If you've been feeling the pinch at the gas pump and the grocery store lately, you aren't alone. For many Canadians, the largest monthly expense after housing is the car payment sitting in their driveway. With interest rates fluctuating and the cost of living in cities from Vancouver to Halifax climbing, that auto loan you signed two years ago might feel like a heavy weight around your neck. But here is the thing: just because you signed a contract doesn't mean you're stuck with those terms forever.

The Canadian automotive market has shifted dramatically. Whether you walked into a dealership with a less-than-perfect credit score or simply took the first offer the finance manager handed you, there is a high probability you are overpaying. Car refinancing is the "secret weapon" of savvy Canadian consumers, yet it remains one of the most misunderstood financial tools in the country. This guide is designed to pull back the curtain and show you exactly how to restructure your debt, free up monthly cash flow, and take back control of your financial future.

Key Takeaways

- What it is: Refinancing replaces your current high-interest auto loan with a new loan featuring better terms or a lower interest rate.

- The 6-Month Rule: Most Canadian lenders want to see at least 6 to 12 months of consistent, on-time payments before they will consider a refinance application.

- Vehicle Limits: Generally, your car should be less than 10 years old and have under 150,000-200,000 kilometres to qualify for the best rates.

- Watch the Equity: If you owe $25,000 on a car worth $18,000 (negative equity), refinancing becomes more difficult but not impossible.

- Total Cost vs. Monthly Cost: Lowering your monthly payment by extending the loan term can increase the total interest you pay over time. Always calculate the long-term impact.

How Car Refinancing Works in Canada

Think of refinancing as a fresh start. You aren't simply "changing" your current loan; you are taking out a brand-new loan from a different lender (or sometimes the same one) to pay off the original balance in full. Once the old lender is paid, you begin making payments to the new lender under the new, hopefully more favourable, terms.

In the Canadian landscape, this process is handled by a mix of the "Big Five" banks, credit unions, and specialized online automotive lenders. The mechanics are relatively straightforward, but the distinction between prime and non-prime refinancing is where most people get lost.

| Feature | Prime Refinancing | Non-Prime (Subprime) Refinancing |

|---|---|---|

| Credit Score Required | 700+ (Good to Excellent) | 500 - 680 (Poor to Fair) |

| Typical Interest Rates | 4.9% - 8.9% | 9.9% - 24.9% |

| Primary Goal | Lowering interest costs | Improving cash flow & credit building |

The Major Benefits of Refinancing Your Vehicle

Why go through the effort of paperwork and credit checks? For most Canadians, the motivation is purely mathematical. If you bought a car during a period of high inflation or when your credit was recovering from a rough patch, you might be sitting on an interest rate that is double what you actually qualify for today.

Securing a Lower Interest Rate (APR): This is the holy grail of refinancing. A drop of even 3% or 4% in your interest rate can save you thousands of dollars over the remaining life of the loan. In a market where some dealer-financed used car loans hit 15% or higher, moving to a 7% or 8% rate is a massive win.

Improving Your Debt-to-Income (DTI) Ratio: When you apply for a mortgage or a significant credit line in Canada, lenders look at how much of your monthly income is eaten up by existing debt. By refinancing to a lower monthly payment, you effectively lower your DTI, making you a more attractive borrower for other financial products.

Removing a Co-signer: Perhaps you needed your parents or a spouse to co-sign when you first bought the car. If your income has stabilized and your credit score has improved, refinancing allows you to take full ownership of the debt, releasing the co-signer from their legal obligation and their liability on the loan.

When is the Right Time to Refinance? (The 2024/2025 Outlook)

Timing is everything. You can't just refinance a week after buying a car; the "financial dust" needs to settle first. Most Canadian institutions want to see a track record of at least six months of on-time payments. This proves you are a reliable borrower and gives your credit score time to adjust to the new debt.

