.

Your Next Steps to Approval: Turning the 'Roller Coaster' into a Smooth Ride

The Pre-Approval Playbook: What to Gather and How to Present Your Case

Preparation is key to turning those bursary 'roller coaster' payments into a smooth ride to car loan approval. Here’s a comprehensive checklist of documents to gather for your pre-approval application:

- Official bursary award letters detailing amounts and payment schedules.

- Bank statements for the past 6-12 months, clearly showing all bursary deposits and your spending patterns.

- Proof of any other income (pay stubs from part-time jobs, invoices for freelance work, bank statements for gig economy earnings).

- Your current credit report from Equifax Canada and TransUnion Canada.

- Government-issued identification (driver's license, passport).

- Proof of residence (utility bill, lease agreement).

- A detailed budget sheet outlining your monthly income and expenses.

- If applicable, your co-signer's financial documents and identification.

Beyond the paperwork, craft a compelling narrative. Be ready to articulate how you manage your finances despite income inconsistency, highlighting your budgeting strategies, savings habits, and commitment to timely payments. Show confidence in your ability to manage the loan responsibly.

Negotiating Your Terms: Empowering Yourself at the Dealership

Once you have a pre-approval in hand, you’re in a powerful position. When you visit the dealership, remember to negotiate not just the car price, but also interest rates, loan terms (length of the loan), and any trade-in value you might have. Always try to separate the car purchase negotiation from the financing discussion. First, agree on the vehicle price, and only then discuss financing options. Being prepared to walk away if the terms aren't favourable is your strongest negotiating tool. Remember, you have options beyond what a single dealership offers.

Post-Approval Prudence: Managing Your Loan Responsibly for Future Financial Success

Securing the loan is just the beginning. The critical importance of making all your car loan payments on time, every time, cannot be overstated. This is the single most impactful action you can take to build a strong credit history and ensure future financial success. Set up automatic payments from your bank account to avoid missed deadlines. Responsible loan management will not only keep your car but will also positively impact your credit score, opening doors to better rates on future loans (like mortgages or other car loans) and financial products. It proves you are a reliable and trustworthy borrower, setting you up for a lifetime of financial stability.

Pro Tip 5: Reviewing the Fine Print – Understanding Your Loan Agreement

Before signing anything, meticulously read the entire loan contract. Do not rush. Highlight key areas to scrutinize: the Annual Percentage Rate (APR), which includes interest and other fees; the total cost of borrowing over the life of the loan; penalties for late payments; any prepayment clauses (can you pay it off early without penalty?); and any hidden fees or charges. If anything is unclear, ask for clarification. A reputable lender will be happy to explain everything in detail. Your signature is a legal commitment, so ensure you understand exactly what you're agreeing to.