Walking into a Canadian car dealership without a plan is a bit like skating onto the ice without sharpened blades-you might move, but you certainly won't have any control. The Canadian automotive market has shifted significantly over the last few years. With vehicle prices reaching record highs and interest rates fluctuating, the gap between a "good" deal and a "bad" deal has widened into a chasm. Today, the difference between being prepared and winging it can literally cost you $10,000 or more over the life of your loan.

Most Canadians focus on the colour of the car or the horsepower under the hood. However, the real "secret" to a successful car purchase happens long before you smell that new-car scent. It starts with your mindset. You need to stop thinking like a consumer and start thinking like a lender. Banks and finance companies aren't looking at how much you love that SUV; they are looking at risk. When you understand how to minimize that perceived risk, you unlock the door to the lowest interest rates and the most flexible terms available in the Great White North.

Key Takeaways

- The 660 Threshold: In Canada, a credit score of 660 is the "magic number" that typically separates prime lending rates from subprime territory.

- Pre-approval is Power: Securing a rate before you visit the lot prevents the dealership from adding "points" to your interest rate for their own profit.

- Income is Everything: Lenders prioritize stability. Having your Notice of Assessment (NOA) and recent paystubs ready can shave days off the approval process.

- Watch the Term: While 84 and 96-month loans offer lower monthly payments, they often lead to "negative equity," where you owe more than the car is worth.

- Tax Savings: Trading in a vehicle in most Canadian provinces allows you to pay GST/HST only on the "cash difference," potentially saving you thousands.

Understanding the Canadian Lending Landscape

The Canadian market is unique. Unlike the United States, our banking system is highly centralized, dominated by a few massive players, yet supported by a robust network of local credit unions and specialized lenders. Knowing who you are dealing with is the first step in acing your application.

The Big Five Banks

CIBC, RBC, TD, BMO, and Scotiabank handle the lion's share of automotive financing in Canada. They offer the most competitive rates for "prime" borrowers (those with excellent credit). However, their criteria are often rigid. If you don't fit their specific box-perhaps you're self-employed or a newcomer-they might decline you despite having a healthy bank account.

Credit Unions: The Local Alternative

Credit unions like Vancity, Meridian, or Desjardins often provide a more personalized approach. Because they are member-owned, they sometimes look beyond just the credit score and consider your overall "character" and history with the community.

Captive Lenders

These are the financing arms of the manufacturers themselves-think Toyota Financial Services or Ford Credit. Their main goal is to sell cars, not necessarily to make a massive profit on the interest. This is where you find those elusive 0% or 1.9% financing offers, though these are almost exclusively reserved for brand-new vehicles and top-tier credit scores.

| Lender Type | Best For | Pros | Cons |

|---|---|---|---|

| Big Five Banks | Prime Borrowers | Competitive rates, convenient apps | Strict criteria, slow manual reviews |

| Credit Unions | Thin Credit Files | Flexible, character-based lending | May require membership first |

| Captive Lenders | New Car Buyers | 0% - 3.9% promotional rates | Hard to qualify, limited to one brand |

| Subprime Lenders | Credit Rebuilding | High approval rates | High interest rates (15%+) |

The Credit Score Deep Dive

In Canada, your financial reputation is managed by two main bureaus: Equifax and TransUnion. While they both collect the same type of data, they use slightly different algorithms to calculate your score. Most Canadian automotive lenders lean toward Equifax, but it is not uncommon for a dealership to pull both.

What is a "good" score? Generally, anything above 720 is considered excellent and will get you the best rates. A score between 660 and 719 is considered "prime" and should still qualify you for standard bank rates. Once you dip below 600, you are entering the world of "alternative" or "subprime" lending, where interest rates can climb into the double digits.

Before you apply, you need to check your score. Many Canadian banking apps (like RBC or Scotiabank) now offer free credit score checks that use a "soft inquiry." Unlike a "hard inquiry" which happens when you apply for a loan, a soft inquiry does not hurt your score. If you find your score is just below a threshold-say, 650-it might be worth waiting 30 days to pay down your credit card balances. Reducing your credit utilization (the amount of your limit you actually use) is the fastest way to see a 20-30 point jump in your score.