Looking at the 2024 and 2025 landscape, we are seeing a shift in Bank of Canada policies. As the central bank adjusts the overnight rate to combat inflation, prime rates at commercial banks fluctuate. If you see news that the Bank of Canada is lowering rates, that is your signal to start shopping. However, your personal milestones are often more important than national trends. If you've just landed a higher-paying job or finally cleared off an old credit card balance, your personal "risk profile" has dropped, even if the national economy is shaky.

The "Equity Sweet Spot" is another critical factor. This is the moment when your car's market value is higher than what you owe on the loan. When you have positive equity, lenders view the loan as "low risk" because the asset (the car) can easily cover the debt if something goes wrong. This is the best time to negotiate for rock-bottom rates.

Eligibility Criteria: What Canadian Lenders Look For

Lenders aren't just looking at you; they are looking at the machine in your driveway. In Canada, the rules for auto refinancing are often stricter than the rules for a standard purchase loan. Here is what you need to have in order:

- Credit Score: While you can refinance with a score as low as 500, the best terms are reserved for those above 660. If you are below 600, you will likely be looking at alternative or "B-lenders."

- Vehicle Age: Most banks stop refinancing cars once they hit the 10-year mark. The logic is simple: the car's value is dropping too fast to serve as reliable collateral.

- Mileage: If your odometer is screaming past 200,000 kilometres, most traditional lenders will pass. They want to ensure the car will last at least as long as the new loan term.

- Loan Amount: There is a floor to how much lenders will bother with. Usually, if you owe less than $7,500, the administrative costs of the refinance don't make sense for the bank.

| Credit Tier | Score Range | Refinance Outlook |

|---|---|---|

| Excellent | 760 - 900 | Top-tier rates; easy approval. |

| Good | 660 - 759 | Competitive rates; multiple offers. |

| Fair | 560 - 659 | Moderate rates; might need a co-signer. |

| Poor | 300 - 559 | Specialized lenders only; focus on credit repair. |

The Step-by-Step Guide to Refinancing in Canada

Ready to pull the trigger? Don't just walk into your local bank branch without a plan. Follow these steps to ensure you get the best deal possible.

Step 1: Audit Your Current Loan

Dig out your original contract. What is your current APR? Is it a "fixed" or "variable" rate? Most importantly, check if the loan is "open" or "closed." In Canada, most auto loans are open, meaning you can pay them off early without penalty. If you have a closed loan, you might face a "prepayment penalty" that could wipe out your refinancing savings.

Step 2: Document Preparation

Lenders will want to see proof of your ability to pay. Have your recent T4 slips, at least two recent pay stubs, your current vehicle insurance policy, and your provincial vehicle registration ready to go. Digital copies are usually preferred by online lenders.

Step 3: Check Your Credit Report

In Canada, we have two main credit bureaus: Equifax and TransUnion. Sometimes they have slightly different data. Check both to ensure there are no errors (like a "late payment" that you actually paid on time) that could hurt your application.

Step 4: Shop and Compare Quotes

Don't settle for the first quote. Check with your current bank, but also look at specialized online automotive finance platforms. These platforms often have relationships with dozens of lenders and can find "niche" programs that a big bank might not offer.

Potential Pitfalls and Hidden Costs

While refinancing is generally a positive move, there are traps that can catch the unwary. The most common mistake is focusing exclusively on the monthly payment while ignoring the "Total Cost of Borrowing."

Imagine you have 3 years left on a loan at 12%. You refinance to a 6-year loan at 8%. Your monthly payment will drop significantly, providing immediate relief. However, because you are now paying interest for an additional 3 years, you might actually end up paying thousands more in total interest than you would have if you had just stuck with the original, higher-rate loan. Always ask the lender for the total interest figure over the entire term.

Then there is the issue of "Negative Equity," colloquially known as being "upside down" or "underwater." This happens when you owe $20,000 on a car that is only worth $15,000. Many lenders will refuse to refinance more than 100% to 110% of the car's value. If you are deeply underwater, you might need to pay a lump sum to bridge the gap before a new lender will take on the debt.