Preparation: Gathering Your 'Approval Kit'

The number one reason car loan approvals get delayed in Canada isn't bad credit-it's missing paperwork. Lenders are increasingly cautious about "stated income" and want to see cold, hard proof. If you arrive at the dealership with your "Approval Kit" ready, you signal that you are a low-risk, organized borrower.

Your kit should include:

- Proof of Income: Your two most recent paystubs showing year-to-date (YTD) earnings. If you are self-employed, you will need your last two years of Notice of Assessments (NOA) from the CRA.

- Residency Documentation: A utility bill (hydro, water, or gas) or a signed lease agreement. Lenders want to know you aren't a "flight risk."

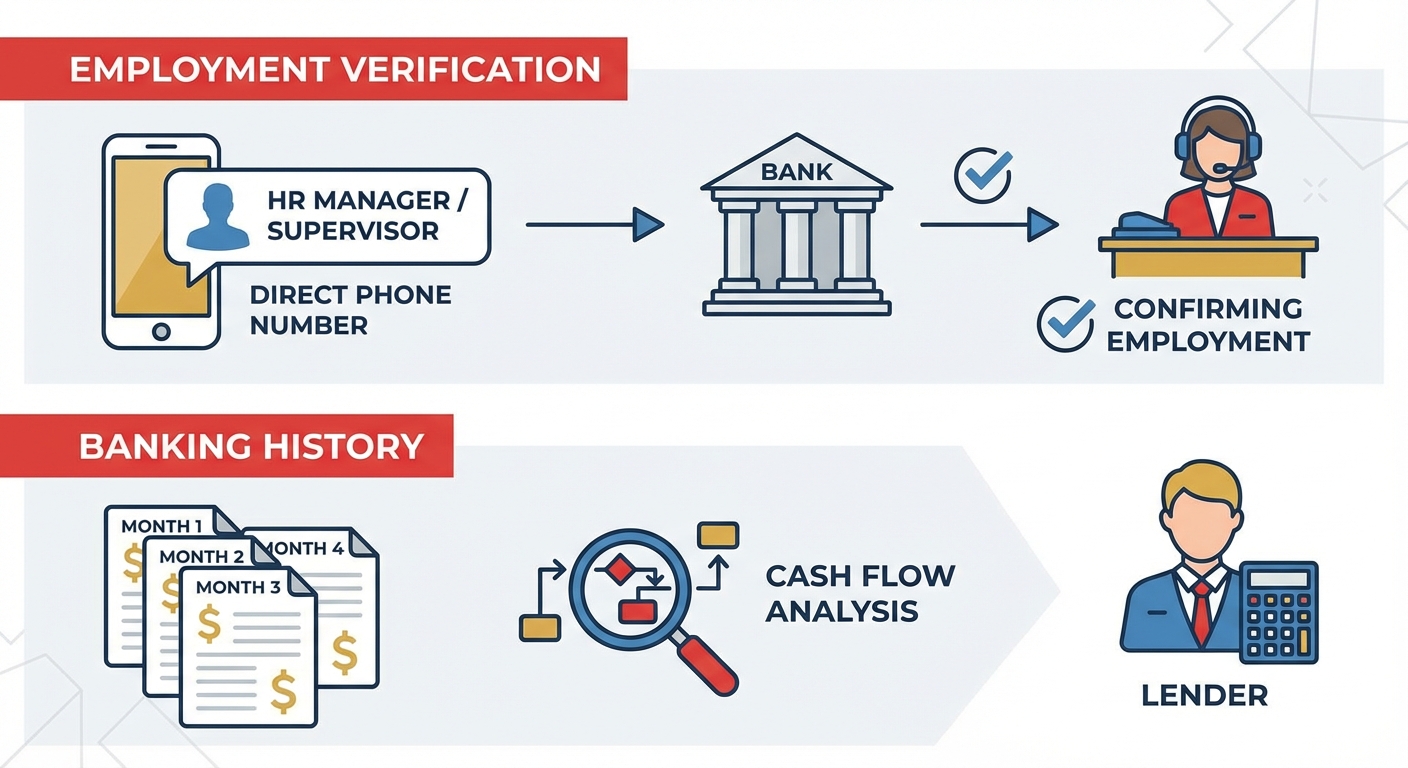

- Employment Verification: The name and direct phone number of your HR manager or supervisor. Yes, the bank will often call them to ensure you still work there.

- Banking History: Sometimes, lenders ask for three months of bank statements to see how you manage your cash flow.

The Mathematics of Approval: Ratios You Need to Know

Lenders don't just look at your income; they look at your "room" to breathe. They use two primary calculations: Gross Debt Service (GDS) and Total Debt Service (TDS). While these are more common in mortgage lending, car lenders use a simplified version called the Debt-to-Income (DTI) ratio.

The DTI ratio is your total monthly debt payments divided by your gross monthly income. Most Canadian lenders want to see your total debt (including your new car payment, rent/mortgage, and credit card minimums) stay below 40-45% of your pre-tax income. If you are already at 40% before the car loan, you will likely be declined or asked for a significant down payment.

When calculating what you can afford, don't just look at the loan payment. You must factor in the "Total Cost of Ownership." In Canada, this includes GST/HST (which varies by province), PPSA registration fees (a small fee to register the lien), and the often-overlooked cost of insurance. Since the car is financed, the lender will require you to carry "Full Coverage" (Collision and Comprehensive) insurance, which is significantly more expensive than basic liability.

Choosing the Right Vehicle for Approval

Believe it or not, the car you choose affects your interest rate as much as your credit score does. Lenders view different vehicles as different levels of collateral. A brand-new car is a safe bet because it has a predictable value and a warranty. A 10-year-old car with 180,000 kilometres is a gamble.

In Canada, there is a psychological "Mileage Cap." Most major banks are hesitant to finance vehicles that have more than 100,000 kilometres or are more than 7-8 years old. If they do finance them, the interest rates are often much higher. If you are looking at a used vehicle, try to find a "Certified Pre-Owned" (CPO) model. Lenders love CPOs because they have passed a rigorous inspection and often come with a manufacturer-backed warranty, making them a "safer" asset in the bank's eyes.

The Down Payment Strategy

While "Zero Down" offers are plastered all over Canadian dealership windows, they aren't always the best move. Putting money down changes your "Loan-to-Value" (LTV) ratio. If you are borrowing $30,000 for a $30,000 car, your LTV is 100%. If you put $6,000 down, your LTV drops to 80%. A lower LTV means less risk for the bank, which can often trigger a lower interest rate.

Furthermore, in provinces like Ontario, BC, and Alberta, your trade-in acts as a tax shield. If you buy a $40,000 car and trade in your old one for $15,000, you only pay sales tax on the $25,000 difference. In a province with 13% HST, that's a direct savings of $1,950. This is often a better financial move than selling the car privately and dealing with the hassle of "curbsiders" or tire-kickers.

The Application Process: Step-by-Step

The process of getting a car loan in Canada usually follows a specific four-step path. Understanding these steps helps you stay in control of the timeline.

- Pre-Qualification: This is usually a soft credit hit. It gives you a "ballpark" figure of what you might qualify for. It's great for window shopping.

- Formal Pre-Approval: This involves a hard credit hit and a review of your documents. Once you have this, you have a "blank cheque" (up to a certain limit) and a locked-in interest rate for 30 days.

- Vehicle Selection and VIN Submission: Once you find the car, the lender needs the Vehicle Identification Number (VIN) to ensure the car's value matches the loan amount.

- Final Underwriting and PPSA Registration: The lender does one last check, you sign the contracts, and they register their interest in the vehicle through the Personal Property Security Act (PPSA) system.

Special Circumstances in the Canadian Market

Canada is a land of newcomers and entrepreneurs, but the traditional banking system hasn't always kept up. If you fall into a "special circumstance" category, you need a different strategy.

Newcomers to Canada

If you have just arrived on a Work Permit or as a Permanent Resident, you likely have no Canadian credit history. Scotiabank, RBC, and others have specific "Newcomer to Canada" programs. These often require a larger down payment (usually 25%) but don't require a Canadian credit score. You will need to show your landing papers and a valid employment contract.

The Self-Employed Struggle

If you are a freelancer or business owner, your "stated income" on your tax returns might be low due to business deductions. Lenders call this "Income Verification" issues. To ace this, provide your last six months of business bank statements to show the actual cash flow entering your accounts, rather than just the net income shown on your T1 General.