Finally, watch out for administrative fees. Some Canadian lenders charge a "processing fee" or "documentation fee" to set up the new loan. If the fee is $500 and you are only saving $15 a month, it will take you nearly three years just to break even on the cost of the refinance.

Refinancing with Bad Credit: Is it Possible?

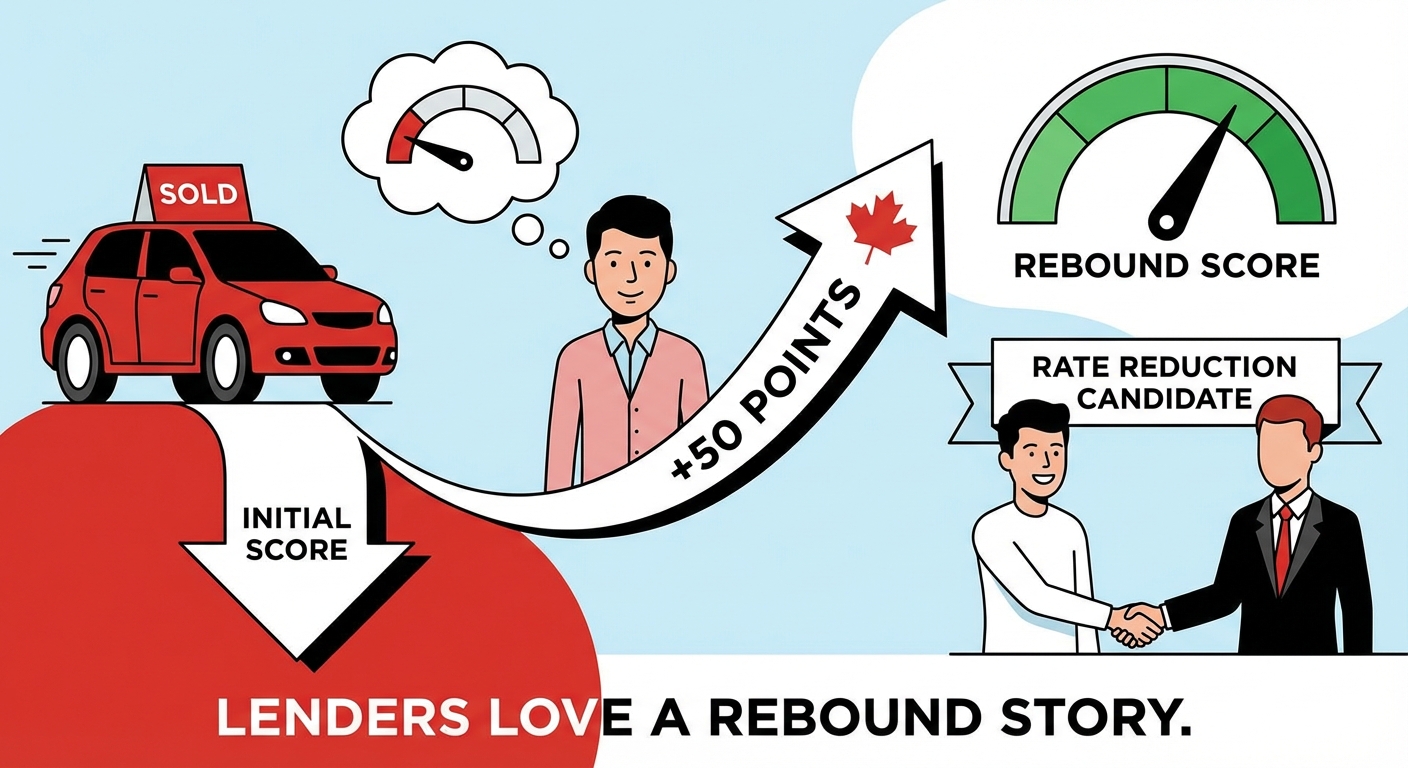

Absolutely. In fact, for many Canadians with subprime credit, refinancing is a planned part of their financial recovery. If you bought a car with a 20% interest rate because your credit was in the 500s, and you have spent the last year making every payment on time, your score has likely improved.