Students and First-Time Buyers

If you have no credit and no high-paying job yet, you will likely need a cosigner. A cosigner is someone (usually a parent) who signs the loan with you and is equally responsible for the debt. This is the single most effective way for a young person to get a prime interest rate and start building their own credit history.

Negotiating the Loan Terms

The biggest mistake Canadians make at the dealership is negotiating the monthly payment instead of the total cost. Dealership "F&I" (Finance and Insurance) managers are experts at stretching a loan from 60 months to 84 months to make a high-priced car "fit" your monthly budget. This is a trap.

Always ask for an "Open" loan. In Canada, almost all standard car loans are open-ended, meaning you can pay them off early without any penalty. If a lender tries to lock you into a "Closed" loan, walk away. An open loan allows you to make extra payments whenever you have a little extra cash, which can save you thousands in interest over time.

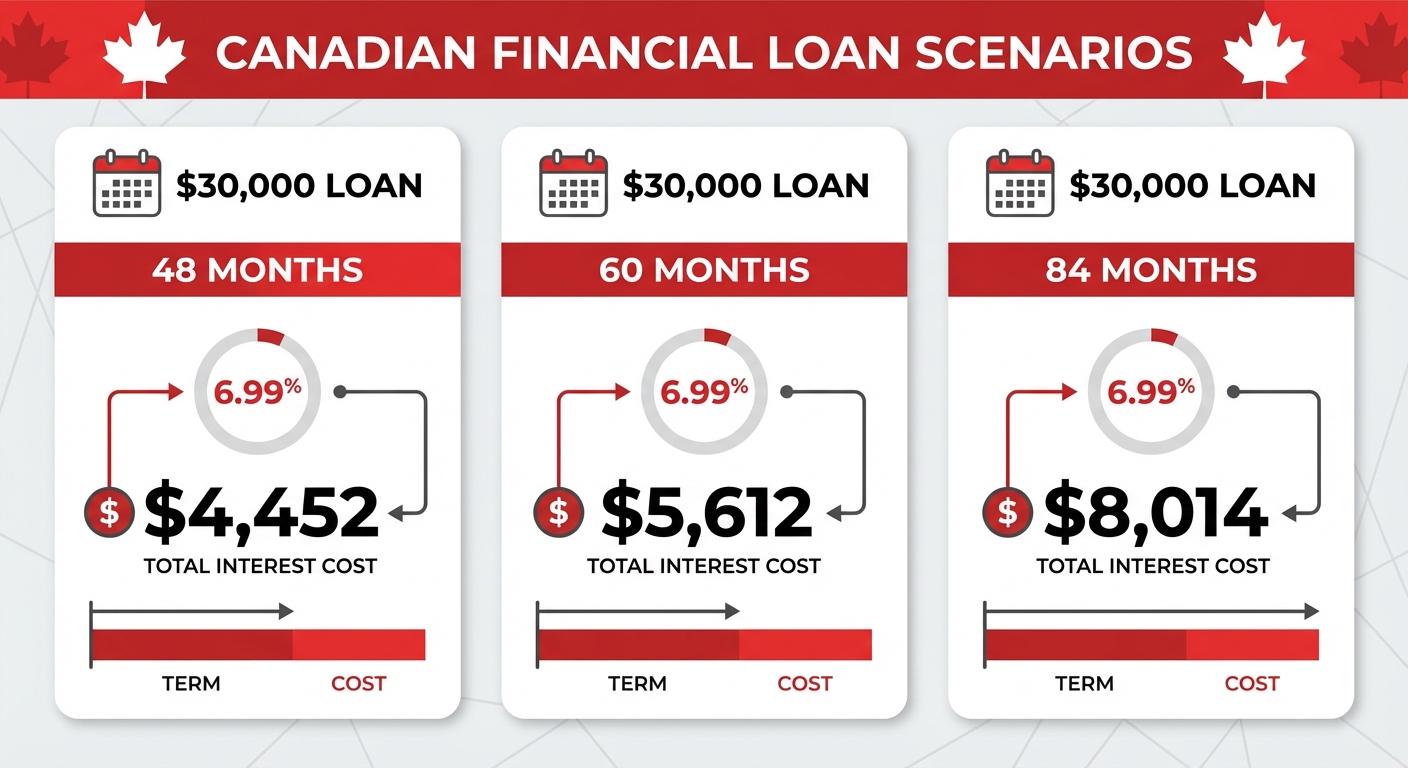

| Loan Amount | Term (Months) | Interest Rate | Total Interest Paid |

|---|---|---|---|

| $30,000 | 48 | 6.99% | $4,452 |

| $30,000 | 60 | 6.99% | $5,612 |

| $30,000 | 84 | 6.99% | $8,014 |

Avoiding Common Pitfalls and Scams

The Canadian car-buying journey is filled with "add-ons" that can kill an approval. If a lender has approved you for exactly $35,000 and the dealer tries to add $4,000 in warranties, rust protection, and "nitrogen tires," the loan might get rejected by the bank's automated system because the LTV is now too high.

Be wary of "Weekly" or "Bi-weekly" payment quotes. Dealers love these because they sound smaller. "It's only $99 a week!" sounds better than "$430 a month." However, bi-weekly payments mean you are making 26 payments a year (the equivalent of 13 months), which actually accelerates your loan payoff but can catch you off guard if you aren't prepared for those months with three payment dates.

Finally, watch out for "Yo-Yo Financing" or "Spot Delivery." This happens when a dealer lets you take the car home before the bank has officially signed off on the loan. A week later, they call you and say the financing fell through, but they can "get you approved" at a much higher interest rate. Never drive the car off the lot until you have a signed confirmation of the interest rate from the lender.

Post-Approval: Finalizing the Deal

Once you are approved, the finish line is in sight. But don't let your guard down. You need to review the "Bill of Sale" carefully. Ensure that the price of the car matches what you negotiated and that there are no "admin fees" or "documentation fees" that weren't previously disclosed. In many Canadian provinces, "All-in Price Advertising" laws require dealers to include these fees in the advertised price.

You will also see a charge for PPSA registration. This is a government fee that allows the lender to register their legal claim to the vehicle. It's standard and usually costs between $40 and $100 depending on the province and the length of the loan. Finally, you will set up a Pre-Authorized Debit (PAD) agreement. Make sure this is linked to an account that always has sufficient funds, as a single "NSF" (Non-Sufficient Funds) notification can damage your credit score as much as a late payment.

Frequently Asked Questions

Can I get a car loan with a 500 credit score in Canada?

Yes, but it won't be from a major bank. You will likely need to work with a subprime or "special finance" lender. Expect interest rates between 15% and 25%. In these cases, the goal should be to take a shorter loan, make every payment on time, and refinance after 12-18 months once your score has improved.

How long does a car loan approval take?

If you have all your documents ready (paystubs, ID, etc.), an automated approval can happen in minutes. If your application requires a "manual look" by a credit officer (common for self-employed or thin-credit applicants), it can take 24 to 48 hours.

Can I pay off my Canadian car loan early without penalty?

In almost all cases, yes. Most Canadian automotive loans are "simple interest, open-ended" loans. This means interest is calculated daily, and there is no penalty for paying the balance off in full at any time. Always double-check your specific contract for the word "Open."

What is the maximum age of a used car that banks will finance?

Most Canadian banks prefer vehicles that are less than 7 years old. Some will go up to 10 years for borrowers with excellent credit, but the interest rates will be higher. Vehicles older than 10 years usually require a personal loan or a line of credit rather than a traditional auto loan.

Does a car loan help build my credit for a mortgage?

Absolutely. An auto loan is considered an "installment loan." Having a history of on-time installments combined with "revolving credit" (like a credit card) is the best way to prove to mortgage lenders that you are a responsible borrower. It shows you can handle large, long-term financial commitments.

The Final Word on Car Loan Approvals

Acing your car loan application isn't about luck; it's about removing the "guesswork" for the lender. By walking in with a solid credit score, a prepared "Approval Kit," and an understanding of your debt ratios, you shift the power dynamic in your favour. You are no longer someone "asking" for a loan; you are a high-quality client that banks want to compete for.

Take the time to shop around, compare the Big Five with local credit unions, and never be afraid to walk away from a deal that relies on long-term, high-interest debt. The car you drive is a tool for your life, but the loan you choose is a tool for your financial future. Use it wisely.