The goal for bad credit borrowers is "stepping stones." You might not go from 20% to 5% overnight. But moving from 20% to 14% is a massive improvement. A year later, you might refinance again to get down to 9%. This "laddering" strategy is the fastest way to rebuild your credit profile while keeping your vehicle. If your score is still too low to qualify on your own, adding a co-signer with strong credit during the refinance can help you secure a much lower rate than you could get solo.

| Metric | Original Loan (High Rate) | Refinanced Loan (Lower Rate) |

|---|---|---|

| Loan Balance | $25,000 | $25,000 |

| Interest Rate (APR) | 14.5% | 7.5% |

| Monthly Payment | $860.50 | $777.65 |

| Monthly Savings | - | $82.85 |

| Total Interest Saved | - | $2,982.60 |

Alternatives to Refinancing

Sometimes, refinancing isn't the best path. If your car is older than 10 years or has extremely high mileage, you might find it impossible to get approved. In these cases, you have other options to lower your monthly costs.

Trading In: You can trade your current vehicle for a more affordable, fuel-efficient model. The dealer will roll your current loan balance (even if there is negative equity) into a new loan for the cheaper car. While this doesn't always lower the interest rate, it can significantly drop the monthly payment by reducing the total amount borrowed.

Private Sale: Selling your car privately often yields a higher price than a dealer trade-in. You can use that money to pay off your loan and then use any leftover cash as a down payment on a vehicle you can buy with a smaller, more manageable loan.

Lease Takeovers: If you are currently leasing and the payments are too high, platforms exist in Canada where you can "transfer" your lease to someone else. This gets you out of the debt entirely, though you'll be left without a vehicle and will need to find a more affordable alternative.

Frequently Asked Questions (FAQ)

Does refinancing my car hurt my credit score?

In the short term, you may see a small dip of 5-10 points because the lender will perform a "hard credit inquiry." Additionally, the average age of your accounts will decrease because you are opening a new loan. However, in the long term, if the lower payments help you stay consistent and you pay off the loan on time, your score will actually increase.

Can I refinance if I owe more than the car is worth?

Yes, but it is more challenging. This is called having "negative equity." Some lenders allow you to refinance up to 120% of the car's "Black Book" value, but you will likely pay a slightly higher interest rate for that privilege. Alternatively, you can pay down the difference in cash to bring the loan-to-value ratio in line with the lender's requirements.

How many times can I refinance the same vehicle?

Technically, there is no legal limit to how many times you can refinance. However, every time you do it, the car gets older and the mileage goes up, making it harder to find a lender. Most people refinance once or twice during the ownership of a vehicle-usually once their credit has improved significantly.

Is there a 'best' month of the year to refinance in Canada?

There isn't a specific "seasonal sale" for refinancing like there is for buying new cars. However, keep an eye on the Bank of Canada's scheduled interest rate announcements. If they announce a rate cut, banks usually follow suit within a few weeks, making it a prime time to apply.

Do I need to stay with my current bank to refinance?

Not at all. In fact, it is often better to switch. Your current bank already has your business; a new lender is motivated to offer you a better deal to "steal" that business away from their competitor. Always shop around to see who is currently most aggressive in the Canadian auto finance market.

Taking Control of Your Auto Debt

The most important thing to remember is that an auto loan is not a life sentence. In the Canadian financial market, you have the power to renegotiate, restructure, and reduce your debt. Whether your goal is to save $100 a month to help with the grocery bill or to shave $3,000 off your total interest costs, refinancing is a proven path to getting there.

Don't wait for the bank to call you with a better offer-they won't. Take ten minutes today to look at your current interest rate and your remaining balance. If you've been paying on time for more than six months and your credit is in a better place than it used to be, you are likely leaving money on the table every single month. Audit your loan, gather your documents, and start the process of slashing those payments today.

![Bank Statements Only Car Refinance Canada [2026 Guide]](/images/2026-01-04_bank-statements-only-car-refinance-canada-2026-guide/cover.png)